With the threat of nuclear war with North Korea looming, inquiring minds may be wondering what that threat is currently worth.

Indices

Currencies

Commodities

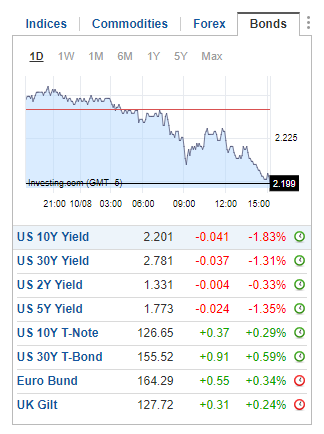

Bonds

The above are charts from Investing.Com.

What’s the Threat of Nuclear War Worth?

If you assign today’s movement to a nuclear war threat here are some possible assignments:

- Commodities: Gold was up less than one percent, silver up a bit more than a percent, oil fell about 2%.

- Equities: The Dow dropped less than a percent, the S&P 500 fell about 1.5% and the Nasdaq about 2.5%.

- Currencies: The dollar index barely budged.

- Bonds: the 30-year and 10-year treasury yields each went down a mere 4 basis points.

Ho Hum. The market essentially discarded the threat of war.

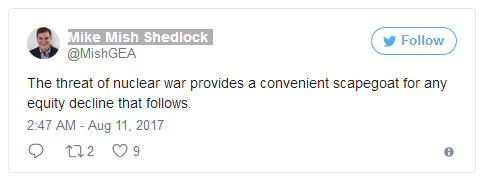

More accurately, one might even wonder if the threat of war had anything at all to do with today’s action.

Dow Since May 17

Correction Hasn’t Begun to Begin!

About the only thing that budged substantially today is the VIX.

If nuclear war breaks out, we will likely something like 1,000 DOW point moves. Even then, all an initial 1,000 point move would do is take the DOW back to where it was in May.

If the stock market drops 15% from here, that’s likely just the beginning. It would take a 40% to 50% decline for valuations to get to normal. Overshoots are possible. So don’t blame North Korea no matter how deep the ultimate dive.

Heck, given the move in the VIX, it could have been Jeffery Gundlach triggering the action with his VIX Bet, not North Korea.

At this stage in the bubble, literally anything could provide a trigger.

For a discussion of valuations, please see:

- Median Price-to-Revenue Ratio Higher in All Deciles vs 2007, 90% vs Dot-Com Bubble: THE Choice

- Bubblicious Debate: Greenspan Says “Bond Bubble About to Break”, No Stock Market Bubble,

- Tracking the Amazing Junk Bond Bubbles in the US and Europe

Trends in Sentiment, Asset Bubble, Gold

Finally, please consider my 38 slide powerpoint Venture Alliance Presentation on trends in sentiment, asset bubbles, and gold.