A few steel stocks are among a wide swath of companies slated to report their quarterly numbers on Jul 25. The second-quarter earnings season has gotten off to a solid start with a barrage of stocks coming up with positive earnings surprises.

Based on the latest Earnings Preview, 97 companies on the S&P 500 index have already reported their quarterly numbers as of last Friday. Total earnings for these companies (representing 28.1% of the index’s total market capitalization) have increased 8.4% year over year on 5.1% higher sales.

As per the Zacks Industry classification, steel is grouped under the broader Basic Materials sector. Overall Q2 earnings for the sector are projected to rise 1.5% while revenues are expected to increase 2.8%.

After being in a rut for long, the steel industry has staged a recovery driven by favorable developments on steel trade cases in the recent past and improved prices. Steel stocks got a big thrust following Donald Trump’s election win in Nov 2016 on expectations of significant infrastructure spending under his administration. However, nothing concrete has materialized from the new administration yet on the infrastructure spending front.

Nevertheless, the steel industry continues to benefit from sustained healthy demand in the automobile and construction sectors. The Trump administration’s aggressive trade policies are expected to provide more protection to the U.S. steel industry.

Let’s take a peek at three steel companies that are gearing up to report their second-quarter results on Jul 25.

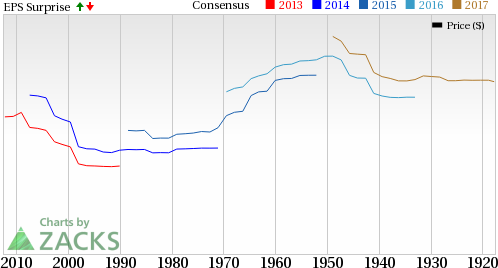

United States Steel Corporation (NYSE:X) will report after the bell. The company has an Earnings ESP of -8.70% as the Most Accurate estimate stands at 42 cents while the Zacks Consensus Estimate is pegged at 46 cents. Although the stock carries a favorable Zacks Rank #3 (Hold), its negative ESP makes surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

U.S. Steel beat the Zacks Consensus Estimate in two of the trailing four quarters, while missed in the other two, resulting in an average positive surprise of 557.43%. The company continues to face certain operational issues in its Flat-Rolled division. Increased outage costs, operating inefficiencies and higher plant maintenance costs hurt this division in the first quarter and remained a headwind in the second quarter.

However, the company is taking actions to improve its cost structure through its “Carnegie Way” program. This should lend some support to its second-quarter results. (Read more: U.S. Steel Q2 Earnings: Stock to Disappoint Again?)

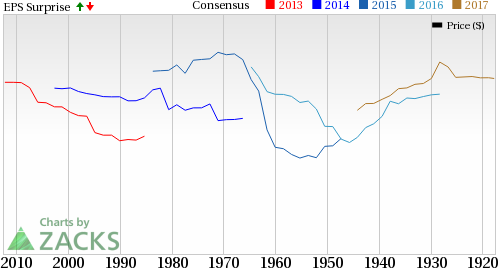

AK Steel Holding Corporation (NYSE:AKS) will report earnings numbers ahead of the bell. The company has an Earnings ESP of -7.69% as the Most Accurate estimate stands at 12 cents while the Zacks Consensus Estimate is pegged at 13 cents. Although the stock carries a Zacks Rank #3, its negative ESP makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AK Steel has an impressive surprise history. It beat estimates in each of the trailing four quarters, at an average of 161.34%.

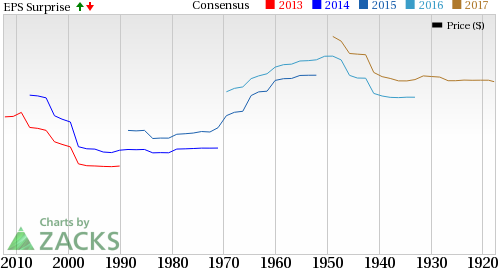

Allegheny Technologies Incorporated (NYSE:ATI) will report quarterly results before the bell. The company has an Earnings ESP of 0.00% as the both the Most Accurate estimate and the Zacks Consensus Estimate stand at 7 cents. The stock carries a Zacks Rank #4 (Sell). We caution against Sell-rated (Zacks Rank #4 or 5) stocks going into the earnings announcement.

Allegheny surpassed the Zacks Consensus Estimate in three of the trailing four quarters while missed on one occasion. In this timeframe, it delivered an average positive surprise of 16.8%.

Alleghany remains exposed to certain challenges in its core Flat Rolled Products (FRP) segment. Challenging conditions across certain key end-use markets including oil & gas are weighing on the prospects of the FRP unit. Demand for the company’s products in the oil and gas market is expected to remain under pressure given the low oil price environment. (Read more: What's in the Cards for Allegheny in Q2 Earnings?)

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

AK Steel Holding Corporation (AKS): Free Stock Analysis Report

United States Steel Corporation (X): Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI): Free Stock Analysis Report

Original post

Zacks Investment Research