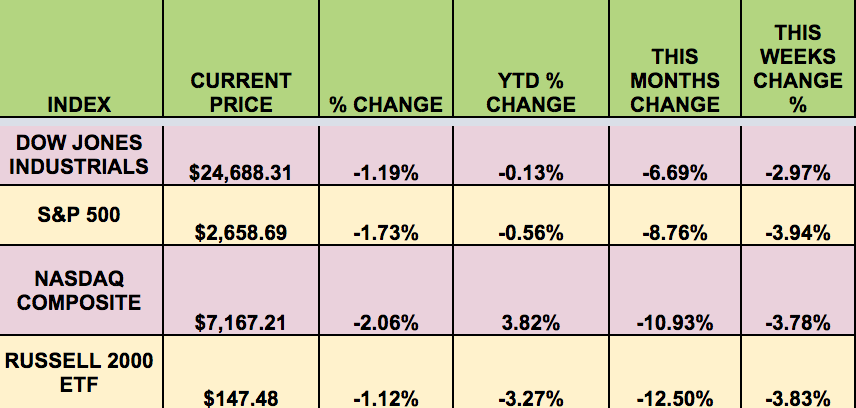

Markets: It was yet another turbulent week for the market, with all 4 indexes down at least around -3% or more. The Dow Jones 30 Futures held up the best, but still lost -2.97%, while the S&P 500 trailed, losing nearly -4%. Both the DOW and the S&P are now in the red for 2018. The Russell small caps and the NASDAQ Composite both lost ~-3.8%.

Disappointing earnings reports from Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL), put investors on edge Friday, spurring fears of an economic slowdown, in spite of a positive GDP report for Q3. The S&P 500 ended at its lowest level since early May, after technology and internet shares sold off further on Friday, capping a volatile week that confirmed a correction for the Nasdaq.

High Dividend Stocks Going Ex-Dividend Next Week: MSB, AGNC, Chatham Lodging Trust REIT (NYSE:CLDT), Colony Northstar Credit Real Estate Inc (NYSE:CLNC), EPD, EPR, GEL, Mesa Royalty Trust (NYSE:MTR), Orchid Isla (NYSE:ORC), PSEC, Phillips 66 (NYSE:PSX) Partners LP (NYSE:PSXP), SKT, Tallgrass Energy GP LP (NYSE:TGE), TLP, TRGP, VET, Western Gas Partners LP (NYSE:WES), WGP.

Volatility: The VIX rose 21% this week, ending at $24.16.

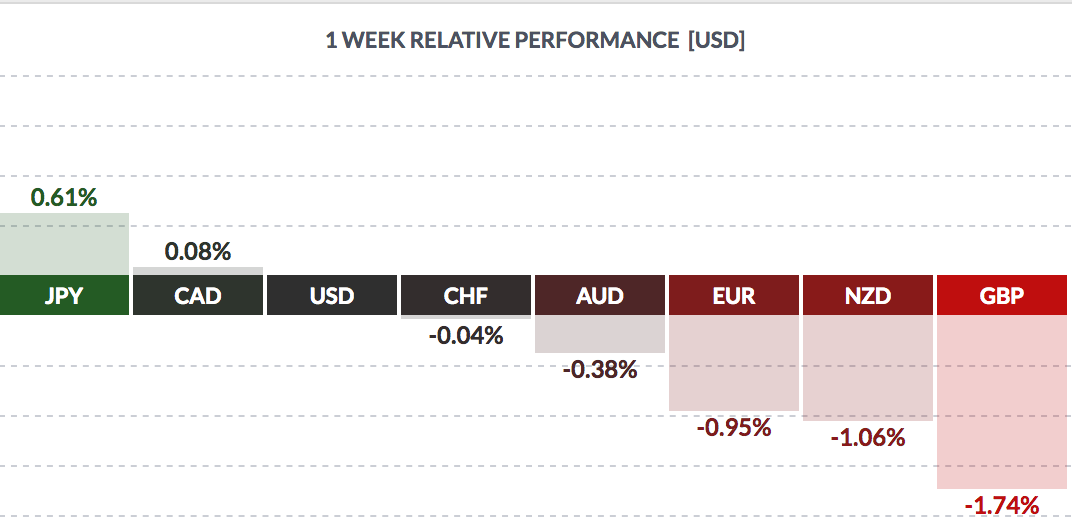

Currency: The USD rose vs. most major currencies, except for the Yen.

Market Breadth: 6 of the DOW 30 stocks rose this week, vs. 19 last week. Only 16% of the S&P 500 rose this week, vs. 54% last week.

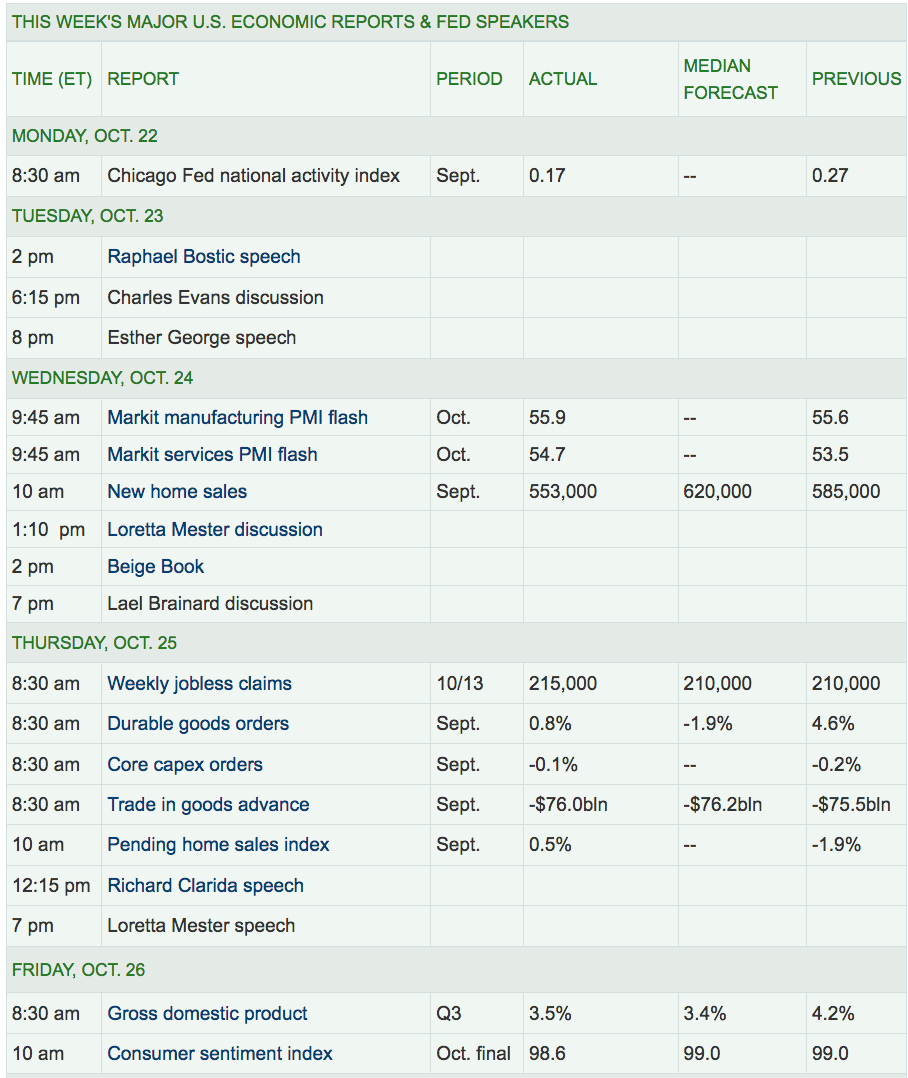

Economic News:

Q3 ’18 GDP came in at 3.5%, slightly ahead of the 3.4% forecast, down from the Q2 pace of 4.2%.

“Sales of newly-constructed homes swooned to the lowest since December 2016. September’s selling pace of 553,000 was 5.5% lower than in August, and 13.2% lower than a year ago. The median selling price in September was $320,000, 3.5% lower than a year ago. At the current pace of sales, it would take 7.1 months to exhaust available supply, a 6-year high”. (MarketWatch)

“New orders for key U.S.-made capital goods fell for a second straight month in September and the goods trade deficit increased further amid rising imports, suggesting economic growth moderated in the third quarter. The Commerce Department said orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, dipped 0.1 percent last month amid weakening demand for fabricated metals and electrical equipment, appliances and components.”

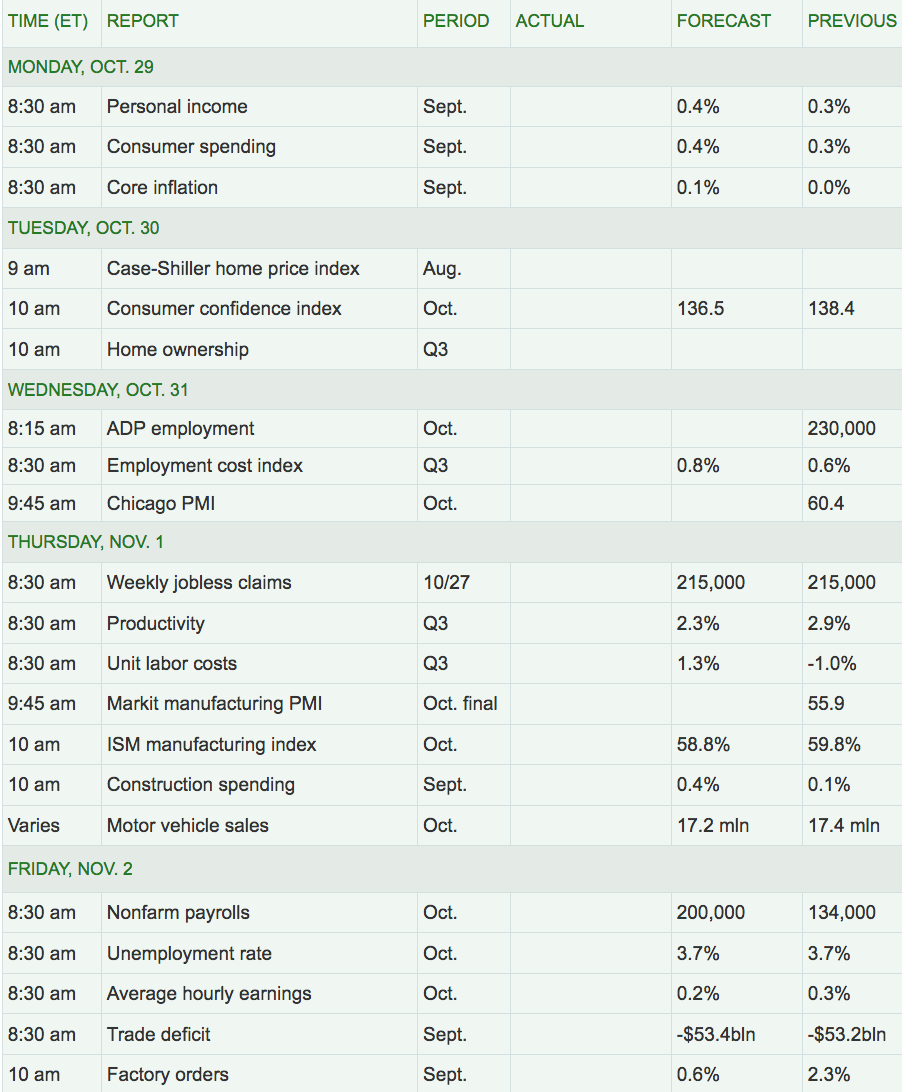

Week Ahead Highlights: The Sept. Non-Farm Payrolls report and the Unemployment Rate comes out on Friday. Q3 Earnings season rolls on, with 10 DOW stocks reporting, including AAPL, KO, XOM, PFE (NYSE:PFE), and CVX. 34% of the S&P 500 will also report, including GOOG, AMZN, Altria Group (NYSE:MO), Comcast Corp (NASDAQ:CMCSA), General Electric Company (NYSE:GE), Caterpillar Inc (NYSE:CAT), and T, among many others.

Next Week’s US Economic Reports:

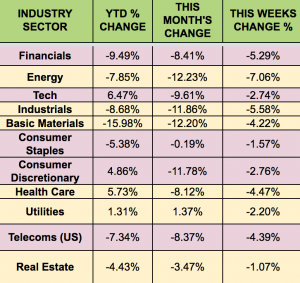

Sectors: It was another defensive sector week, with Real Estate and Consumer Staples falling the least, as Energy and Industrials trailed.

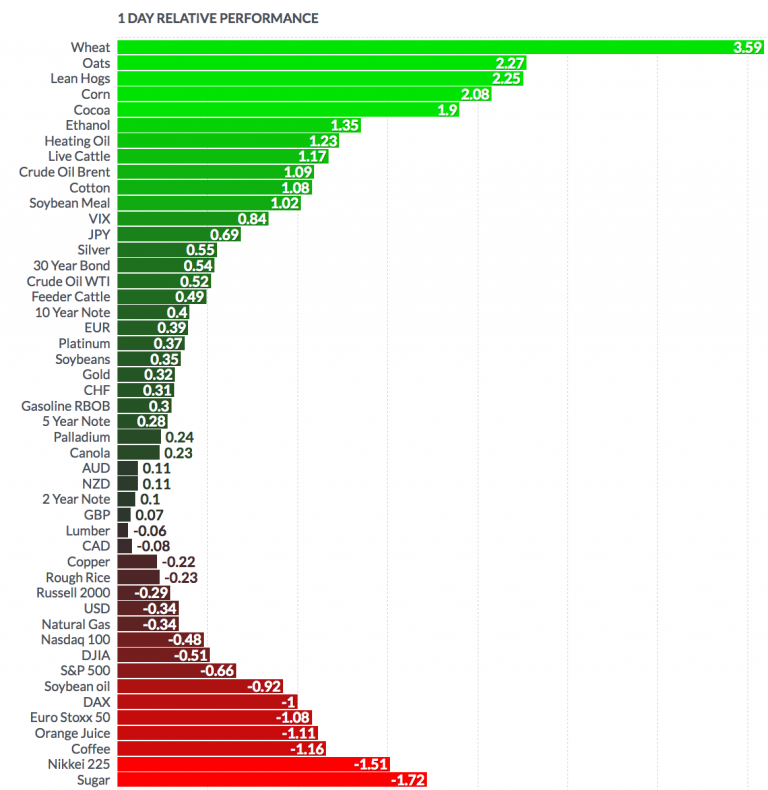

Futures:

WTI rose .52%, finishing the week at $67.62, while Natural Gas fell -.34%.

“Oil prices are pointing lower again, with Saudi credit default swaps ballooning … as the market becomes incredibly uncertain if there will be a shift in power when the crown prince is directly linked with the Khashoggi murder,” said Stephen Innes, head of trading at foreign-exchange trader Oanda. Brent crude futures LCOc1 were down 39 cents at $79.39 a barrel by 1333 GMT, while U.S. crude futures CLc1 fell 45 cents to $68.67.

“As far as next year’s supply/demand balance is concerned, it’s not justified for them (Saudi Arabia) to increase production,” PVM Oil Associates strategist Tamas Varga said.