Last week’s review of the macro market indicators noted heading into the last days of February the equity markets had recovered much of the downturn and were looking stronger. Elsewhere looked for Gold ($GLD) to bounce around in a wide range while Crude Oil ($USO) resumed on the path higher. The US Dollar Index ($DXY) was pausing in its downtrend while US Treasuries ($TLT) were biased lower. The Shanghai Composite ($ASHR) and iShares MSCI Emerging Markets (NYSE:EEM) ($EEM) both looked to continue higher.

Volatility ($iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX)) looked to continue to drift lower toward the range t

hat held it for the last couple of years, but remained above it. This was easing the pressure on the equity index ETF’s $SPDR S&P 500 (NYSE:SPY), $iShares Russell 2000 (NYSE:IWM) and $PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed the QQQ with the strongest recovery and it was looking to resume the long uptrend. The SPY (NYSE:SPY) and IWM were still holding under critical levels and were showing less positive conviction at this point. Another positive week could end that.

The week played out with Gold dropping early and finding support while Crude Oil started higher but retreated lower the rest of the week. The US Dollar also started moving higher but fell back late in the week while Treasuries drifted higher but in a very narrow range. The Shanghai Composite made a higher high to start the week before pulling back with Emerging Markets following a similar pattern higher and then down.

Volatility started the week continuing lower but quickly reversed and pushed back over 20, adding pressure to the equity markets. The Equity Index ETF’s all continued higher Monday before a 4 day retreat. Each then bounced intraday Friday. What does this mean for the coming week? Lets look at some charts.

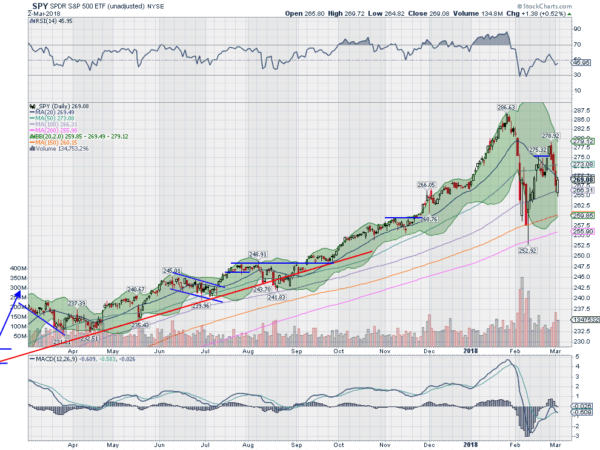

The SPY came into the week starting into a secondary move off of the February 9th low. This looked promising with a Measured Move target to 290. But Monday was the only strength it showed. It opened slightly higher Tuesday, rising to just shy of a 78.6% retracement of the draw down and then marched lower with three strong candles to the downside, 3 Black Crows, to touch the 100 day SMA. Friday traded higher all day, moving in and out of positive territory around that 100 day SMA line at midday and then finishing very strong.

The daily chart shows the RSI moving back and forth around the mid line, over 40 but under 60. The MACD is also playing with a cross and holding near zero. The Bollinger Bands are starting to squeeze in. No strong confirmation week, but also no retest of the lows. A week but mixed bag on this timeframe.

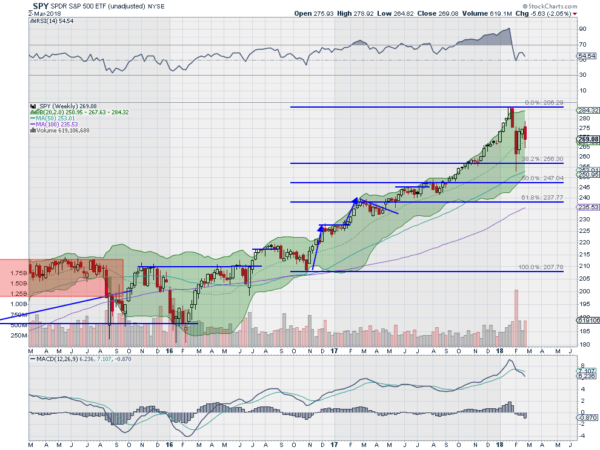

In the longer chart the picture is decidedly more bearish. A bearish engulfing candle adding to a broad bear flag that is building. It is holding over the 20 week SMA. And the RSI is turning back lower, but remains over the mid line while the MACD is moving lower, but is still at a high level. There is resistance above here at 272.50 then 275 and 279. Support lower comes at 267 and 265.50 followed by 262.50. Possible Pause in Short Term Downtrend.

As the calendar turns to March equity markets again looked weak only to finish with a strong Friday, like February 9th. Elsewhere look for Gold to continue to consolidate in a broad range while Crude Oil may pause in its short term downtrend. The US Dollar Index continues to consolidate sideways while US Treasuries are consolidating after their move lower. The Shanghai Composite is biased to the downside short term and Emerging Markets look to tighten their broad consolidation at the recent top.

Volatility looks to remain elevated keeping the bias lower for the equity index ETF’s SPY, IWM and QQQ. Their charts showed big moves lower this week and then strength on Friday suggesting a possible reversal. The weekly charts are not as optimistic with red candles at lower highs. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.