Despite my recent bearish call (see Global growth scare = Trend Model downgrade), I didn't expect that the US equity market would sell off so hard on little or no news Thursday after an upside surprise on 1Q GDP and a relatively unsurprising FOMC meeting. After the dust settled, the SPX was down about 2% on the day, which is highly unusual given the recent low volatility environment that the market has been experiencing.

What caught my eye was the sheer panic associated with Thursday's sell-off. The prices of none of the usual diversifying asset classes such as Treasuries (iShares Barclays 7-10 Year Treasury Bond (ARCA:IEF), iShares Barclays 20+ Year Treasury (ARCA:TLT)) and gold held up well on the day. This is suggestive of a rush to cash - a seemingly margin clerk's market where market participants are forced to de-risk for institutional reasons. But that explanation doesn't really hold water, as the SPX is only about 3% from its all-time high at the close Thursday. I honestly have no idea why the markets went risk-off it did on Thursday, but the lack of an explanation suggests that the markets are due for a dead-cat bounce in the near future. Note that this is strictly a tactical short-term call with a 1-5 day time horizon.

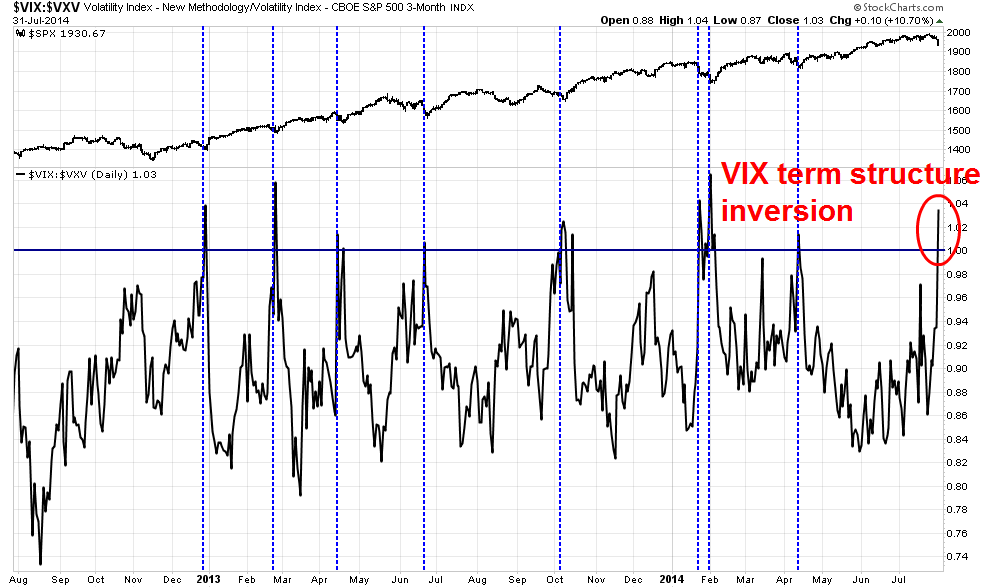

VIX term structure inversion is bullish

As I watched stock prices crater throughout the day, a key characteristic about the sell-off was the spike in fear levels seen in the option market. The VIX/VXV ratio, which is a measure of the term structure of volatility, moved from a normal upward sloping curve to inversion in a single day. As the chart below shows, the majority of past VIX inversion, which are marked by dotted vertical lines, have historically been reasonably low-risk entry points on the long side of the market (also see my previous analysis Is the MH17 sell-off a gift to the bulls?).

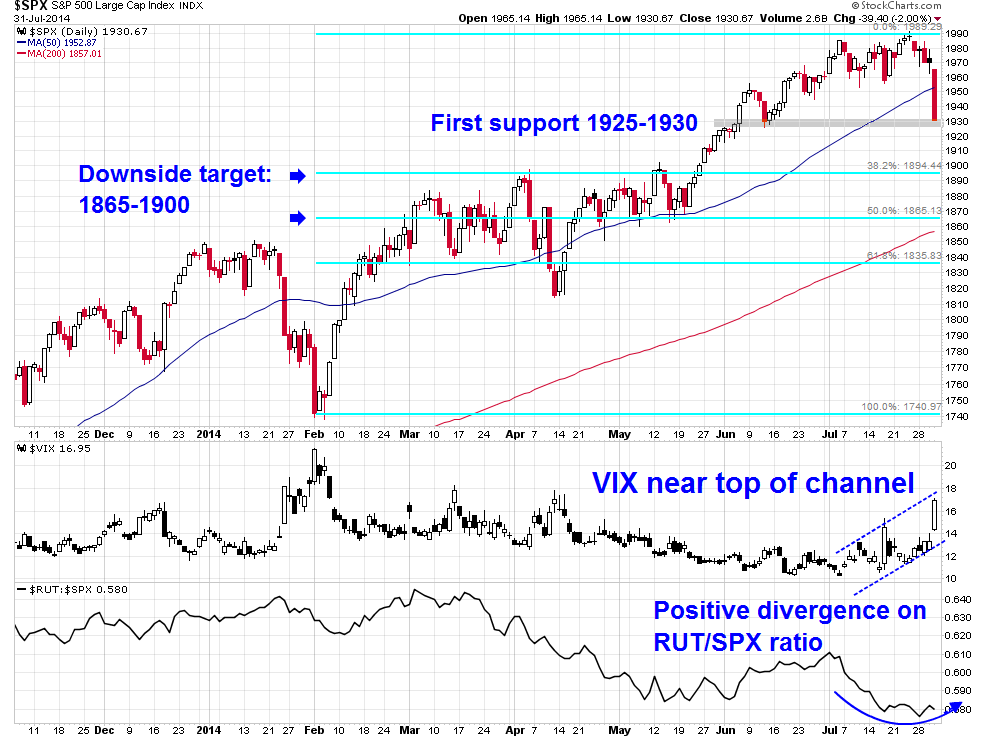

As well, other signs are showing that the fear levels are getting a little overdone in the short-term. The middle panel of the chart blow shows that the VIX Index is at or near the top of an upward sloping channel indicating excessive panic. In addition, the bottom panel shows the ratio of the small cap Russell 2000 to the large cap SPX. Small caps have been very weak in the last few weeks, but the RUT/SPX ratio did not make a new low and confirm Thursday's weakness - a supportive sign for the dead-cat bounce case.

Despite the oversold readings, the technical picture for the SPX is mixed. The index sliced through the 50 day moving average, which typically acts as a support zone, as if the support level was non-existent. Such episodes of dramatic weakness are indications of severe technical breakdown. Short-term, the SPX is sitting just above a minor support zone at the 1925-1930 level which could serve to arrest any further near-term weakness.

I have no idea what NFP will show tomorrow morning, but US equities are oversold and due for a dead-cat bounce. Intermediate term, however, the crystal ball gets a little cloudy. I would like to look at how the market behaves at the obvious downside targets at the next two Fibonacci retracement levels of about 1900 and 1865 and how the fundamental backdrop is developing before making further calls on market direction.

My inner trader remains bearish intermediate term, but he closed out his shorts and he has taken a modest position on the long side.

Disclosure: Long TNAVIX-VXV

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.