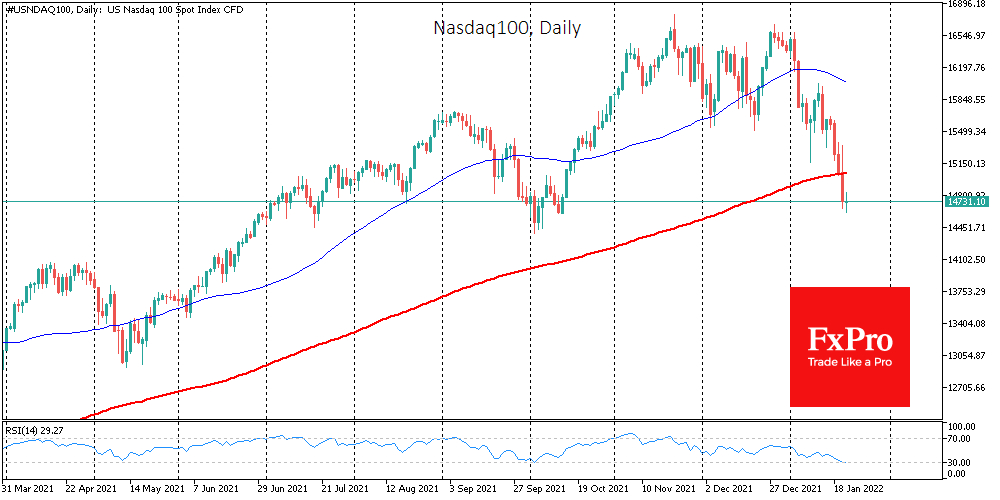

The buying reflex on drawdowns can provide a false start for short-term investors. In the previous two years, markets fell on fears of pandemic effects, but central bankers and governments gave a supporting hand to the economy and pulled the markets through it.

Since the beginning of the year, the downside driver has been an increasingly hawkish tone of commentary, pushing up the risk-free interest rate level. We do not rule out that markets are going too far in their expectations, predicting more than four Fed rate hikes this year.

Since the beginning of the month, market turbulence should send a clear signal to the Fed that the market (or economy) is not ready for such a drastic move.

Previously, Powell missed such a signal in autumn 2018 by insisting on further rate hikes in 2019. This harshness was misguided, which the Fed acknowledged by softening the rhetoric and then lowering the rate in 2019.

Did Powell draw the correct conclusions from that episode? This is a question for hundreds of billions of dollars, which could be added to or wiped from the stock market capitalization.

Losses during earnings season

This corporate earnings season, gaining momentum this week, has so far caused more worries and disappointments than pleasant surprises. Judging by market dynamics, investors are getting rid of shares of pandemic favorites. However, we can't say yet that they are ready to massively add value stocks to their portfolios, though the latter are falling much less than the former.

So far, this is the worst January in 14 years.

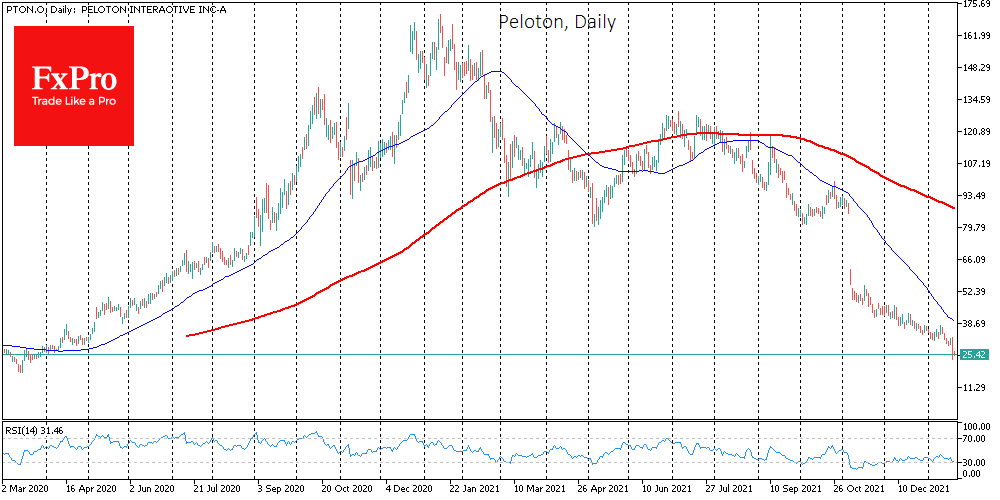

Shares of Peloton (NASDAQ:PTON) collapsed 24% Thursday on reports that the company is suspending production of exercise bikes and treadmills because of scarce demand. With the latest momentum of the decline, the stock was near the mark where it traded just after its September 2019 offering and about 85% below the peak levels it reached a year ago.

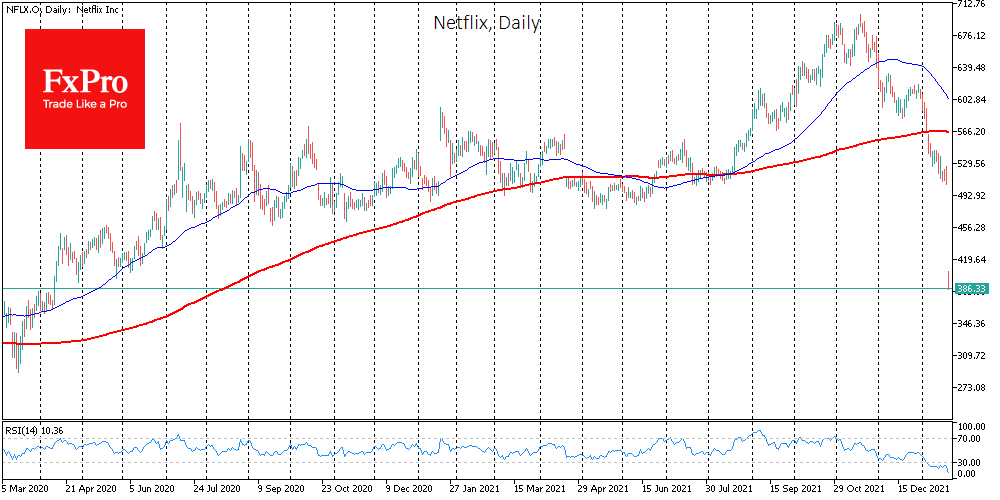

Despite having 20 times bigger capitalization, Netflix (NASDAQ:NFLX) hasn't been left out of the strong moves. Its shares lost 20% in the post-market after its earnings release. The company continues to grow, but investors punished it for lowering its growth rate forecasts despite revenue and earnings above expectations last quarter. But the market now values it at June 2020 levels.

Earlier in the week, Goldman Sachs (NYSE:GS) lost 10% in a day after disappointing investor reports. Since then, stocks have continued to cruise near their lows since May 2021.

The coming week, Apple (NASDAQ:AAPL) is due to report, but it has already lost 10% from the historic highs reached on the first day of trading this year.

The FxPro Analyst Team