That was a difficult week of news to digest. While the market continue to flirt with its 2019 highs, new risks have emerged:

• The Saudi Oil attack disruption, combined with increased sanctions on Iran, left the energy supply and price outlook unclear. Prices finished higher on the week, but well off their Monday levels suggesting that the world is still oversupplied and a disruption of the world’s largest source will be temporary.

• The Federal Reserve cut their Fed Funds rate by 0.25% and strongly suggested that any future action will be data dependent. Meanwhile, dissension among its Members increased with disagreements in both policy direction.

• FedEx Corporation (NYSE:FDX), Owens Corning Inc (NYSE:OC) and the Steel companies warned about future earnings, suggesting that customers have already reduced spending due to trade uncertainty.

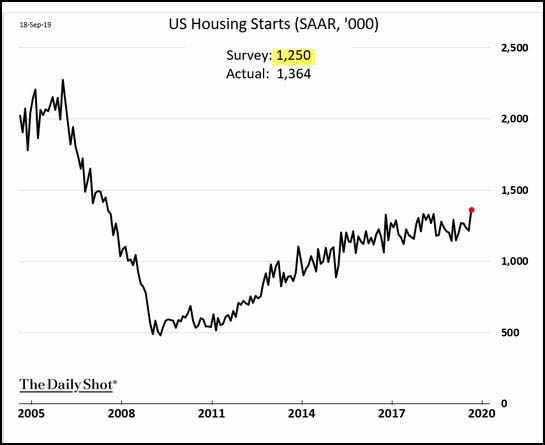

• On the flipside, U.S. Housing data continues up and to the right.

• The General Motors (NYSE:GM) strike is rippling backward into its 30,000-part supply chain.

• The video streaming wars have accelerated as new devices, new channels and very big dollars for content hit the tape last week.

• On Friday, the China/U.S. trade war discussions ended with a long flight home back to China without the planned Montana steak dinner. And Sheldon Adelson is not happy about it.

• WeWork IPO delayed and its investors are doing everything they can to keep it from becoming worthless.

This is the last week of September and the third quarter which means the stock repurchase desks will be going into shutdown for the next 3 weeks until companies report their earnings. With the largest buyer of stocks taking a break, stocks will be even more dependent on the micro and macro news flow. We might even see some month/quarter-end portfolio rebalancing this week and next. And, with stocks outperforming bonds for the month, expect a shift in the opposite direction.

Fed Chair Powell’s press conference gave us some glimpses into their crystal ball…

Since the middle of last year, the global growth outlook has weakened, notably in Europe and China. Additionally, a number of geopolitical risks, including Brexit, remain unresolved. Trade policy tensions have waxed and waned, and elevated uncertainty is weighing on U.S. investment and exports. Our business contacts around the country have been telling us that uncertainty about trade policy has discouraged them from investing in their businesses. Business fixed investment posted a modest decline in the second quarter and recent indicators point to continued softness. Even so, with household spending remaining on a solid footing and with supportive financial conditions, we expect the economy to continue to expand at a moderate rate.

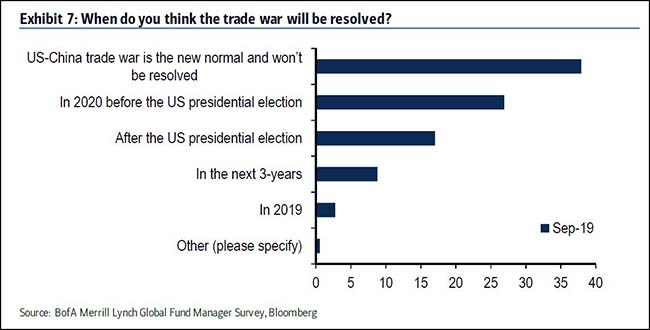

Despite somewhat more positive trade news over the last couple of weeks, there appears to be little fundamental shift in the US or Chinese positions on key trade issues. We therefore expect progress in upcoming trade talks between the US and China to be incremental at best, especially following reports that Chinese officials’ recent visit was cut short.

(Jan Hatzius, GS)

Portfolio Managers are giving up on the Trade Wars…

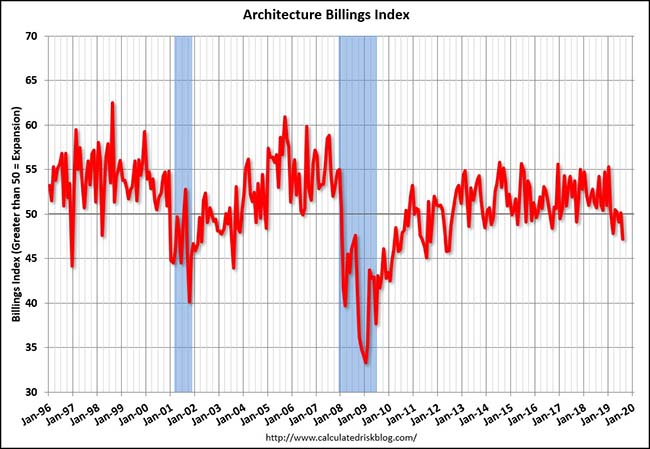

Global uncertainties are now rolling over into the architecture and commercial building industry…

Demand for design services in August took a markedly downward swing compared to July’s already soft score, according to a new report released today from The American Institute of Architects (AIA).AIA’s Architecture Billings Index (ABI) score of 47.2 in August showed a significant drop in architecture firm billings compared to the July score of 50.1. Any score below 50 indicates a decrease in billings. The design contracts score also declined to 47.9 in August, representing a rare dip for this indicator. Billings in the West stayed modestly positive while all other regions remained in negative territory.

But residential housing remains one of the shining stars of the economy…

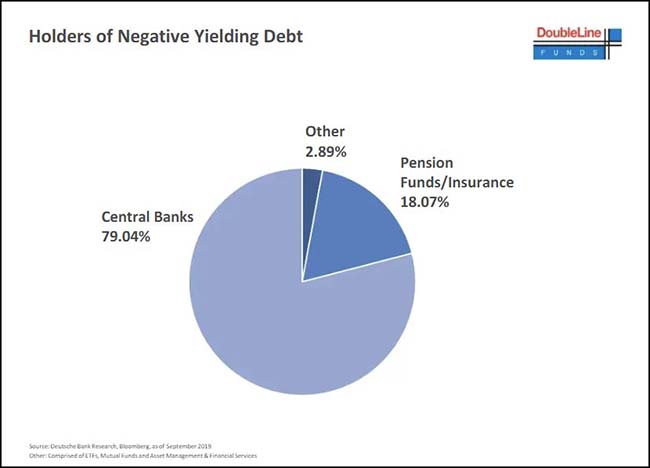

A most interesting chart on who holds the world’s negative yielding debt?

And so while the Central Banks crowd into the negative debt, it is investors who are crowding into America to buy our positive yielding debt.

What an incredible waste of time, money and productive brainpower…

The duties have undermined Arrowhead’s business model of selling cheaper alternatives to manufacturers’ parts, company officials said. Appealing the levies has proved a challenge in itself, illustrating the trade war’s sometimes hidden toll on U.S. companies. “We basically put everything else on the back burner” to appeal the tariffs, said John Mosunic, Arrowhead’s chief operating officer.

Seeing no viable alternatives to the many parts it imports from China, Arrowhead contacted the office of its local congressman, Rep. Tom Emmer (R., Minn.), to see if there was any way to streamline the appeals process.

The guidance Arrowhead received: Be as specific as you can in seeking exemptions, Mr. Mosunic said. So Arrowhead, which employs about 1,000 people, ended up filing appeals for each gasket, air filter, spark plug and other parts it imports, hiring a crew of temporary workers to submit the requests manually…

The Office of the U.S. Trade Representative has said it would evaluate appeals individually, weighing factors such as whether a product is only available from China and whether duties would harm the company significantly.

Trade experts said navigating the process is especially tough on smaller companies with limited resources.

“Small businesses wouldn’t have that kind of money to hire one of the well-connected firms,” said Clark Packard, the trade policy counsel at the free market think tank R Street Institute and a former Republican policy adviser. “For an administration that claims to be ‘draining the swamp,’ it’s certainly been a bonanza for trade lawyers and lobbyists.”

Another Trade War casualty: No more American peanut butter in Germany…

The U.S. cattle industry is now resorting to legislation to slow their decline…

Our American youth knows that climate change is occurring and eats less-legged meat. Rather than fight “naming “wars, ranchers should focus on producing the highest quality meat on earth, while spending their lobbying time trying to end the global trade wars, so they can sell it for the premium prices that they deserve.

Wyoming, Oklahoma and South Dakota are among the states working to control the labelling of meat substitutes as the products appear in more restaurants and supermarkets.

Their efforts address an industry that threatens sales of beef, pork and chicken. Alternative meats could grow to become 10 per cent of the $1.4tn global meat industry over the next 10 years, according to Barclays…

Mr Gordon this year signed a bill into law that bans the word “meat” from being used if the meat in question does not come from an animal. A dozen states have passed such statutes since last year, with more legislation introduced elsewhere.

The laws come as plant-based protein producers strive for the taste, texture and juiciness of ground beef. Their products are now available in fast-food chains such as Burger King and in the meat aisles of grocery stores.

“If you liked the Theranos documentary The Inventor: Out for Blood in Silicon Valley, you’ll love Community-Based EBITDA: The Story of We, coming soon to Hulu.”

The halcyon of the markets coupled with feckless regulatory bodies and the decimation of investigative journalism has made the markets ripe for fraud. We is falling off the tree.Predictions:* In the next 30 days, a series of explosive investigative journalism pieces will document breathtaking malfeasance at We.* In the next 60 days, a state attorney general, SEC, or other regulatory body will launch a formal investigations into We.* Over the next 12 months, SoftBank’s Vision Fund will be shuttered.

There is not enough lipstick…

John McClain, a portfolio manager at Diamond Hill Capital Management, said he could not remember another unicorn — a privately held start-up valued at more than $1bn — having “zero support from either debt or equity investors”.

“Their borrowing model is seriously in question at this point,” he added. “There is not a level that we could become interested in owning this company based on the business, the governance, and the financial statements

Larry Ellison is not a fan…

Ellison asserted that while he is close friends with Softbank’s Masayoshi Son, he doesn’t see the investment case for either WeWork or Uber (NYSE:UBER), both large holdings in Softbank’s Vision Fund. He declared both the companies “almost worthless.”WeWork declined to comment on Ellison’s remarks. Uber didn’t immediately respond to a request for comment.Ellison argued that while Uber raises capital to spend on gaining market share from rival Lyft (NASDAQ:LYFT), the business they secure doesn’t necessarily stay with the company. He pointed out that Uber doesn’t own its cars and doesn’t control their drivers. And he declared that “they have an app my cat could have written.”Ellison said losing money to gain market share is “idiotic” if customers won’t stay with the firm. “They have nothing,” he said. “No technology. And no loyalty.”He mocked WeWork’s assertion that it is a technology company. “WeWork rents a building from me, and breaks it up, and then rents it,” Ellison said. “They say, ‘We’re a technology company, and we want a tech multiple.’ It’s bizarre.”(

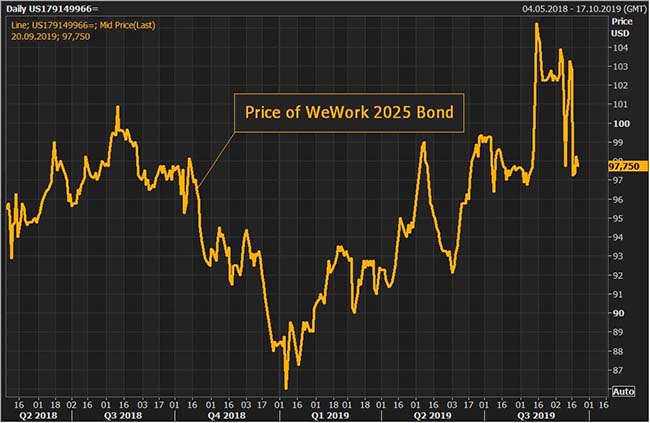

One factor could be a “change of control” clause in WeWork’s prospectus. If it’s triggered, the company will be required to offer to repurchase all outstanding notes at 101% of their principal amount plus accrued and unpaid interest to the purchase date. Imagine the lucrative capital gain: As of Monday morning, WeWork’s 2025 bond was trading at 95.8 cents.

(@Schuldensuehner)

The failure of We is much more than the collapse of just one private company…

The biggest casualty of the postponed initial public offering for We Co., parent of the office-sharing business WeWork, isn’t the company or its bankers. It’s the myth that private markets are superior to public markets.Investors have long been told that the stars of the financial universe are hedge fund, venture capital and private equity managers. These supposedly visionary geniuses are said to be immune to the short-term thinking that poisons the public markets. Investment horizons should be longer, risks lower, returns higher.Since 2008, pension funds, university endowments and other giant investors have poured roughly $2 trillion into private vehicles on that promise. Individual investors have seldom been allowed past the velvet rope—but, as the We debacle shows, that isn’t always a bad thing.Not long ago, We’s venture-capital backers valued it at $47 billion. The proposed IPO faltered when public investors signaled they wouldn’t value the company much above $15 billion—implying the supposedly sophisticated private market had been pricing We at roughly three times what it is worth.(

If you wake up on a Casper mattress, hail a Lyft (NASDAQ:LYFT) to get to your desk at WeWork, use DoorDash to order lunch to the office, hail another Lyft home, and have Uber (NYSE:UBER) Eats bring you dinner, you have spent your entire day interacting with companies that will collectively lose nearly $13 billion this year. Most have never announced, and may never achieve, a profit.

There are several reasons companies that have become synonymous with consumer tech and the new urban Millennial lifestyle might appear zealously averse to turning a profit. Some are temporarily keeping prices down to grow their price-sensitive customer base with the promise that they’ll easily raise prices once they’re big enough. Or they’re earning on every ride and rice-bowl delivery, but they’re losing on customer acquisition. Or they can’t raise prices, because they know that if they do, some other venture-capital darling in their market segment will undercut them—or, just as dispiritingly, the Amazon (NASDAQ:AMZN) CEO Jeff Bezos, the archangel of superfluous margins, will swoop down and destroy them.

But whatever the rationale behind such colossal losses, it’s now clear that the tale private investors heard, and wanted to believe, when they poured tens of billions of dollars into these firms, is in conflict with the less exuberant reality of these companies’ precarity, spelled out in each federal filing.

Even the Fed’s Rosengren thinks WeWork is skinny dipping in this low interest rate tide…

In his speech Friday, Rosengren reiterated his concerns that lowering interest rates has its own risks, and could introduce more leverage into the system as risky assets ride higher on cheaper funding costs.Rosengren particularly cast light on leverage loans, the corner of risky borrowing undertaken by companies saddled with debt.Rosengren also worried that too-low interest rates could result in a spillover of risk into real estate, arguing that co-working spaces like WeWork could be in jeopardy because of the term structures built into their business models.Because co-working companies have long-term leases on buildings but re-lease office space to young and risky companies on short-term leases, Rosengren worries that in a downturn vacancies would rise dramatically as a drying-up of tenant income exposes the co-working company to default risk on their longer-term leases.Rosengren added that because co-working companies also use a shell game of “special purpose entities” to hedge their losses on unprofitable lease arrangements, he worries about commercial real estate suffering substantial losses in the next downturn.“The incentive to take on more leverage and to reach for yield can be costly – but the costs are apparent only when a downturn occurs,” Rosengren said.(

Among the more than 16,200 condo units across 682 new buildings completed in New York City since 2013, one in four remain unsold, or roughly 4,100 apartments — most of them in luxury buildings, according to a new analysis by the listing website StreetEasy…

For an industry accustomed to selling apartments years ahead of completion and skilled at concealing the pace of sales when the market falters, further headwinds could force more drastic measures.

Moreover, a growing share of condos sold in recent years have been quietly re-listed as rentals by investors who bought them and are reluctant to put them back on the market. Of the 12,133 new condos sold between January 2013 and August 2019, 38 percent have appeared on StreetEasy as rentals…

Even in buildings that have nearly sold out inventory, the high rate of apartments becoming rentals is concerning. The tower at 30 Park Place in TriBeCa, where about 90 percent of units have sold for an average price of $3,282 a square foot, has had almost 58 percent of those sales re-listed as rentals, according to Streeteasy.

Facebook (NASDAQ:FB) is the 4th largest stock in the S&P 500…

FB trades at 19.5x next years earnings estimate and has stumbled in the market for the past year. The world’s governments are not fans and given what Bob Iger said about Twitter, I doubt he would run to buy the core Facebook engine in a distressed sale. Seems like many better fish to fry in the market than this one right now.

New channels, new devices and $1 billion paid for ‘The Big Bang Theory’…

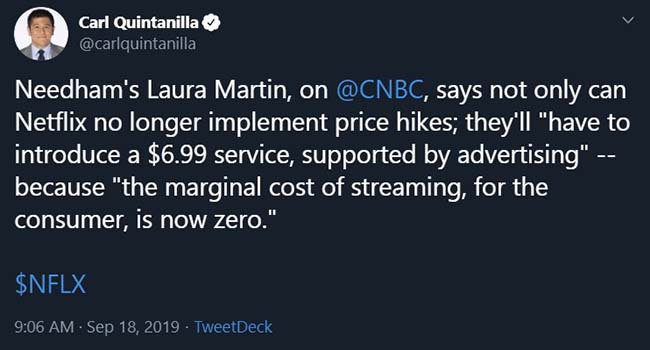

After dominating the subscription streaming scene for so long, Netflix (NASDAQ:NFLX) is girding for a new phase in the SVOD wars with the entry of more deep-pocketed players like Disney and Apple (NASDAQ:AAPL), CEO Reed Hastings said Friday.

“While we’ve been competing with many people in the last decade, it’s a whole new world starting in November…between Apple (NASDAQ:AAPL) launching and Disney launching, and of course Amazon’s ramping up,” said Hastings, who also cited NBCUniversal’s coming Peacock service. “It’ll be tough competition. Direct-to-consumer [customers] will have a lot of choice.”…

Hastings warned that steadily rising production costs would climb even higher with the advent of the likes of Disney Plus and AppleTV Plus.

Higher costs plus lower pricing for all streaming players…

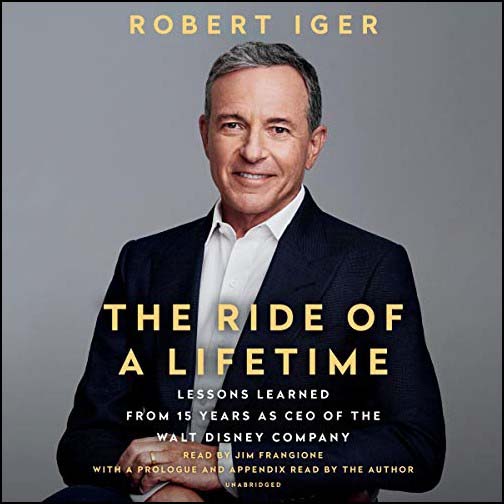

Bob Iger is the opposite of any character in “Succession”. I can’t wait to read this book…

“Literally, I have never heard one person say a bad thing about him and I have never seen him be mean,” David Geffen marveled. “To be honorable, decent, smart, successful and a terrific guy is unusual anywhere. But it is most unusual in the entertainment business. He’s in a category of one.”…

But his book makes clear how much effort went into his effortless demeanor. By eighth grade, he was working as a stock boy in a hardware store. At 15, he toiled as a janitor for his school district. “Cleaning gum from the bottoms of a thousand desks can build character, or at least a tolerance for monotony,” he writes.

At Ithaca College, he earned spending money making pizza every night at Pizza Hut. After he graduated, he became a weatherman in Ithaca and delivered a lot of bad news about the gloomy weather there.

He gave up a dream of being Walter Cronkite and moved to New York City and started at the bottom rung at ABC: $150 a week for menial labor on game shows, soap operas and newscasts. His friends say he was long underestimated and treated as a glorified errand boy, even when he worked under Michael Eisner at Disney.

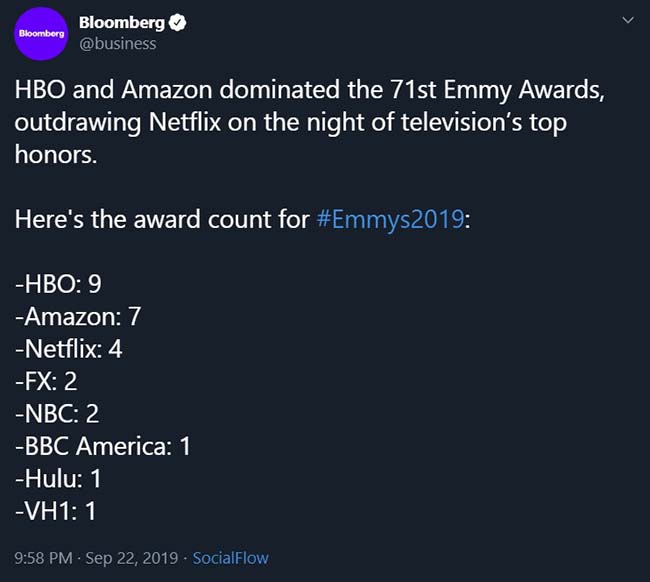

This year’s Emmy count…

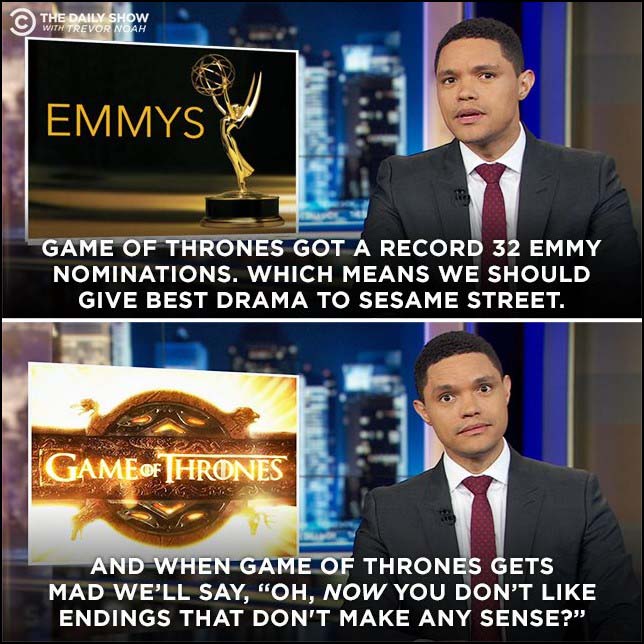

And a missed opportunity at the Emmy’s last night…

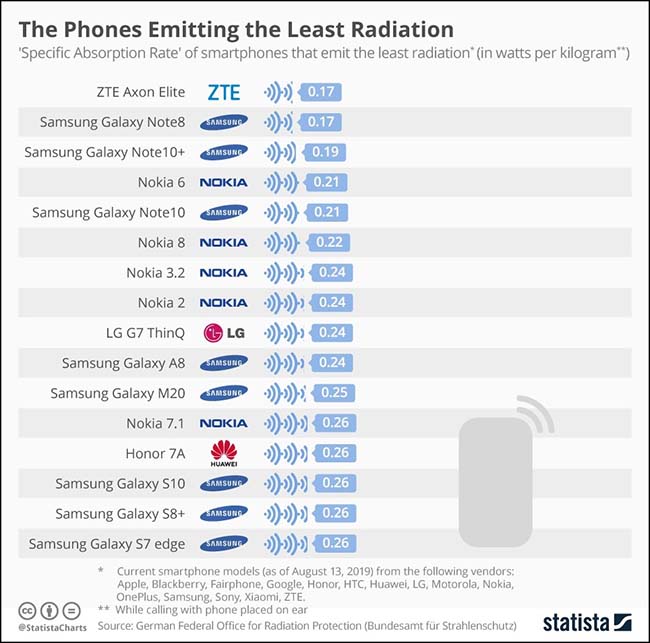

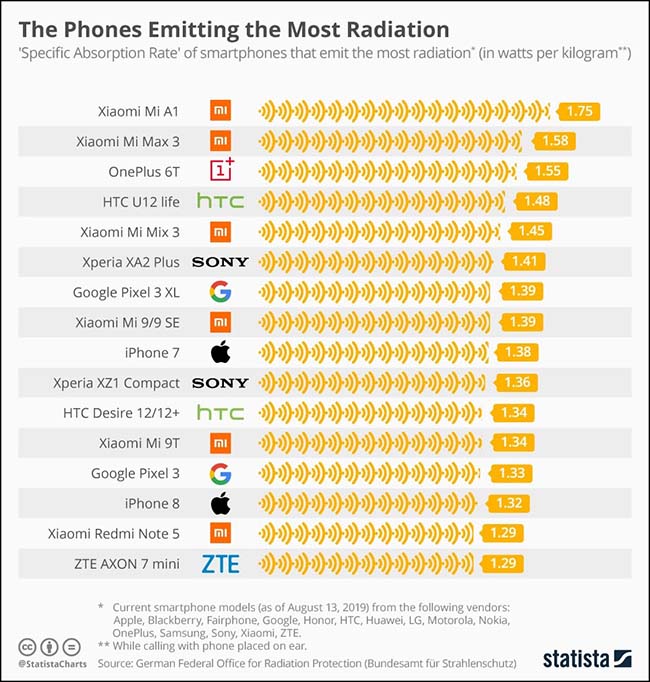

If you are concerned about cellphone radiation emissions, here is your cheat sheet…