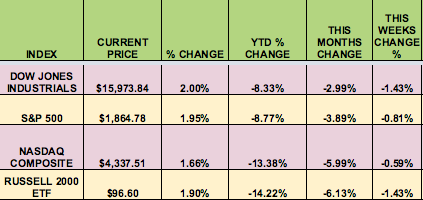

Markets: In spite of a big rally Friday, it was another down week for the market – the S&P 500 has been down 5 of the 7 past weeks. Even beleaguered small caps caught a break on Friday, sending the Russell 2000 to a nearly 2% gain on the day.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: N:CVX, O:LAND, N:APO, N:AZN, N:RDSb, O:HRZN

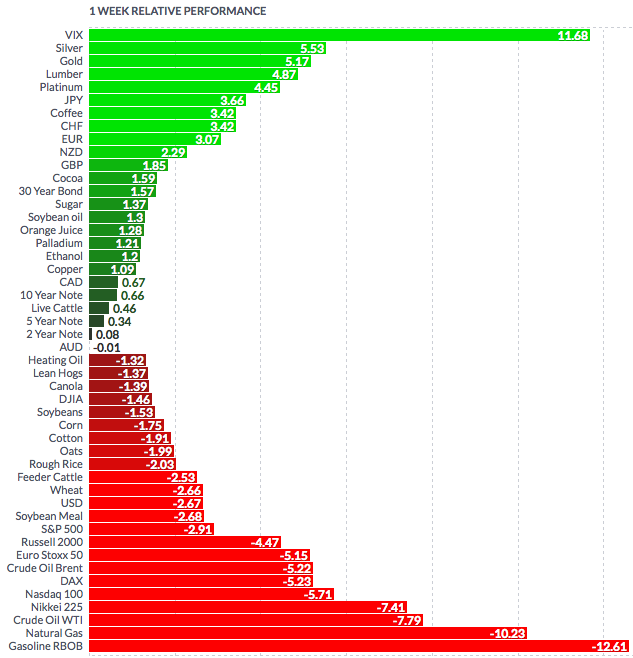

Volatility: The VIX rose 8.6% this week, finishing at $25.40.

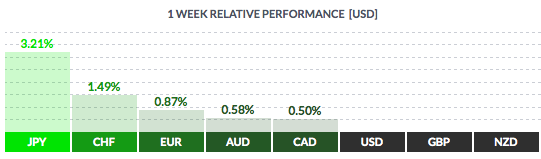

Currency: The US dollar fell vs. most major currencies this week, losing over 3% vs. the yen, (a 16-month low), as investors saw the probability of a March Fed rate hike fading, on the basis of Fed Chief Yellen’s testimony before Congress.

Market Breadth: 11 of the DOW 30 stocks rose this week, vs. 10 last week. 35% of the S&P 500 rose this week, vs. 30% last week.

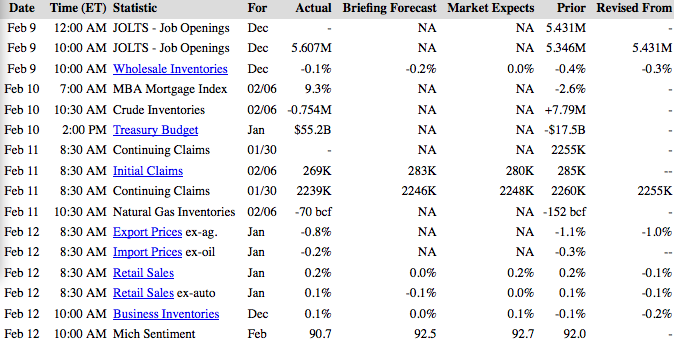

US Economic News: Initial Claims were the lowest in 7 weeks. January ex-Auto Retail Sales exceeded forecasts.

Week Ahead Highlights: It will be a short week, with US markets closed for Presidents Day on Monday. Earnings season continues, with several S&P 500 firms reporting, including Walmart (N:WMT), Hormel (N:HRL), Genuine Parts Co. (N:GPC), Dr Pepper (N:DPS), VFC (N:VFC), Macy's (N:M), and John Deere (N:DE). We’ll get fresh Housing data for January as well. Friday, Feb. 19th is the expiration date for this month’s options.

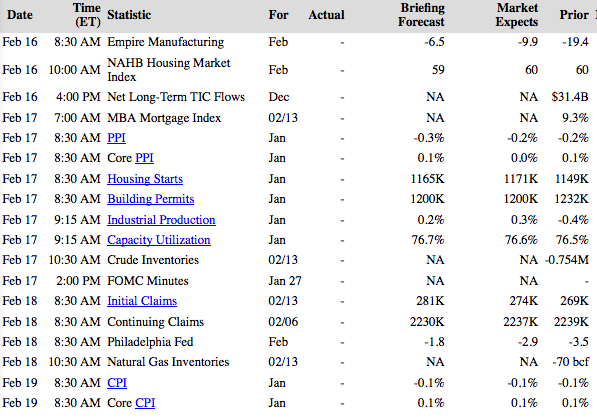

Next Week’s US Economic Reports:

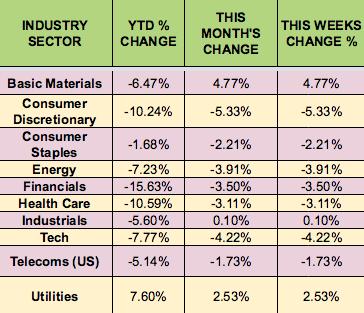

Sectors and Futures:

Basic Materials led this week, helped by a falling US dollar, as Consumer Discretionary stocks trailed.

Silver and gold led this week, with gasoline, natural gas, and crude oil trailing: