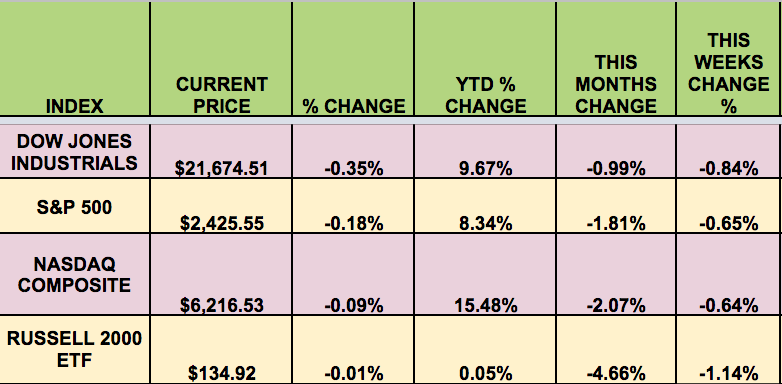

Markets: The market fell for the 2nd straight week, with Thursday being the biggest loss in 3 months. Investors are growing more skeptical about any tax reform plans getting done in 2018. Ongoing political instability in the administration, which had to dissolve several business councils this week, after CEO’s walked, continues to shake investor confidence. The Russel small caps trailed again, with the S&P and NASDAQ losing the least.

Earnings season has wound down, with ~ 72% of the 456 S&P 500 companies having topped estimates through last Friday.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: CPTA (NASDAQ:CPTA), MCC (NYSE:MCC), MDLY (NYSE:MDLY), AWP (NYSE:AWP), RAS (NYSE:RAS), PBI (NYSE:PBI), CBA (NYSE:CBA), CHCT (NYSE:CHCT).

Volatility: The VIX rose as high as $15.84 this week, and finished at $14.26, down 8%.

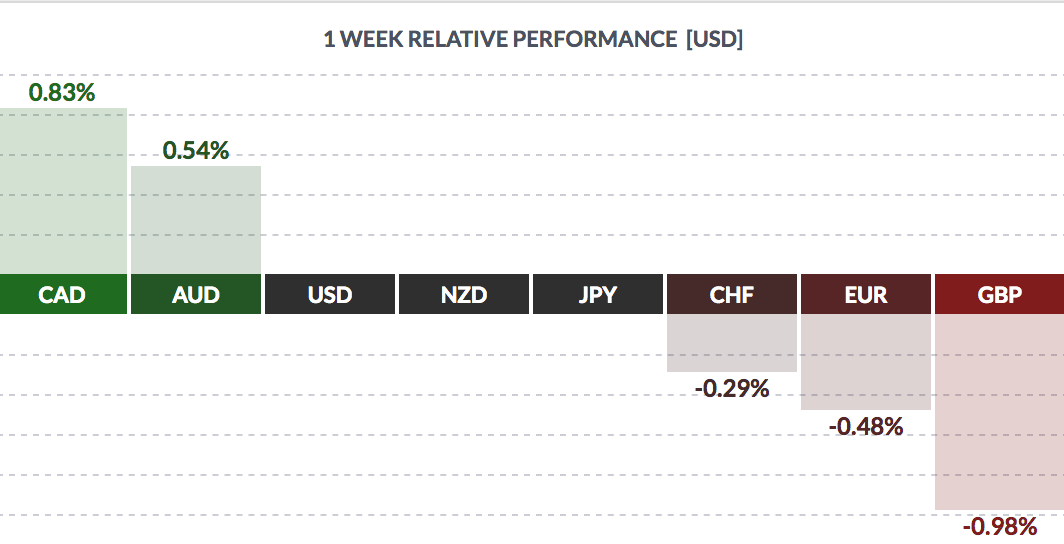

Currency: The dollar rose vs. the the pound, the euro, and the Swiss franc, and fell vs. the Aussie dollar, and the loonie.

Market Breadth: 12 of the DOW 30 stocks rose this week, vs. 5 last week. 44% of the S&P 500 rose, vs. 20% last week.

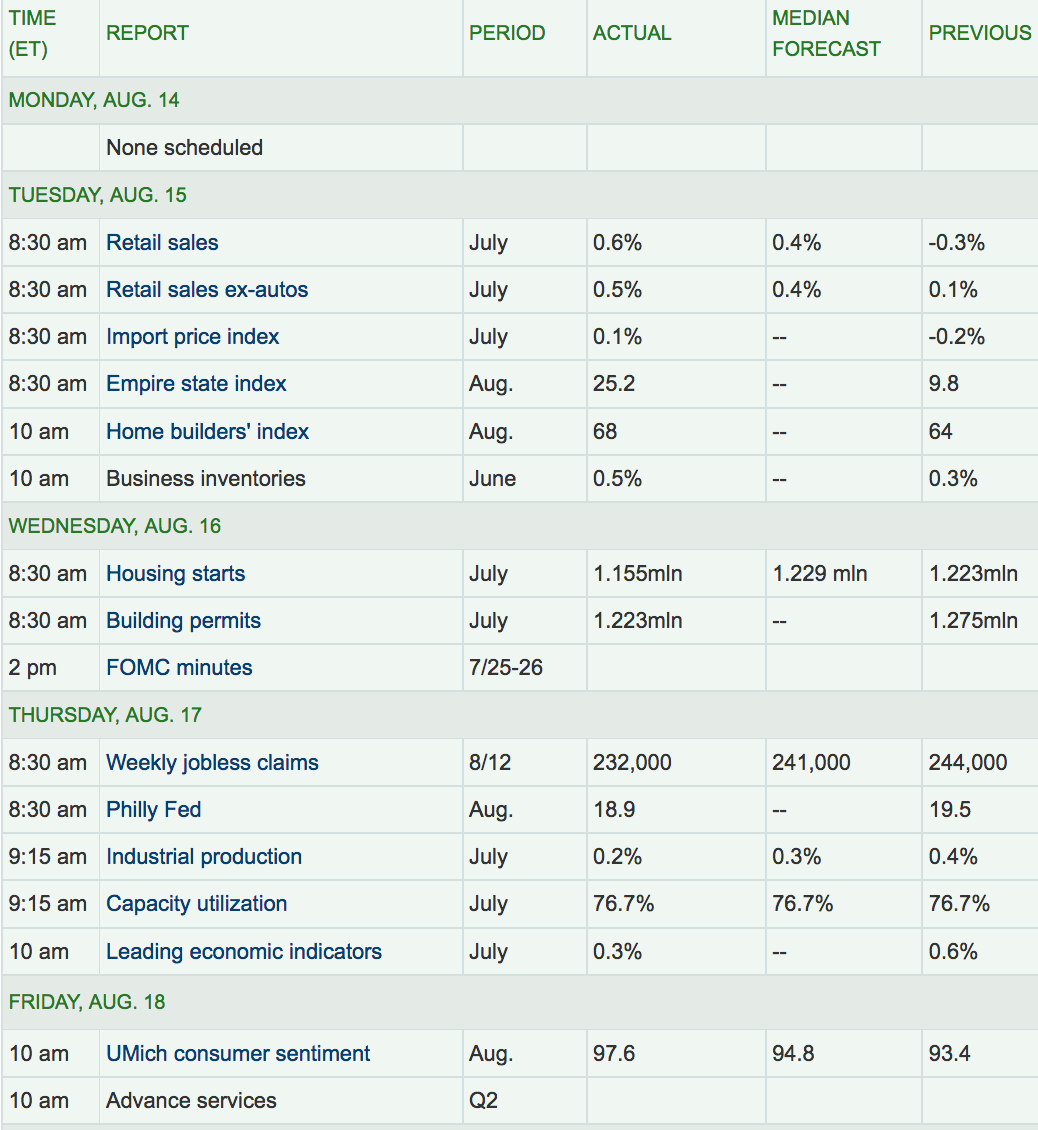

Economic News: Retail Sales bounced back in July, far above forecasts. Consumer Confidence rose to 97.6. The Empire NY index also surprised to the upside, with its best reading since 2014. Housing Starts and Building Permits fell, as did Leading Economic Indicators.

Week Ahead Highlights: Q2 Earnings season continues, at a slower pace, with some discount retailers, such as Costco (NASDAQ:COST), Dollar Tree (NASDAQ:DLTR) and Dollar General, reporting, as well as Tech firms HPE and INTU.

The Fed’s annual Jackson Hole, WY conference begins on Thursday, Aug. 24th. Fed chief Yellen is scheduled to speak on Friday, 8/25.

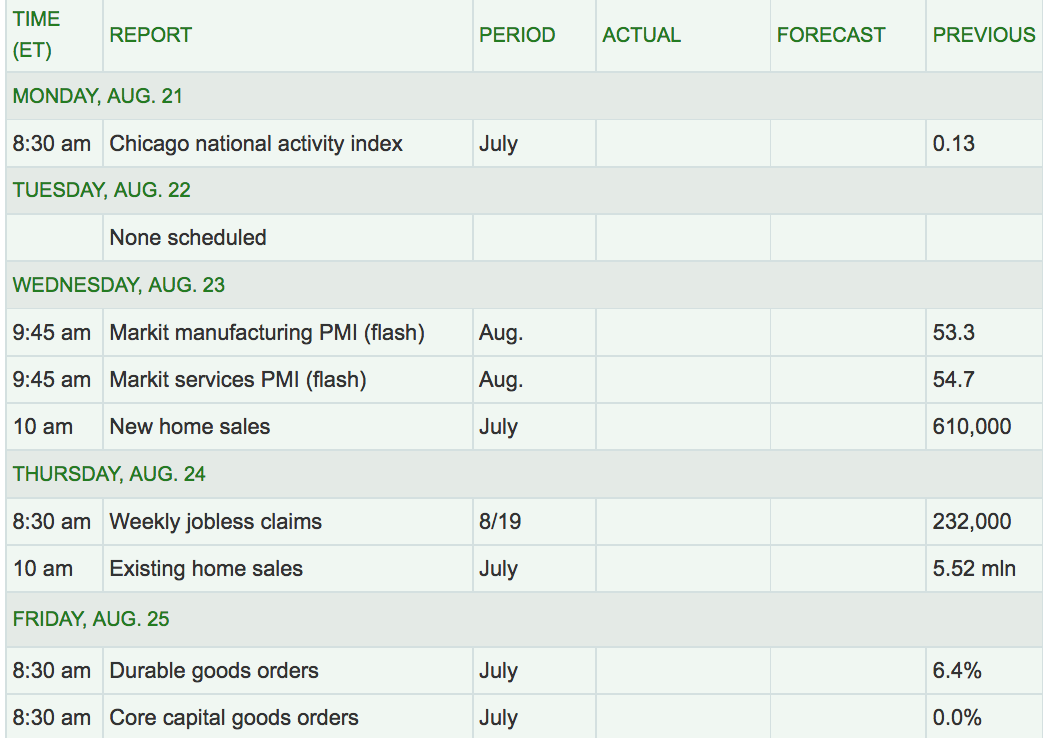

Next Week’s US Economic Reports: It will be an anemic week for economic reports next week, featuring New and Existing Home Sales data from July.

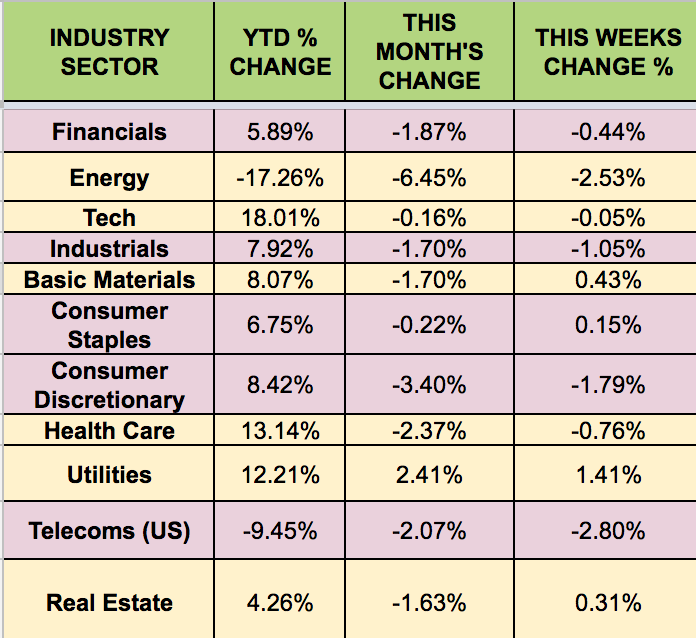

Sectors: The defensive Utilities sector led this week, but were barely positive, as Energy and Telecoms trailed again.

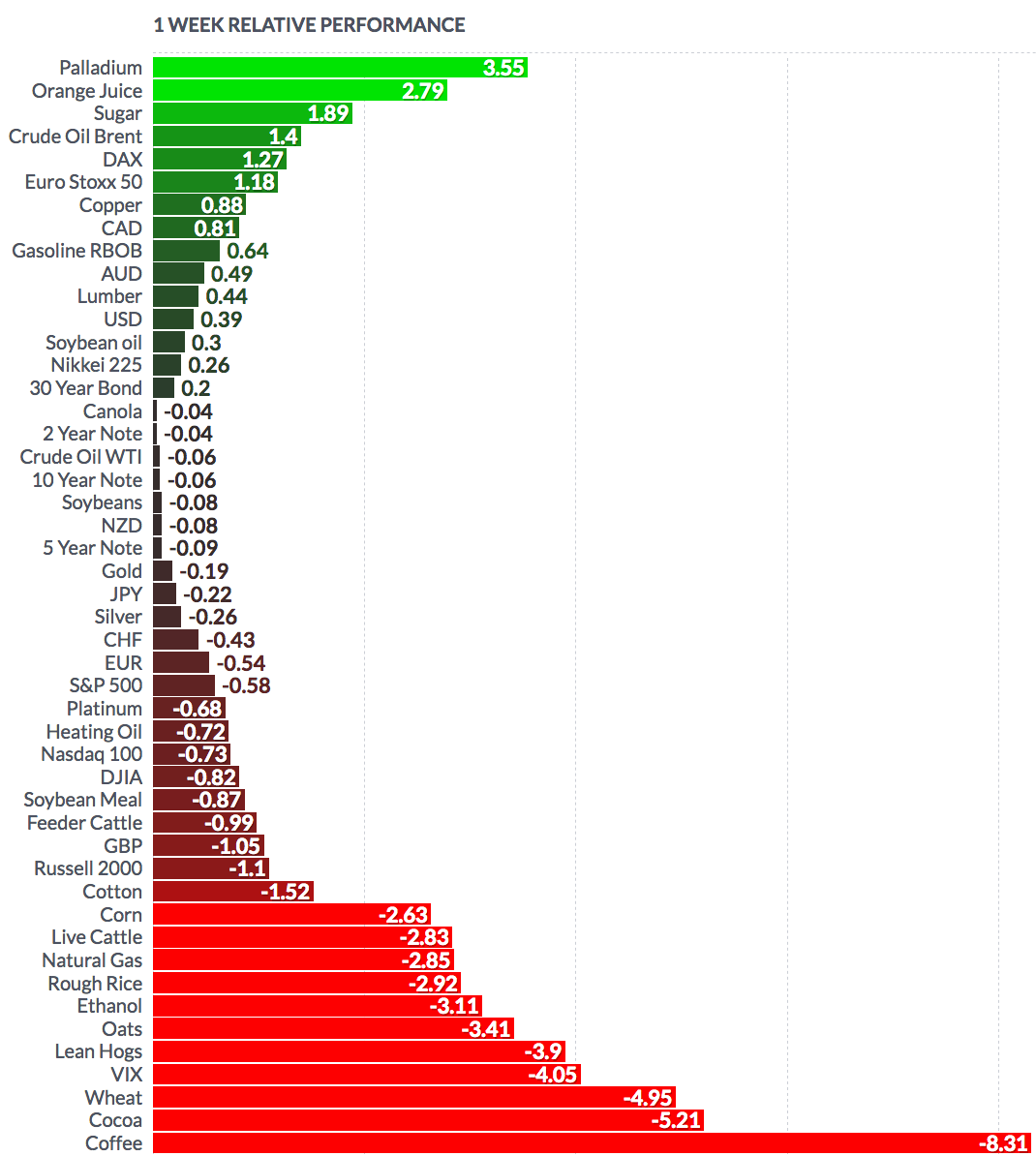

Futures: Natural Gas futures fell -2.85% this week, while WTI Crude was flat, but Brent Crude rose 1.4%, its Brent rose to its highest point since late May on signs supplies are tightening: