A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators which with Options Expiration behind and heading into the last week before the unofficial start of summer, saw equity markets treading water. Elsewhere looked for Gold (SPDR Gold Shares (NYSE:GLD)) to consolidate in its uptrend while Crude Oil (United States Oil (NYSE:USO)) continued higher, perhaps with a short term pause. The US Dollar Index (PowerShares DB US Dollar Bullish (NYSE:UUP)) looked to continue higher while US Treasuries (iShares 20+ Year Treasury Bond (NYSE:TLT)) consolidated broadly in their uptrend.

The Shanghai Composite (Deutsche X-trackers Harvest CSI 300 China A-Shares (NYSE:ASHR)) looked to continue to consolidate with a downward bias and Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)) looked to head lower. Volatility (iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) looked to remain subdued keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed continued short term confusion, with the SPY extending a long bull flag, maybe too long, and the IWM and QQQ looked more like they could start a reversal higher.

The week played out with gold breaking support and dropping lower while crude oil started lower but quickly bounced to new highs. Both the US dollar and Treasuries held in a tight range. The Shanghai Composite moved sideways as well just over 2800 while Emerging Markets rebounded higher.

Volatility pulled back to the mid May lows. The Equity Index ETF’s had a slow start Monday but then all marched higher, ending the week near their April highs. The SPY is now within 4 points of its all-time high, while the IWM and QQQ still have some ground to cover to get there. What does this mean for the coming week? Lets look at some charts.

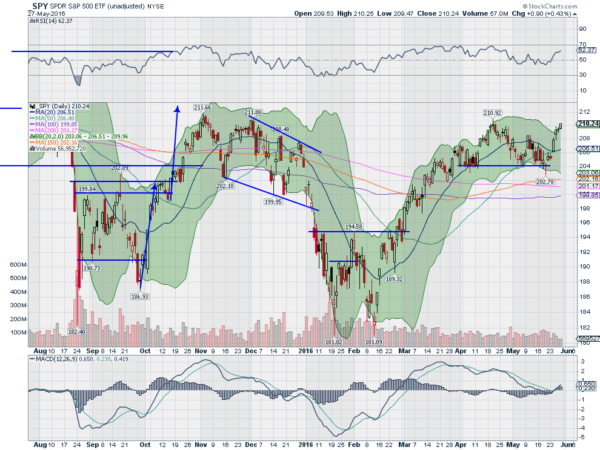

SPY Daily

The SPY started the week with an inside candle, a Harami, that is a reversal candle. After just confirming the upside the prior Friday this was disappointing. But Tuesday saw a gap higher and run up with follow through Wednesday to the top of the Bollinger Bands®. But rather than act as a brake the Bollinger Bands opened higher and the SPY continued to drift up the rest of the week. The movement took it over the May 10th high but leaves it short of the April 20th high.

Still the momentum is supportive of more upside. The daily chart shows the RSI breaking into the bullish zone over 60 and the MACD crossed up and rising in positive territory. One thing to note is that the last 3 day rise happened on smaller candles and slowing volume. This is characteristic of a pennant, a possible reversal signal.

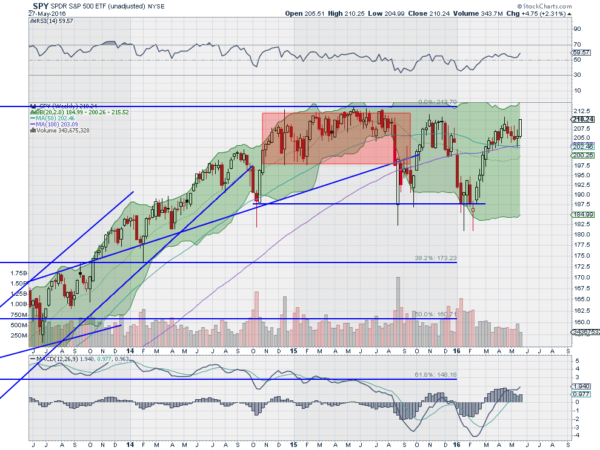

On the weekly chart the SPY shows strong price action driving off the doji star last week. And although it did not break the intra-week highs on the daily chart the finish on the weekly is the highest since July 25, 2015 with nearly a bullish Marubozu candle. The break of the flag to the upside also gives a target to 232.61. But there is some work to do first.

The RSI on this timeframe is on the cusp of a move over 60 into the bullish zone while the MACD has been rising and continues to do so. There is resistance above at 210.75 and 211.50 followed by 213 and then the all-time high close at 213.50 and intraday at 213.78. Support lower comes at 208.50 and 207.60 followed by 206 and 203.75. Continued Upward Price Action.

SPY Weekly

As the markets head into the Memorial Day Weekend and the unofficial start of Summer, equities are looking strong, but not quite free of caution. Elsewhere look for gold to continue lower while crude oil continues to the upside. The US Dollar Index looks to improve while US Treasuries continue to consolidate. The Shanghai Composite is also in consolidation mode but with a downward bias while Emerging Markets are biased to the upside in the short term.

Volatility looks to remain subdued keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts also suggest more upside, and are stronger looking on the weekly timeframe, with rising pennants on the daily timeframe giving minor caution of a short term pullback or consolidation. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.