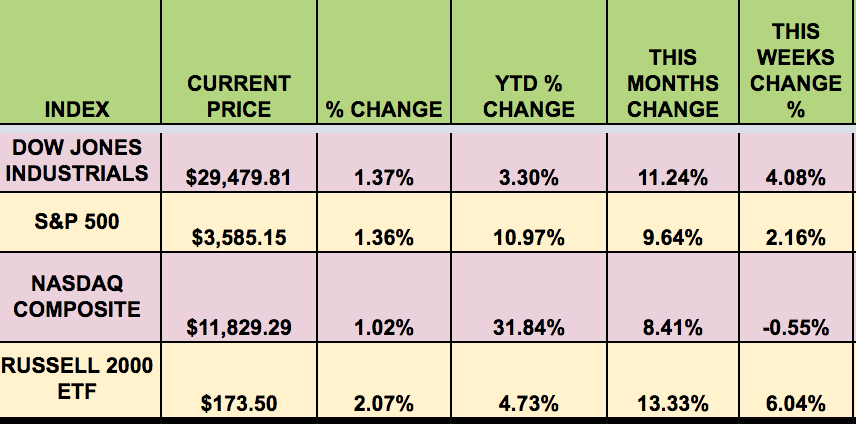

Market Indexes:

The market had another good week, although the Tech-heavy NASDAQ lost some ground. Pfizer (NYSE:PFE)’s vaccine announcement on Monday, and the Biden Presidential victory announcement lifted the market, in spite of rapidly rising coronavirus cases across the US. The S&P 500 finished the week at an all-time high.

“Pfizer said on Monday its experimental vaccine was more than 90% effective in preventing COVID-19, based on initial data from a large study. The Dow Jones Industrial Average jumped 1,084 points, or 3.83%, to 29,408, the S&P 500 soared 2.59% and the Nasdaq rose 0.75%.

The Dow set an all-time high intraday earlier in the session of 29,933 – the blue chip index last set a record high on Feb. 12.. The S&P 500 set a record high Monday of 3,645.

Pfizer shares jumped 9.64% to $39.91 after the drug giant reported on the vaccine’s effectiveness in late-stage trials and said it plans to seek emergency use authorization from U.S. health officials later this month.

Pfizer said it saw no serious safety concerns from its ongoing trial, and expects to have as many as 1.3 billion doses produced next year if and when the drug is ultimately approved by regulators. In the interim, Pfizer said it would seek emergency use approval from the Food and Drug Administration in late November. The company’s Phase III trial should be concluded in early December. The 90% efficacy rate, Pfizer said, was identified from 94 confirmed cases who received two doses of the vaccine.

Stocks also were buoyed by Joe Biden being declared the winner of the presidential election over the weekend and as the president-elect began outlining his plans for when he takes offices in January.” (The Street)

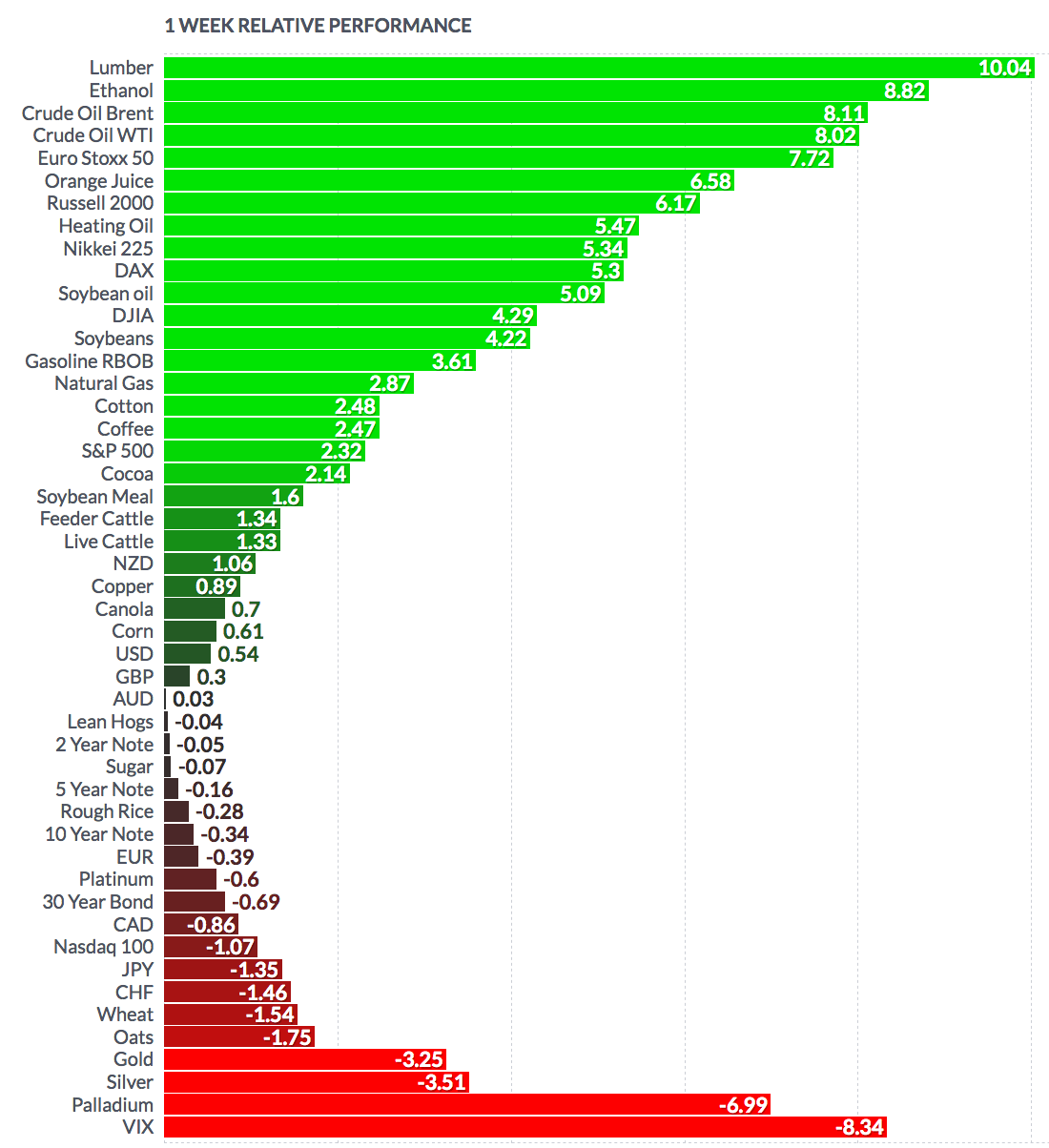

Volatility:

The VIX fell 7% this week, but remained at a high level, ending at $23.10.

High Dividend Stocks:

These high dividend stocks go ex-dividend next week: PSX, PFLT, CVX, HRZN, VLO, FHB, DLX.

Market Breadth:

25 out of 30 Dow stocks rose this week, vs. 30 last week. 80% of the S&P 500 rose, vs. 94% last week.

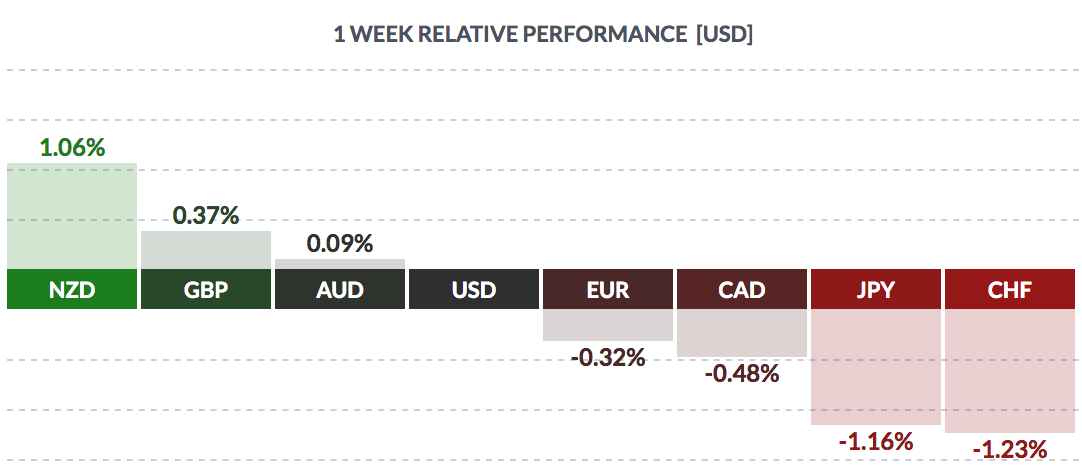

Forex

The USD fell vs. the New Zealand dollar and the Aussie, and the Pound, and rose vs. the euro, Loonie, yen, and Swiss franc this week.

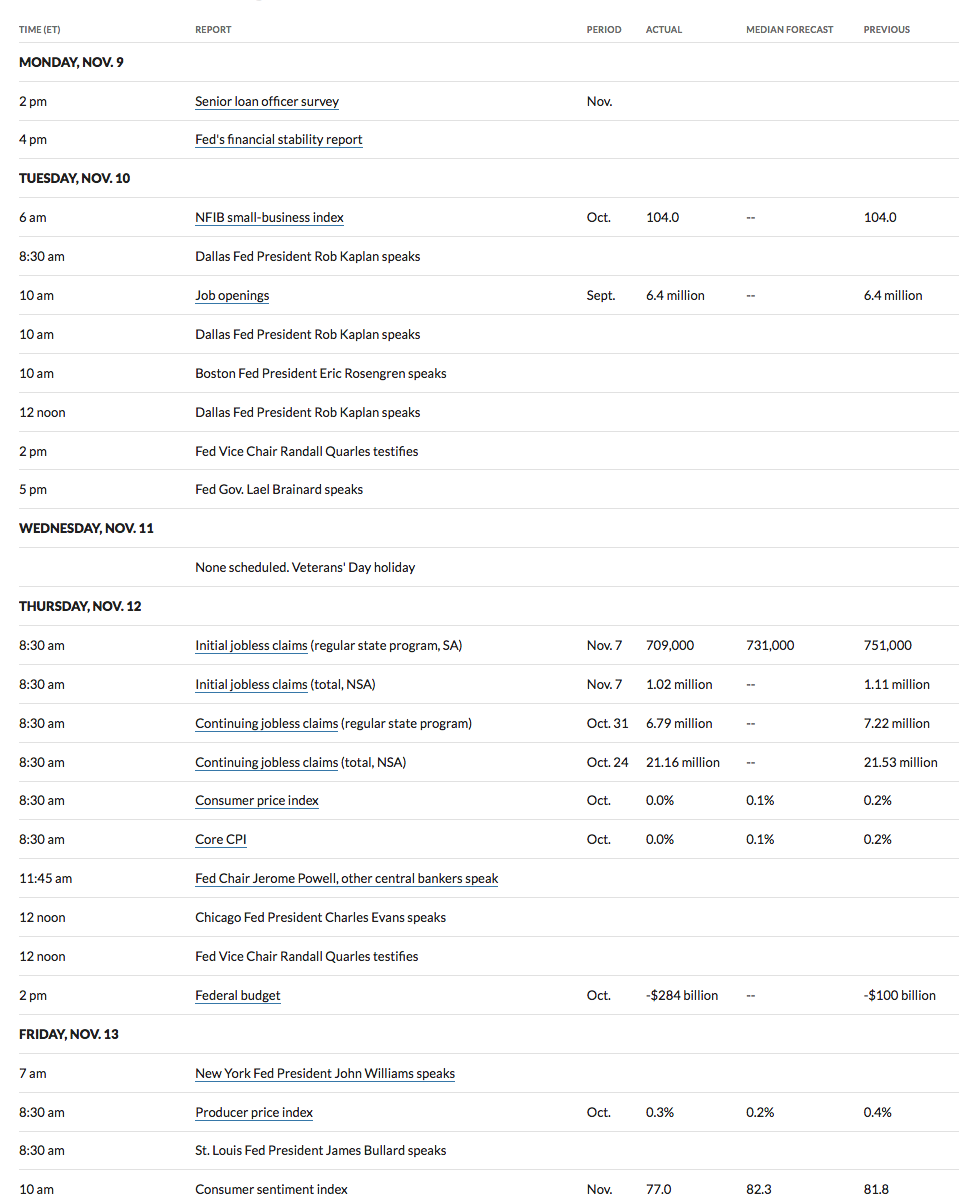

Economic News:

“The number of Americans filing new claims for unemployment benefits fell to a seven-month low last week, but the pace of decline has slowed and further improvement could be limited by a raging COVID-19 pandemic and lack of additional fiscal stimulus.

Other data on Thursday showed consumer prices were unchanged in October as moderate gains in the cost of food were offset by cheaper gasoline amid slack in the economy. The frail economy is one of the major challenges President-elect Joe Biden faces when he takes over from the current administration in January.

Initial claims for state unemployment benefits fell by 48,000 to a seasonally adjusted 709,000 for the week ended Nov. 7. Data for the prior week was revised to show 6,000 more applications received than previously reported.” (Reuters)

“The U.S. Federal Reserve for the first time called out climate change among risks enumerated in its biannual financial stability report, and warned about the potential for abrupt changes in asset values in response to a warming planet.

“Acute hazards, such as storms, floods, or wildfires, may cause investors to update their perceptions of the value of real or financial assets suddenly,” Fed Governor Lael Brainard said in comments attached to the report, released Monday.” (Reuters)

Week Ahead Highlights:

Q3 earnings season continues to wind down. There will be several Housing reports due out, in addition to the Index of Leading Economic Indicators.

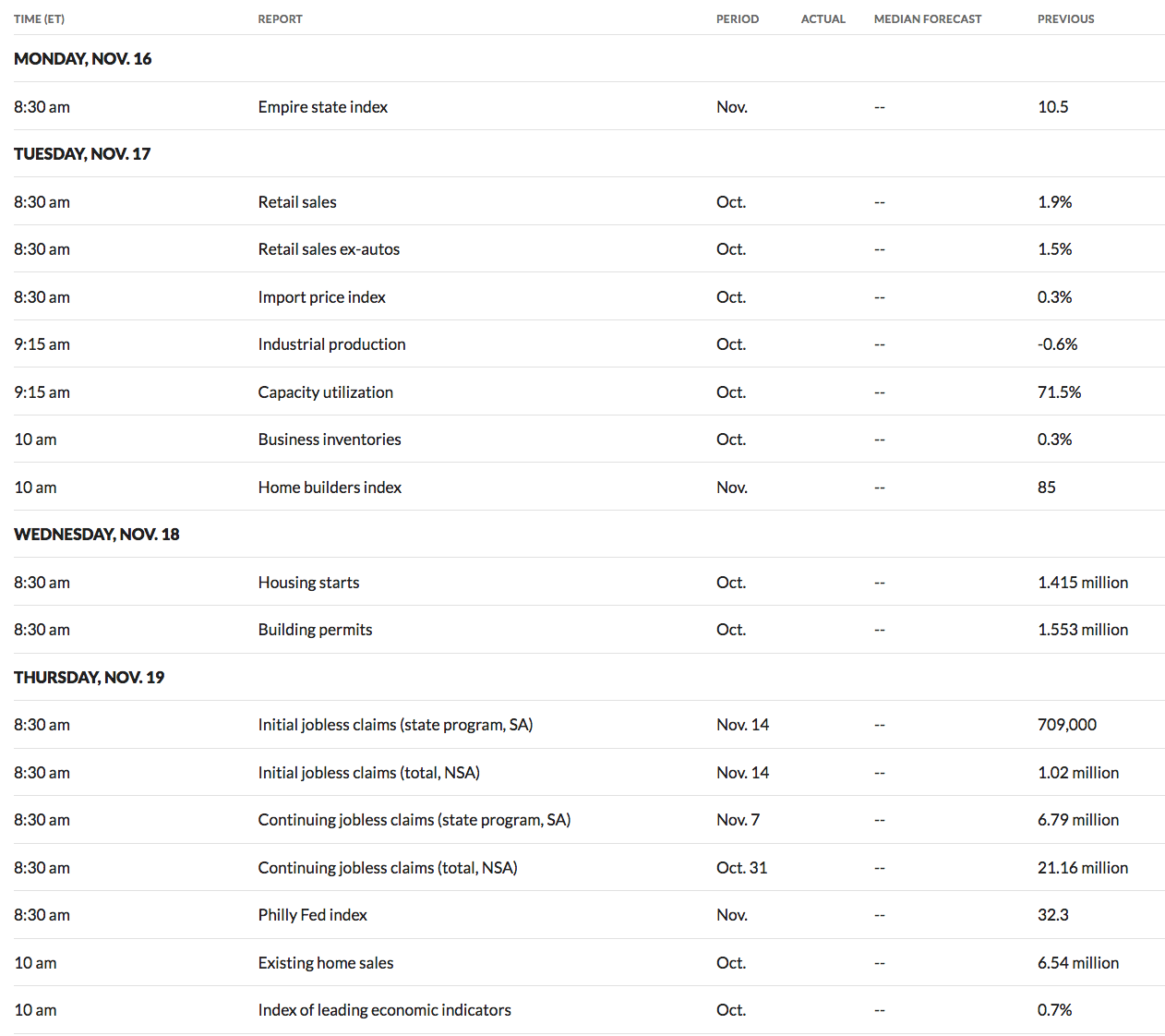

Next Week’s US Economic Reports:

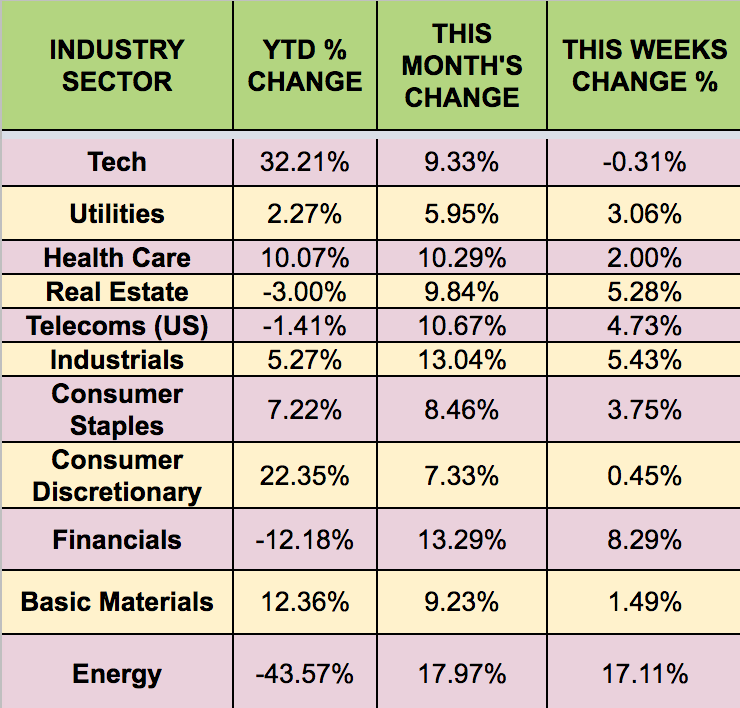

Sectors:

The Energy sector had a huge week, rising 17% this week, with Tech being the only sector in the red.

Futures:

WTI rose 8% this week, ending at $40.12. Natural Gas rose 2.87%.

“Oil jumped by the most since May as news of a potential Covid-19 vaccine breakthrough injected fresh hope that an end is in sight to the worst demand slump in decades.

Futures spiked as much as 11% in New York alongside a broader market rally after a vaccine being developed by Pfizer Inc. (NYSE:PFE) and BioNTech SE (NASDAQ:BNTX) prevented more than 90% of infections in a study of 43,538 participants.” (Bloomberg)