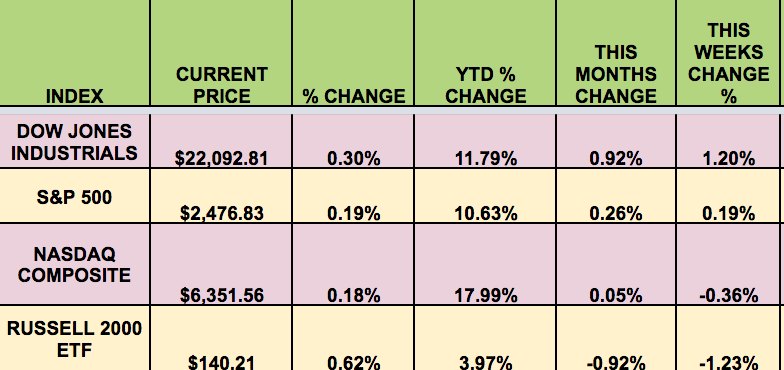

Markets: The DOW advanced .92% this week, hitting more record highs, and exceeding the 22,000 level for the 1st time ever. The S&P 500 had a minor gain, while was flat, and the RUSSELL small caps trailed again.

The DOW was powered by Apple (NASDAQ:AAPL), Johnson & Johnson (NYSE:JNJ), Exxon (NYSE:XOM), and JPMorgan (NYSE:JPM), all among the top 5 in market cap for the index. A positive Non-Farm Payrolls report boosted indexes on Friday, coming in above forecasts.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: Global Partners LP (NYSE:GLP), Amerigas Partners LP (NYSE:APU), Boardwalk Pipeline Partners LP (NYSE:BWP), Cedar Realty Trust Inc (NYSE:CDR), Royal Dutch Shell (LON:RDSa) B PLC (NYSE:RDSb), Enviva Partners LP (NYSE:EVA), BGC Partners Inc (NASDAQ:BGCP), PBF Logistics LP (NYSE:PBFX), SunCoke Energy Partners LP (NYSE:SXCP).

Volatility: The VIX fell 2% this week, and finished at $10.03.

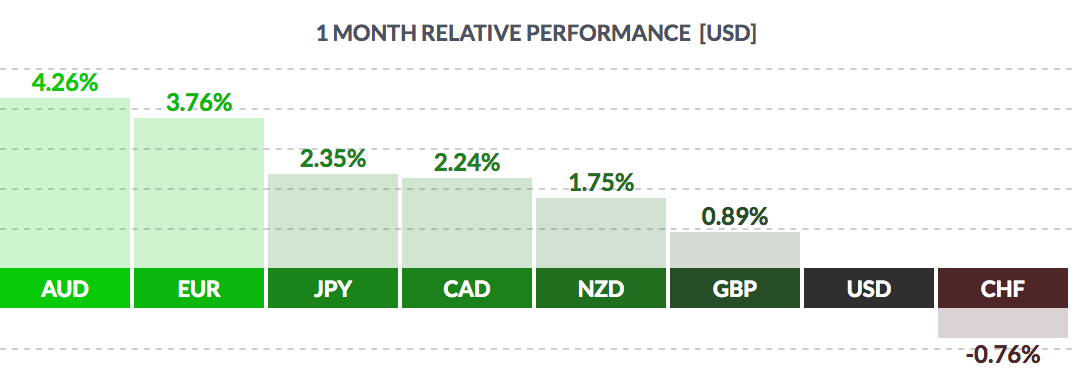

Currency: The USD fell vs. most other major currencies over the past month, (except the Swiss Franc.)

Market Breadth: 23 of the DOW 30 stocks rose this week, vs. 15 last week. 51% of the S&P 500 rose, vs. 50% last week.

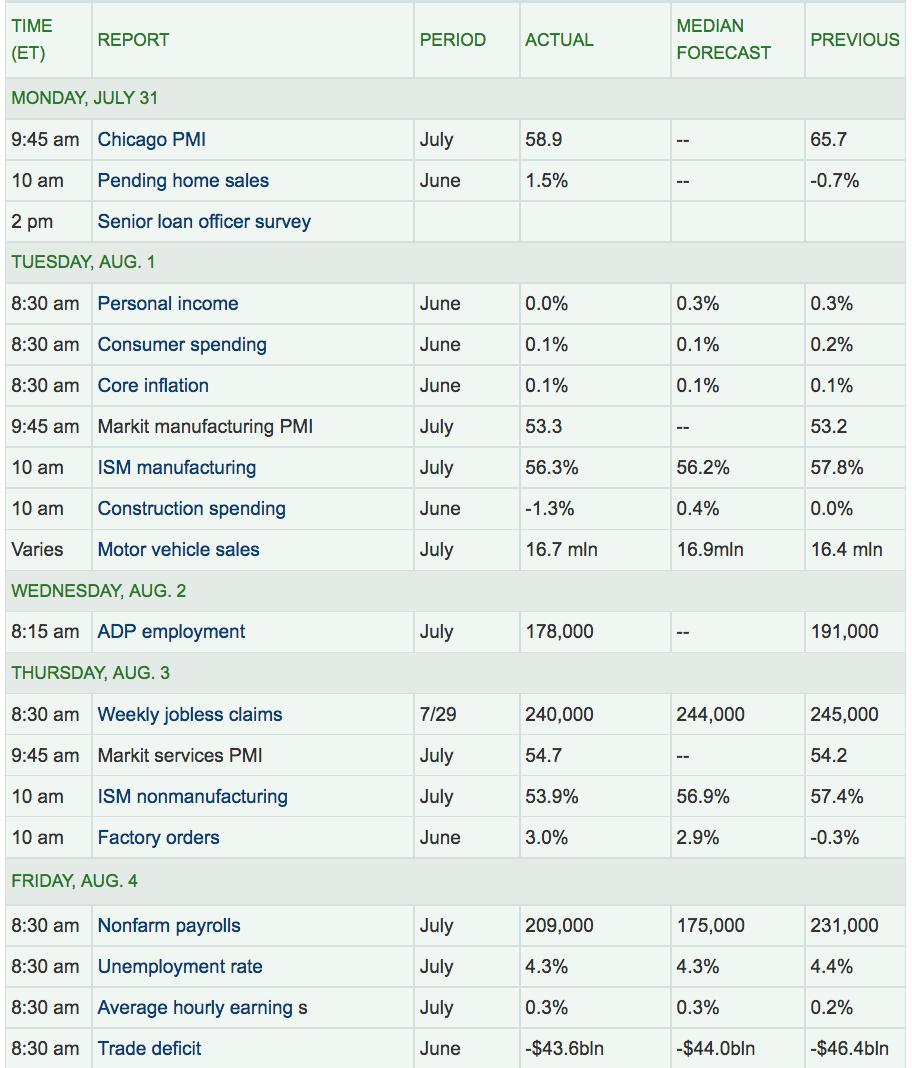

Economic News: Non-farm payrolls came in at 209k, well above the 178 expected. Unemployment fell from 4.4% to 4.3%, but Personal Income was flat. Pending home sales increased 1.5% in June, above the 0.9% forecast.

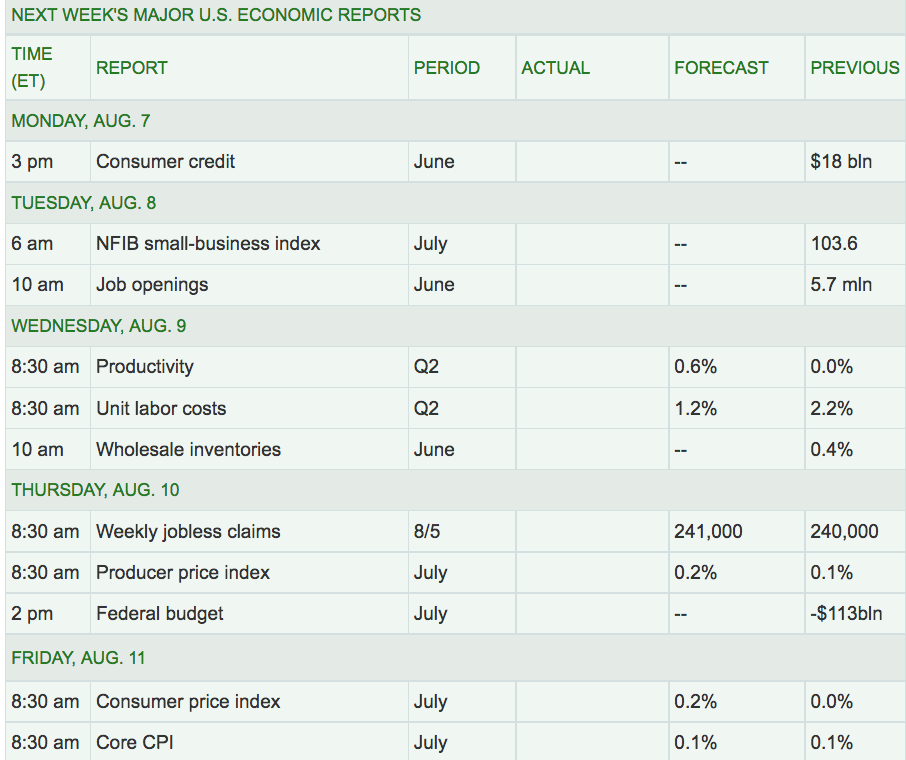

Week Ahead Highlights: Q2 Earnings season continues, with Walt Disney Company (NYSE:DIS), plus several retailers reporting, such as Macy’s Inc (NYSE:M), Kohl’s Corporation (NYSE:KSS), and Nordstrom (NYSE:JWN).

Next Week’s US Economic Reports: It’ll be a very light data week.

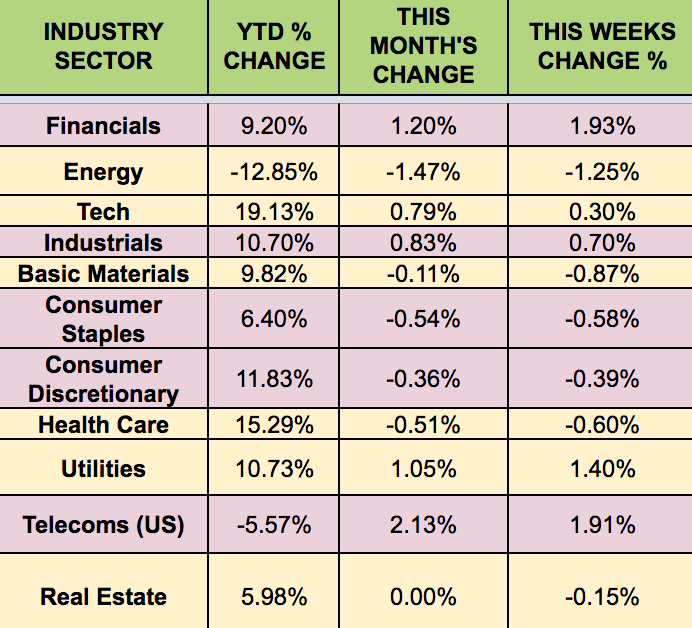

Sectors: The Financials sector surged rose 1.93% this week, as Energy trailed.

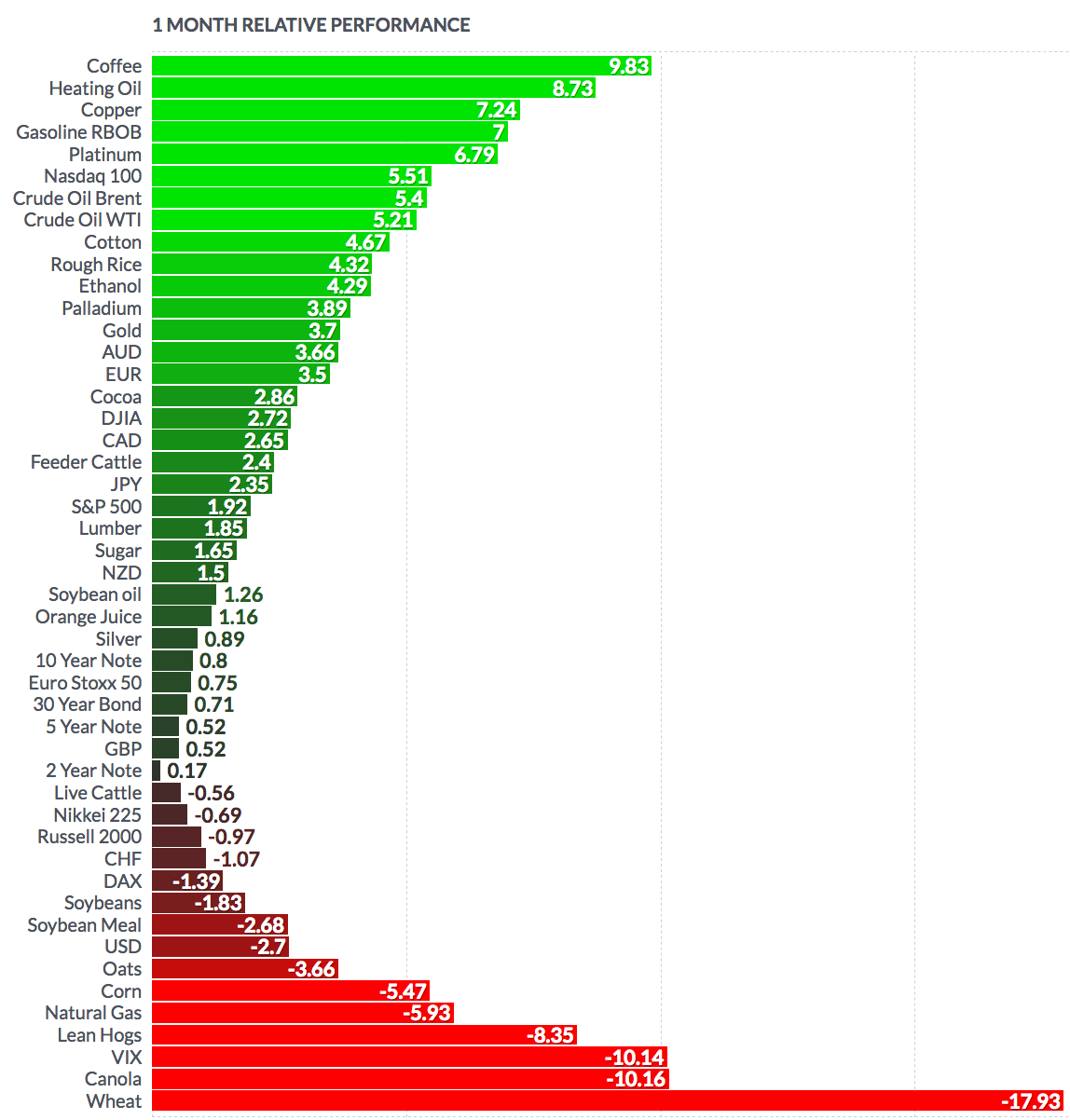

Futures: Crude Oil WTI Futures rose 5.2% in July, while Natural Gas fell -5.93%: