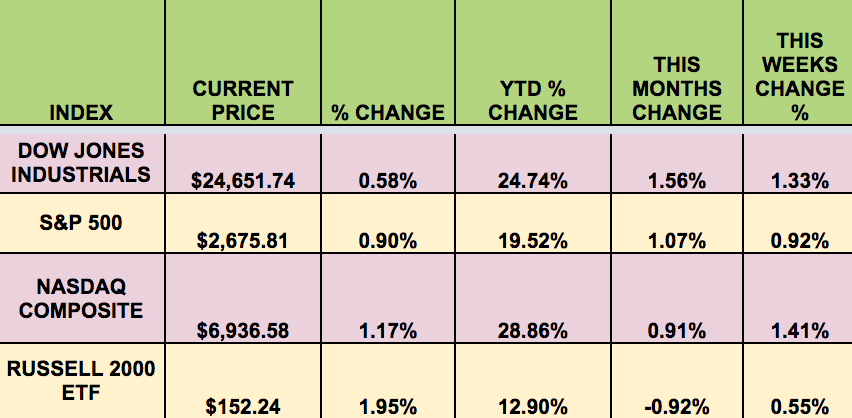

Markets: It was a mixed week again- with 3 out of 4 indexes gaining for the week and closing at record highs on Friday, as the Tax Bill advanced further through the legislative process. The Dow Jones 30 and the S&P 500 led, and the NASDAQ gained, but the Russell Small Caps actually lost .92%.

Quadruple witching, the simultaneous expiration of U.S. options and futures contracts for stocks and indexes, boosted volume to 10.7 billion shares, well above the 6.73 billion average over the last 20 trading days, and the highest since a year ago.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Gladstone Investment Corporation (NASDAQ:GAIN), Gladstone Capital Corporation (NASDAQ:GLAD), Gladstone Commercial Corporation (NASDAQ:GOOD), BlackRock Kelso Capital Corporation (NASDAQ:BKCC), Capitala Finance Corp (NASDAQ:CPTA), FDUS, Fs Investmt (NYSE:FSIC), VGR, AINV, SUNS, American Capital (NASDAQ:ACSF), CYS Investments Inc (NYSE:CYS), One Liberty Properties Inc (NYSE:OLP).

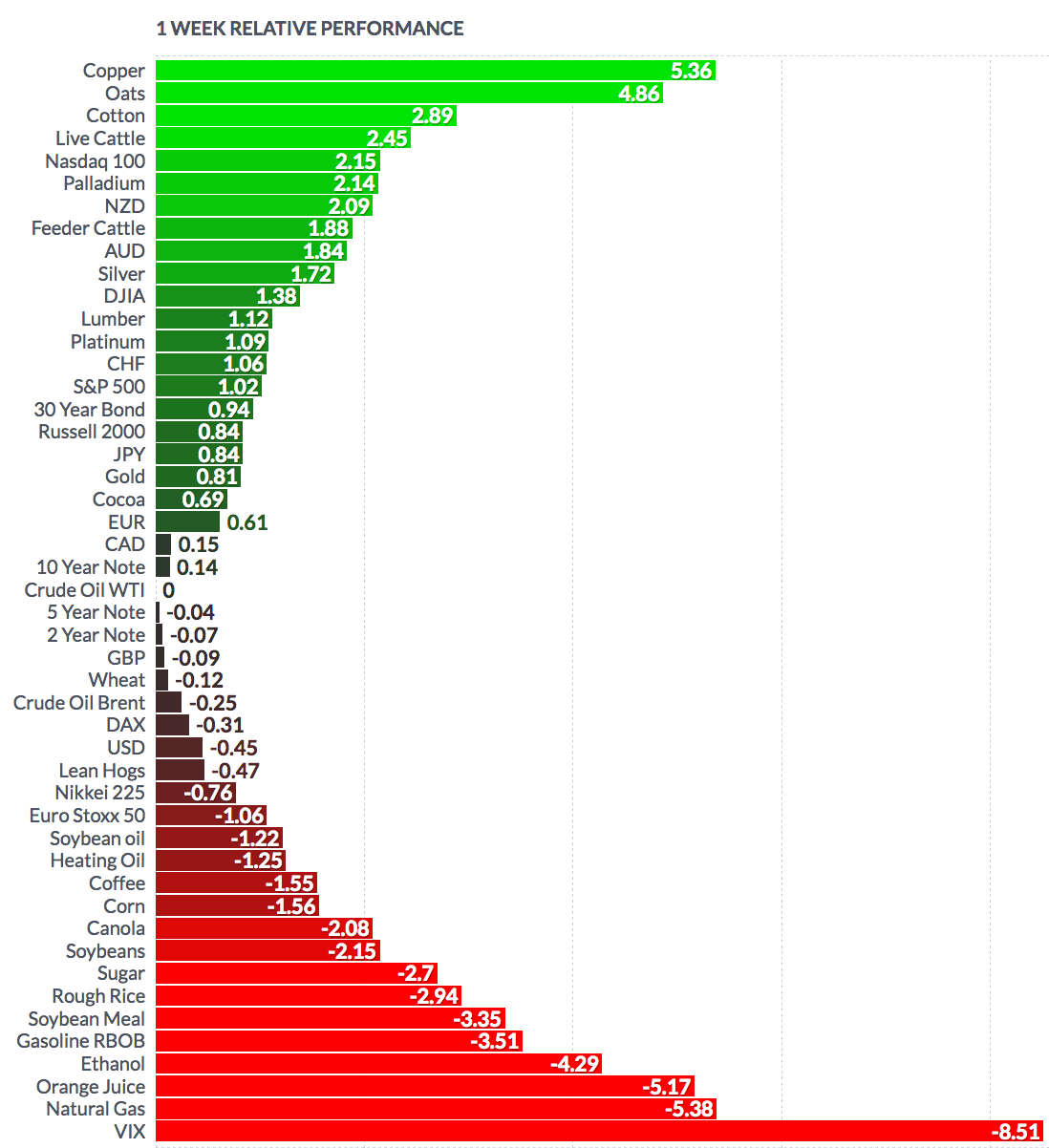

Volatility: The VIX fell 1.3% this week, ending at $9.45.

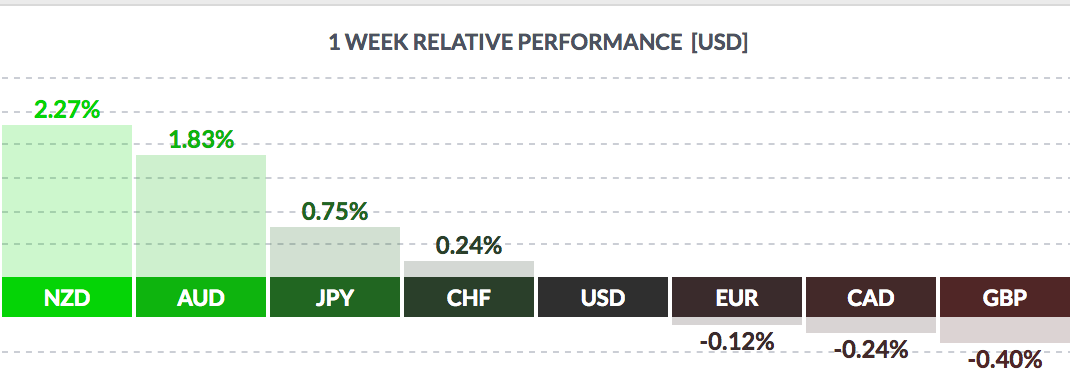

Currency: The $ rose vs. the Euro, Loonie and the Pound this week, but fell vs. the YEN, and the NZ and Aussie $.

Market Breadth: 24 of the DOW 30 stocks rose this week, vs. 15 last week. 47% of the S&P 500 rose, vs. 55% last week.

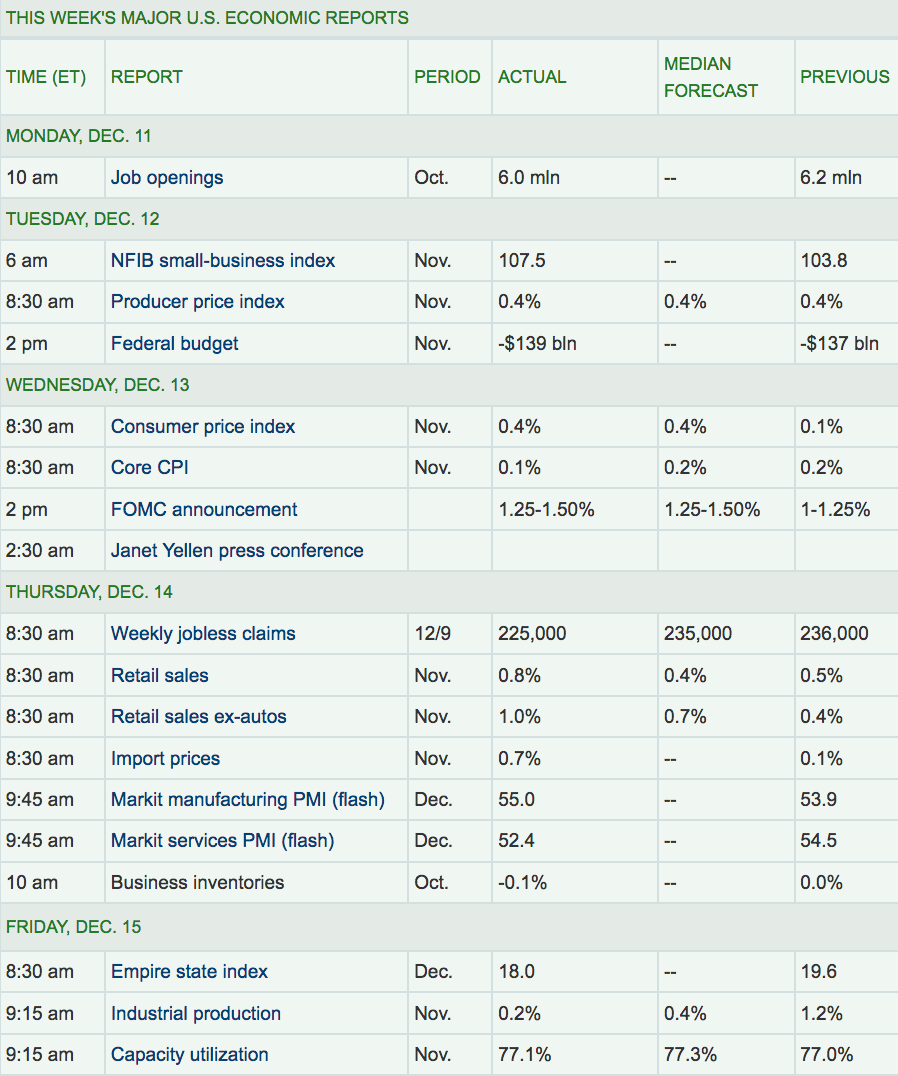

Economic News: “Underlying U.S. consumer inflation slowed in November amid weak healthcare costs and the biggest drop in apparel prices since 1998. The annual increase in the core CPI slowed to 1.7 percent in November from 1.8 percent in October.

The Feds preferred inflation measure, the personal consumption expenditures (PCE) price index excluding food and energy, has consistently undershot the U.S. central banks 2 percent target for almost 5-1/2 years. The cost of healthcare services slipped 0.1 percent, the first drop since May. The cost of doctor visits fell 0.8 percent last month. In the 12 months through November, the price of doctor visits fell 1.8 percent, the biggest decline since records started in 1947.”

“Apparel prices dropped 1.3%, the largest drop since September 1998. New motor vehicle prices rose 0.3% after two straight monthly declines.” (Source: Reuters)

“On Thursday. No one expected Mario Draghi, the bank's president, to drop any bombshells when he faced reporters after the bank’s final meeting of 2017. But there were lots of questions about what will be coming in the New Year.

It could be a watershed. The central bank’s own economists substantially raised their estimates for eurozone growth, portending an end to the crisis measures that have been in place in the 19-nation common currency area since 2008. That would usher in a new era, with monetary policy returning to normal and the central bank beginning to gently push up interest rates.

Mr. Draghi’s news conference on Thursday revolved around how soon the stimulus measures might end. While he said there has been significant improvement in the growth outlook, he steadfastly avoided any statements that would change investor expectations. Still, Mr. Draghi offered a few clues about the central banks evolving views.

Here are some of the key takeaways.

The Governing Council did not change its stance on Thursday, repeating that it can step up the stimulus measures at any time if the eurozone economy starts to flag. That's a sign that interest rate increases are still far in the future.The eurozone economy is humming. In new estimates published Thursday, the European Central Bank's economists said economic growth would accelerate to 2.3% in 2018. That compares to their estimate in September of 1.8%.

The Bank of England raised its benchmark rate in November for the first time in a decade.” (Source: NY Times)

Week Ahead Highlights: The market will be watching the progress of the Tax bill closely, not only for its ultimate fate, but also for new details, as they relate to the investing world.

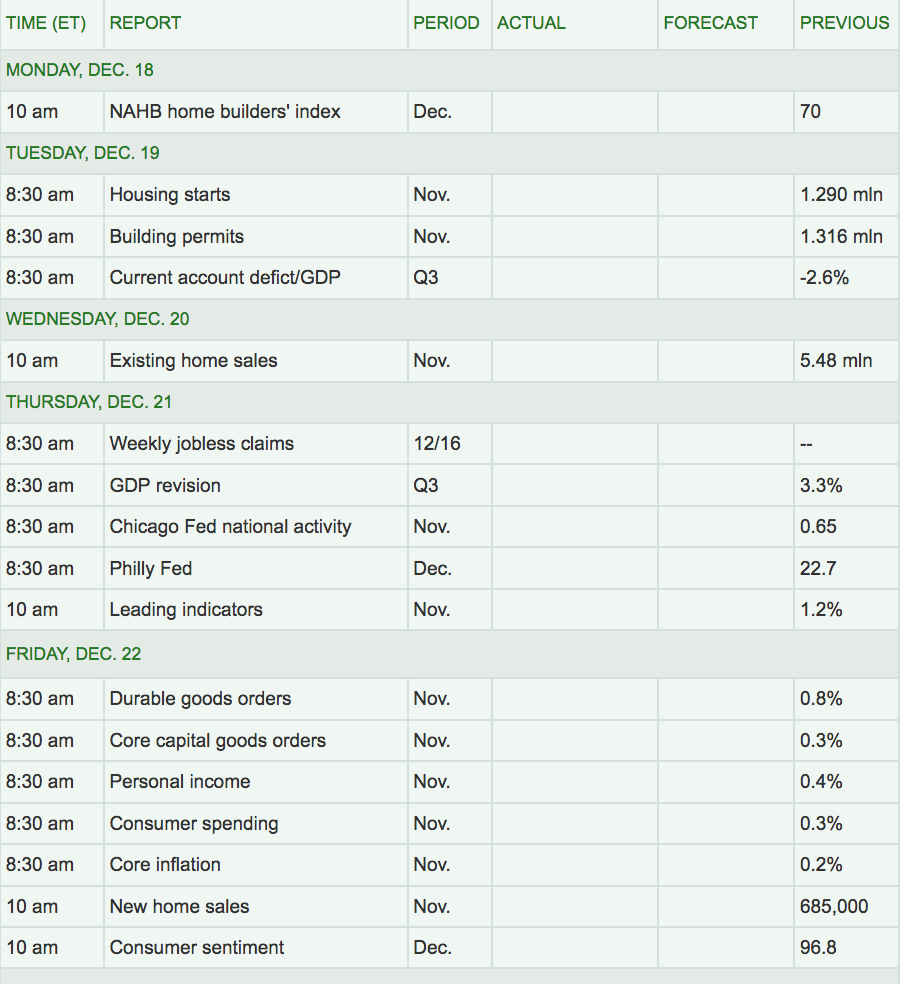

Next Week’s US Economic Reports: We’ll get an update for Q3 GDP, and a lot of data on the Housing industry – Housing Starts, Building Permits, Existing and New Home Sales, and the Builders Index. There will also be the Core Inflation report and some consumer reports due out:

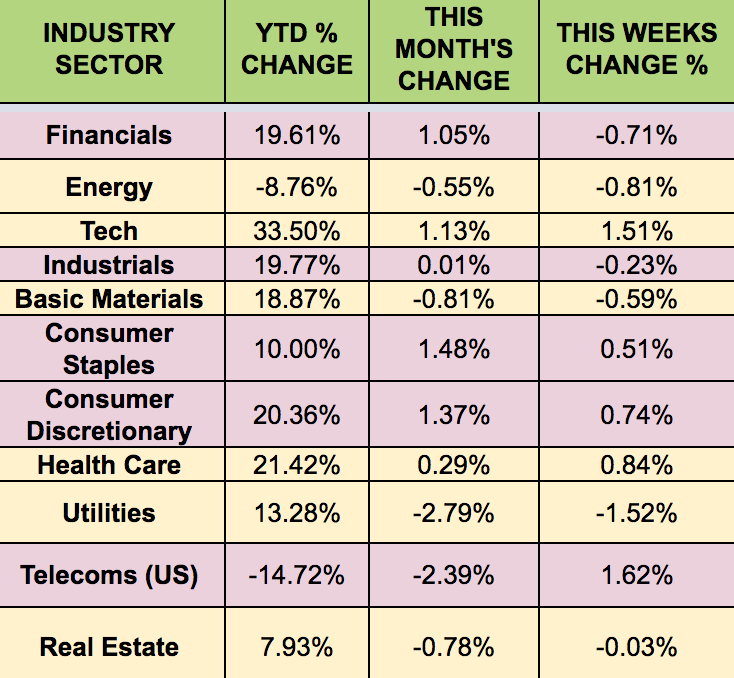

Sectors: The Tech and Telecoms sectors bounced back, and led this week, with Utilities trailing. article

Futures: Crude Oil WTI Futures were flat this week, and Natural gas fell 5.38%.