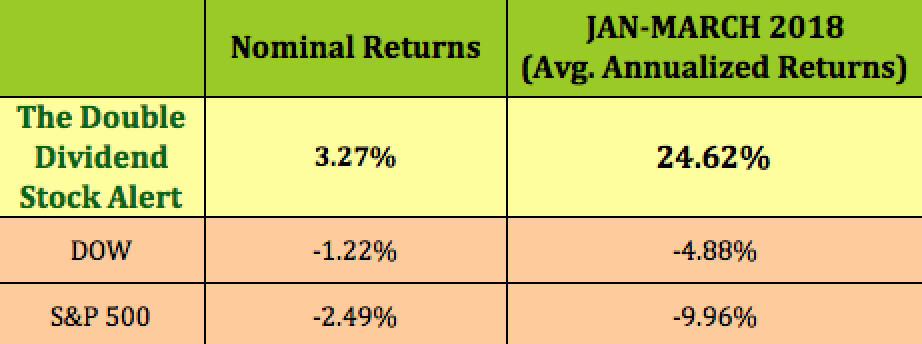

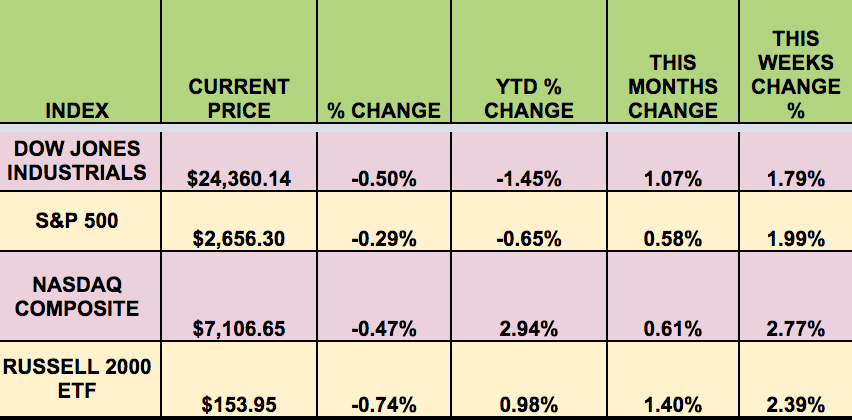

Markets: It was an up week for the market, with all 4 indexes posting strong gains, as the market turned in its best performance in a month. Trade war fears ebbed, but investors were unimpressed on Friday by good major bank earnings reports, sending the market down in late trading. Even though JPM, C, and WFC beat earnings estimates, investors were expecting more, due to the anticipated benefits from the tax cut bill. These 3 banks fell from -1.5% to 3.4% on Friday.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: PennantPark Floating Rate Capital Ltd (NASDAQ:PFLT), Compass Diversified Holdings (NYSE:CODI), Capitala Finance Corp (NASDAQ:CPTA), LTC Properties Inc (NYSE:LTC), Costamare Inc (NYSE:CMRE), Main Street Capital Corporation (NYSE:MAIN).

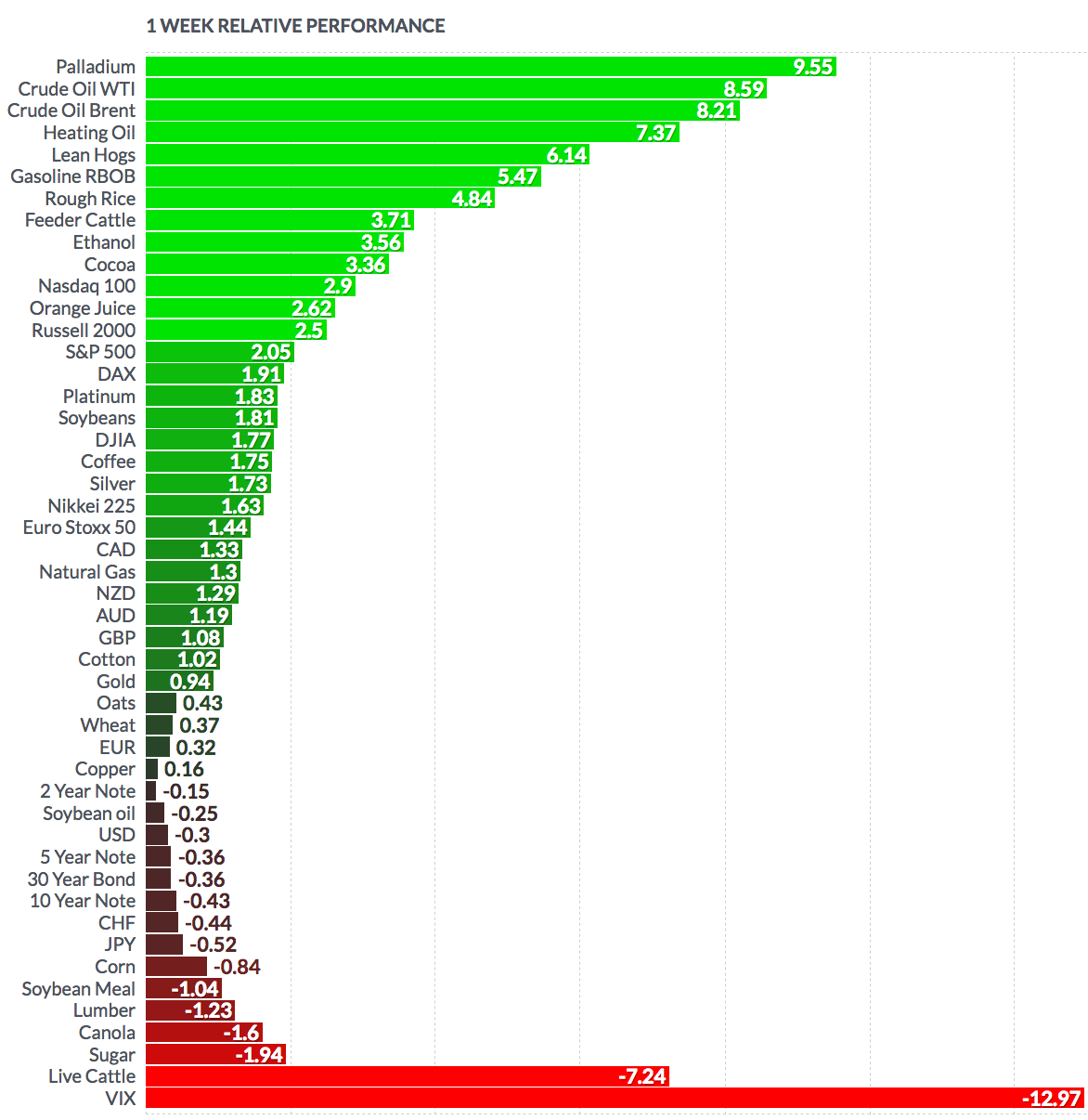

Volatility: The VIX fell -21% this week, ending the week at $17.01.

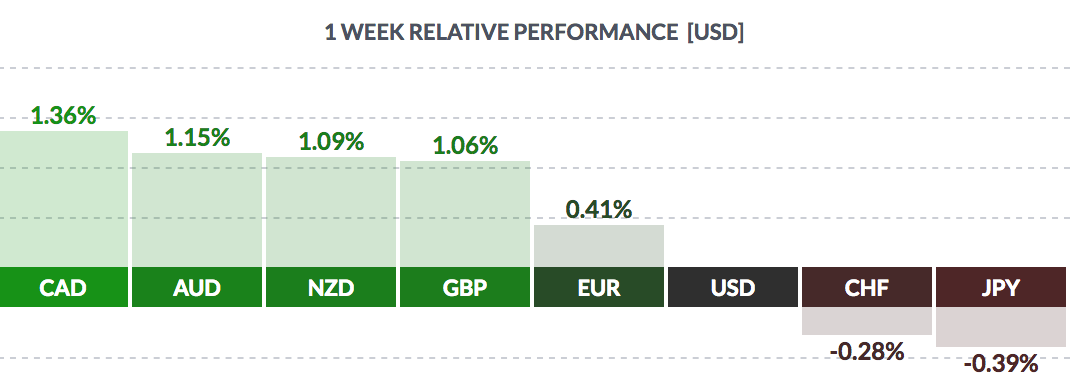

Currency: The dollar fell vs. most major currencies this week, except the Swiss franc and the yen.

Market Breadth: 24 of the Dow 30 stocks rose this week, vs. 27 last week. 72% of the S&P 500 rose this week, vs. 86% last week.

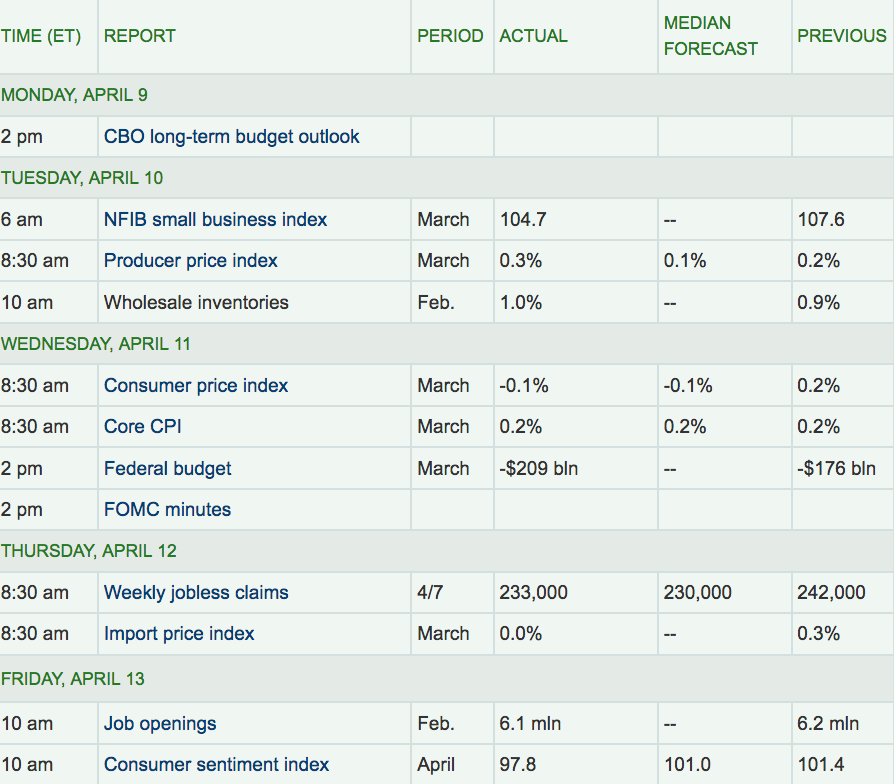

Economic News: Consumer Sentiment fell to 97.8, below the 101.0 forecast. Core CPI met forecasts, at 0.2%. The Federal budget deficit rose to -$209B.

The Congressional Budget Office on Monday forecast the return of trillion-dollar deficits in 2020, in the nonpartisan agency’s first budget update since the enactment of the tax cut law last year and the big spending bill this year. The CBO said the deficit for fiscal 2018 would total $804 billion, up from $665 billion in the last fiscal year. In 2019, the agency said, the shortfall will total $981 billion. Beginning in 2020, however, the CBO said deficits would exceed $1 trillion a year. The projected deficit for fiscal 2018 is $242 billion larger than the shortfall the agency projected back in June. The U.S. last ran a budget deficit of more than $1 trillion in 2012. (Source: MarketPulse)

Some members of the Federal Reserve are urging the bank to consider raising interest rates more quickly, in what could mark a turn from the gradual approach it has taken in recent years.They expect stronger economic growth and inflation to warrant more aggressive action over the medium term. Their views were laid out in the Feds March meeting minutes, published on Wednesday. “Almost all” participants agreed that a gradual approach to raising interest rates remained appropriate in the medium term, according to the minutes.

However, “a number of participants” said they expect stronger growth and inflation in the next few years, suggesting the path for interest rates “would likely be slightly steeper than they had previously expected”, according to the minutes.

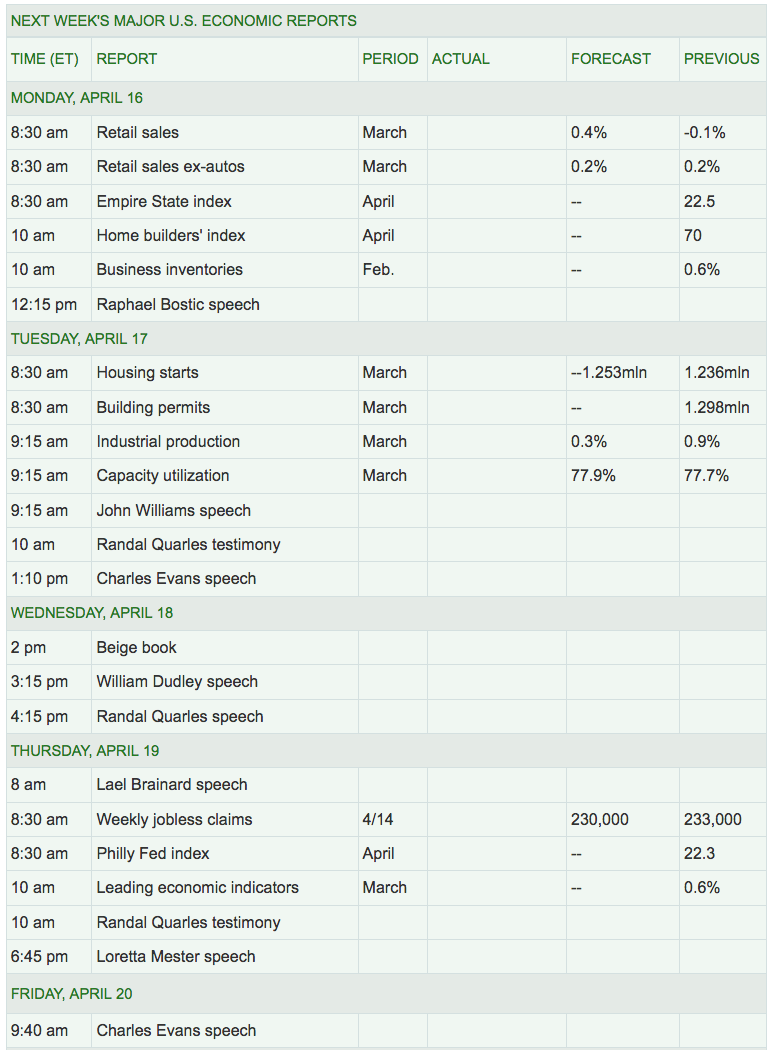

Week Ahead Highlights: Q1 ’18 earnings season heats up, with 7 DOW stocks reporting, including GE, IBM, and P&G.

Next Week’s US Economic Reports: There will be several Housing reports out next week, in addition to retail sales figures for March.

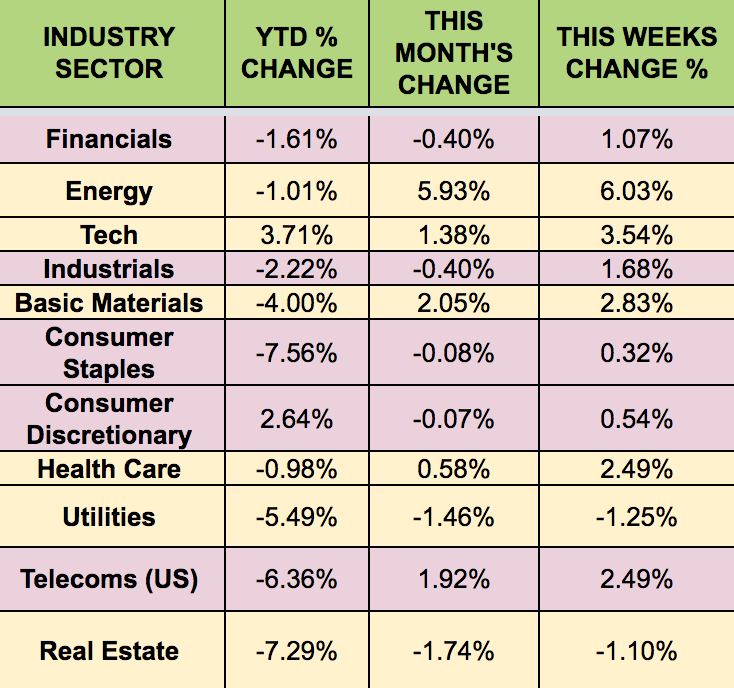

Sectors: The Energy) sector led again this week, as Utilities trailed. Crude Oil WTI Futures hit their highest mark in 2 years, spurred on by the threat of US air strikes on Syria. Some major airlines were re-routing flights on Wednesday after Europe's air traffic control agency warned aircraft flying in the eastern Mediterranean to exercise caution due to possible air strikes on Syria. Syria is not a significant oil producer, but any sign of conflict in the region tends to trigger concern about potential disruption to crude flows across the wider Middle East, home to some of the worlds biggest producers. The U.S. Energy Information Administration (EIA) said on Tuesday that it expects domestic crude oil production in 2019 to rise by more than previously expected, driven largely by growing U.S. shale output.

Futures:

WTI Crude futures rose 8.6% this week, while Natural Gas futures rose 1.3%.

Oil futures climbed Friday to post gains for the week, holding ground at their highest since early 2014. Prices got a boost on the potential for a U.S.-led military strike on Syria and a report from the International Energy Agency that said global oil supplies are falling back toward their five-year average. May West Texas Intermediate crude rose 32 cents, or 0.5%, to settle at $67.39 a barrel.