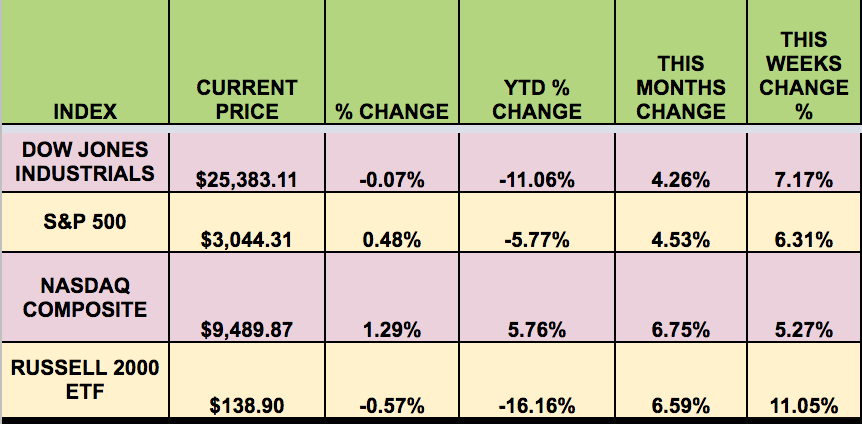

Market Indexes:

It was a big up week for the market, with all 4 indexes gaining over 5%, as investors were positive about many states and nations reopening. The Russell small caps led, rising 11%. The S&P 500 added 17.8% for April and May, its biggest two-month percentage gain since 2009.

“U.S. stocks were mostly higher at the open Wednesday, looking for a second straight session of gains, on growing optimism that governments around the world will be able to loosen lock-down measures in place to combat the coronavirus pandemic.” (MarketWatch)

“For a second day this week, stocks most punished by the coronavirus, from Carnival (NYSE:CUK) Corp. to United Airlines, surged as investors anticipate a sharp uptick in spending on non-essential goods and services. The tech-heavy Nasdaq 100 Index retreated as investors shunned the high flyers that dragged equities off their lows throughout April and much of May. Rising tensions with China also weighed on chipmakers.” (Bloomberg)

Volatility:

The VIX fell 2.3% this week, ending at $27.51, vs. $31.89 last week, but still remains at a heightened level.

High Dividend Stocks:

These high yield stocks go ex-dividend next week: UG, CEO, GARS, RF, SNR, AFIN.

Market Breadth:

26 out of 30 Dow stocks rose this week, vs. 23 last week. 90% of the S&P 500 rose, vs. 86% last week.

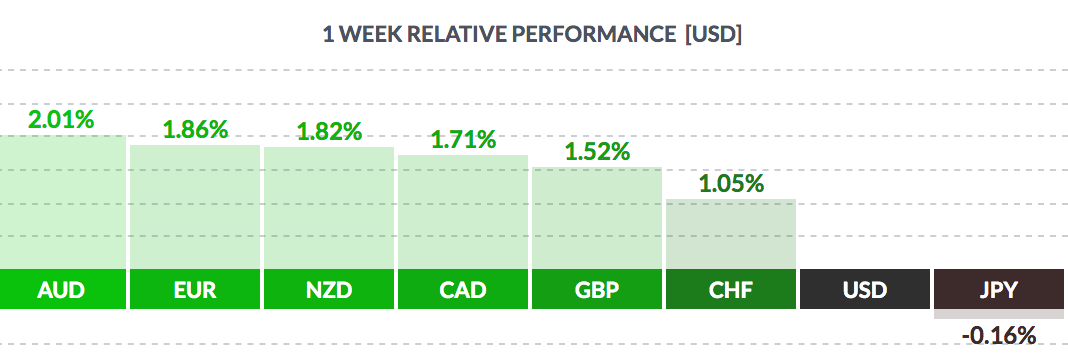

FOREX:

The USD fell vs. most major currencies again this week, except the yen.

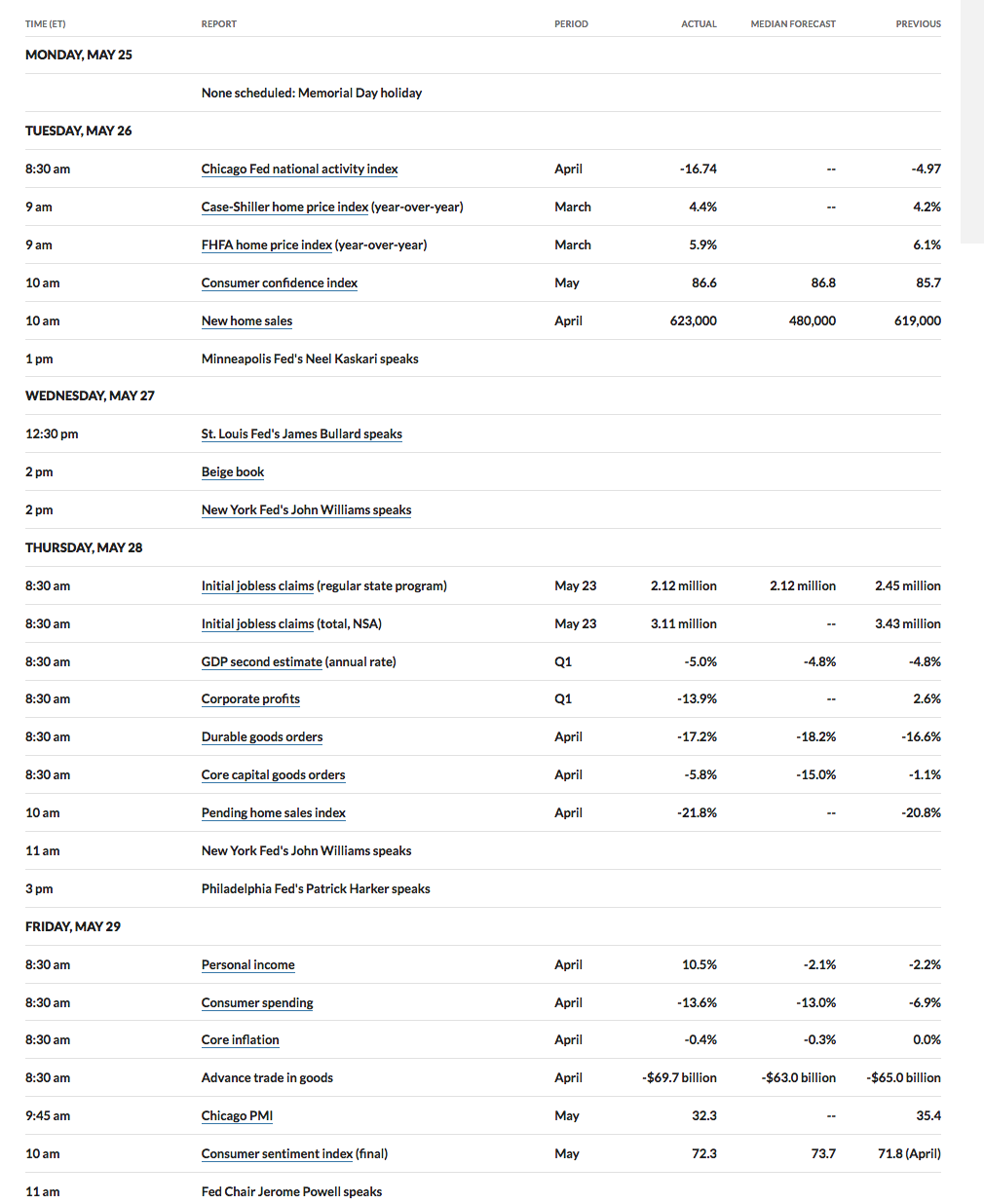

Economic News:

“The number of Americans seeking jobless benefits fell for an eighth straight week last week, likely as some people returned to work, but claims remained at astonishingly high levels, suggesting it could take the economy a while to rebound as businesses reopen. Initial claims for state unemployment benefits fell 323,000 to a seasonally adjusted 2.123 million for the week ended May 23, the Labor Department said. Claims have declined steadily since hitting a record 6.867 million in late March, but have not registered below 2 million since mid-March.

Economists polled by Reuters had forecast initial claims falling to 2.1 million in the latest week. Layoffs persist in the insurance, educational services, public administration, transportation and warehousing, agriculture, construction, manufacturing and retail trade industries.

That was underscored by other data from the Commerce Department on Thursday showing business spending on equipment plummeting in April and the economy contracting at a much steeper 5.0% annualized rate in the first quarter instead of the previously estimated 4.8% pace.

Data in hand, including on the housing market, manufacturing and consumer spending has left economists expecting gross domestic product could drop in the second quarter at as much as a 40% rate, the worst since the Great Depression.” (Reuters)

Q1 GDP’s 2nd estimate came in at -5%. Q1 corporate profits fell -13.9%.

Week Ahead Highlights:

The May Non-Farm Payrolls report is due out on Friday and is likely to be rather grim. The Unemployment rate may reach -20%.

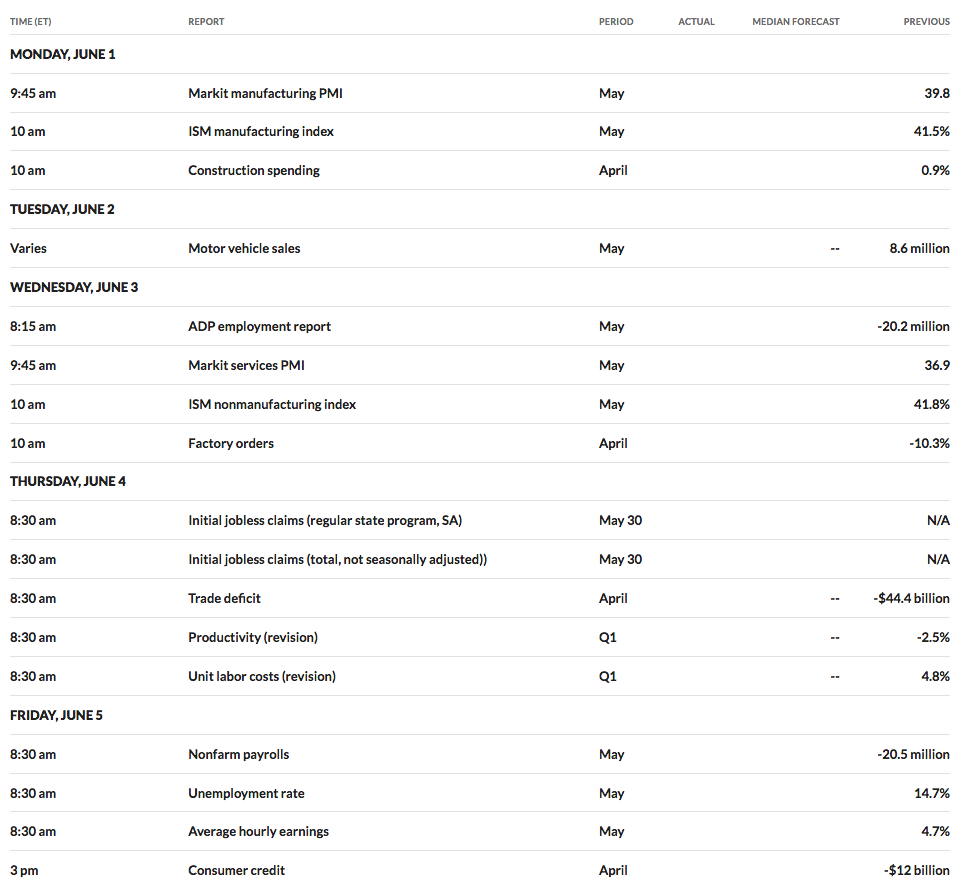

Next Week’s US Economic Reports:

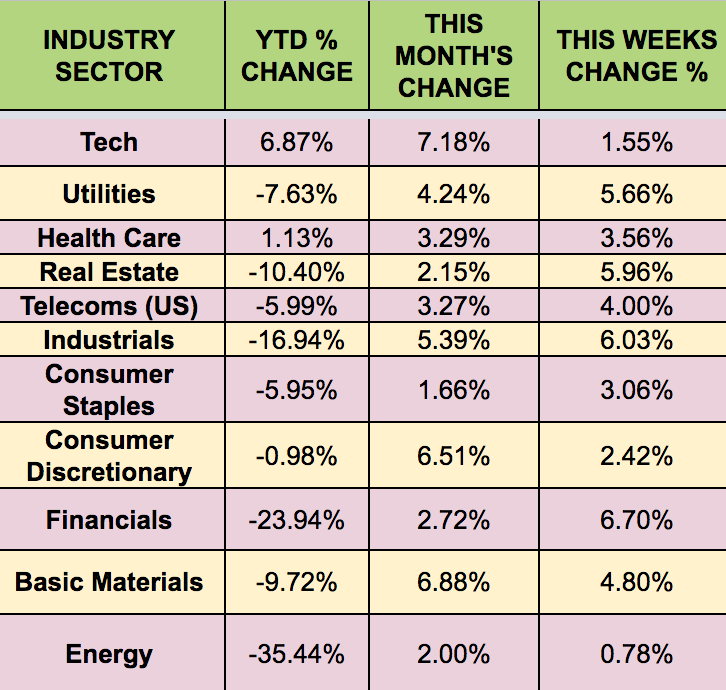

Sectors:

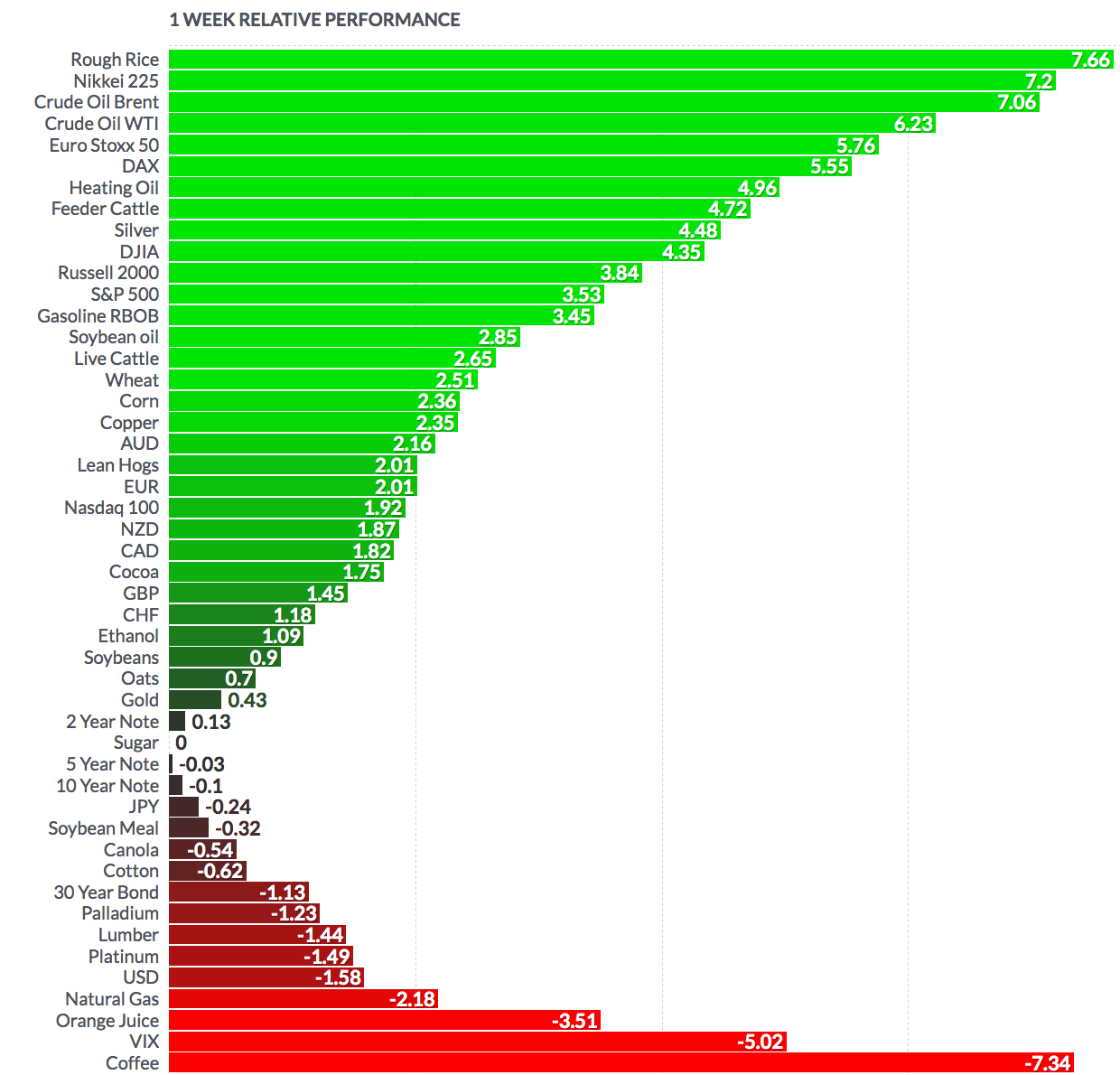

Industrials and Financials led this week, with Tech lagging, on renewed US-China tensions.

Futures:

Oil rose once again this week, banking on many US states and foreign nations. starting to reopen. WTI rose 6.23% this week, ending at $35.32.