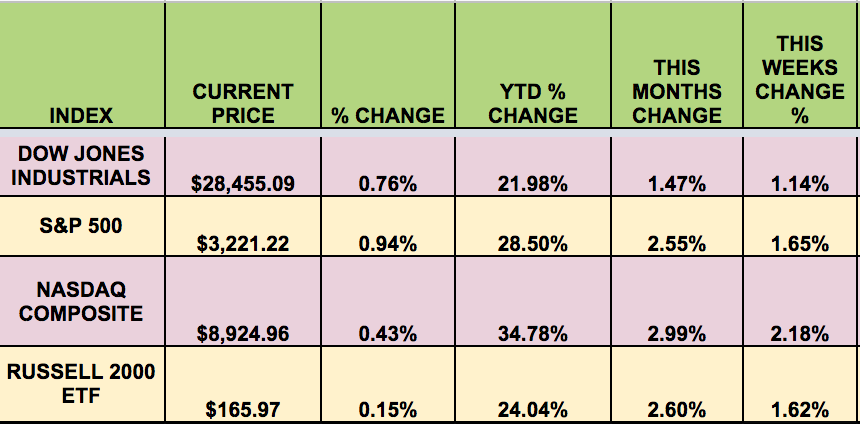

Market Indexes: It was an upmarket this week, supported by a Q3 GDP report showing 2.1% growth, flat vs. Q2 ’19. Strong consumer spending offset the weaker business investment.

“Dow Jones Market Data figures going back to 1950 indicate that the Dow Jones Industrial Average tends to climb 75% of the time, with an average return of about 8.9% in the following year, when it finishes the previous year with a return of at least 20%. It tends to ring up an average annual gain of 11.2% when it finishes the preceding year with an advance of at least 20%, and gains 83% of the time, according to the data team.”

(MarketWatch)

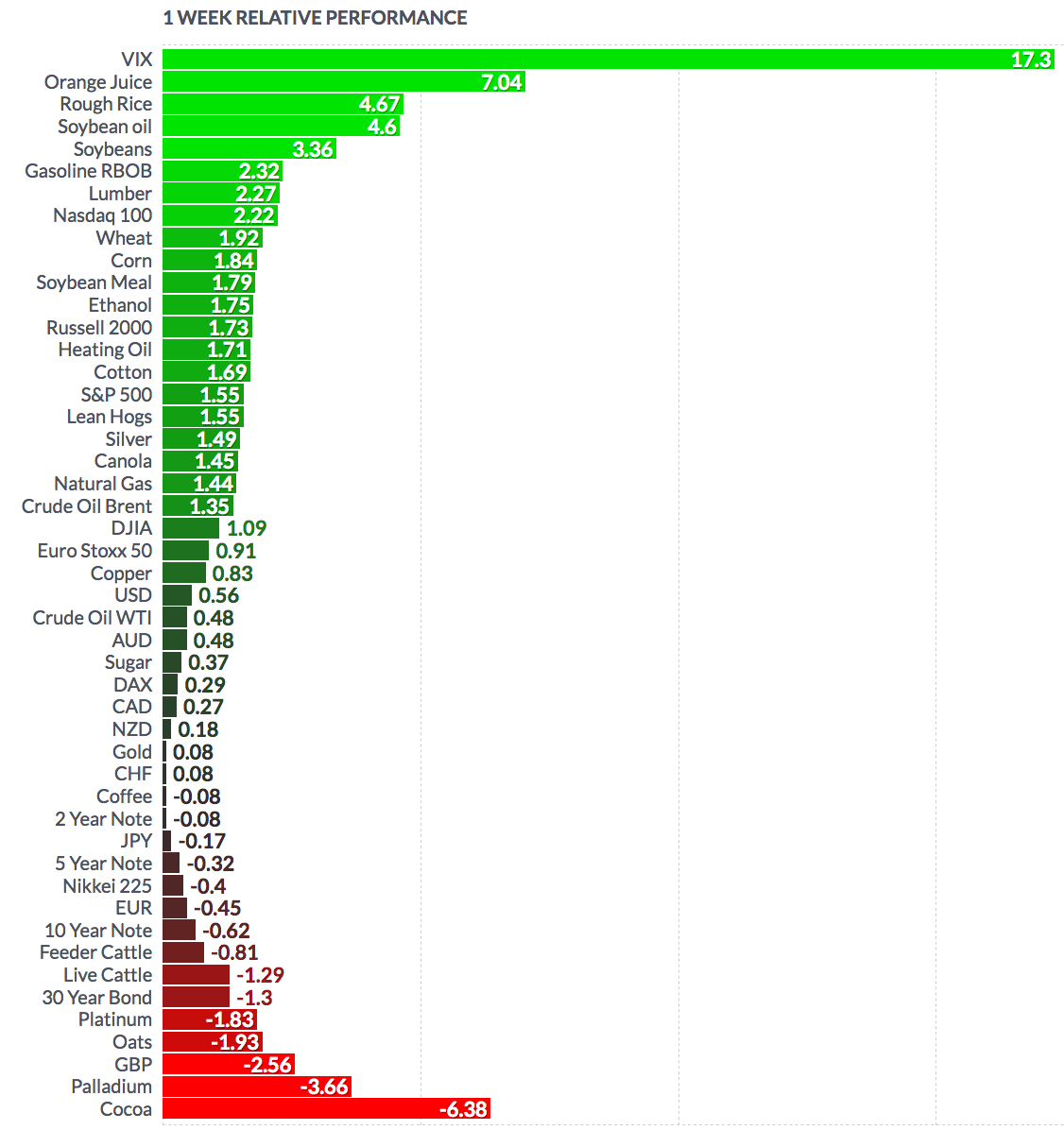

Volatility: The VIX fell .09% this week, ending the week at $12.51.

High Dividend Stocks: These high yield stocks go ex-dividend next week: BRG, MO, ACRE, CPLG, MFA, TDI.

Market Breadth: 28 out of 30 DOW stocks rose this week, vs. 20 last week. 81% of the S&P 500 rose, vs. 62% last week.

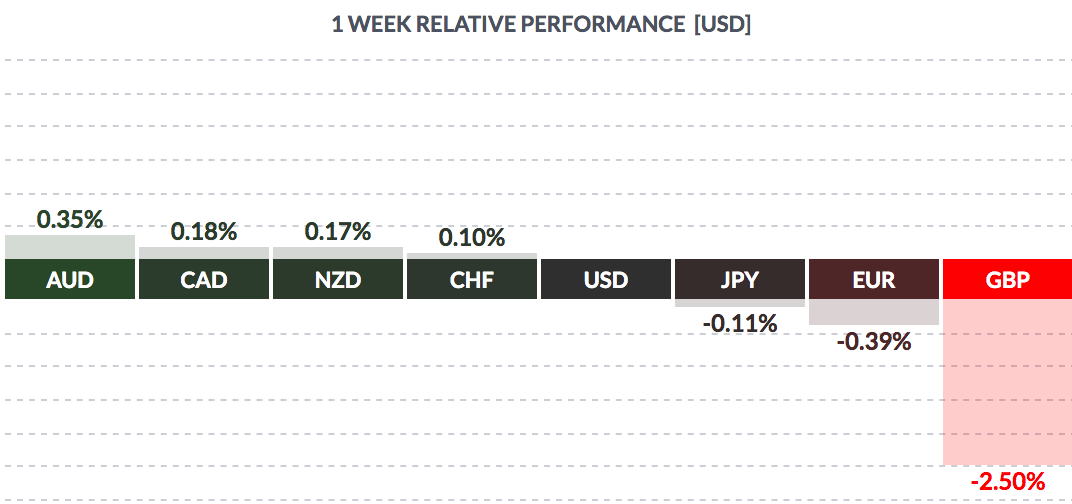

FOREX: The USD fell vs. most major currencies this week, except the yen, the euro, and the pound.

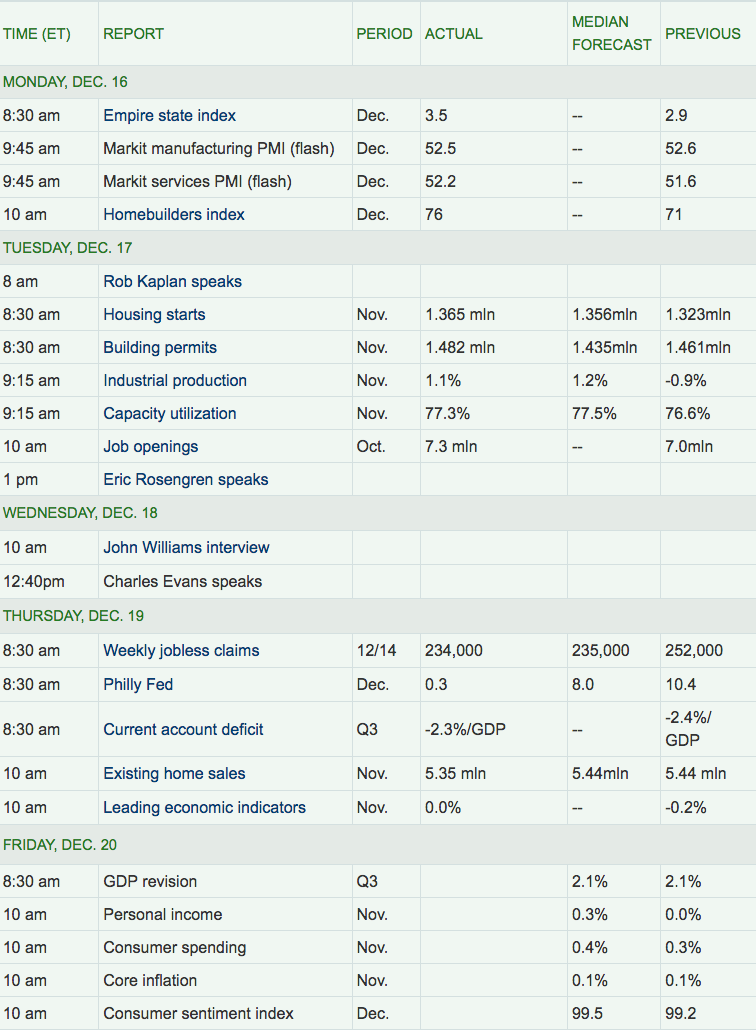

Economic News:

“The U.S. House of Representatives overwhelmingly approved a new North American trade deal on Thursday that includes tougher labor and automotive content rules but leaves $1.2 trillion in annual U.S.-Mexico-Canada trade flows largely unchanged. The changes negotiated by Democrats, which include tighter environmental rules, will also set up a mechanism to quickly investigate labor rights abuses at Mexican factories. They have earned the support of several U.S. labor unions that have opposed NAFTA for decades.

The biggest changes require increased North American content in cars and trucks built in the region, to 75% from 62.5% in NAFTA, with new mandates to use North American steel and aluminum.

In addition, 40% to 45% of vehicle content must come from high-wage areas paying more than $16 an hour – namely the United States and Canada. Some vehicles assembled in Mexico mainly with components from Mexico and outside the region may not qualify for U.S. tariff-free access.

The U.S. Congressional Budget Office estimated earlier this week that automakers will pay nearly $3 billion more in tariffs over the next decade for cars and parts that will not meet the higher regional content rules.” (Marketwatch)

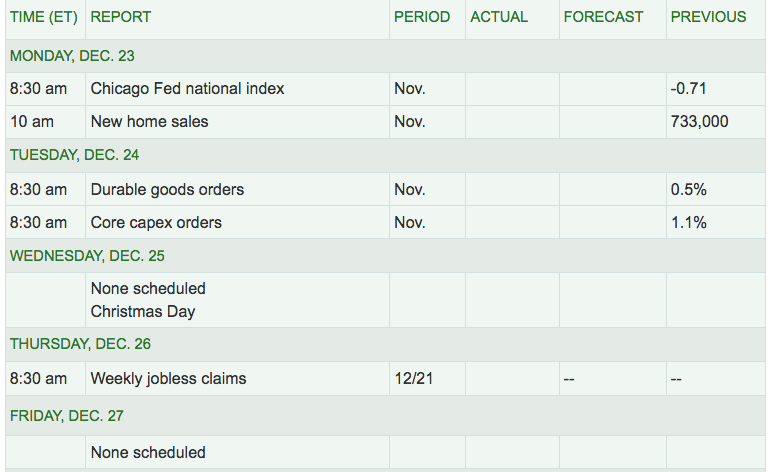

Week Ahead Highlights: It’ll be a shortened week, with US markets closing early, at 1PM on Wednesday for Christmas Eve, and closing on Thursday for Christmas.

Next Week’s US Economic Reports:

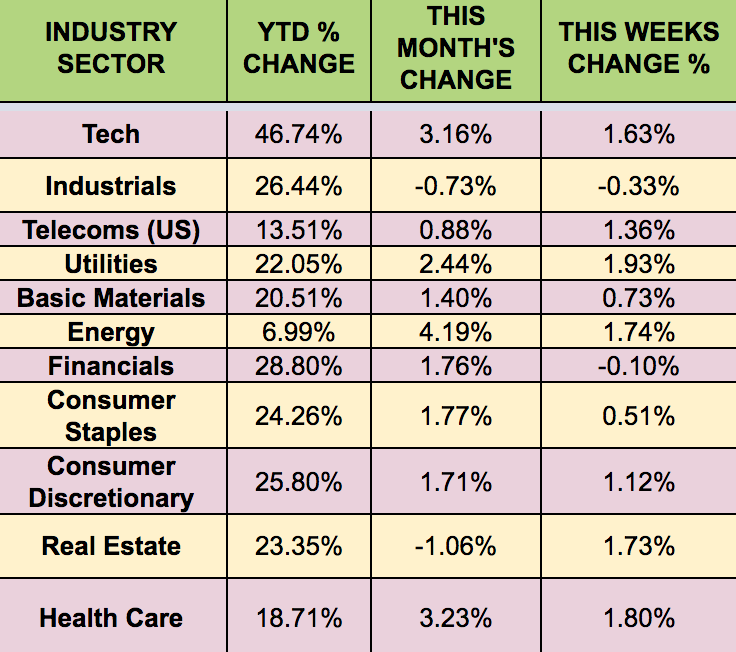

Sectors: Utilities and Health Care led this week; Industrials lagged.

Futures: WTI Crude rose .48% this week, finishing at $60.36, another high weekly close.

“Oil prices held steady near three-month highs on Friday, heading for a third consecutive weekly rise, on the back of easing Sino-U.S. trade tensions that have weighed on demand as well as the global economic growth outlook. China on Thursday announced a list of import tariff exemptions for six oil and chemical products from the United States, days after the world’s two largest economies announced an interim trade deal set to be signed at the beginning of January.” (Reuters)