Last week’s review of the macro market indicators noted heading into the week that Equity markets were strong but mixed with the iShares Russell 2000 (NYSE:IWM) lagging the SPDR S&P 500 (NYSE:SPY) and that trailing a red hot PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Elsewhere looked for Gold (SPDR Gold Shares (NYSE:GLD)) to continue its short term downtrend while Crude Oil (United States Oil (NYSE:USO)) raced higher. The US Dollar Index ($DXY) looked to continue its move up while US Treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) joined it in their short term trend higher.

The Shanghai Composite ($ASHR) and Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)) looked to consolidate their gains at multi-year highs. Volatility (iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) looked to remain non-existent keeping the wind at the backs of the equity index ETF’s $SPY, $IWM and $QQQ. The QQQ looked to continue higher leading the charge with the SPY moving up at a slower pace and the IWM sitting on the curb, watching as it consolidated.

The week played out with Gold finding support right away Monday and rising all week while Crude Oil continued its trip higher Monday and then consolidated the rest of the week. The US dollar marked time heading sideways all week while Treasuries started higher but reversed with a vengeance to end lower on the week. The Shanghai Composite started to move higher off of 3400 while Emerging Markets held in a narrow range over support.

Volatility increased all week but barley broke 11, keeping the bias higher for equities. The Equity Index ETF’s continued their paths with the QQQ moving up and SPY tagging along but the IWM flat at the start of the week. All 3 gave back some ground late in the week to end lower. What does this mean for the coming week? Lets look at some charts.

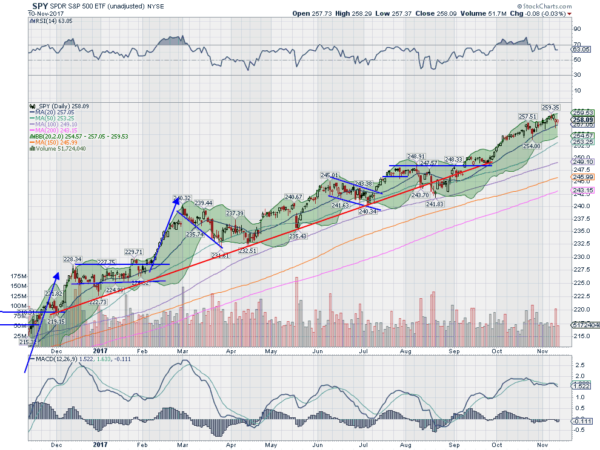

SPDR S&P 500 (NYSE:SPY)

The SPY came into the week at an all-time high and in a strong uptrend. Monday tie made another all-time high and then again Wednesday. But it pulled back Thursday, touching the 20 day SMA intraday before bouncing. It started lower again Friday and slowly recovered all day to end the week slightly lower. What many thought was the start of a reversal Thursday looks sedate when pulling back to the daily chart. Just a routine pullback in an uptrend.

The Bollinger Bands® continue to point higher, not squeezing or expanding. The RSI is strong over 60 and rising again while the MACD is crossed down but moving sideways. The full range this week was a penny shy of 3 points or less than 1.25%. Not really indicative of trouble.

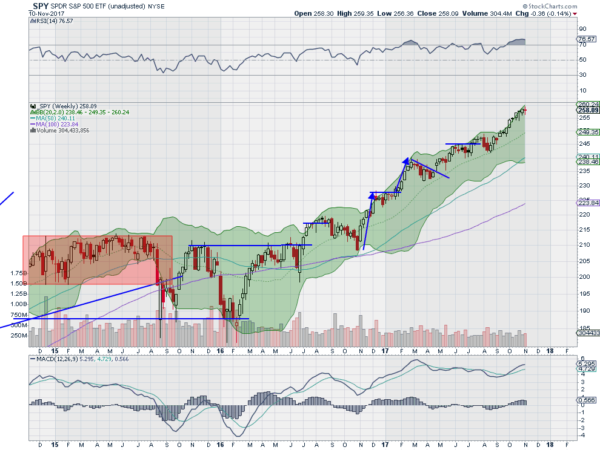

On the longer weekly timeframe the SPY the upper and lower shadows show the indecision of a doji. The RSI is technically overbought, but under 80 so strong. The MACD is starting to level as it moves higher. There is no resistance above the Wednesday candle topping at 259.35. Support lower comes at 256 and 254.50 followed by 252.50 and 250. Continued Uptrend.

SPY Weekly, $SPY

Heading into November Options Expiration the Equity markets have weathered a minor tremor but are still fazed. Elsewhere look for Gold to pause in its downtrend while Crude Oil slows in its uptrend. The US Dollar Index is looking better to the upside after some consolidation while US Treasuries are biased lower. The Shanghai Composite has gained strength and is rising again while Emerging Markets continue to churn following their break of long term resistance.

Volatility looks to remain at low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts show strength on the longer timeframe intact, with the SPY and QQQ the strongest and the IWM retesting the breakout. On the shorter timeframe the IWM is most vulnerable as it continues in a long bull flag, while the SPY and QQQ appear to have held off deeper pullbacks for now. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.