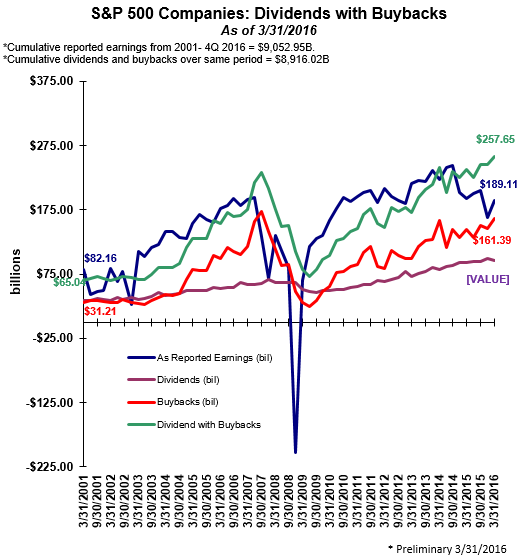

S&P 500 Dow Jones Indices reports first quarter stock buybacks for the S&P 500 Index were higher by 12% on a year over year basis. On a quarter over quarter basis buybacks were higher by 10.6%. The increase in buyback activity was supported by a quarter over quarter 15.8% increase in as reported earnings. Disappointingly though was the fact QOQ dividend payments declined 3.1%. Additionally, the combination of dividends and buybacks equaled $257.65 billion and was in excess of reported earnings of $189.11 billion. This is the six straight quarter buybacks plus dividends exceeded reported earnings.

Several highlights from S&P's report:

- The Health care sector increased 86.1% to $30.6 billion for the quarter, up from the prior quarter’s $16.5 billion, as Gilead Sciences (NASDAQ:GILD) spent $8 billion (ranking as the 18th largest in S&P 500 history).

- The Energy sector conducted only minor buybacks ($2.1 billion), as it posted a 20.6% decline for the quarter and a 62.9% decline from Q1 2015.

- For the ninth consecutive quarter, more than 20% of the S&P 500 issues reduced their year-over-year diluted share count by at least 4%, therefore boosting their earnings-per-share (EPS) by at least 4%. The participation rate for significant EPS impact rose to 28.2% for Q1 2016, up from 25.8% in Q4 2015.

- Total shareholder return, dividends plus buybacks, set a quarterly record of $257.6 billion in Q1 2016 and a 12-month record of $974.6 billion for the period ending in March 2016.

Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices. said, "The Q4 2015 uptick in buybacks was a surprise to many in the market, but it continued in Q1 2016. The pace of buybacks was partially driven by companies supporting their stock during the opening downturn of the year, which coincidentally started in early February when many earnings lock-ups ended. The upswing in both expenditures and participation appears to persist in the market, meaning that the upturn in Q4 was not single-shot. Looking at Q2 2016, the share count reduction trend is already baked in, as more than 20% of the issues have reduced their share count by at least 4% from Q2 2015."

Silverblatt also noted in the report cash reserves set a new record and increased 1.6% to $1.347 trillion. "Shareholder returns continue to increase, as companies remain awash with cash and have access to low-cost financing – especially in Europe and Asia," said Silverblatt. "The rate of dividend increases has slowed, as commodity-based issues remain a major uncertainty. Given the current cash-flow, projections, and an expected slow and measured pace of interest rate increases in the U.S. by the FOMC, companies have the ability to increase returns, as they remain under continued pressure from outside investors."

From an investor perspective, at HORAN, we prefer to see companies commit to higher dividend payments versus just an increase in buybacks. Dividends tend to be a more permanent commitment on a company's part and an indication of more consistent expected earnings 'growth', where buybacks can be turned off and on at will.