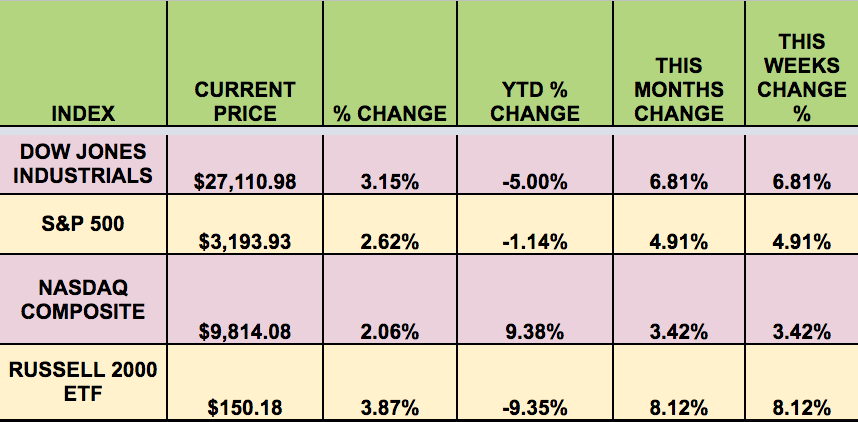

Market Indexes

It was a big up week for the market, with all 4 indexes gaining over 5%, with big gains on Friday, as investors cheered a better than expected May jobs report. The Russell small caps led, rising 8%.

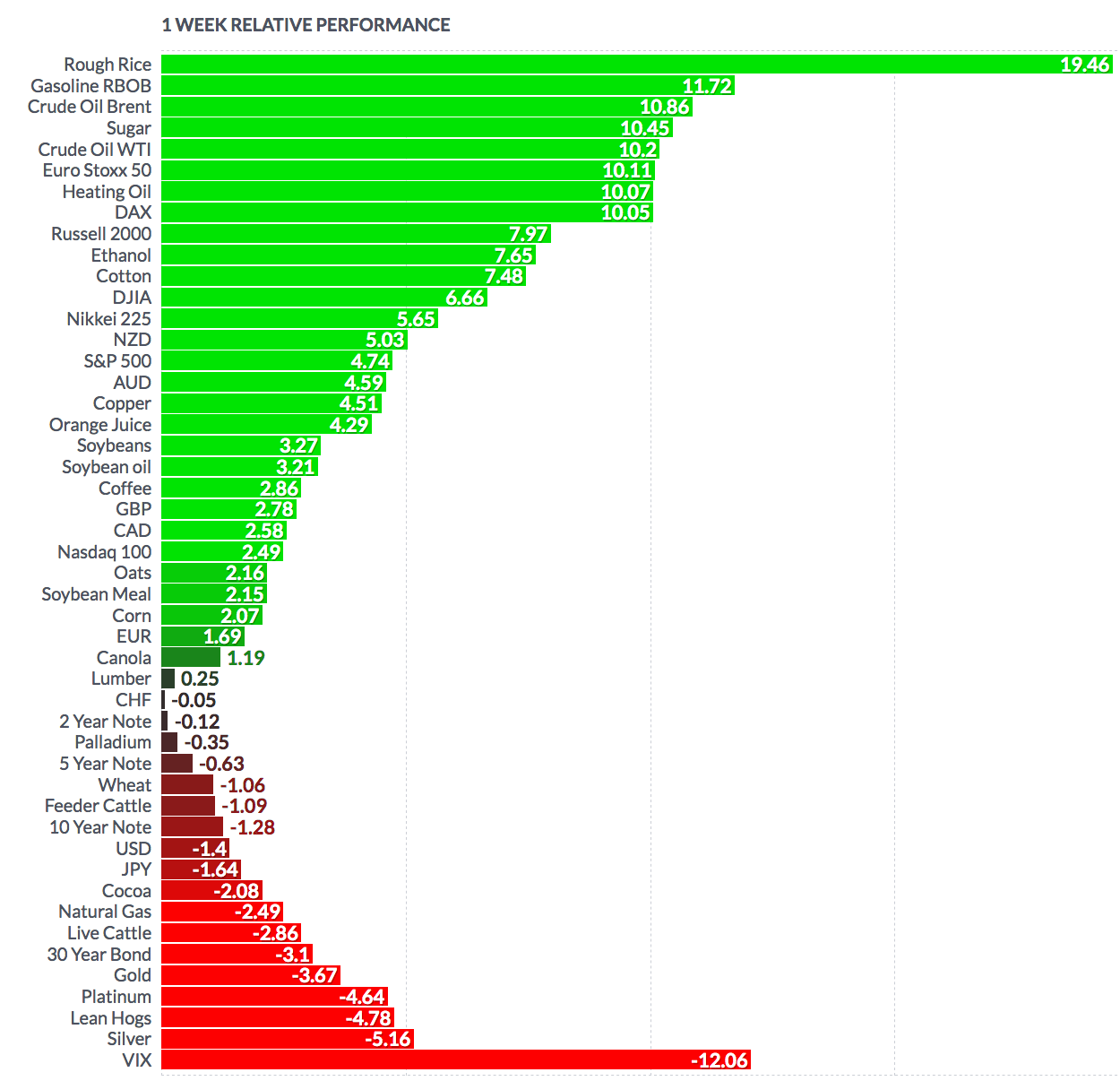

Volatility

The VIX fell 11% this week, ending at $24.42, vs. $27.51 last week, but still remains at a heightened level.

High Dividend Stocks

These high yield income vehicles go ex-dividend next week: BEP-A, PGZ.

Market Breadth

24 out of 30 Dow stocks rose this week, vs. 26 last week. 85% of the S&P 500 rose, vs. 90% last week.

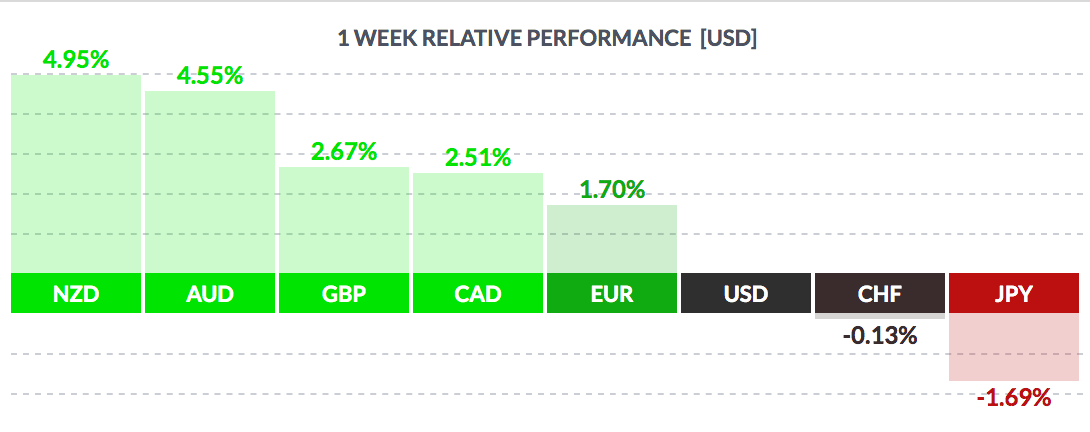

FOREX

The USD fell vs. most major currencies once again this week, except the yen and theSwiss franc.

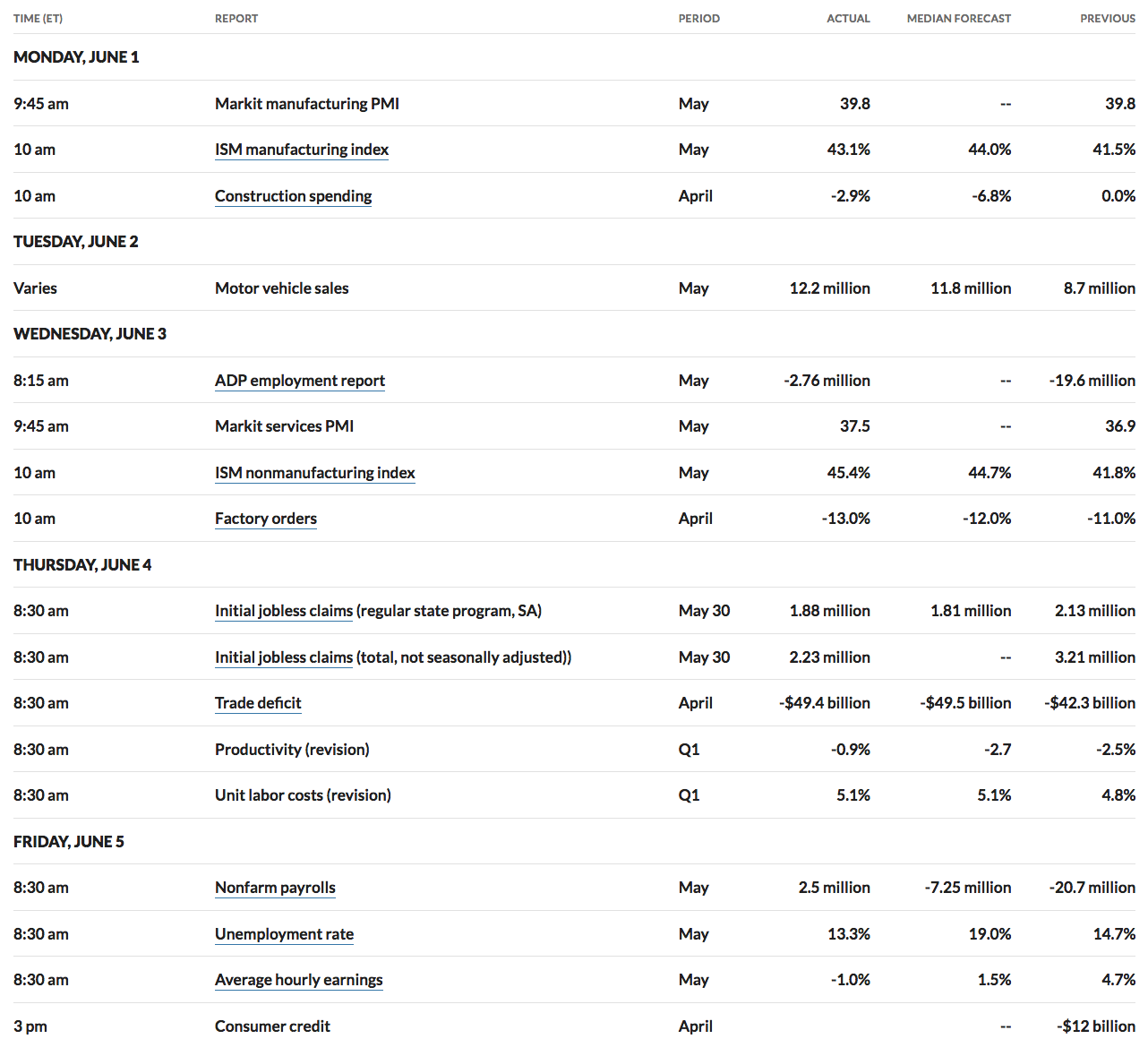

Economic News

“More than 2.5 million people were newly employed last month, the Labor Department reported on Friday, but that follows a record drop of more than 20 million in April. The unemployment rate fell to roughly 13% compared to almost 15% in the prior month. Much of the rise in jobs was centered on hardest-hit industries in food services and drinking places, which added 1.4 million jobs and accounted for about half of the employment gains. The leisure and hospitality sector overall added 1.2 million jobs.” (Reuters)

“The ADP National Employment Report showed private employers laid off another 2.76 million workers last month after a record 19.557 million in April. Economists polled by Reuters had forecast private payrolls dropping by 9 million in May.

A staggering 25 million private jobs were lost over the past three months. The ADP (NASDAQ:ADP) report is jointly developed with Moody’s Analytics. Last month’s smaller-than-expected drop in private payrolls mirrored declines in the number of people filing claims for unemployment benefits and remaining on jobless rolls.In a separate report on Wednesday, the Institute for Supply Management said its non-manufacturing activity index rose to a reading of 45.4 in May from 41.8 in April, which was the lowest since March 2009 and the first showing contraction since December 2009.

A reading below 50 indicates contraction in the services sector, which accounts for more than two-thirds of U.S. economic activity. Economists had forecast the index increasing to a reading of 44.0 in May.” (Reuters)

“An additional 1.877 million Americans filed for unemployment benefits in the week ending May 30, exceeding economists’ estimates for 1.843 million initial jobless claims during the week. The prior week’s figure was revised upward, to 2.13 million from the previously reported 2.12 million.

This week’s report marked the first time that weekly initial jobless claims came in below two million in 10 weeks. Over the past 11 weeks, more than 42 million Americans have filed for unemployment insurance.” Yahoo

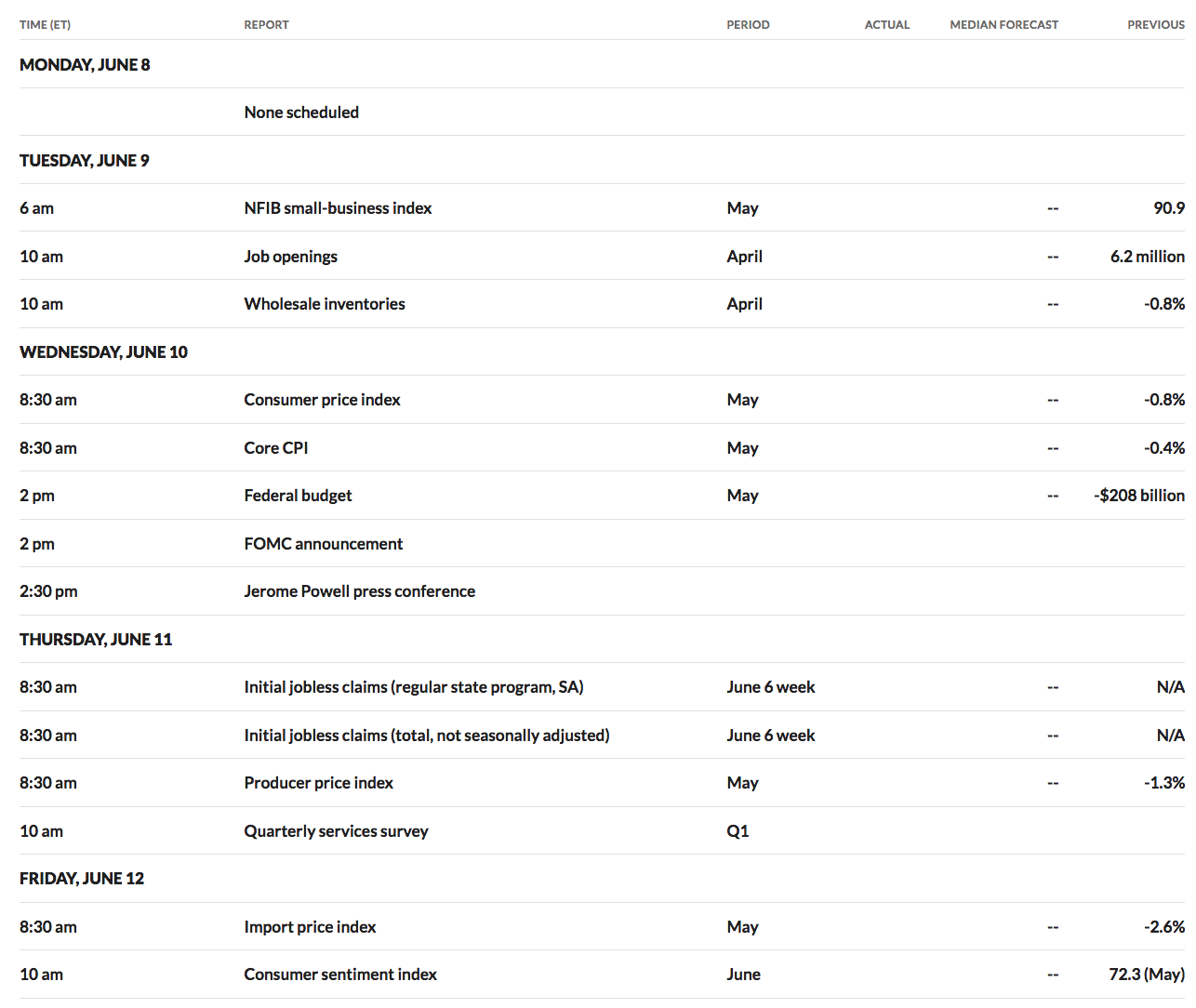

Week Ahead Highlights:

The Fed’s Open Market Committee meets Wed., followed by a press conference with Fed chief Powell, which is sure to be closely watched for any signs in of a changing direction in Fed policy. OPEC ave a ministers h

Next Week’s US Economic Reports:

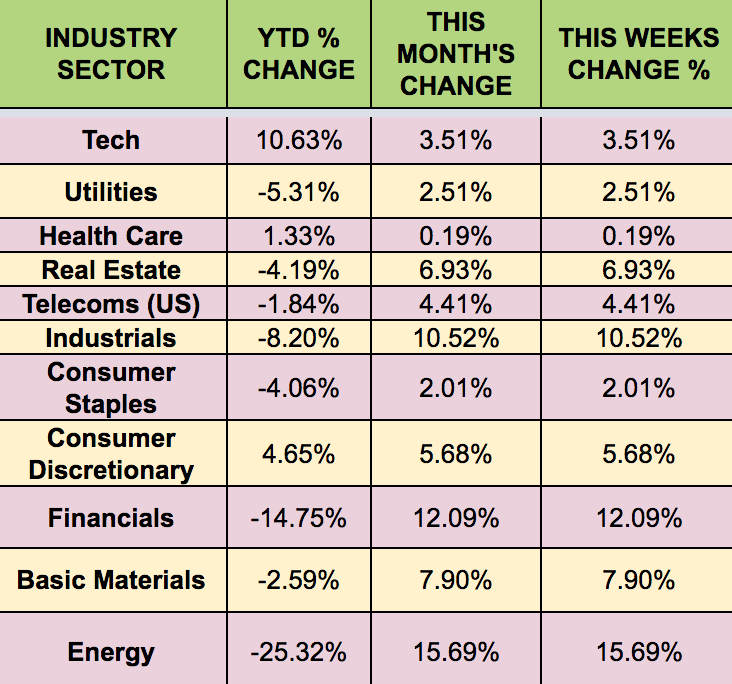

Sectors:

Energy surged this week, buoyed by a possible OPEC production cut extension, and better-than-expected May jobs report.

Futures:

Oil rose once again this week, banking on many US states and foreign nations. starting to reopen. WTI rose 10.2% this week, ending at $38.97.

“Oil futures rallied Friday, buoyed by better-than-expected data on U.S. employment and expectations that the Organization of the Petroleum Exporting Countries and its allies will agree to extend current production cuts at a meeting Saturday.” (MarketWatch)