Market Indexes:

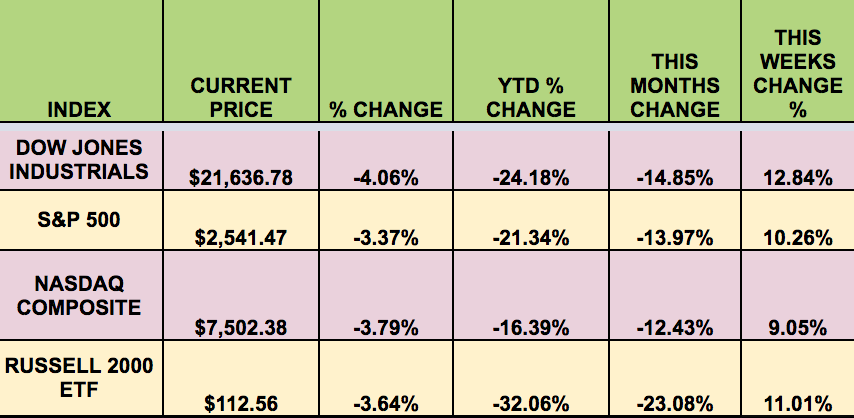

The market bounced back in a big way this week, registering its biggest 3-day gain since 1933, in a reaction to unprecedented amounts of QE by the Fed, and the passage of a Senate stimulus bill for ~$2 trillion.

Showing the most support for mega-caps AND small caps, the Dow Jones Industrial Average and the Russell 2000 small caps led the way, followed by the S&P 500 and the NASDAQ.

“The U.S. Federal Reserve on Monday mounted an extraordinary new array of programs to offset the “severe disruptions” to the economy caused by the coronar virus outbreak, backstopping an unprecedented range of credit for households, small businesses and major employers.

The new programs mean the Fed will lend against student loans, credit card loans, and U.S. government backed-loans to small businesses, and buy bonds of larger employers and make loans to them in what amounts to four years of bridge financing. A new “Main Street Business Lending Program” that will extend credit to small- and-medium sized businesses will also be announced “soon,” the Fed said.

Existing purchases of U.S. Treasury and mortgage-backed securities will be expanded as much as needed “to support smooth market functioning and effective transmission of monetary policy to broader financial conditions and the economy.” (Reuters)

This Week’s Options Trades: Looking for high yield covered call hedging trades and high yield put-selling trades?

Options Yields are still surging. We added 2 new trades this week to our Public Cash Secured Puts Table and our Public Covered Calls Table.

Volatility: The VIX remained high this week, ending at $65.54, vs. $66.04 last week.

High Dividend Stocks: These high yield stocks go ex-dividend next week: ACRE, AGNC, ATAX, BGS, CGBD, NHI, ORCC, CXW, WDC, BRX.

Market Breadth: 28 out of 30 DOW stocks rose this week, vs. 0 last week. 93% of the S&P 500 rose, vs. just 5% last week. Market breadth bounced back in a major way.

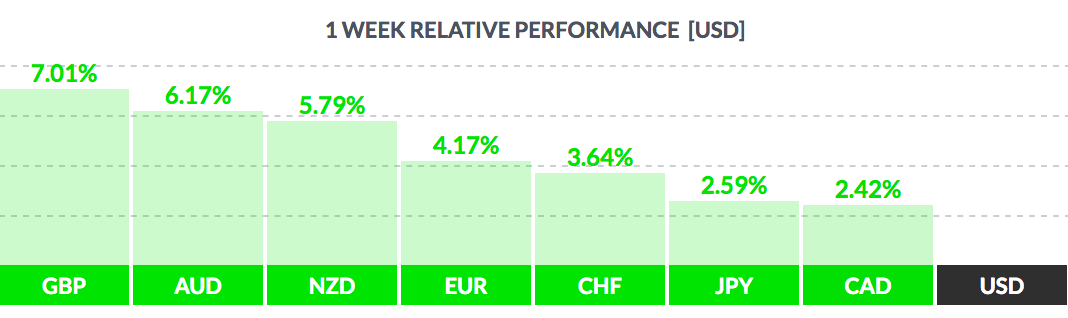

FOREX: The US $ fell vs. most major currencies again this week, on the heels of the Fed’s massive new QE program.

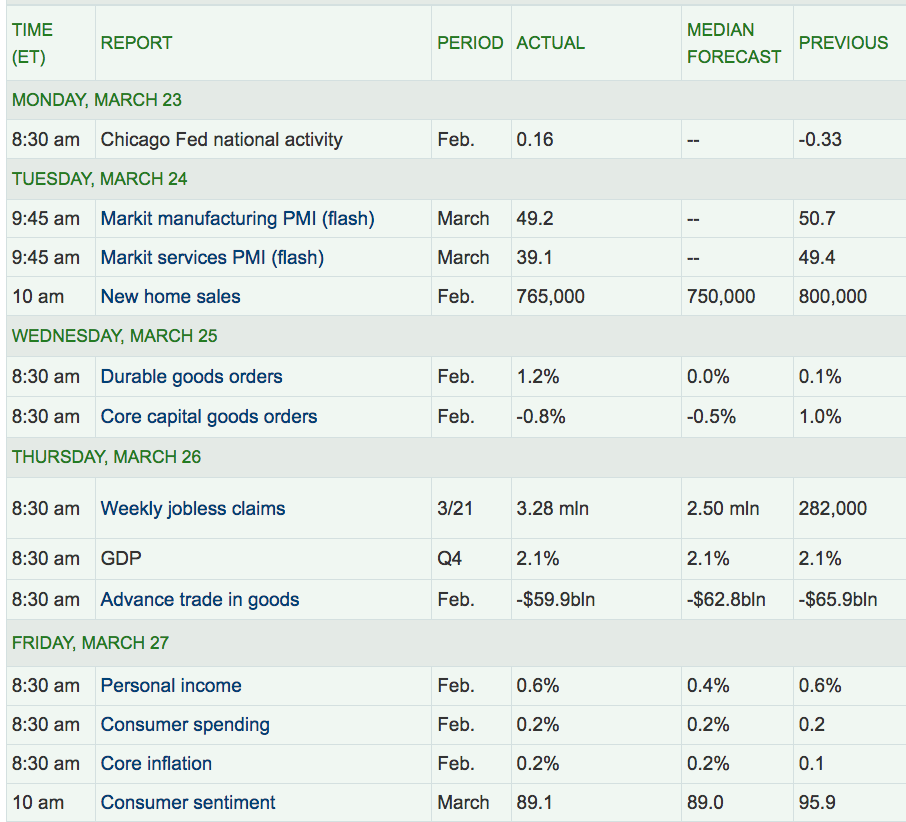

Economic News: On Thursday, there was a record rise in weekly applications for unemployment benefits, which rose to almost 3.3 million, vs.282,000 last week.

U.S. consumer sentiment dropped to near a 3-1/2-year low in March, to 89.1.

Q4 GDP rose 2.1%, the same as Q3 GDP.

“The Senate stimulus package gives directly a one-time payment of $1,200 per adult and $500 per child directly to the public. A huge cash infusion for hospitals expecting a flood of COVID-19 patients grew during the talks at the insistence of Sen. Chuck Schumer, the Democratic leader, while Republicans pressed for tens of billions of dollars for additional relief to be delivered through the Federal Emergency Management Agency, the lead federal disaster agency.

The package includes an “employee retention” tax credit that’s estimated to provide $50 billion to companies who retain employees on payroll and cover 50% of workers’ paychecks. Companies would also be able to defer payment of the 6.2% Social Security payroll tax. To provide transparency, the package is expected to create a new inspector general and oversight board for the corporate dollars, much as was done during the 2008 Troubled Asset Relief Program bank rescue, officials said.” (AP)

“Leaders of the U.S. House of Representatives are determined to pass a $2.2 trillion coronavirus relief bill by Saturday at the latest, hoping to provide quick help as deaths mount and the economy reels.” (Reuters)

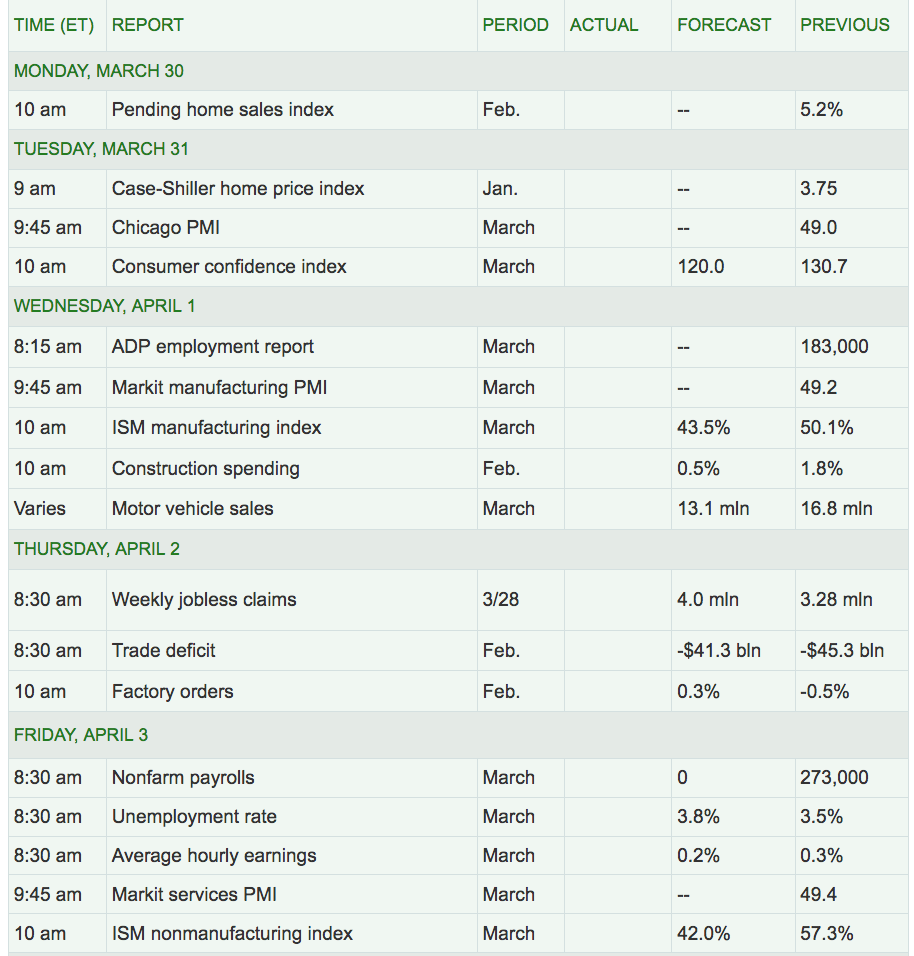

Week Ahead Highlights: The Unemployment rate and the March Non-Farm Payrolls report come out on Friday. The estimate is a rise to 3.8% for the Unemployment rate, with 273K jobs added.

Next Week’s US Economic Reports:

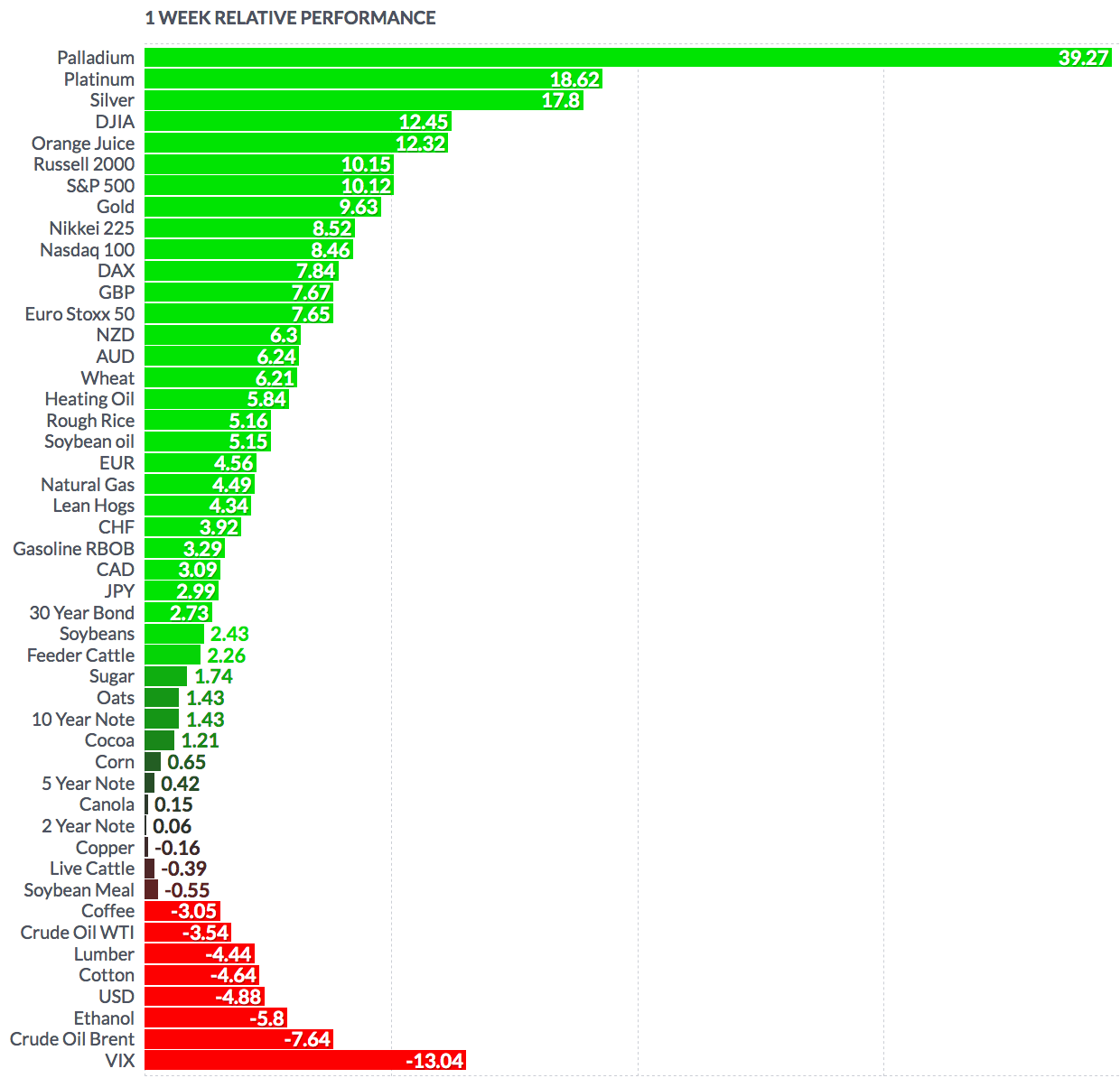

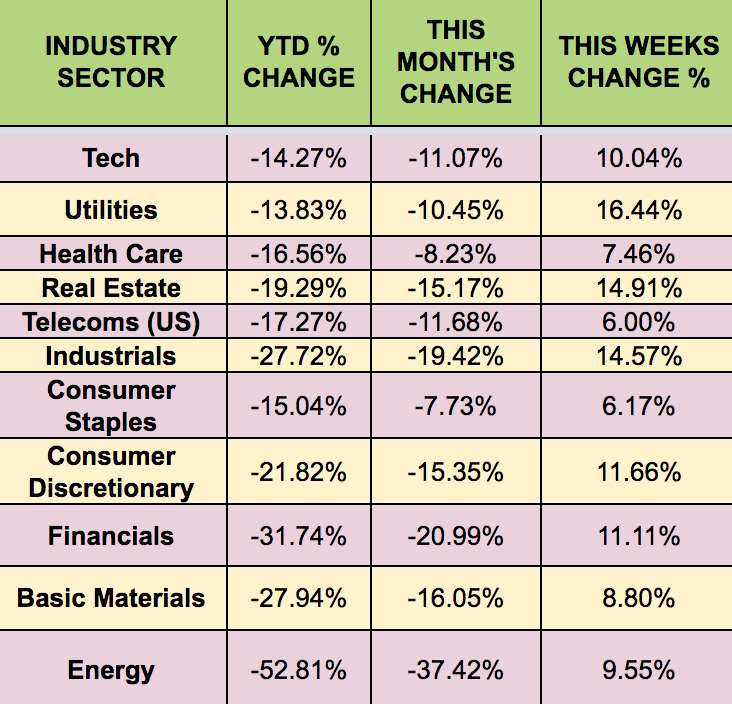

Sectors: All sectors bounced back this week, with Real Estate and Industrials leading, and defensive Consumer Staples & Telecoms lagging.

Futures: WTI crude oil fell again this week, down -3.54%, and ending at $21.84.

“Oil prices fell 5% on Friday and posted a fifth straight weekly loss as demand destruction caused by the coronavirus outweighed stimulus efforts by policymakers around the world. With 3 billion people in lockdown, global oil demand could be cut by a fifth, International Energy Agency head Fatih Birol said as he called on major producers such as Saudi Arabia to help to stabilise oil markets.” (Reuters)