Stock Market New – May 4, 2019

Markets:

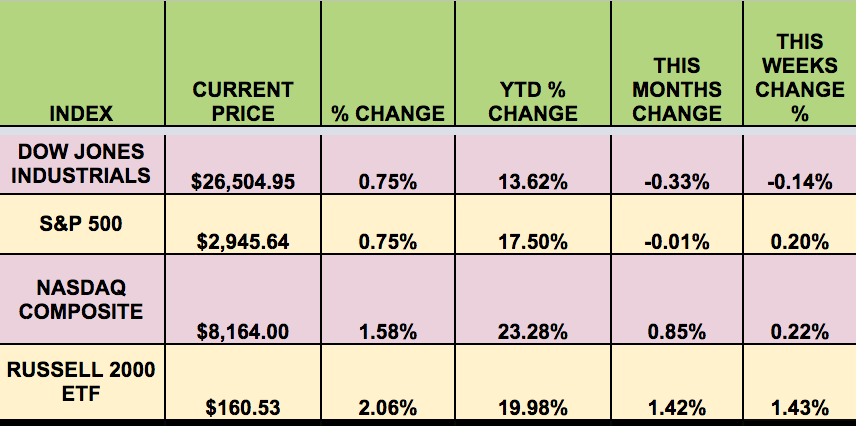

It was another mixed week for the market, with the DOW down, and the S&P flat, whereas the RUSSELL gained 1.42%, and the NASDAQ reached a new high on Friday.

High Dividend Stocks:

These high yield stocks go ex-dividend next week – CEQP, MMP, NS.

Market Breadth:

18 out of 30 DOW stocks rose this week, vs. 16 last week. 58% of the S&P 500 rose again, vs. 58% last week.

Volatility:

The VIX rose 1.8% this week, ending the week at $12.87.

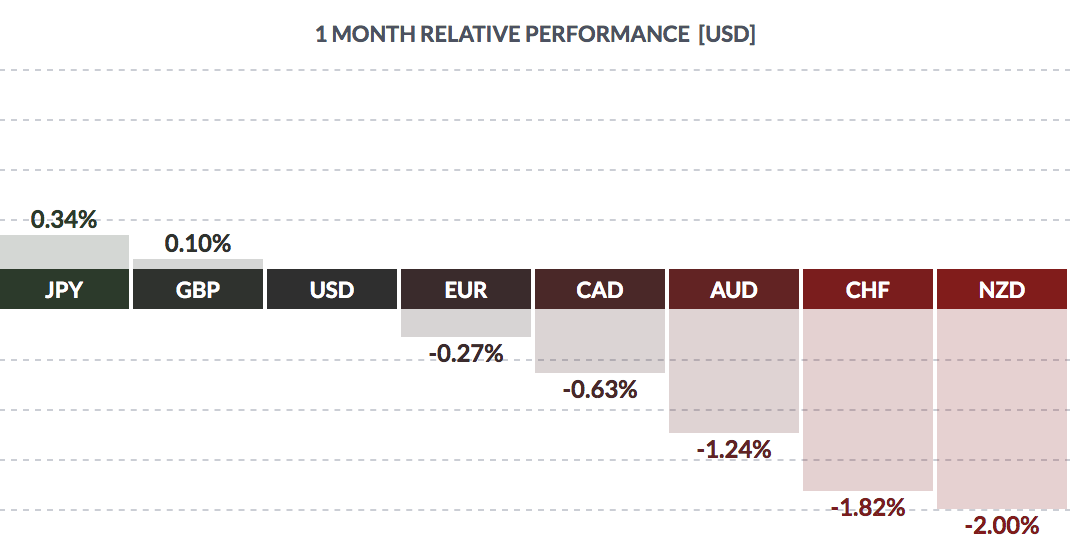

FOREX:

The USD rose vs. most major currencies once more this week, excepting the yen and the pound.

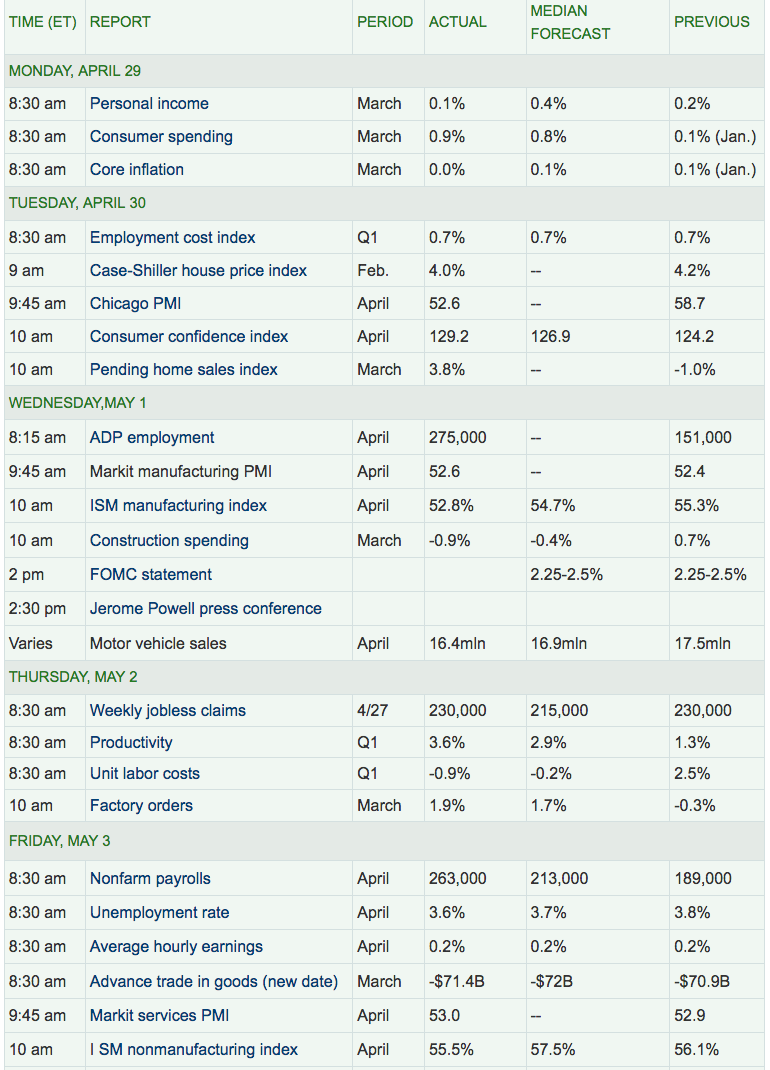

Economic News:

The Fed kept its benchmark interest rate in a range of 2.25% to 2.5% on Wednesday.

“The U.S. created 263,000 new jobs in April to help drive the unemployment rate down to a 49-year low of 3.6%, the latest cue pointing to a rebound in the economy after a slow start in the new year. The increase in hiring was concentrated at white-collar businesses, construction and health care. The only sector to suffer a big drawback was retail, whose employment fell for the third straight month.

The unemployment rate slipped to 3.6% from 3.8% in March, marking the lowest level since December 1969. One caveat: The decline stemmed in large part from nearly a half-million workers dropping out of the labor force. Fewer people said they were unemployed, however.” (MarketWatch)

“”U.S. consumer spending increased by the most in more than 9-1/2 years in March as households stepped up purchases of motor vehicles, but price pressures remained muted, with a key inflation measure posting its smallest annual gain in 14 months. The surge in consumer spending reported by the Commerce Department on Monday sets a stronger base for growth in consumption heading into the second quarter after it slowed sharply in the first three months of the year.

It further allayed concerns about the economy’s health, which had been brought to the fore by a temporary inversion of the U.S. Treasury yield curve last month. Tame inflation, however, supported the Federal Reserve’s recent decision to suspend further interest rate increases this year.” (Reuters)

“The S&P CoreLogic Case-Shiller 20-city index rose a seasonally adjusted 0.2% in February compared to January, and was 3.0% higher compared to a year ago. That was the slowest pace of annual growth since September 2012, and just missed the Econoday consensus forecast for a 3.2% yearly increase.

National home price appreciation has thudded back to earth, and a regional realignment is underway. In February, 14 of 20 cities reported monthly, seasonally adjusted price increases, but only one city had a stronger annual price increase than in January.

California, stung by the tax-law changes of 2017, is no longer on top. In fact, Los Angeles, San Francisco and San Diego had the slowest annual price growth in the three month period ending in February. But Americans still prize warm weather and moderately-priced housing: the top three metros were Las Vegas, Phoenix, and Tampa.”

Week Ahead Highlights:

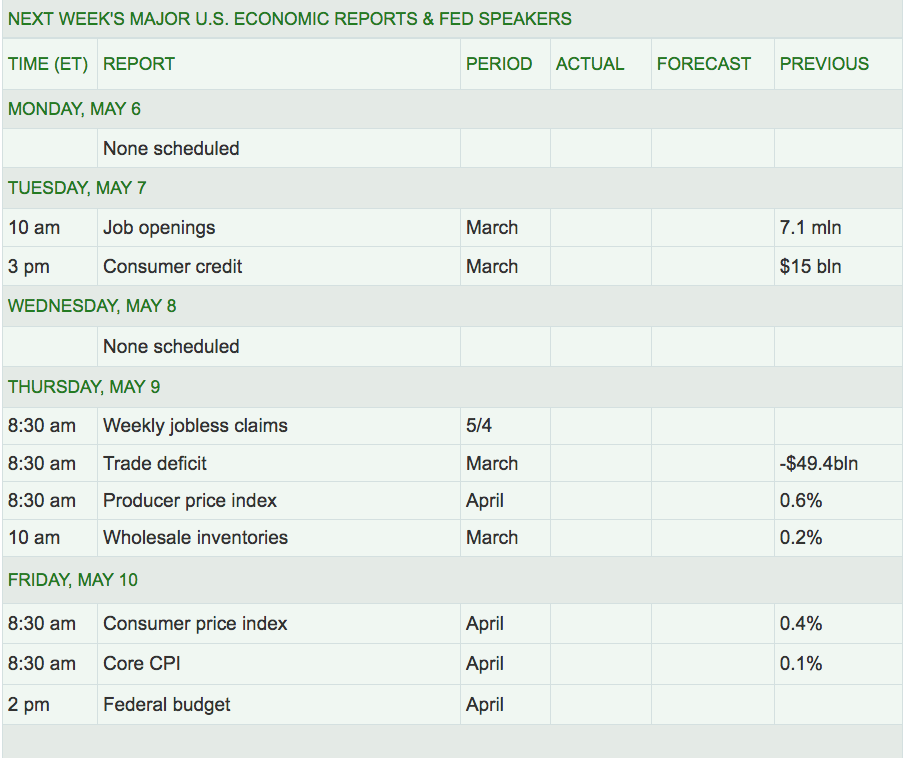

Q1 Earnings season slows, with 1 DOW component reporting, DIS, and ~10% of the S&P reporting. It’ll also be a slow week for economic reports next week, but the CPI and PPI reports will come out later in the week.

Next Week’s US Economic Reports:

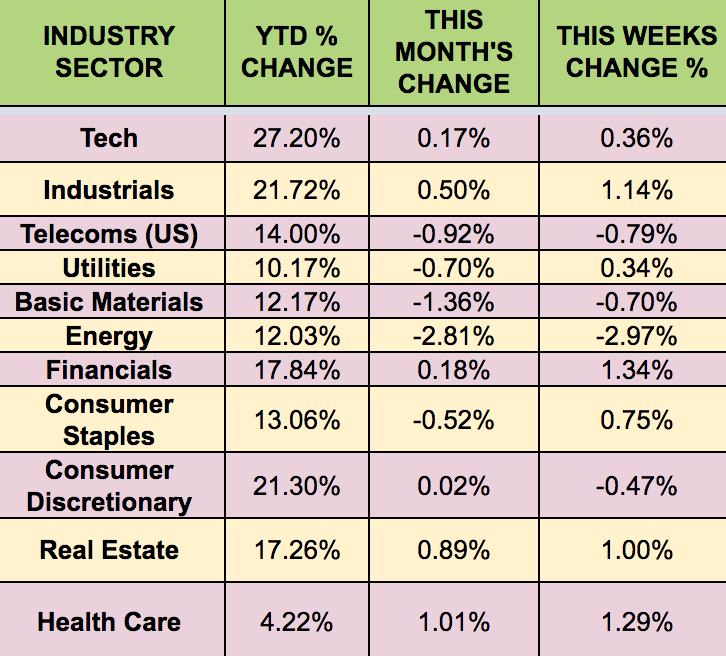

Sectors:

Health Care bounced back a bit this week, and led all other sectors, followed by Industrials, while Energy lagged.

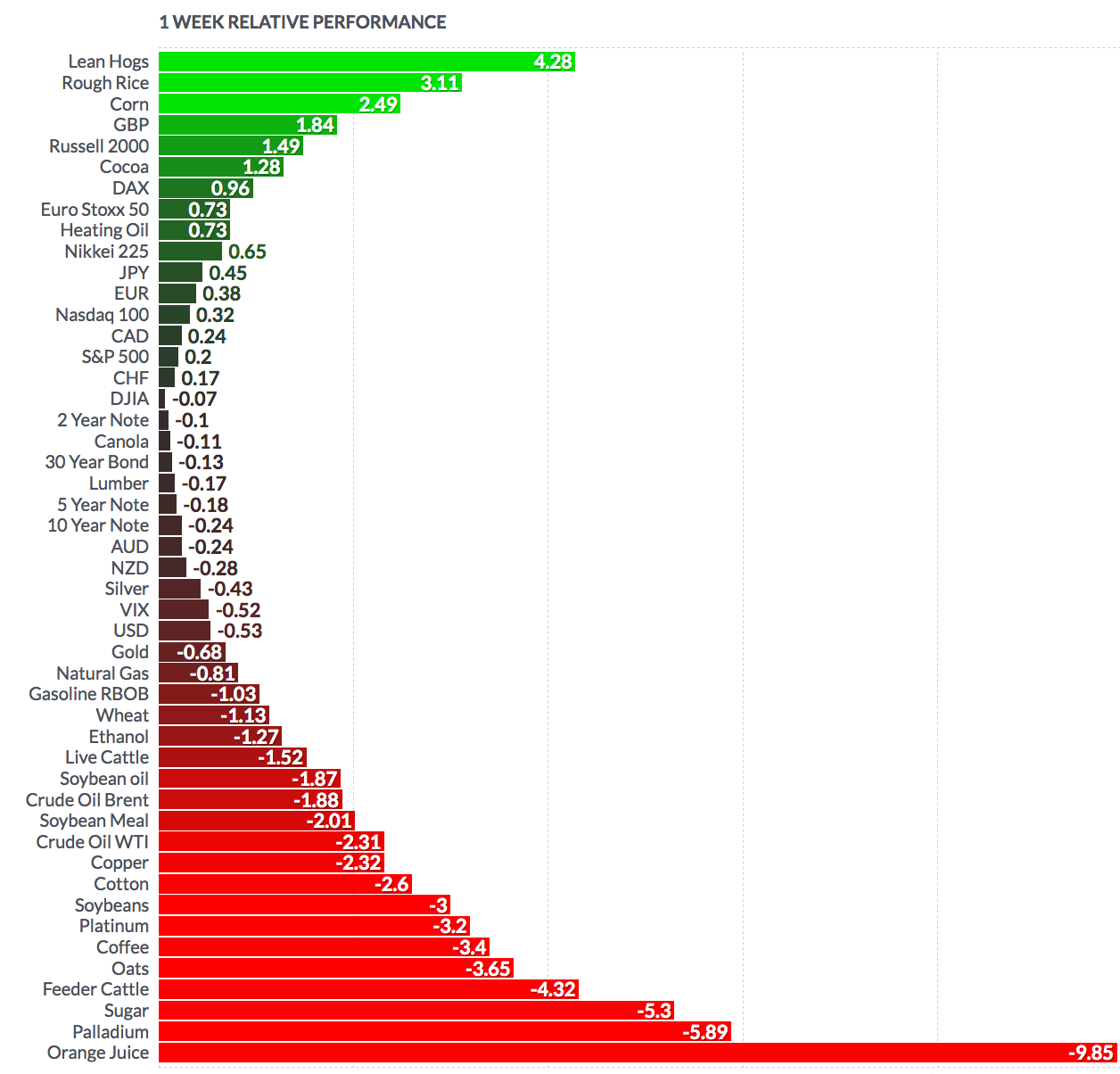

FUTURES:

WTI Crude fell 2.3% this week, finishing the week at $61.86, while Natural Gas fell once again, down -.81%.