Last week’s review of the macro market indicators noted with October Options Expiration in the rearview mirror that equities had pushed through the first 20 days of October looking very strong. Elsewhere looked for Gold to continue lower in the short run while Crude Oil ($USO) slowly moved higher. The US Dollar Index (DXY) looked to continue consolidation with a possible reversal building while US Treasuries (TLT) were heading lower.

The Shanghai Composite looked to mark time in the slow uptrend while Emerging Markets (EEM) paused and possibly retested the recent breakout. Volatility (VXX) looked to remain very low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts agreed with the only caution a possible pause in the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), perhaps a rotation back to the IWM again.

The week played out with Gold continuing lower while Crude Oil continued higher, accelerating at the end of the week. The US Dollar confirmed a reversal to the upside while Treasuries continued to lower lows. The Shanghai Composite reached higher to 22 month highs while Emerging Markets pulled back to retest the recent break out levels.

Volatility briefly tried to move higher but fell back late in the week, keeping the bias higher for equities. The Equity Index ETF’s pulled back in bull flags early in the week, with the SPY (NYSE:SPY) and IWM reversing mid week. The QQQ waited until Friday but blasted off to new all-time highs. What does this mean for the coming week? Lets look at some charts.

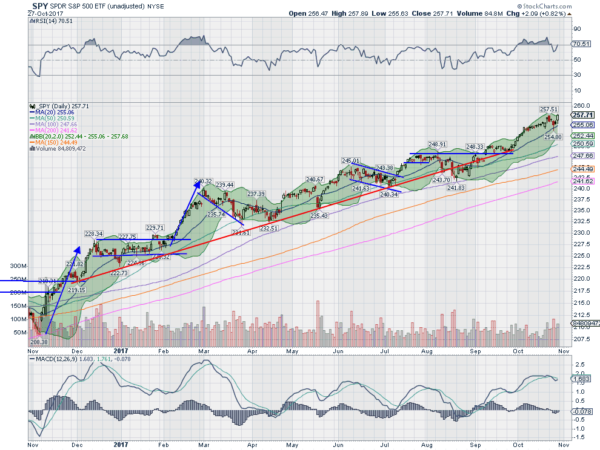

SPY Daily, $SPY

The SPY came into the week off of a fresh new all-time high. Monday saw it open higher still but then it sold off all day creating a bearish engulfing Marubozu candle. It held in a tight range inside that candle Tuesday and then continued lower Wednesday, touching the 20 day SMA for the first time in a month, before recovering. Thursday confirmed the Hammer as a reversal higher and then Friday it rocketed back higher to a new all-time high.

The daily chart shows the pullback reset the RSI from an overbought condition. It too bounced and is heading higher in the bullish zone now with the MACD about to cross back up. The Bollinger Bands® that had squeezed are opening higher to allow a move up.

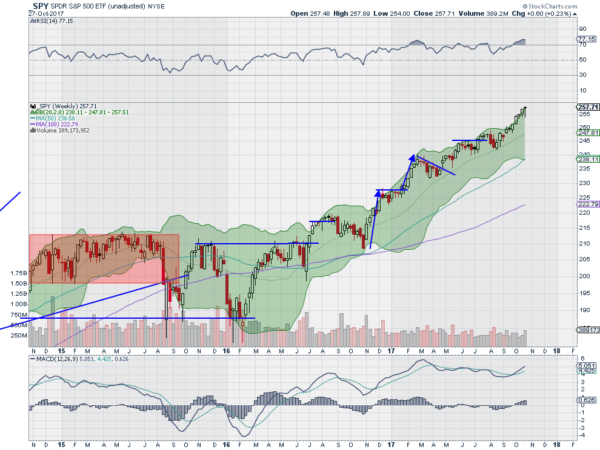

On the weekly chart price continues to rise along the top of the Bollinger Bands. It finished this week with a Hanging Man candle. Watch next week to see if it is confirmed as a reversal or not. The RSI is overbought and the MACD is rising. There is no resistance higher. Support lower may come at 256 and 254.50 followed by 252.50 and 250. Continued Uptrend.

SPY Weekly, $SPY

Heading into the last days of October the equity markets look strong. Elsewhere look for Gold to continue lower in the short run while Crude Oil looks for new 52 week highs. The US Dollar Index has renewed strength and looks to continue higher while US Treasuries are biased lower but at long term support. The Shanghai Composite continues to make higher highs as it approaches 2 year highs and Emerging Markets are holding on a retest of break out levels.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts also look better higher on both the short and intermediate timeframe, though the IWM may need a kick in the pants to get out of consolidation. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.