Last week’s review of the macro market indicators noted heading into October Options Expiration, that equity markets were all at record highs and looking strong. Elsewhere looked for Gold to continue higher in the short term while Crude Oil (USO (NYSE:USO)) also slowly pushed its way up. The US Dollar Index (DXY) might be pausing in the longer downtrend while US Treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) were strong and rising short term.

The Shanghai Composite (ASHR) and Emerging Markets ($EEM) both looked to continue to move higher in slow fashion. Volatility ($iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) looked to remain at very low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts agreed completely on the longer timeframe. And all 3 looked good on the shorter timeframe with the QQQ benefiting from short term consolidation in the IWM.

The week played out with Gold finding resistance and stalling after one day then dropping while Crude Oil also met sellers and stalled. The US Dollar continued to hold steady while Treasuries met resistance and then dropped to end the week. The Shanghai Composite paused in its move while Emerging Markets pulled back slightly from new 6 year highs.

Volatility held tight to the 10 level, with the exception of a short lived spike Thursday, keeping the bias higher for equities. The Equity Index ETF’s held in tight ranges on the week, dipping Thursday but quickly recovering. The SPY (NYSE:SPY) closed the week at new all-time highs while the IWM and QQQ ended just pennies short of their highs. What does this mean for the coming week? Lets look at some charts.

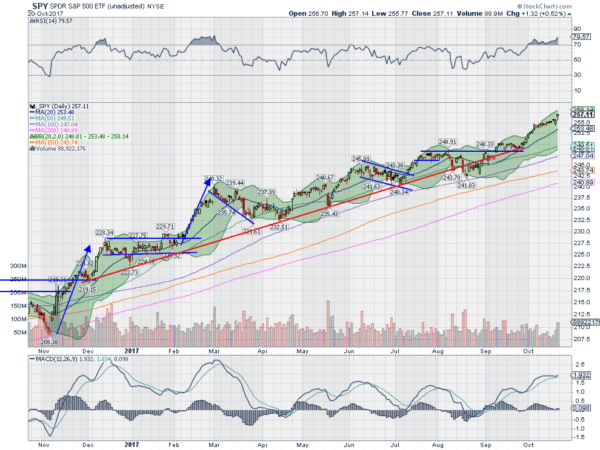

SPY Daily

The SPY came into the week at all-time highs. It had a slow start Monday printing a doji after a slight move up. Another small move Tuesday and Wednesday kept it going. Thursday it gapped down to open but rose all day, closing the gap and then some. And Friday saw a gap up and go. It finished the week at new all-time high after making an all-time high each day of the week.

The daily chart shows the Bollinger Bands® pointing higher, not tightening. The SMA’s are all rising and near parallel. The RSI is bullish and starting to get a bit overbought as it touches 80. The MACD just avoided a cross down and is moving up again. This is strong like a Bull!

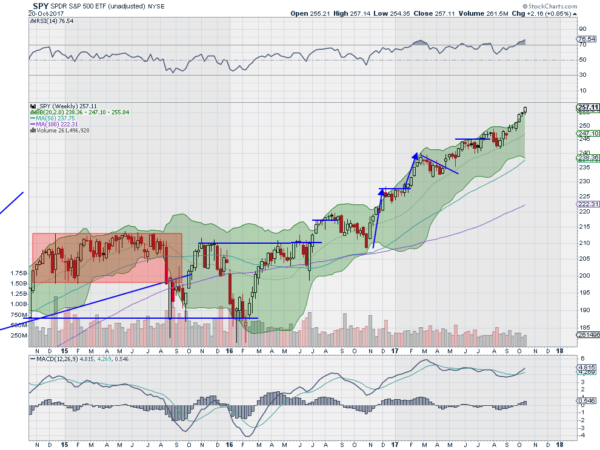

On the weekly chart it also very strong. The price is moving up out of the Bollinger Bands with the RSI rising into technically overbought territory while the MACD moves up. There is no resistance above but a Measured Move to 258. Support lower sits at 254.50 then 252.50 and 250 before 248 and 246.

Continued Uptrend.

SPY Weekly

October Options Expiration is in the rearview mirror and equities have pushed through the first 20 days of October looking very strong. Elsewhere look for Gold to continue lower in the short run while Crude Oil slowly grinds higher. The US Dollar Index looks to continue consolidation with a possible reversal building while US Treasuries are heading lower.

The Shanghai Composite looks to mark time in the slow uptrend while Emerging Markets pause and possibly retest the recent breakout. Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts agree with the only caution a possible pause in the QQQ, perhaps a rotation back to the IWM again. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.