Stock Market News: March 30, 2019

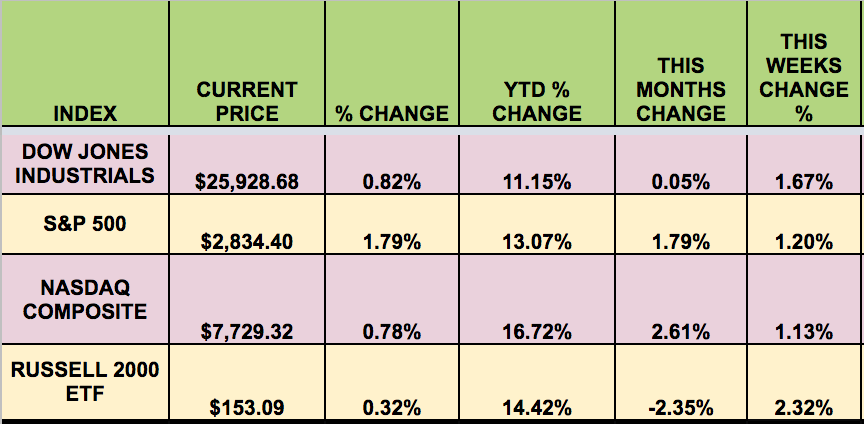

Markets:

It was an up week for the market, with all four indexes posting gains. The Russell Small Caps led, with a 2.33% gain this week, although they lost -2.35% in March. The Tech-heavy NASDAQ is the leading index in 2019. The S&P 500 had its best quarterly gain since 2009.

“Benchmark U.S. Treasury yields sank to fresh 15-month lows on Wednesday and German bond yields fell further below zero after more dovish talk from central banks, while a gauge of world stocks fell amid new signs of concern for the global economy. China’s industrial firms posted their worst slump in profits since late 2011 in the first two months of this year, data showed.” (Reuters)

“The domestic economy slowed more than initially thought in the fourth quarter, keeping growth in 2018 below the 3 percent annual target, and corporate profits failed to rise for the first time in more than two years. On Wednesday, U.S. officials told Reuters China had made unprecedented proposals in talks on a range of issues, including forced technology transfer, as the countries work to overcome the remaining obstacles to a deal to end their trade war.” (Reuters)

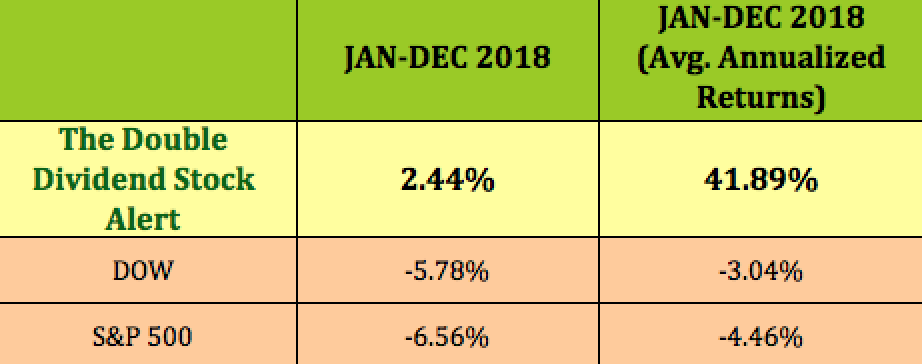

High Dividend Stocks:

These high yield stocks go ex-dividend next week – ITUB, KIM, SUP, BKS, BRX, KCAP.

Volatility:

The VIX fell 14.6% this week, ending the week at $13.71.

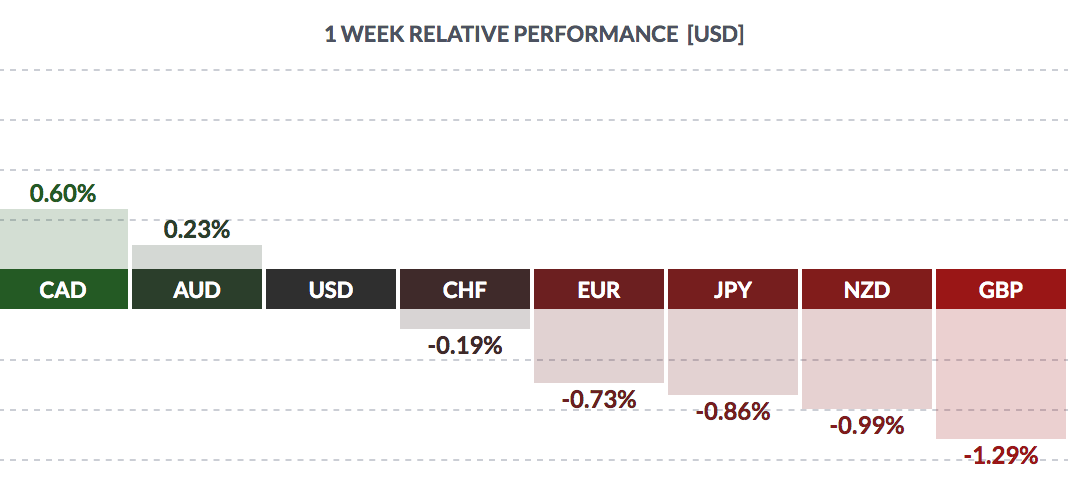

FOREX: The USD fell vs. the Loonie and the Aussie and rose vs. most other major currencies this week, on the back of foreign central banks easing their rates.

The New Zealand dollar tumbled after the country’s central bank flagged a possible cut in interest rates, becoming the latest to turn dovish in the face of slowing global growth. Meanwhile, European Central Bank President Mario Draghi said the ECB could further delay an interest rate hike and may look at measures to mitigate the side-effects of negative interest rates, warning that risks to growth were on the rise.

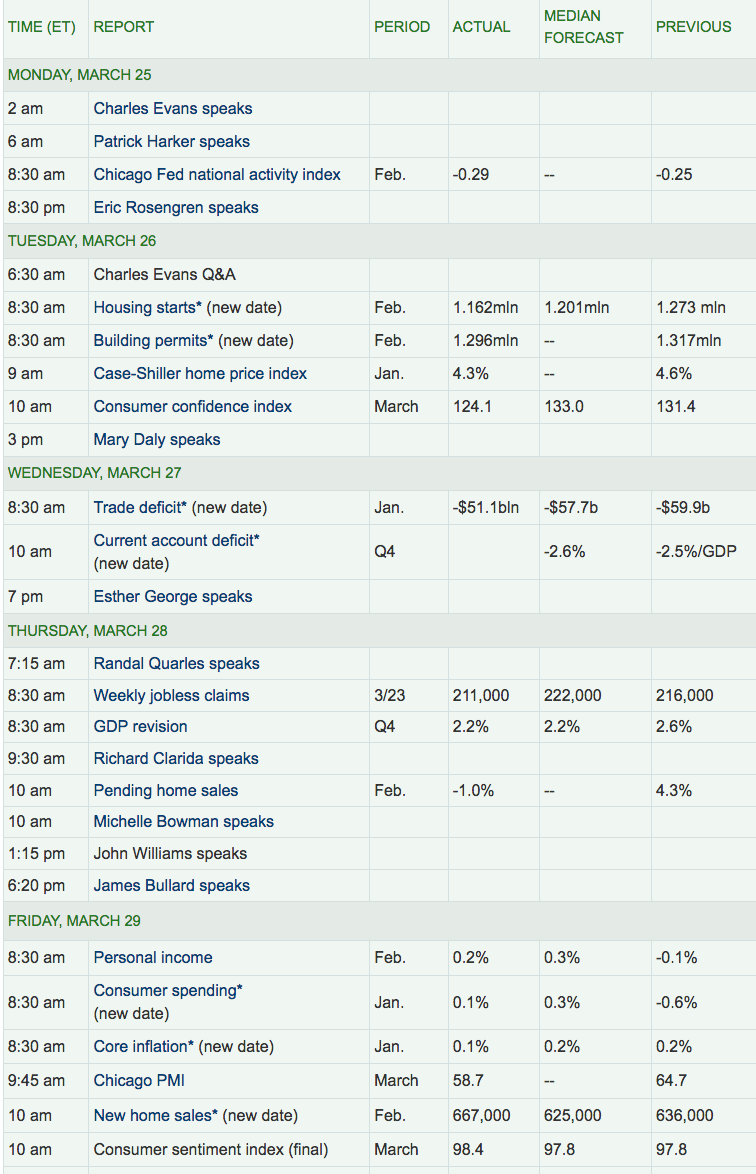

Economic News:

Housing starts and Building permits both fell in February, while New Home sales rose. The Chicago PMI fell from 64+ to 58.7 in March.

Week Ahead Highlights:

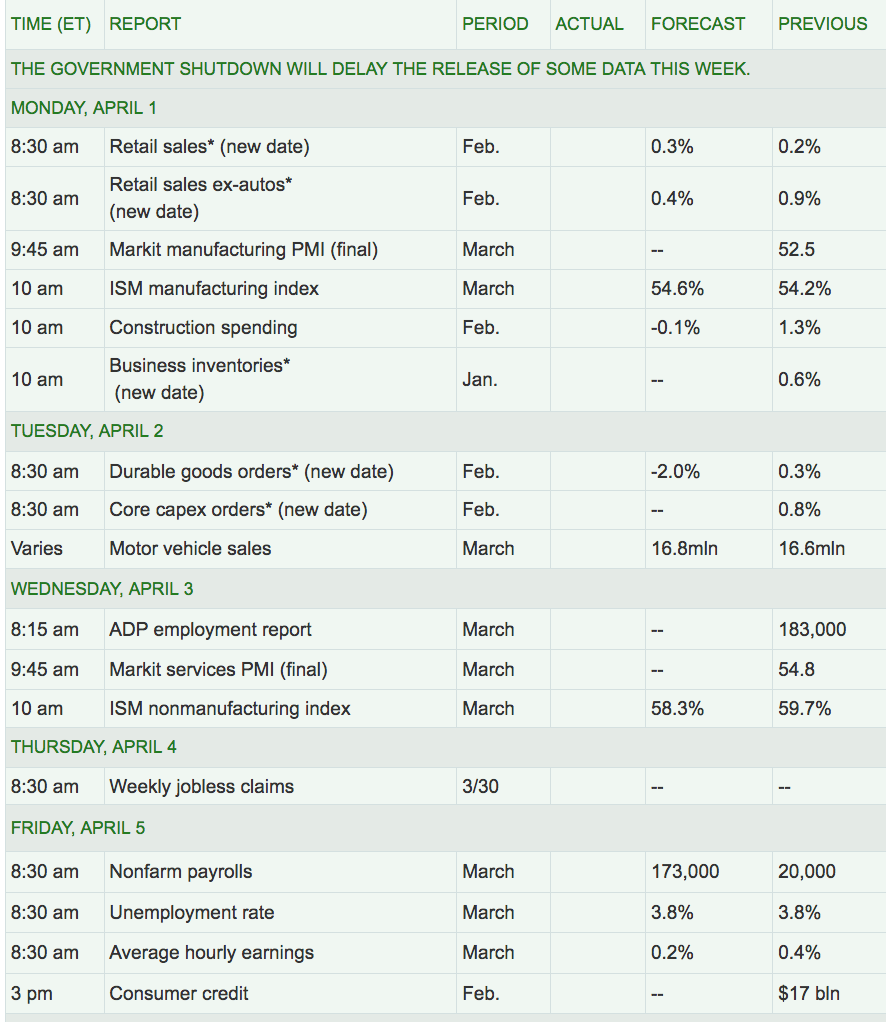

Economists are expecting a strong rebound from last month’s very weak jobs report the number of 20,000 – they’re forecasting an average of 173,000.

Next Week’s US Economic Reports:

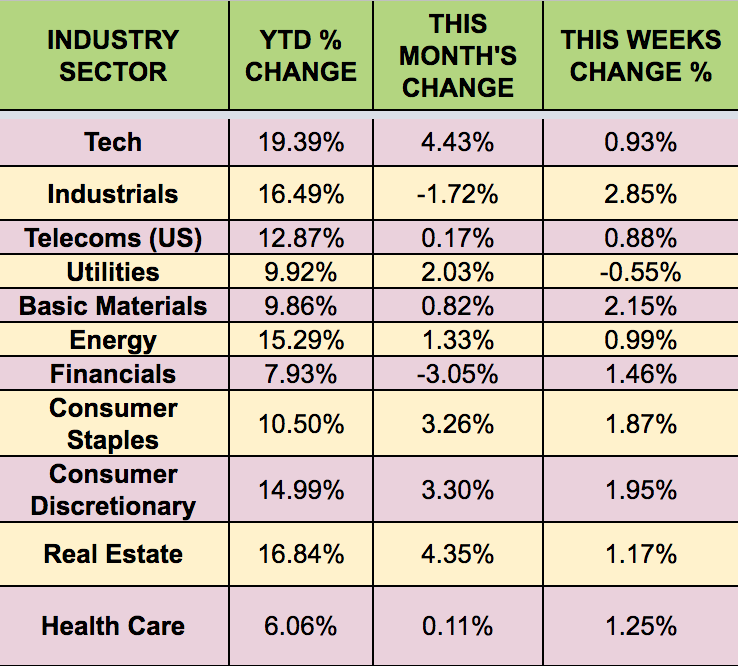

SECTORS:

Industrials and Basic Materials were the leading sectors this week, with Utilities lagging. Tech leads year to date.

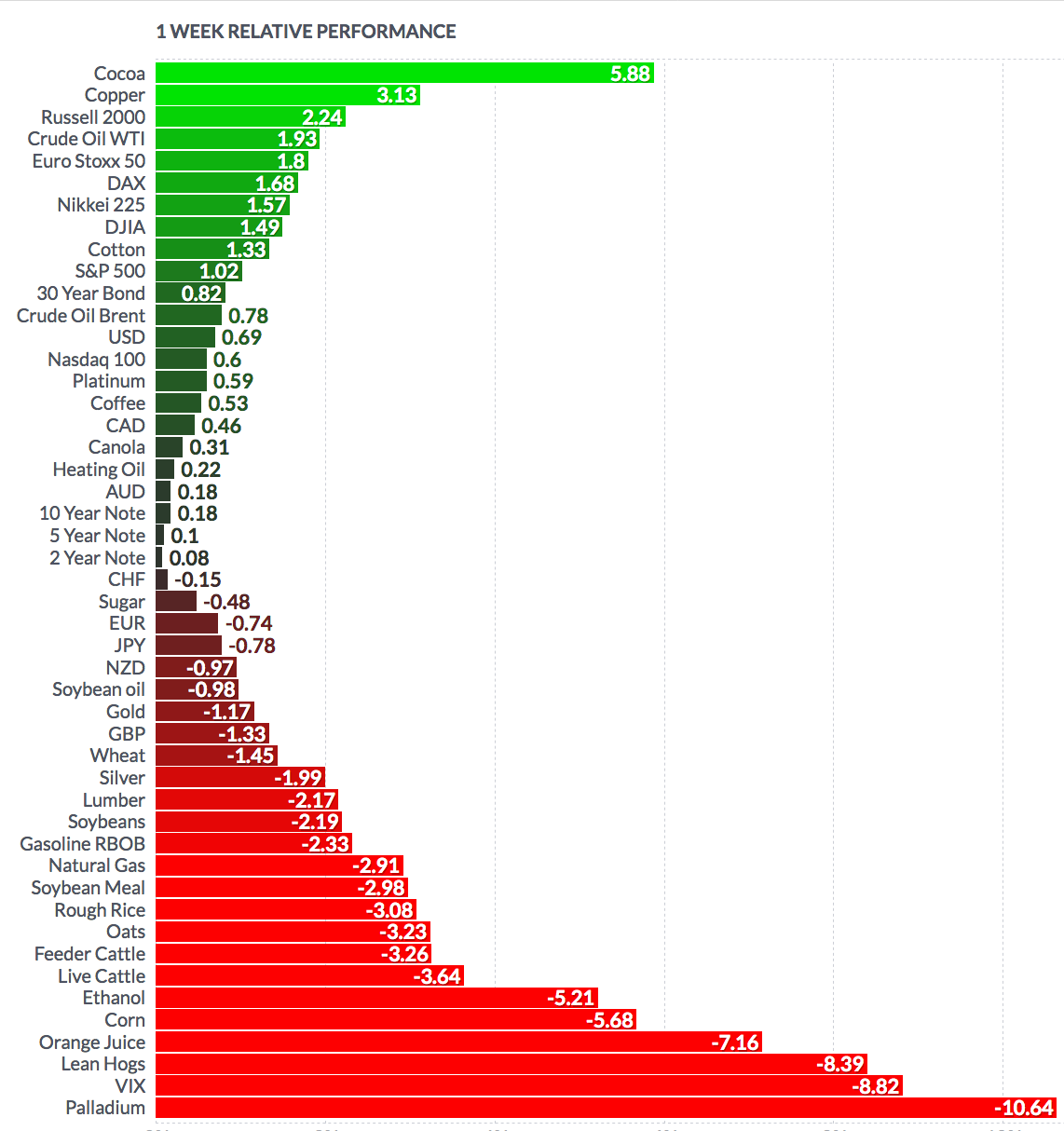

FUTURES:

WTI Crude rose 1.93% this week, finishing the week at $60.18, while Natural Gas fell -2.91%.