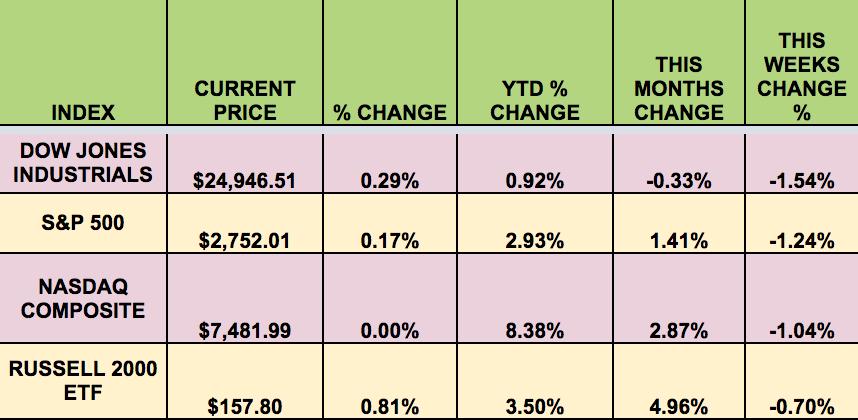

Markets: It was a rough week for the market, with all 4 indexes falling. The NASDAQ & Russell 2000 held up the best, but still lost -1.04% and -.70% respectively. The Dow Jones and the S&P 500 both lost over 1%.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Gladstone Investment Corporation (NASDAQ:GAIN), Gladstone Capital Corporation (NASDAQ:GLAD), Gladstone Commercial Corporation (NASDAQ:GOOD), Newtek Business Services Corp (NASDAQ:NEWT), Vector Group Ltd (NYSE:VGR), Fs Investmt (NYSE:FSIC), OFS Capital Corp (NASDAQ:OFS), Solar Capital Ltd (NASDAQ:SLRC), Solar Senior Capital Ltd (NASDAQ:SUNS), Bluerock Residential Growth REIT Inc (NYSE:BRG), Capitala Finance Corp (NASDAQ:CPTA).

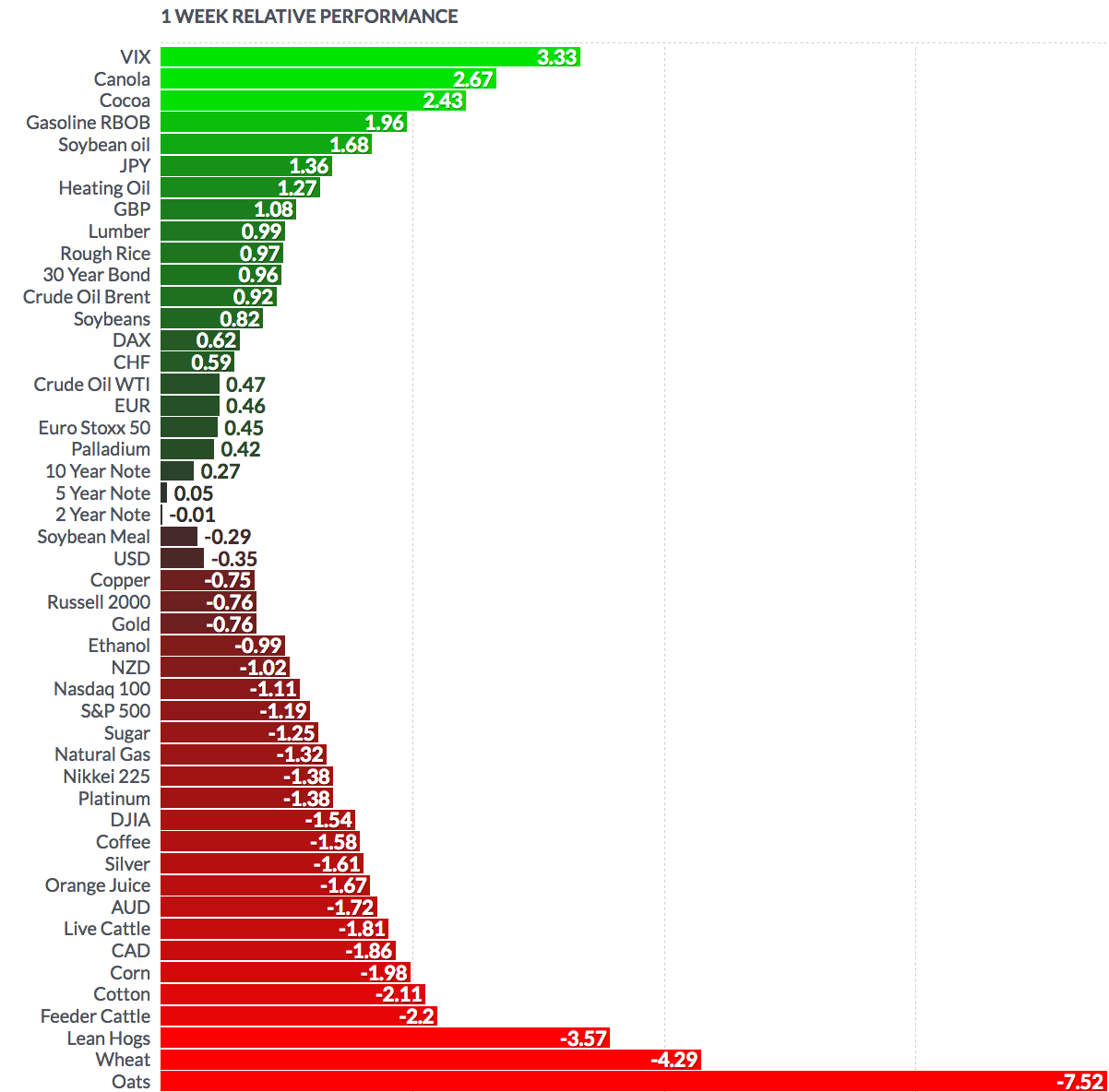

Volatility: The VIX rose 8% this week, ending at $15.80.

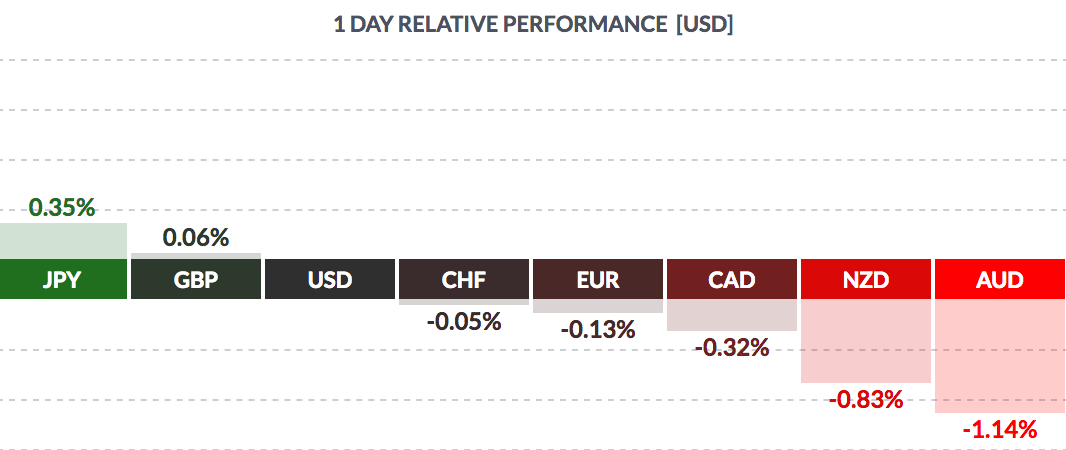

Currency: The US dollar rose vs. most major currencies this week, except the Yen and the British pound.

Market Breadth: Market breadth receded this week – 8 of the Dow 30 stocks rose this week vs. 28 last week. 31% of the S&P 500 rose, vs. 88% last week.

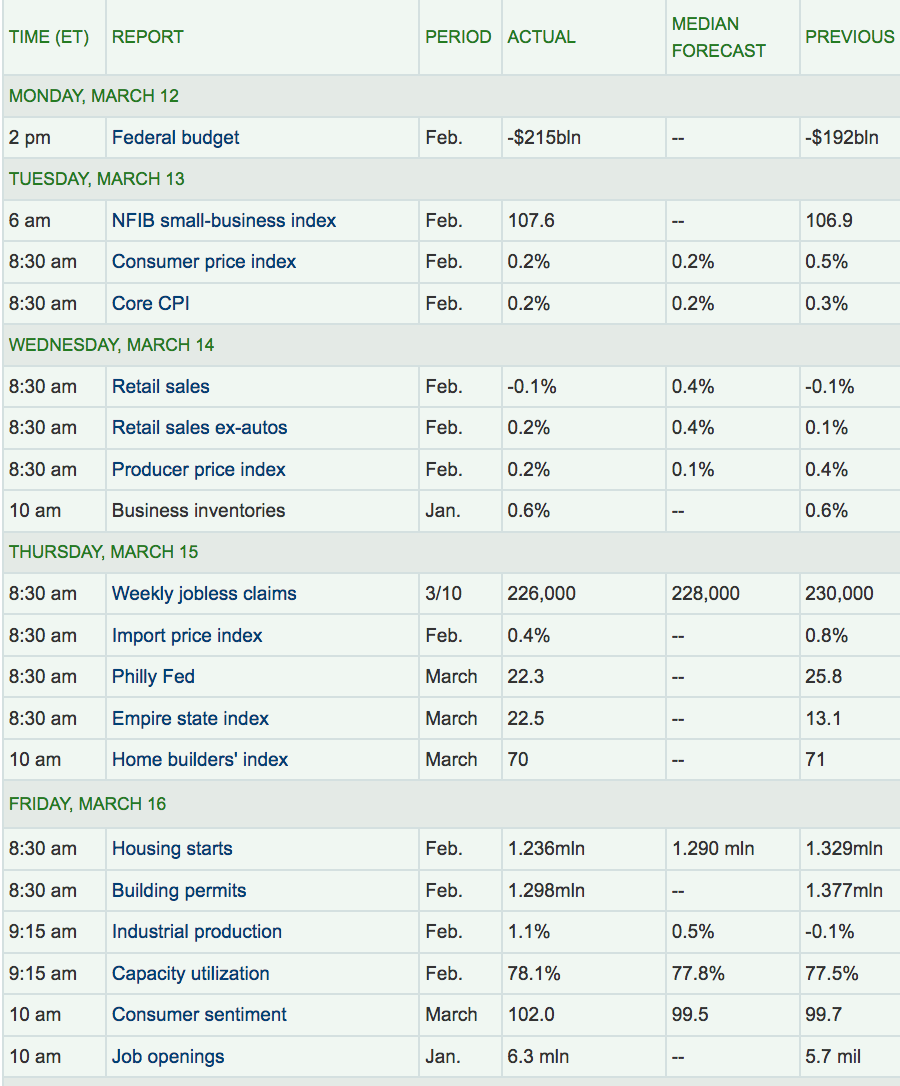

Economic News: “U.S. home building fell more than expected in February as a plunge in the construction of multi-family housing units offset a second straight monthly increase in single-family projects. Housing starts declined 7.0 percent to a seasonally adjusted annual rate of 1.236 million units, the Commerce Department said on Friday. Data for January was revised up slightly to show groundbreaking increasing to a 1.329 million-unit pace instead of the previously reported 1.326 million units.” (Source: Reuters) Feb. Retail Sales disappointed, rising only 0.2%.

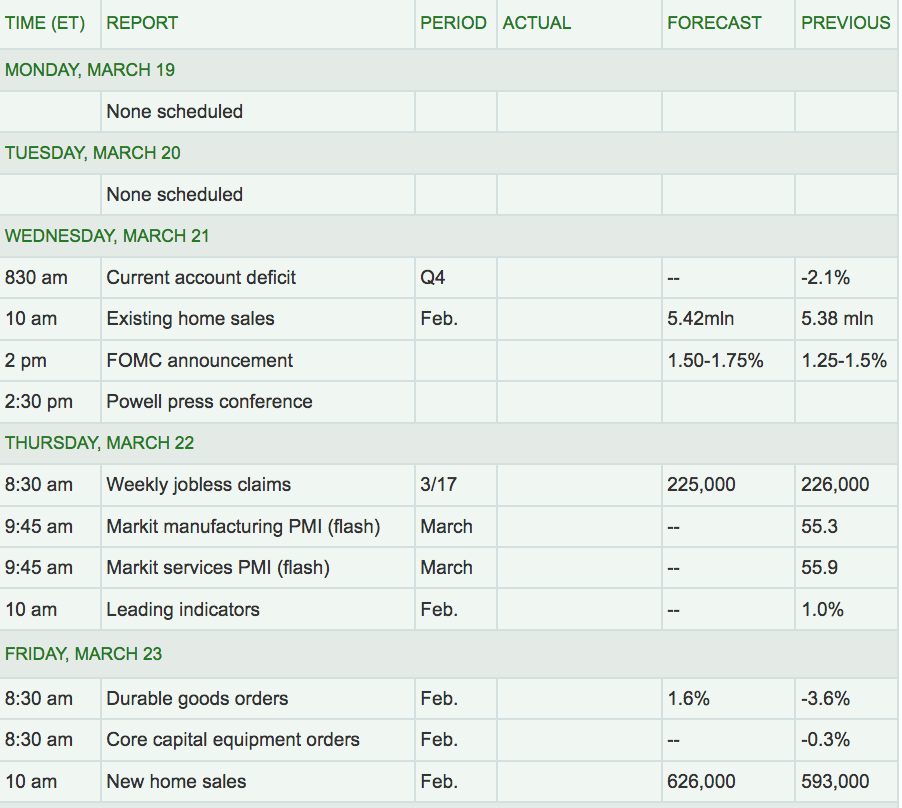

Week Ahead Highlights: For stock market investors, the coming week is likely to see the Federal Reserve move back into focus, stealing the spotlight back, at least briefly, from worries about tariffs and political turmoil.

The Feds two-day policy meeting, which will conclude Wednesday and is widely expected to deliver the first rate increase of 2018, will be Fed Chairman Jerome Powell's first as chairman of the central bank, and investors will be eager to find out just how much he deviates from the legacy of Janet Yellen, whom he succeeded in early February.

While market participants have fully priced in a quarter-percentage point rate increase on Wednesday, investors will parse the wording of the accompanying statement and Powell's subsequent news conference. (Source: MarketWatch)

Next Week’s US Economic Reports: There won’t be much data coming out next week, other than Existing and New Home Sales reports for Feb., and the leading indicators reports.

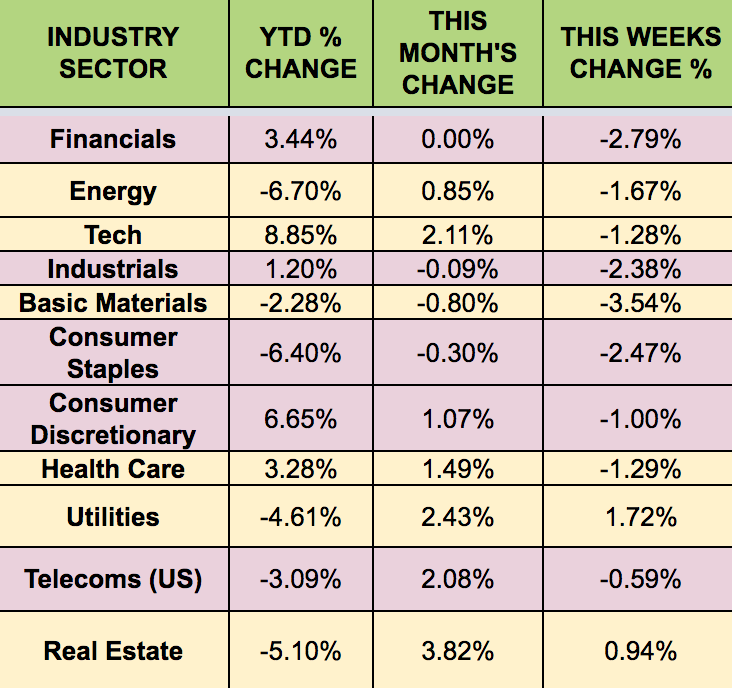

Sectors: All sectors fell this week, with Telecoms losing the least ground, and Basic Materials trailing.

Futures:

Crude Oil WTI Futures rose .47%, while Natural Gas futures fell -1.32%.

“Earlier Wednesday, OPEC projected that U.S. and other non-OPEC supply growth will outpace global demand growth in 2018, raising the risk of imbalance in the oil markets and lower crude prices.

On Monday, the EIA said production from major U.S. shale formations should rise by 131,000 barrels per day in April vs. the previous month to an all-time high of 6.95 million bpd. Longer term, the International Energy Agency expects U.S. shale to cover 80% of the additional oil demand the world will see through 2020 and 60% by 2023, as Permian production doubles.