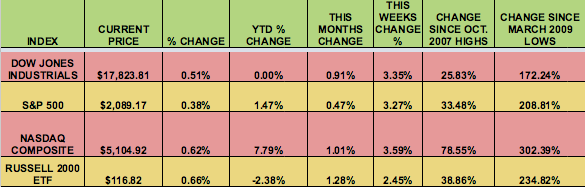

Markets: The S&P had its best week of the year, as the market bounced back strong from last week’s pullback, spurred on by comments from ECB chief Draghi that the ECB may embark on a new round of easing at its Dec. 3rd meeting. Markets were also helped by strong earnings reports from retailers, including Walmart (N:WMT). The Dow is now flat for the year, the S&P is back in positive territory, and the NASDAQ leads by a wide margin.

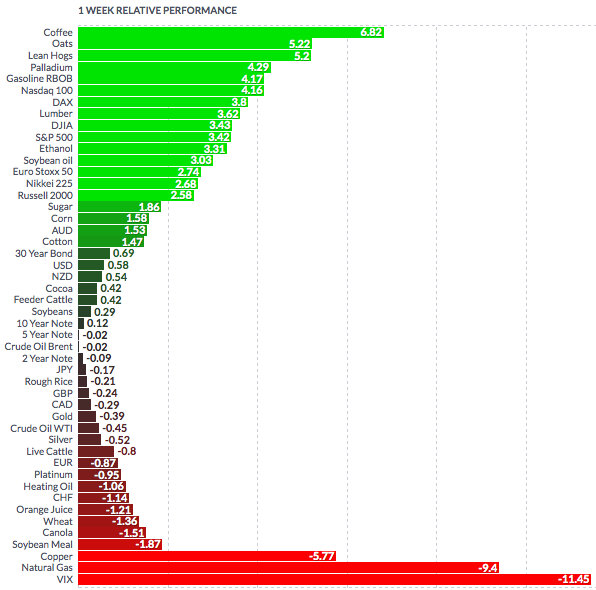

Volatility: The VIX fell 21.26% this week, ending at $15.78.

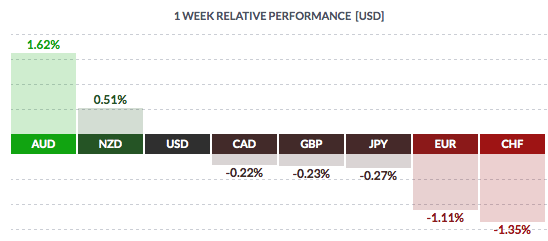

Currency: The dollar rose vs. most major currencies, except the Aussie and NZ dollar, in response to the ECB easing comments.

Market Breadth: 25 of the DOW 30 stocks rose this week, vs. 2 last week. 78% of the S&P 500 rose this week, vs. 10% last week.

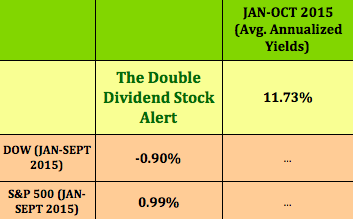

Dividend Stocks Update: These high dividend stocks are going ex-dividend this coming week – O:MAT, N:MCC, N:PBA, O:EVOL, O:FDUS, N:NGG, N:SOR, N:BEP, N:BIP, N:CLDT, N:CSG, N:EXCU, FULL, N:IRT, N:JMP, N:OCIP, O:PSEC, O:GLPI, N:HHS, N:IRM, N:NYLD, O:SAFT, N:TAC.

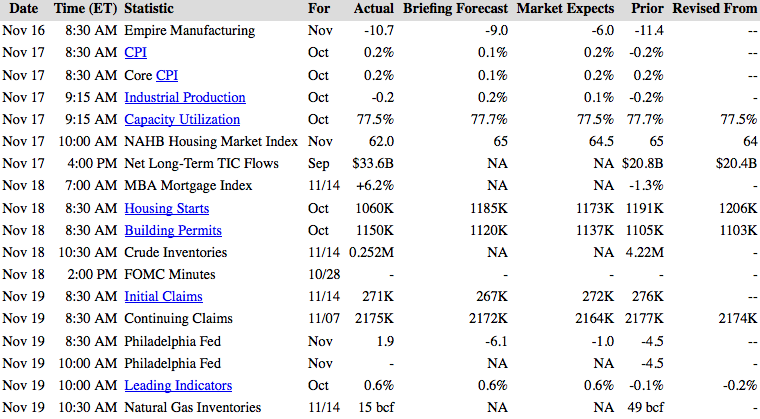

US Economic News: Housing starts slowed down more than expected in Oct., whereas Building Permits, a leading indicator, surprised to the upside.

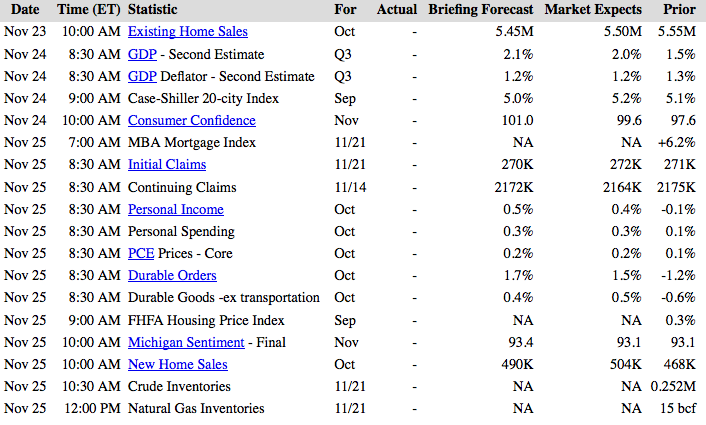

Week Ahead Highlights: We’ll see more Housing data next week, with Existing Home Sales due out on Monday, the Case-Shiller report coming out on Tuesday, and New Home Sales due out on Wed. There will also be GDP data, and Consumer Confidence and Sentiment readings.

It’ll be a short week, with US markets closed on Thursday for the Thanksgiving holiday, and closing early at 1pm on Friday.

Next Week’s US Economic Reports:

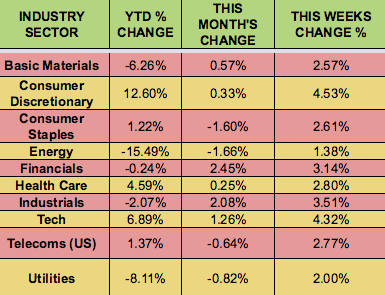

Sectors and Futures:

Consumer Discretionary led this week, while Energy trailed. All sectors were positive.

Coffee led this week, with Natural Gas trailing: