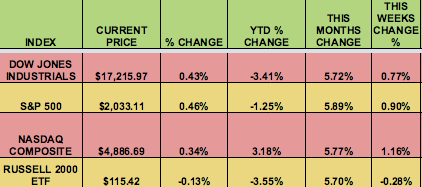

Markets: The market had its 3rd straight weekly gain this week. 3 out of 4 indexes had respectable rallies this week, with the NASDAQ leading the way. Healthcare bounced back this week, and Utilities led the way, as mixed to weaker data gave investors a stronger bias toward the Fed not raising rates until 2016.

Volatility:

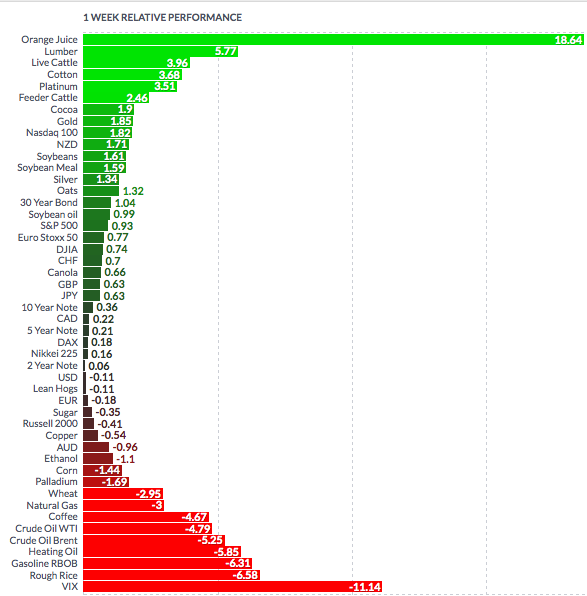

The VIX dropped 12%, to end the week at $15.05, its latest close since August 18th.

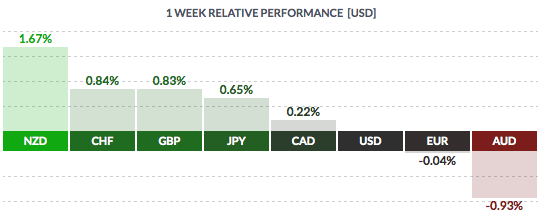

Currency: The dollar fell vs. most major currencies, with rate hike expectations pushed further out. Many commodity-driven nations are selling US debt. Due to falling commodity prices, they don’t have the cash to park in US Treasuries like they formerly did.

Market Breadth: 21 of the DOW 30 stocks rose this week, vs. 29 last week. 58% of the S&P 500 rose this week, vs. 88% last week.

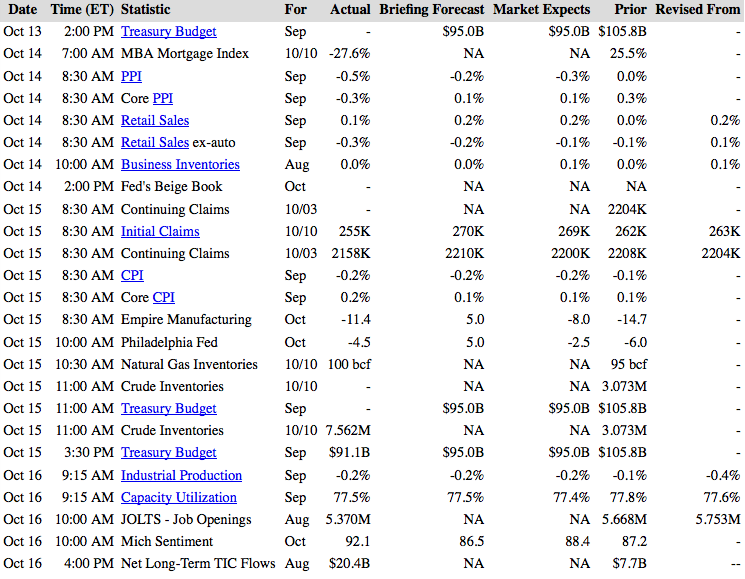

US Economic News: The Initial Unemployment Claims average dipped to its lowest since 1973. Continuing Claims hit its lowest in 15 years. Sept. Retail Sales missed forecasts. Inflation remains tame, with the PPI and the CPI both falling. Consumer Sentiment jumped, beating expectations, and regaining what it lost in Sept. Home purchase apps fell 34%.

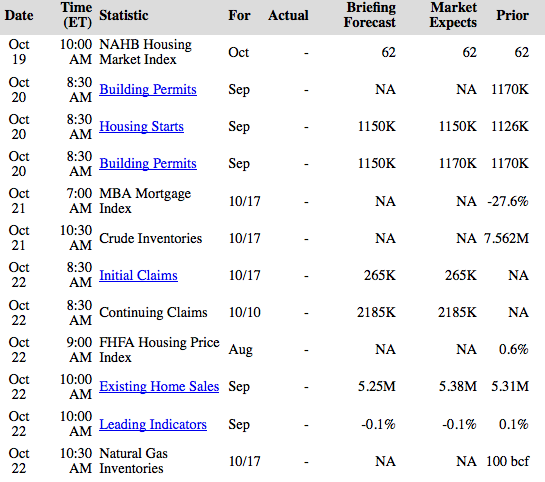

Week Ahead Highlights: The Housing Industry will be in the spotlight net week, with several reports due out. There will also be a focus on Tech earnings, with several large Tech firms reporting, such as Microsoft (O:MSFT), IBM (N:IBM), and Yahoo (O:YHOO). 12 of the 30 DOW stocks will report, and over 20% of the S&P 500 will report as well.

Next Week’s US Economic Reports:

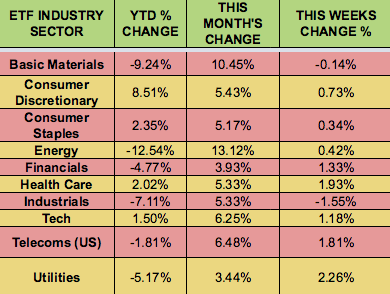

Sectors and Futures:

Utilities led this week,with rate hike fears subsiding, as Industrials trailed, reacting to weak US data.

OJ led this week, with Rough Rice trailing:

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI