Dollar and Yen remains the weakest one for the week. While sell-off slows a little bit in Asian session, there is no sign of bottoming yet. Dollar is apparently still weighed down by Trump’s comments on Fed policy. On the other hand, Yen is pressured by solid risk appetite. S&P 500 hit new record high at 2873.23 last week. While it couldn’t hold on to the gains and closed just up 0.21% at 2862.96, upside momentum remains firm. For today, New Zealand Dollar is trading as the strongest one as boosted by strong retail sales. Sterling follow as second as supported by positive outcome of Brexit negotiation.

In Asia, markets are mixed though. Nikkei, trading up 0.58% at the time of writing, is on course for a positive day. But China Shanghai SE is down -0.62% while Hong Kong HSI is up 0.33%. 10 year JGB yield is up 0.007 at 0.096. But it’s notably lower than 1.31 on August 1. That’s another reason pressuring the Yen.

Technically, Australian’s weakness is a point to note and watch today. AUD/NZD’s break of 1.0991 support is a clear sign of weakness. EUR/AUD also broke 1.5725 resistance overnight to resume the rebound from 1.5578. And, AUD/USD also starts to lose upside momentum as seen in 4 hour MACD. We might see the Australian Dollar turns weaker today.

UK Brexit Minister Raab still targeting to reach agreement with EU by October

Sterling responded well enough to the post meeting press conference of UK Brexit Secretary Dominic Raab and EU chief Brexit negotiator Michel Barnier.

Raab said they had “positive” discussions and UK reaffirmed the commitment regarding Irish border. Raab said there are still “some significant issues to overcome”. Both agreed the need to “step up the intensity” during the final phase of the negotiations. Raab also emphasized that “if we have that ambition, that pragmatism and that energy on both sides, I’m confident we can reach that agreement by October.” Regarding no-deal Brexit, Raab said “some of these hair-raising scare stories are far from true””

Barnier said the negotiation has now entered the final stage. And both the EU and UK agreed to continually negotiation from now on. He added that the EU and UK can find common grounds, and both are now more advanced in defining the common ground, for foreign policy, security and economic relationship.

Both sides will meet again in Brussels next week.

Fed Kaplan supports hikes to neutral level then asset yield curve and other factors

Dallas Fed President Robert Kaplan said in an essay released yesterday that he estimation of the neutral real interest rate is in a “broad range around 0.50-0.75 percent”. And translated to nominal rate, that’s “roughly 2.50-2.75 percent”. That is, with fed funds rate at 1.75-2.00%, it would take approximately “three or four” more 25bps rate hike to reach the neutral level.

On monetary policy, he believed that Fed should “gradually” raise Fed funds rate until this neutral level. And for now, he would be “inclined to step back and assess the outlook for the economy and look at a range of other factors”. Those factors include “levels and shape of the Treasury yield curve”, before further action.

There’s clearly divergence in the emphasis of the views of Fed policy markets. Chicago Fed President Charles Evans said two weeks ago that fed fund rates might eventually enter into “somewhat restrictive” area, at roughly 0.50% above 2.75% neutral rate. Kaplan didn’t show objection to this idea but he emphasized to pause and look before acting.

On the other hand, Atlanta Fed President Raphael Bostic pledged earlier this week that he won’t vote for anything that knowingly inverts yield curve. But Kaplan said he supports raising rate to neutral before looking at the yield curve.

US-Mexico bilateral NAFTA talks postponed to Wednesday

Mexico and the US postponed a high level NAFTA meeting to Wednesday (originally scheduled for Tuesday yesterday). Politico quoted unnamed sources saying that the two sides are targeting to formally announce an agreement on Thursday. And after that Canada would be allowed to rejoin the negotiations.

However, as of now, there is not clear message that a deal is reached between Mexico an the US. A US Trade Representative spokesman said “there is no deal on NAFTA. There are major issues outstanding.” Mexico also denied the “handshake” deal with the US. Meanwhile, Canadian government also said it received no notification of an imminent NAFTA deal.

Eyes will stay on the postponed meeting between Mexican Economy Minister Ildefonso Guajardo and US Trade Representative Robert Lighthizer today.

US postponed auto tariffs investigations without new timeline

US Commerce Secretary Wilbur Ross said yesterday that the timeline for auto tariffs investigation is postponed. Ross originally said the report will be published some time in August. But he told WSJ that it’s “not clear the report will be out at the end of the month”. He went further by refusing to set a new time line. Ross said the report was delayed because of ongoing negotiations with Mexico, Canada and the European Union.

Separately, Trump said at a campaign rally in West Virginia that he told European Commission President Jean-Claude Juncker that “it’s all about cars” during their meeting last month. And Trump added “we’re going to put a 25% tax on every car that comes into the United States from the European Union.”

RBA Debelle discussed low inflation in a speech

RBA Deputy Governor Guy Debelle discussed “Low Inflation” in a speech today. In short, he attributed low inflation to “include increased competition in the retail sector, historically low rental growth, the slow pace of wages growth and developments in some administered prices”. Utility prices boosted inflation for “a number of years” but are expected to reduce in the period ahead.

Debelle reiterated RBA’s forecast of a temporarily slow down in inflation in Q3. But beyond the September quarter, “we continue to expect inflation to be around 2¼ per cent over the next couple of years as above-trend GDP growth reduces spare capacity in the labour market and there is an associated pick-up in wages growth.” Most of the others forces are expected to abut even though “there is uncertainty about how much longer they will persist”.

New Zealand Dollar rebounds on strong retail sales, AUD/NZD reversing?

New Zealand Dollar rebounds strongly today after stronger than expected inflation data. Headline retail sales rose 1.1% qoq in Q2 versus expectation of 0.4% qoq. Core retail sales rose 1.4% qoq versus expectation of 0.8% qoq. Australian Dollar was not bad. Westpac leading index rose 0.0% mom in July. Construction work done rose 1.6% in Q2 versus expectation of 0.9%.

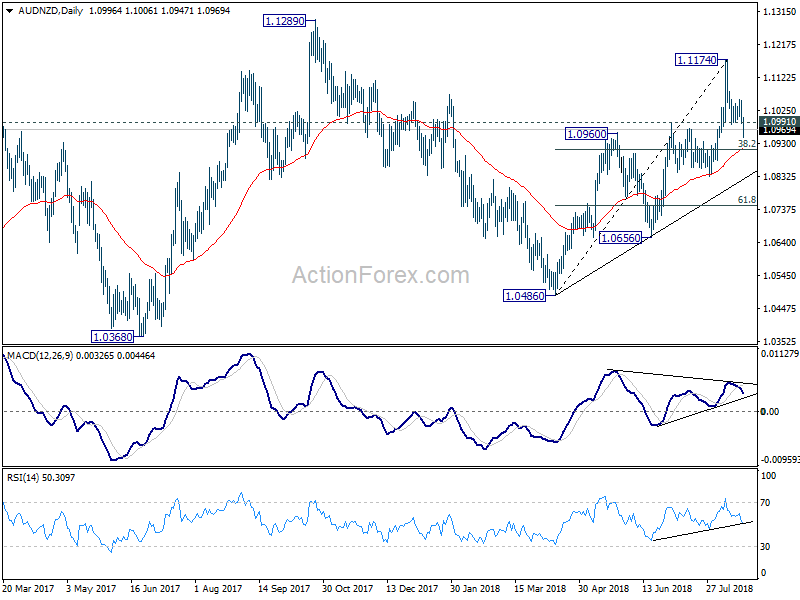

However, AUD/NZD suffers heavy selling in Asian session. The break of 1.0991 resistance turned support is a clear sign of near term weakness in the cross. Deeper fall is now in favor back to 38.2% retracement of 1.0486 to 1.1174 at 1.0911. Note firstly that AUD/NZD is bounded in medium term range of 1.0486/1289. The structure of the rise from 1.0486 doesn’t warrant that it’s an impulsive move for break out yet. Bearish divergence condition is seen in daily MACD. Therefore, firm break of 1.0911 should indicate completion of whole rise from 1.0486. Thus, in that case, AUD/NZD should decline through trend line support to 61.8% retracement at 1.0749 and below.

Looking ahead

Canada retail sales will be closely watched today. We’re leaning towards an October BoC hike but there are speculations that it could be done in September. Let’s see if today’s data will give BoC another push. US will release existing home sales and FOMC minutes. But for Fed, the real focus would be on Fed chair Jerome Powell’s speech at the Jackson Hole Symposium. The US-China low level trade talk will start today. But we’d doubt if anyone has any expectation on it at all.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2822; (P) 1.2873; (R1) 1.2957

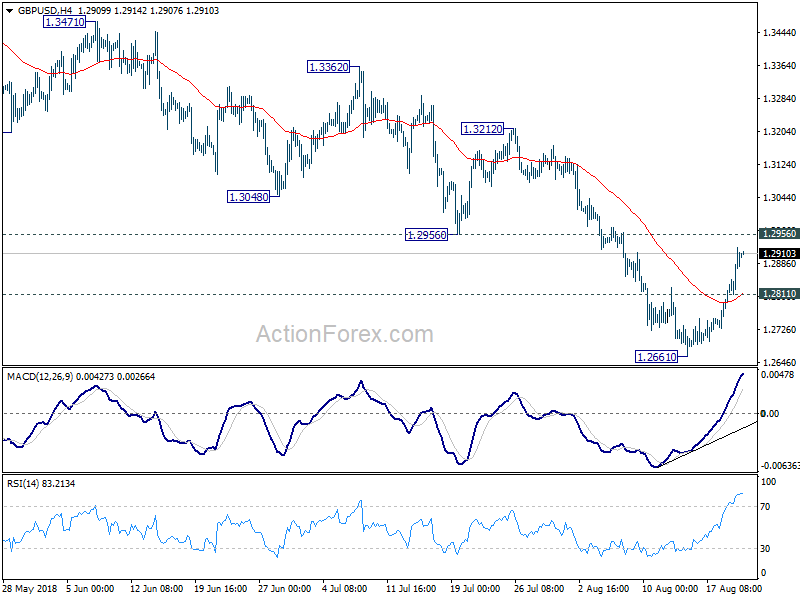

GBP/USD rises to as high as 1.2924 so far as rebound from 1.2661 short term bottom extends. Intraday bias stays on the upside for 1.2956 support turned resistance. At this point, we’d still expect upside to be limited by 1.2956 to bring larger down trend resumption. On the downside, below 1.2811 minor support will turn bias to the downside for retesting 1.2661 low first. However, decisive break of 1.2956 will turn focus to 1.3212 key resistance instead.

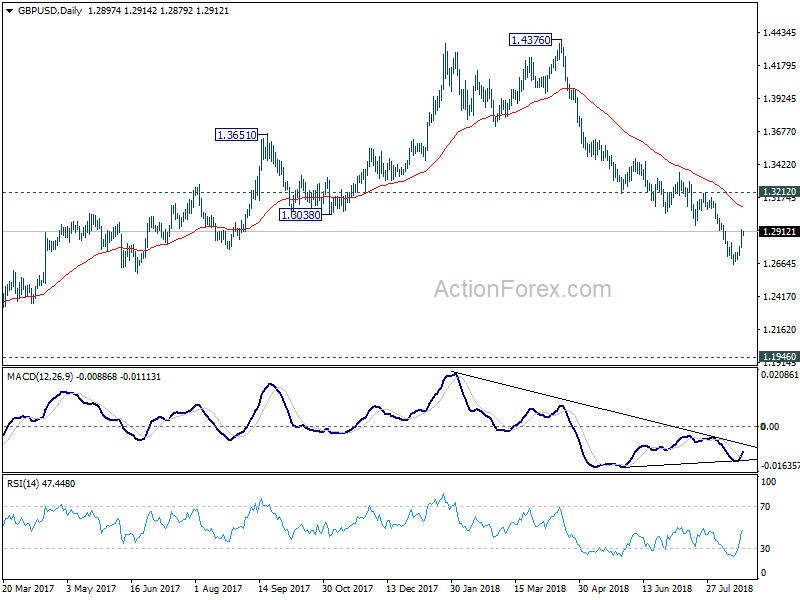

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4091). Current downside acceleration argues that it’s possibly resuming long term down trend. In any case, outlook will stay bearish as long as 1.3212 resistance holds. Retest of 1.1946 should be seen next.