Markets: Mixed earnings weighed on the market last week, as Dow tech components Apple (NASDAQ:AAPL), Intel (NASDAQ:INTC) and Microsoft (NASDAQ:MSFT) all fell. Apple fell over 11%, after reporting its 1st ever drop in iPhone sales, and forecast lower than expected revenues for its next quarter. Weaker US GDP also put pressure on the market.

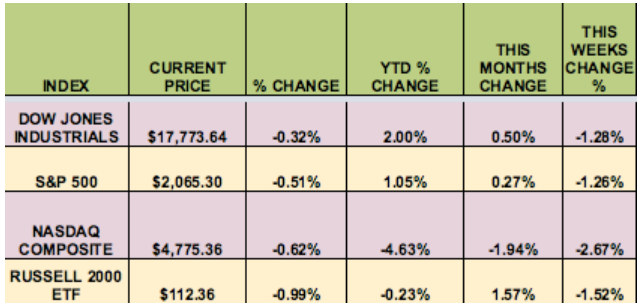

The DOW now leads these other 3 indexes year to date, followed by the S&P 500. Meanwhile, the NASDAQ lagged in April and year to date.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Cone Midstream Partners LP (NYSE:CNNX), KNOT Offshore Partners LP (NYSE:KNOP), Navios Maritime Midstream Partners LP (NYSE:NAP), Golar LNG Partners LP (NASDAQ:GMLP), Sprague Resources LP (NYSE:SRLP), Dynagas LNG Partners LP (NYSE:DLNG), Dynagas LNG Partners LP Unit (NYSE:DLNG_pa), Crestwood Equity Partners LP (NYSE:CEQP), Martin Midstream Partners LP (NASDAQ:MMLP).

Volatility: The VIX rose 4.3% this week, finishing at $16.90.

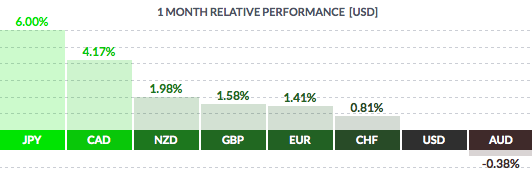

Currency: The dollar fell vs. most major currencies in April, as no Fed rate hike materialized, and the likelihood of a June hike diminished.

Market Breadth: 6 of the DOW 30 stocks rose this week, vs. 15 last week. 38% of the S&P 500 rose this week, vs. 58% last week.

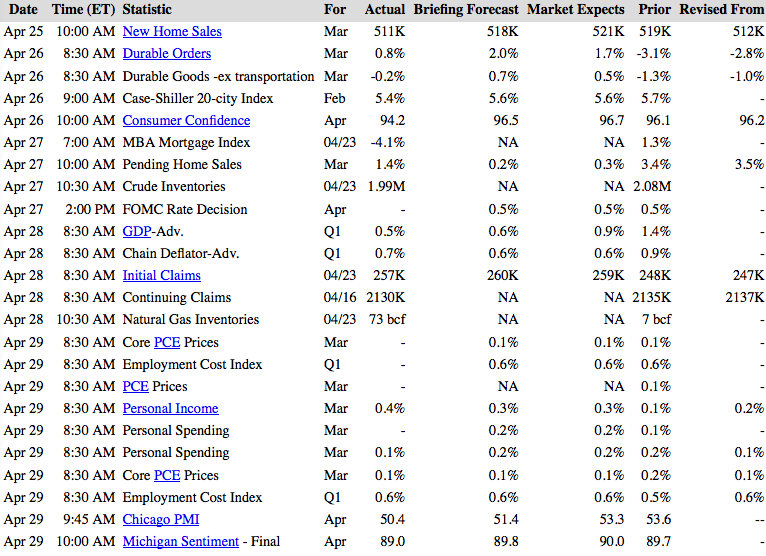

US Economic News: GDP disappointed, growing only .5% in Q1, vs. the .9% forecast. As expected, the Fed didn’t raise the Fed Funds Rate…Pending Home Sales surprised to the upside, hitting a 4-month high, but Existing Home Sales declined in the West, due to rapid price gains of over 35% in the past 3 years.

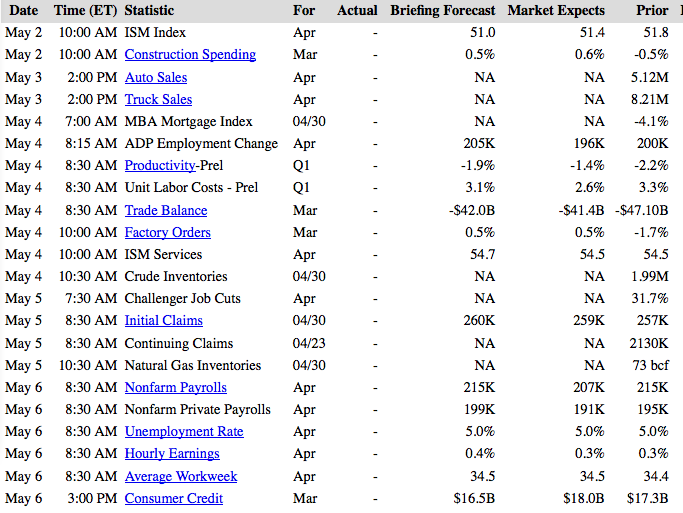

Week Ahead Highlights: The Non-Farm Payrolls report for April comes out next Friday am. The market’s emphasis may switch to jobs, as a forward indicator of potentially better earnings coming in Q2.

Earnings season rolls on, with 24% of the S&P 500 reporting, including Kraft Heinz (NASDAQ:KHC), Con Ed (NYSE:ED), Williams, Dominion Resources (NYSE:D), and many others.

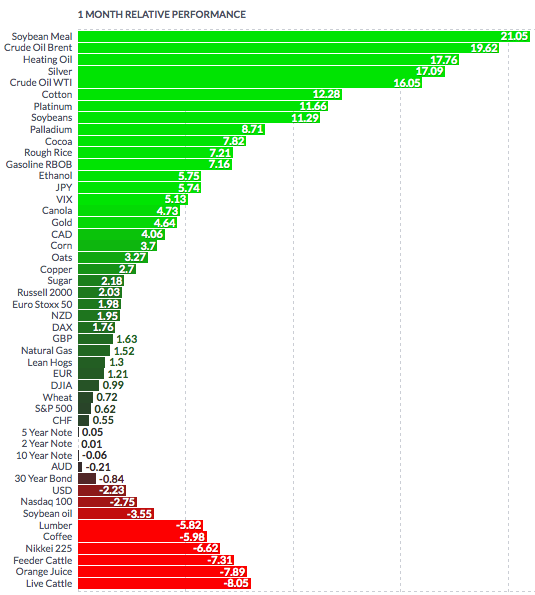

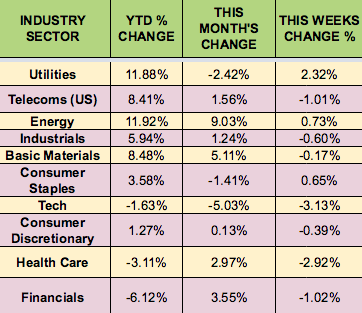

Sectors and Futures:

Energy was the big winner in April, gaining over 9%, while defensive sectors – Utilities and Consumer Staples trailed, although Utilities came back in this down week, leading all other sectors.

Crude Oil futures had big gains in April, with WTI Crude up over 16%, and Brent Crude up over 19%. Cattle futures lagged, falling -8%: