“S&P 500 companies slashed or suspended over $40 billion in dividends in the second quarter, the deepest quarterly drop since 2009.” (Dow Jones)

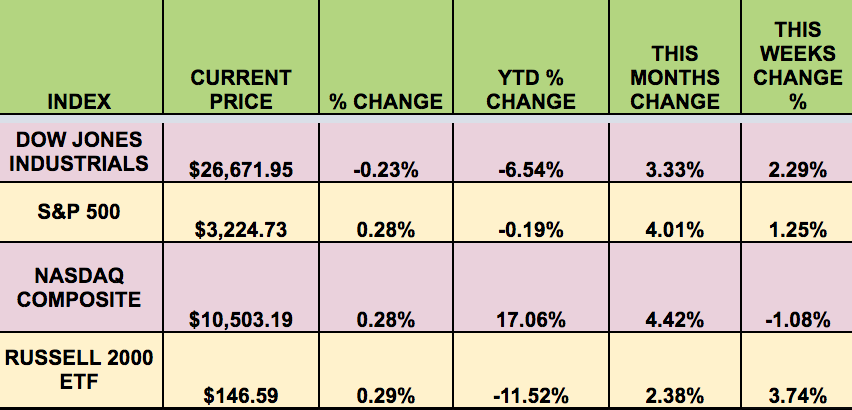

Market Indexes

It was a split market this week, with the NASDAQ actually trailing, while the DOW actually outperformed the S&P 500. The Russell small caps led.

As the Q2 2020 earnings season opened, Goldman Sachs Group (NYSE:GS) had robust earnings, Bank of America's (NYSE:BAC) profit fell by 50%, while Morgan Stanley’s profit soared, due to fixed income trading during the 2nd quarter market rebound. Big banks with trading desks tended to do better in Q2, as trading gains mitigated loan loss reserves.

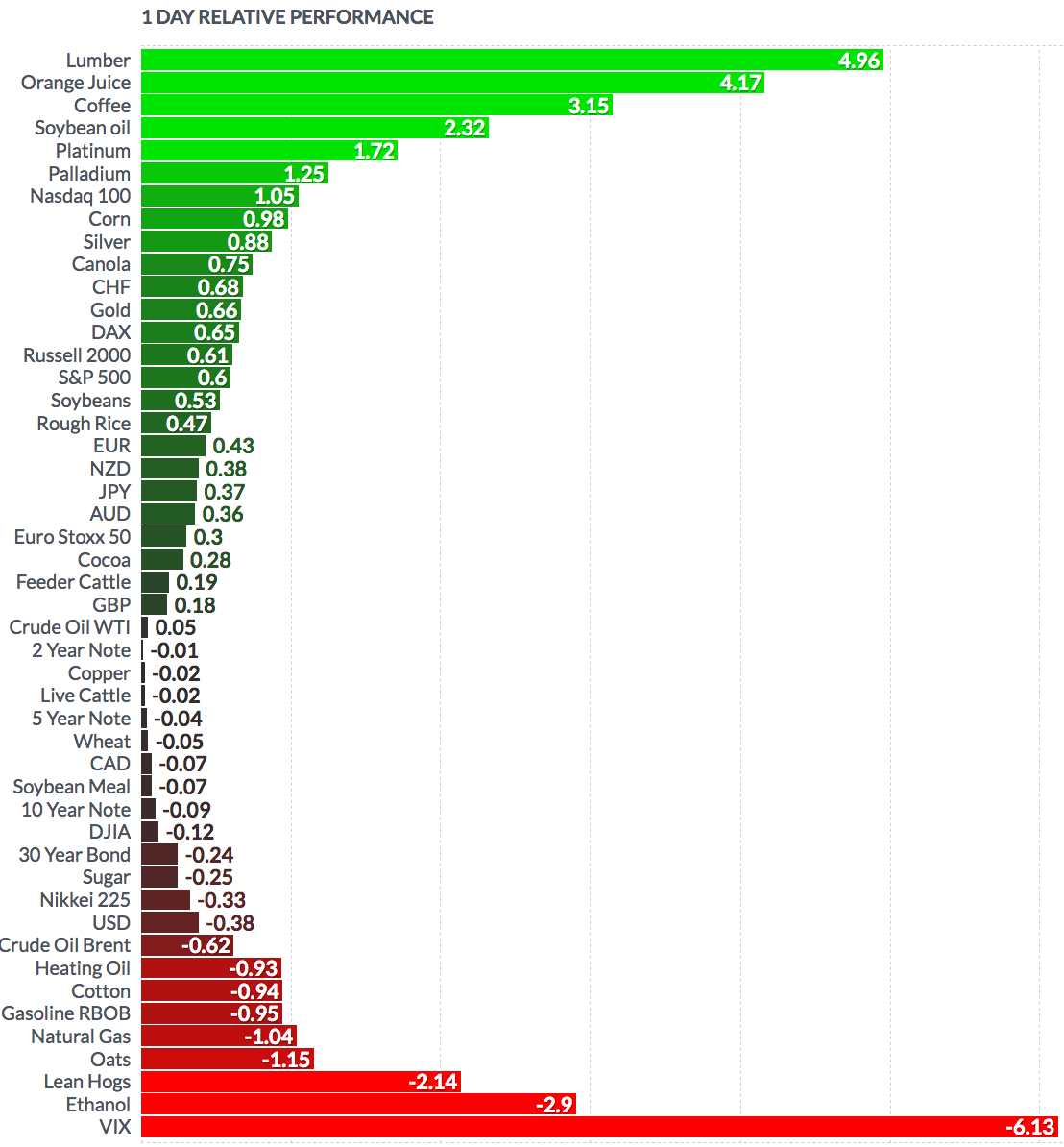

Volatility

The VIX fell 5.8% this week, ending at $25.68, vs. $27.25 last week.

High Dividend Stocks

These high yield stocks go ex-dividend next week: CMRE, SUNS, TYG.

Market Breadth

26 out of 30 DOW stocks rose this week, vs. 7 last week. 84% of the S&P 500 rose, vs. 35% last week.F

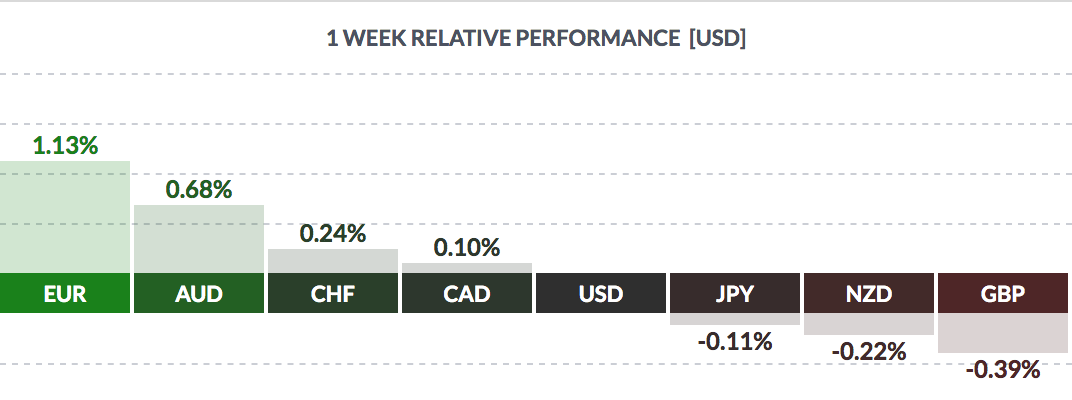

Foreign Exchange Market

US dollar fell vs. the euro, Aussie, the Swiss franc, and the Loonie this week, and rose vs. yen, New Zealand dollar, and the pound.

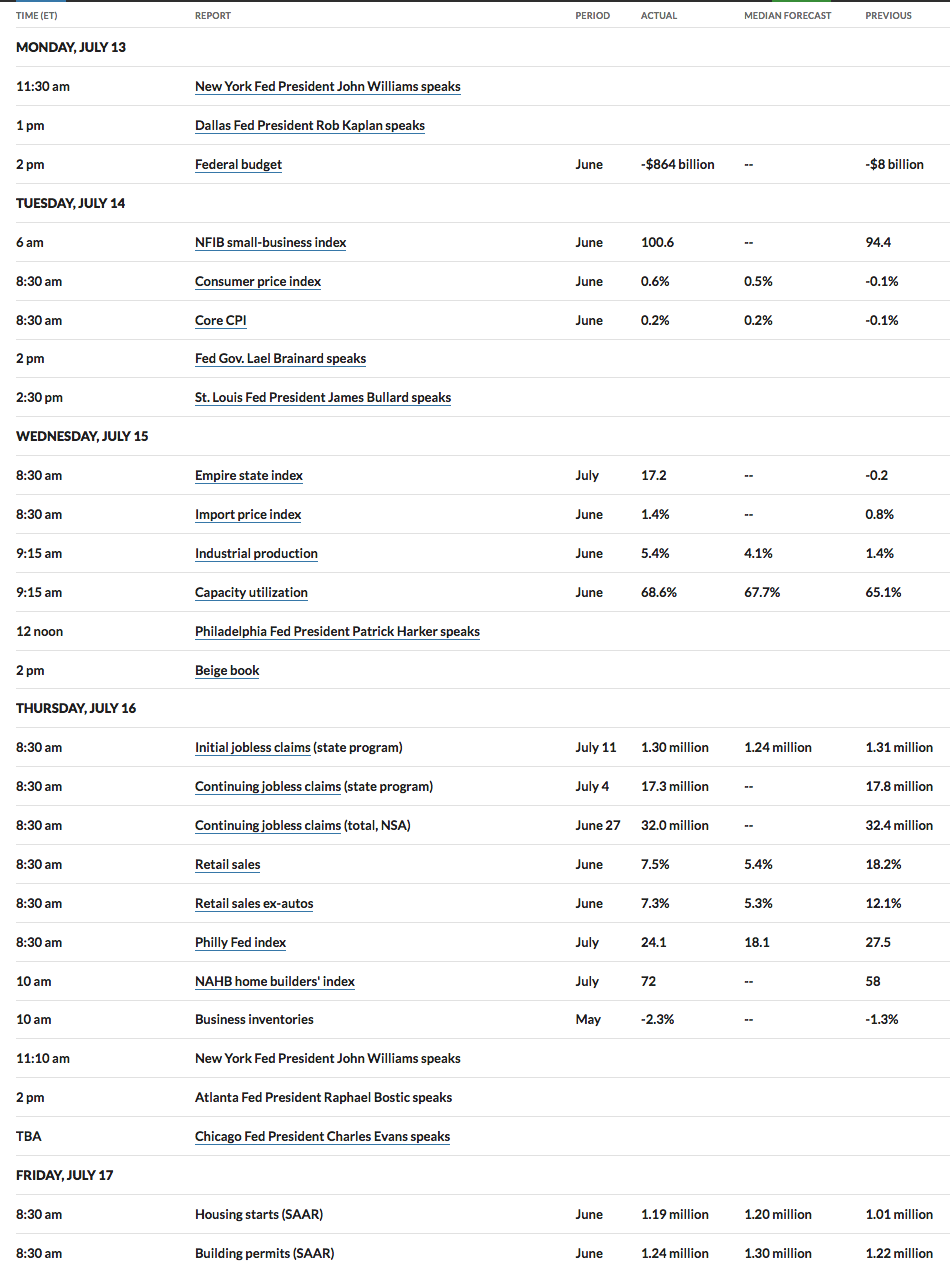

Economic News:

1st-time jobless claims for the week ending July 11 declined by only 10,000 compared to the prior week, to 1.3 million.

“The U.S. federal budget deficit in June surged to $864 billion from single digits a year earlier amid continued strong spending on coronavirus relief programs and a drop in individual and corporate tax receipts, the Treasury Department said on Monday. The June deficit brought the year-to-date fiscal deficit to $2.7 trillion, far eclipsing the previous full-year record of $1.4 trillion in 2009. June receipts fell 28% to $241 billion, a reflection of job losses due to the coronavirus pandemic but also this year’s extension of the tax filing deadline to July from April.” (Reuters)

“Three of the largest U.S. banks said on Tuesday they had set aside a whopping $28 billion for loan losses, in a stark reminder that much of the economic pain from the coronavirus pandemic is still to come. Borrowers have been propped up by trillions of dollars in government and bank assistance, cheap credit and loan forbearance programs, but some of that support is going away, and banks said they fear losses will spike. JPMorgan (NYSE:JPM) and Citigroup Inc (NYSE:C) each reported huge second-quarter profit declines on Tuesday, while Wells Fargo (NYSE:WFC) & Co posted its first loss since 2008.

Banks with big Wall Street businesses were able to offset their loan woes with huge gains in capital markets revenue, particularly trading. The rough results were almost entirely due to loan-loss provisions. The unprecedented government aid programs have created a disconnect between the financial markets and the economy, such that financial conditions look sunny, but could turn upside down quickly if the temporary assistance expires.” (Reuters)

“The consumer price index increased 0.6% last month, the biggest gain since August 2012, after easing 0.1% in May. The increase, which ended three straight months of declines, was driven by rises in the prices of gasoline and food. In the 12 months through June, the CPI climbed 0.6% after gaining 0.1% in May, which was the smallest year-on-year rise since September 2015.” (Reuters)

“5.4 million laid off workers lost their insurance from February to May. The increases in the number of uninsured adults are 39 percent higher than any annual increase ever recorded, and compares with the 3.9 million non-elderly adults who lost their health insurance from 2008 to 2009.” (Patch)

“The market rose Wed. am on newly fueled hopes that a vaccine providing protection against Covid-19 would be developed in the relative near-term. Moderna’s vaccine produced neutralizing antibodies in all 45 patients included in an early-stage human safety trial, according to data published after market close by the peer-reviewed New England Journal of Medicine. A late-stage trial of the vaccine candidate is set to begin July 27, with Moderna (NASDAQ:MRNA) representing one of the companies farthest along in creating a potential inoculation against the coronavirus.” (Yahoo)

“U.S. import prices increased by the most in more than eight years in June amid a surge in the cost of fuel, but the overall trend remained weak, suggesting inflation could stay tame despite a jump in consumer prices last month. Import prices accelerated 1.4% last month, the largest increase since March 2012, after rising 0.8% in May. (Reuters)

Week Ahead Highlights

Q2 2020 earnings season ramps up, with several DOW stocks reporting, including Microsoft (NASDAQ:MSFT), Intel (NASDAQ:INTC), Coca-Cola (NYSE:KO), in addition to ~70 S&P 500 firms. The Leading Economic Indicators report is due out on Thursday morning and it should provide insight on the forward trajectory of the economy.

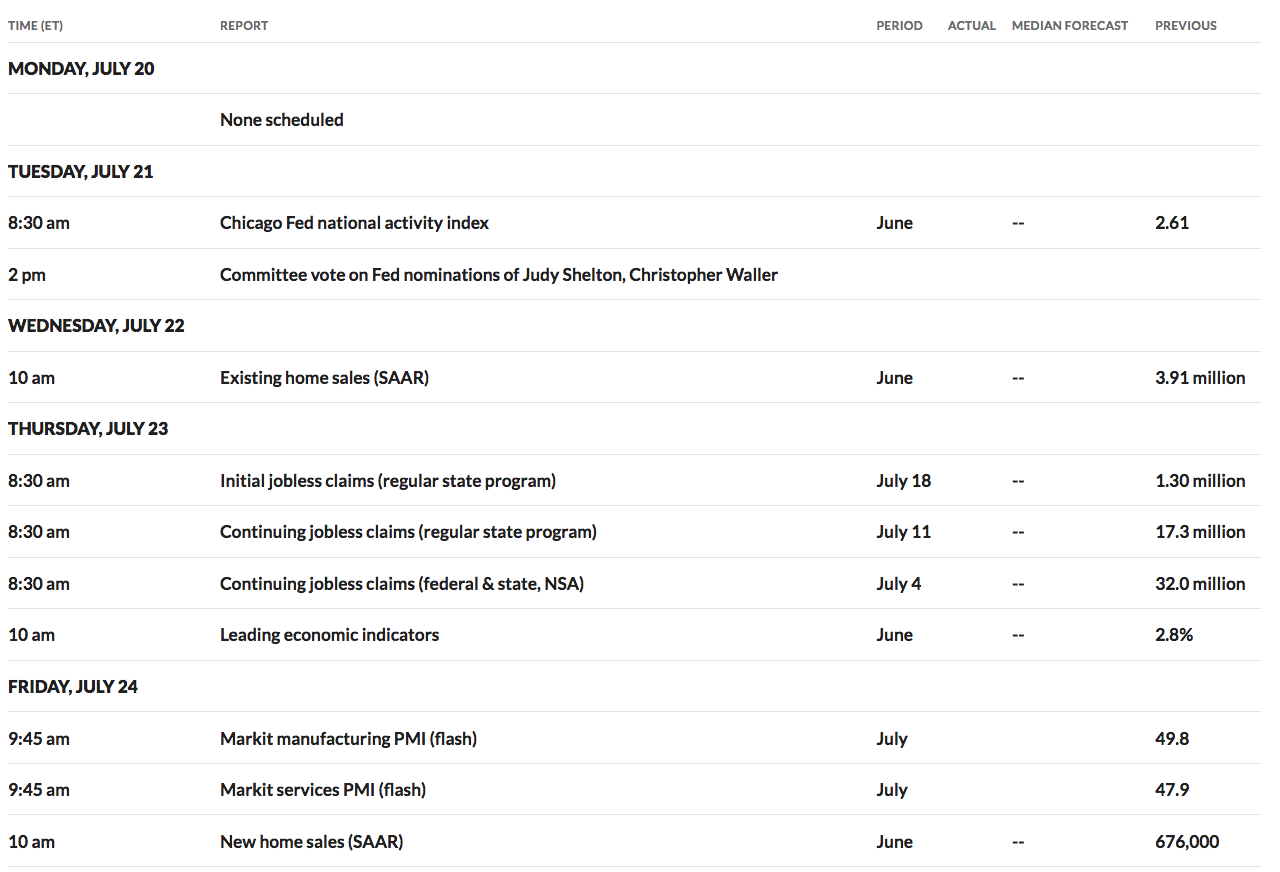

Next Week’s US Economic Reports:

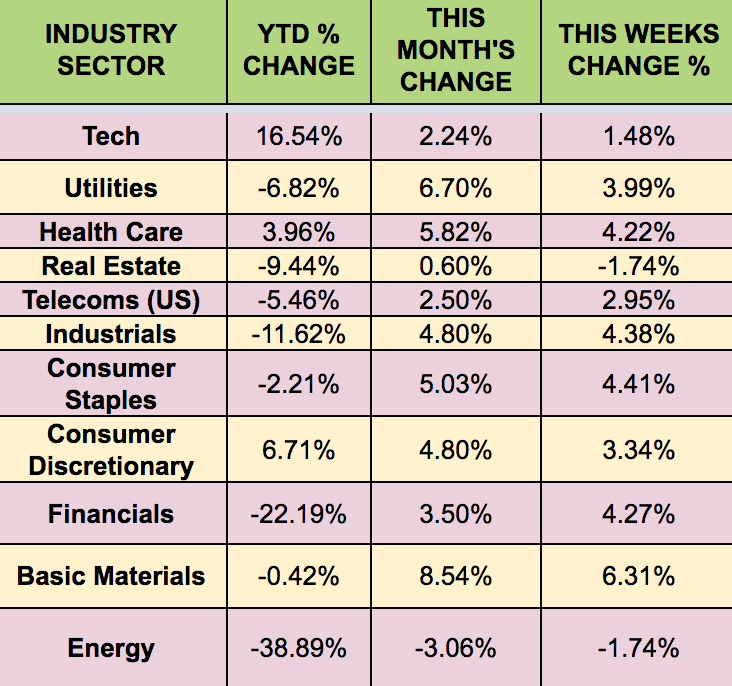

Sectors

Basic Materials led this week, Real Estate lagging.

Futures

WTI was ~flat this week, ending at $40.77.