Last week’s review of the macro market indicators suggested, heading into the May Options Expiration week that the equity markets looked to have weathered a storm, or at least most of one.

Elsewhere looked for gold to continue to move sideways near 1200 while Crude Oil pulled back in its new uptrend. The US Dollar Indexstill looked weak while iShares 20+ Year Treasury Bond (ARCA:TLT) remained biased lower. The Shanghai Composite looked to continue to pullback in its uptrend and iShares MSCI Emerging Markets (ARCA:EEM) were biased to the downside.

Volatility looked to remain subdued keeping the bias higher for the equity index ETF’s S&P 500, iShares Russell 2000 (ARCA:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ), despite the ruckus of the prior week. Their charts all continued to look better on the longer timeframe with the SPY and QQQ looking more sideways in the short run while the IWM might take another leg lower.

The week played out with gold holding before a reversal higher ending at resistance while Crude Oil held in a tight range. The US Dollar continued to move lower while Treasuries also dropped further but found a bid Friday. The Shanghai Composite moved back higher but met resistance while Emerging Markets consolidated in a tight range.

iPath S&P 500 VIX Short Term Futures Exp 30 Jan 2019 (ARCA:VXX) made a weak attempt higher before before pulling back. The Equity Index ETF’s all held a tight range early in the week. But the SPY and QQQ started back higher later, to end the week up and at a new all-time high close for the SPY, while the IWM had less strength. What does this mean for the coming week? Lets look at some charts.

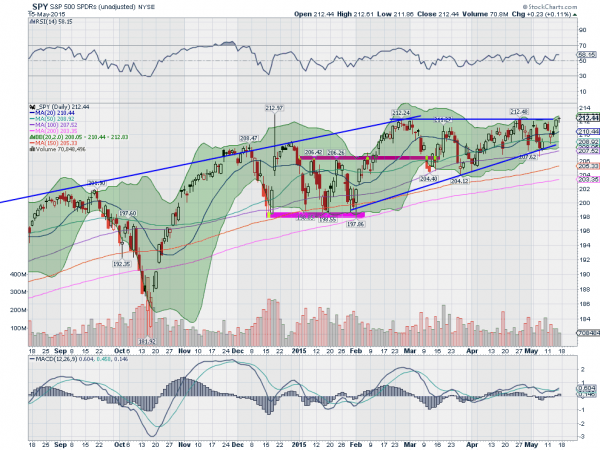

S&P 500 Daily

The SPY started the week with a bearish engulfing candle, bringing out the short sellers calls. It did fall for 1 more day but ended in a Spinning Top candle, a sign of indecision, that resolved over the rest of the week to the upside. It ended the week with consecutive all-time high closes Thursday and Friday. All positive right? Of course not. The Friday candle was a doji, meaning indecision, at resistance of the top of the ascending triangle that has been in place since the beginning of February. I can hear the bearish reversal calls now.

But the rest of the picture in the daily chart is positive. The RSI is holding the bullish range and the MACD has crossed back up, a bullish signal. Even the Bollinger Bands® are turning up and opening. A break of the triangle to the upside would give a target of 221.

On the weekly chart the price continues to test the top of the consolidation box from October. The RSI on this timeframe is also in the bullish zone and the MACD crossing up, but at a very shallow angle. There is no resistance over the current area around 212.50. Support lower may come at 211 and 210.25 followed by 209 and 208. Consolidation in the Uptrend with an Upward Bias.

S&P 500 Weekly

Heading into the Memorial Day Weekend the equity markets look healthy but remain short of break outs. Elsewhere look for Gold to continue to consolidate with a short term upward bias while Crude Oil consolidated in its uptrend. The US Dollar Index looks to continue to pullback while US Treasuries bounce in their downtrend. The Shanghai Composite is in broad consolidation mode while Emerging Markets consolidate with an upward bias in their uptrend.

Volatility looks to remain subdued with a bias lower keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are all still more positive on the longer timeframe, but with the SPY and QQQ looking stronger than the IWM. This might yield an opportunity in the IWM on a catch up. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.