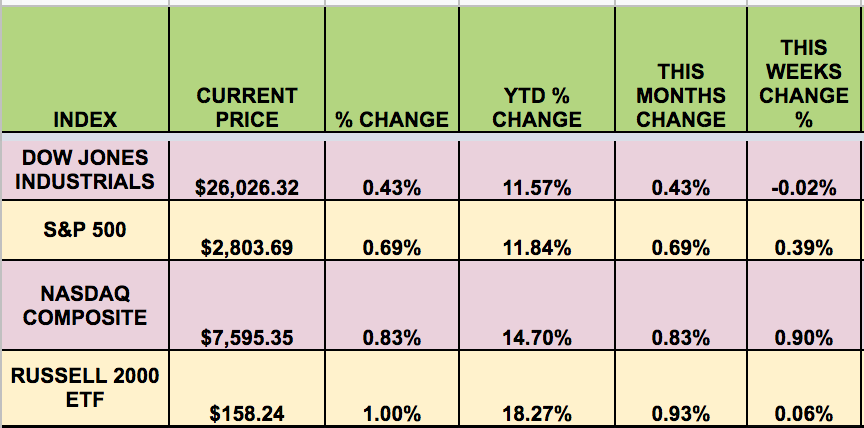

Markets: It was a mixed week for the market, with the DOW and RUSSELL small caps flat, the S&P up .39%, and the NASDAQ leading. Investors were buoyed by positive comments from both sides about the U.S.-China trade talks.

High Dividend Stocks: These high yield stocks go ex-dividend next week – BGCP, GBDC, POPE, AFIN, FDUS,GNL, PPL, WHG,

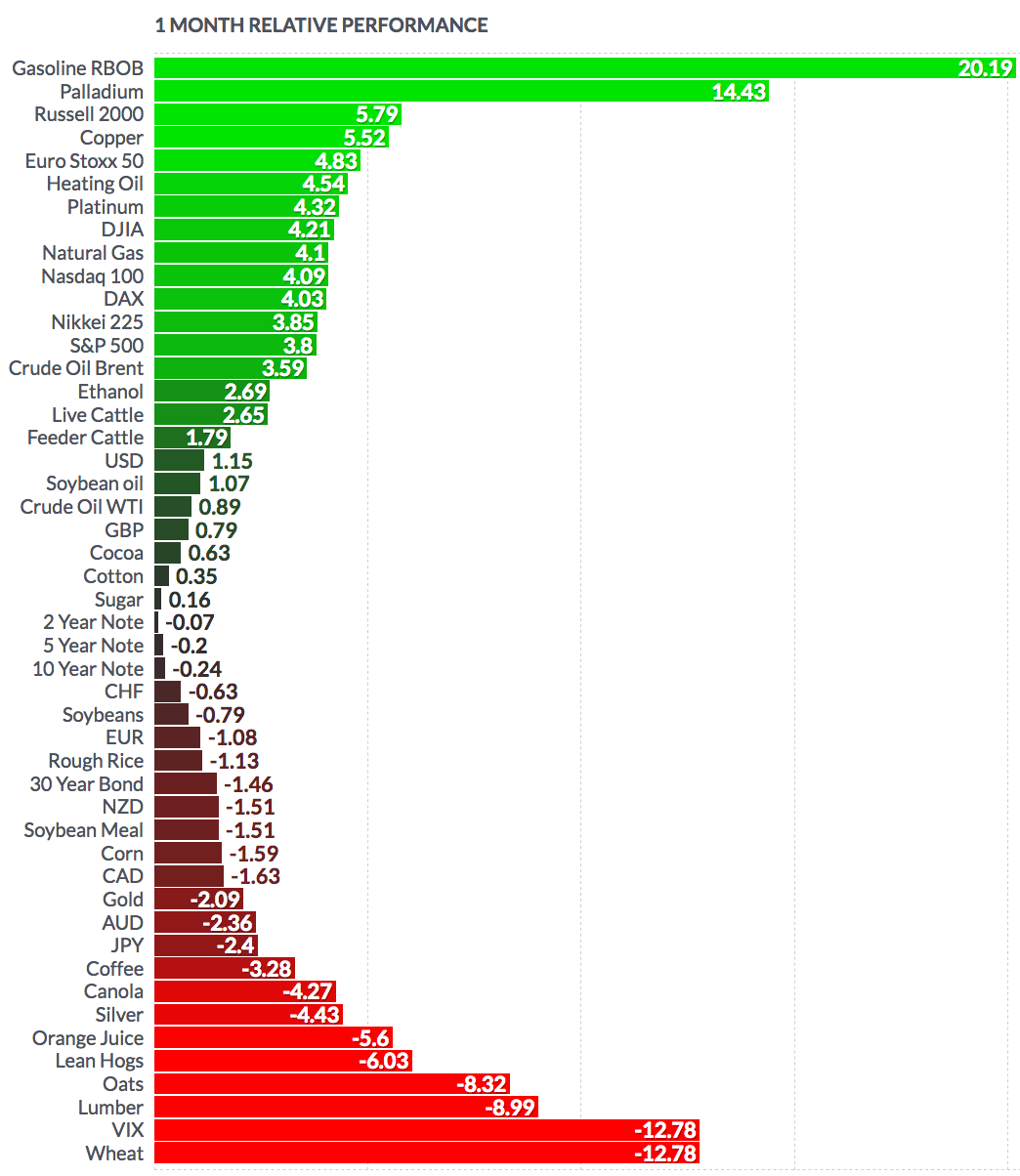

Volatility: The VIX fell -9% this week, ending at $13.57.

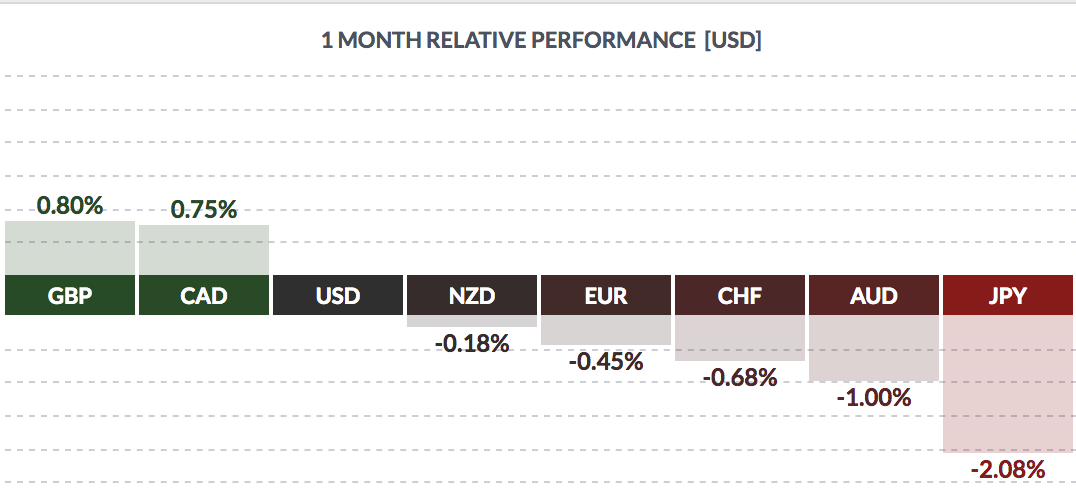

FOREX: The USD rose vs. most major currencies in February, except the pound and the Loonie.

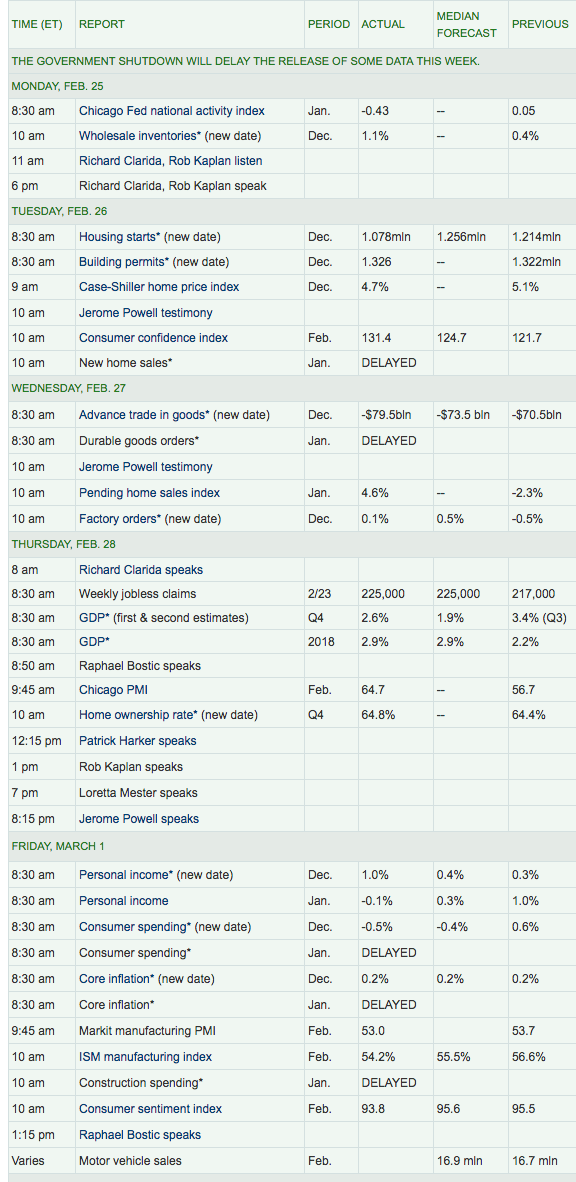

Economic News:

“The U.S. goods trade deficit widened sharply in December as slowing global demand and a strong dollar weighed on exports, another sign that economic growth slowed in the fourth quarter. The Commerce Department said on Wednesday the goods trade gap jumped 12.8 percent to $79.5 billion in December, also with a boost from an increase in imports. Exports declined 2.8 percent and imports rose 2.4 percent in December. The trade data added to weak December reports on retail sales, housing starts and business spending plans on equipment.” (Reuters)

Housing starts slowed in December, while Building Permits were flat. The home price index fell to 4.7%, vs. the previous month’s 5.1% figure. Q4 ’18 GDP rose 2.6%.

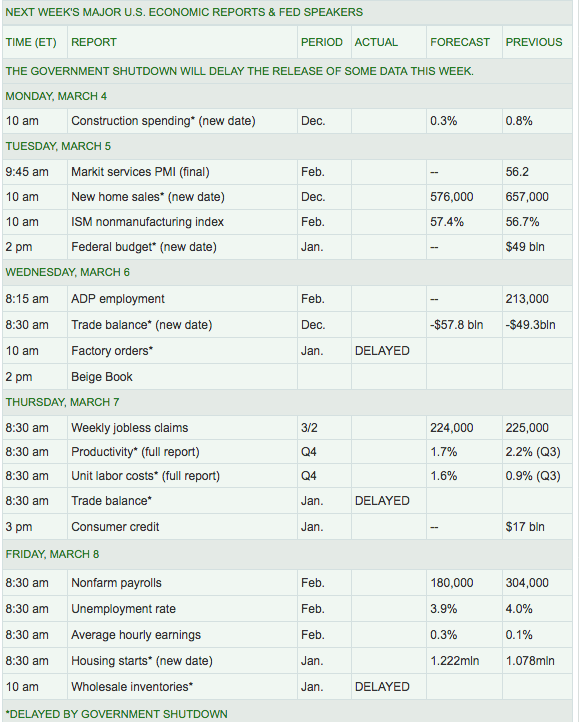

Week Ahead Highlights: The U.S. non-farm payrolls report and the unemployment rate should be released Friday am. China's economic data will also be published next week. The ECB meets – investors are awaiting news of more low cast loans.

Next Week’s U.S. Economic Reports:

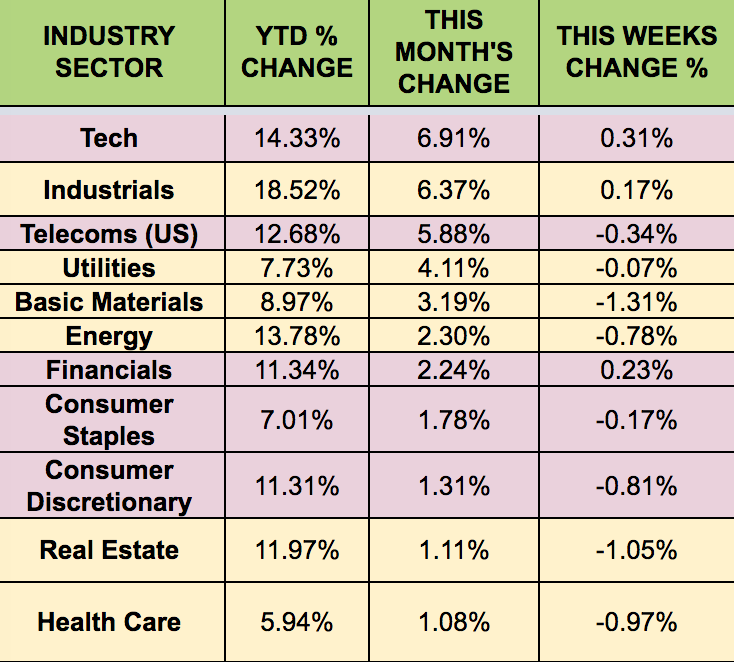

Sectors: Tech and Industrial stocks led the pack in February, with Healthcare trailing. Year to date, Industrials and Tech are also leading, with Healthcare lagging.

WTI Crude rose .89% this week, finishing the week at $55.75, while Natural Gas rose 4.1%.