When I wrote that the US stock market was vulnerable to a pullback (see A short-term negative divergence), I never dreamed that it would be a geopolitical tragedy that would cause the sort of risk-off response that we are seeing.

The news of the crash of MH17, which was apparently shot down by a missile, caused a market freak-out and risk premiums to spike. Unverified reports of intercepted phone calls and that a pro-Russian rebel commander took credit for downing the aircraft (before he knew it was a civilian airliner) didn't help matters. Further, news of an Israeli invasion of Gaza is underway also served to heighten global geopolitical tensions.

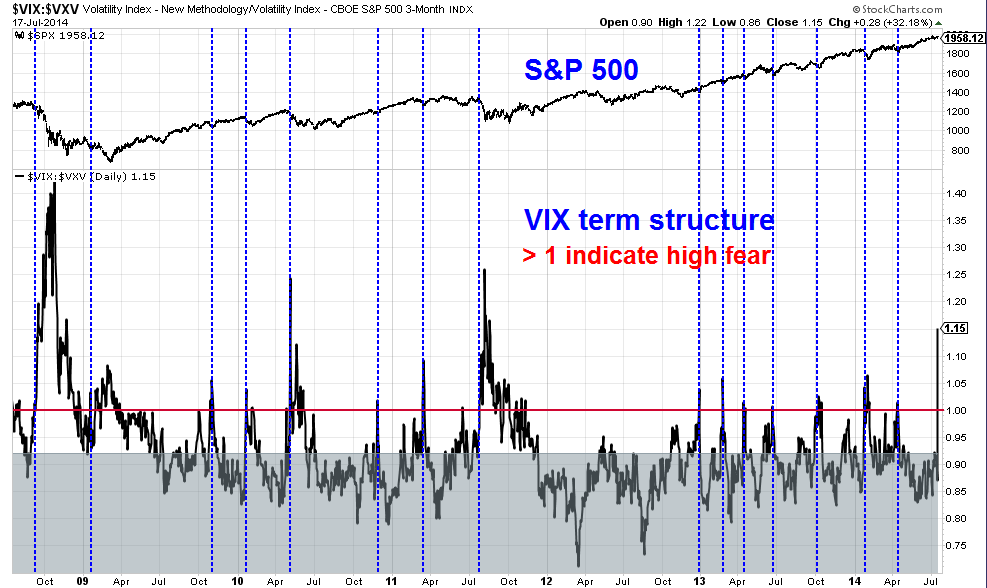

Spiking fear = Buy signal

As a result, VIX spike 3.54, or 34%, in a single day. Moreover, the VIX to VXV ratio, which is a measure of the term structure of VIX, moved from a normally upward sloping term structure to inversion indicating a spike in fear levels. As the bottom panel of the chart below shows, the VIX-VXV term structure soared well above 1. I have also indicated with vertical lines past instances where the term structure inverted. With the exception of episodes in 2008, 2009 (Lehman Crisis) and 2011 (eurozone crisis and US budget impasse), past instances of VIX inversion have marked low-risk entry points into stocks.

A modern Archduke Ferdinand moment?

I would caution, however, that Ian Bremmer of the Eurasia Group indicated that the MH17 incident could prove to be a spark for further escalation on both sides of the simmering Russia-Ukraine dispute (via Business Insider):

• Ukraine's new government, led by President Petro Poroshenko, will feel more intensified pressure to conduct military operations to push back pro-Russian separatists in southeastern regions of Ukraine.• More countries could get involved, and in a broader scope. There could be a new push by the Ukrainian government to get military support from the U.S., which has so far resisted, as well as more nonmilitary aid from the European Union.• During the months-long conflict, Russia has long asserted its right to intervene on behalf of Russian-speaking citizens. The Pentagon said Wednesday that Russia was again building up its forces along the volatile Russia-Ukraine border.

"Ukrainian government now under much more pressure to remove the separatists by force. There's a better chance that they secure meaningful military support (including weapons) from the U.S. and nonmilitary from the EU," Bremmer wrote in an email to BI.

"But the Russians will deny any involvement and demand protection of the Russians on the ground. Likelihood of escalation has just increased significantly."

There are two scenarios at play here:

- These tensions will blow over in a few days and this market freak-out will be a gift for market bulls to buy stocks at a discount.

- This incident turns out to be a modern "Archduke Ferdinand in Sarajevo" moment for the relationships between Russia and the West.

Now ask yourself::

- Which scenario is more likely?

- Is the market pricing risk correctly?