Last week’s review of the macro market indicators saw that with May Options Expiration in the rearview window, traders were looking toward the Memorial Day Weekend and official kick off of the flight to the Hampton’s each Friday. Equities were heading into the summer doldrums firm on the longer time frame but a little shaky short term. Elsewhere looked for gold (NYSE:GLD) to continue to trend higher while crude oil retained an upward bias in consolidation.

The US Dollar Index was sick and looked to continue lower while US Treasuries (NASDAQ:TLT) continued their consolidation. The Shanghai Composite was also in consolidation mode while iShares MSCI Emerging Markets (NYSE:EEM) were biased to continue to the upside. The Volatility Index looked to remain low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all showed consolidation in strength in the longer term, with the QQQ joining this week. In the shorter term there was some minor damage to repair.

The week played out with gold in a holding pattern in a tight range with an upward drift while crude oil started higher but but got smacked down late in the week. The US dollar halted the fall while Treasuries continued in consolidation. The Shanghai Composite consolidated sideways with an move higher at the end of the week while Emerging Markets moved back to their May highs.

Volatility moved back to single digit and held there. The Equity Index ETF’s continued their recovery early in the week, with the SPY and QQQ making new all-time highs by Wednesday and then continuing higher. The IWM filled its gap down by Wednesday but stalled there, lagging the other indexes. What does this mean for the coming week? Lets look at some charts.

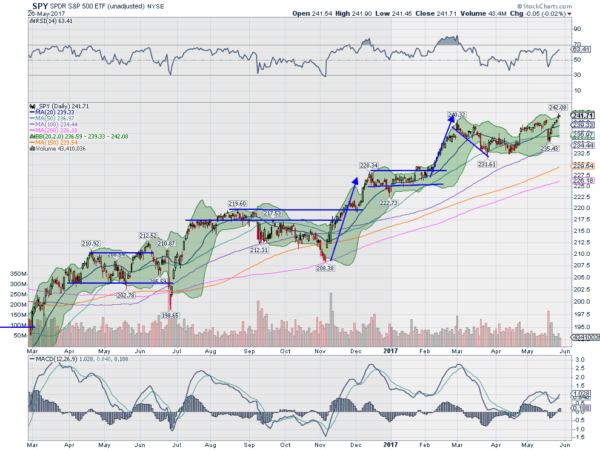

SPY Daily

The SPY had a mini-scare mid in the middle of the options expiration week and had started to recover at the end of the week. Monday saw continuation of the rebound but in a very small range. Three consecutive smaller rising candles can be a sign of exhaustion. But it managed to continue higher with 2 more small candles to reach a new all-time high close by Wednesday, erasing the dip. A gap up and another all-time high Thursday looked like a show of strength as the Bollinger Bands® opened higher.

The RSI on the daily chart confirms as it is back rising in the bullish zone and the MACD crossed up and is rising. On the longer weekly chart things look a lot more firmly bullish. A strong candle finishing near the high after several weeks of lower shadows showed real strength. The RSI on this timeframe is bullish and strong with the MACD flat and positive, poised for a cross up. There is no resistance over 242 but a Measured Move to 248. Support lower comes at 240 and 238 followed by 237.10 and 236 then 233.70. Continued Uptrend.

SPY Weekly

Heading into the unofficial beginning of summer equities look strong. Elsewhere look for gold to consolidate with a bias higher while crude oil consolidates with a bias lower. The US Dollar Index is in a downtrend while US Treasuries consolidate with a bias higher. The Shanghai Composite has stalled the retrenchment and is consolidating while the Emerging Markets continue to move higher.

Volatility looks to remain at abnormally low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. The SPY and QQQ are showing strength on both the daily and weekly timeframes while the small cap IWM is already running out of gas. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.