Last week’s review of the macro market indicators suggested, heading into the March Options Expiration week that the equity markets were a bit mixed, mostly better looking to the downside.

Elsewhere looked for Gold SPDR Gold Trust (ARCA:GLD) to continue lower along with Crude Oil United States Oil Fund (NYSE:USO) for the week. The US Dollar Index PowerShares db USD Index Bullish (NYSE:UUP) might consolidate in the uptrend but had a clear bias higher while US Treasuries iShares Barclays 20+ Year Treasury (ARCA:TLT) were biased lower. The Shanghai Composite db X-trackers Harvest China (NYSE:ASHR) was trying to break consolidation to resume the uptrend while Emerging Markets iShares MSCI Emerging Markets (ARCA:EEM) were biased to the downside still.

Volatility iPath S&P 500 Vix Short Term Fut (ARCA:VXX) looked to remain subdued but above the low range of the early 2014 keeping the bias higher for the equity index ETF’s SPDR S&P 500 (ARCA:SPY), iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ), but with the wind easing at their backs. Their charts all were consolidating in the short run with the bias to the upside for the IWM while to the downside for the SPY and QQQ. The long term uptrend remained intact for each though.

The week played out with Gold probing lower before finding support and rebounding to end the week up while Crude Oil also started lower but rebounded late in the week. The US Dollar moved over 100 and then pulled back while Treasuries moved to the upside through resistance.

The Shanghai Composite continued higher to 7 year highs while Emerging Markets bounced modestly. Volatility settled and moved to a 3 month low. The Equity Index ETF’s responded by moving higher, with the IWM reaching a new all-time high.

What does this mean for the coming week? Lets look at some charts.

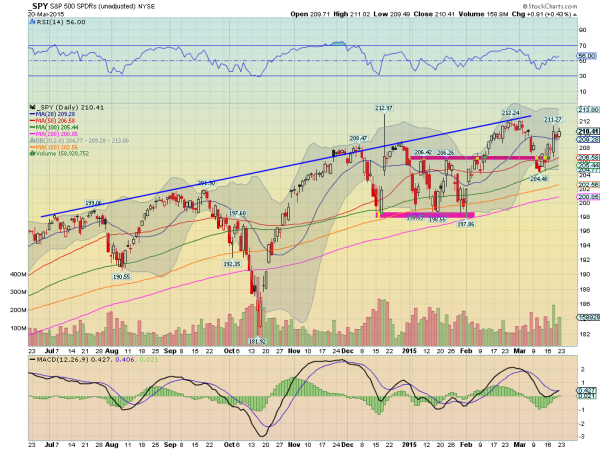

SPY Daily, SPY

The SPY started the week at the top of the consolidation zone that ran from the start of the year into early February. By the close Monday it had moved to the December highs and then Wednesday took it over the 20 day SMA. It ended the week consolidating on the underside of the late February range that made the recent high. A Measured Move higher would target 212.50 and then 218.80. The daily chart shows the RSI rising after making a lower low. Since the price did not make a lower low a Positive RSI Reversal triggers that also targets at least 218.80. The MACD is about to cross up, giving a bullish signal.

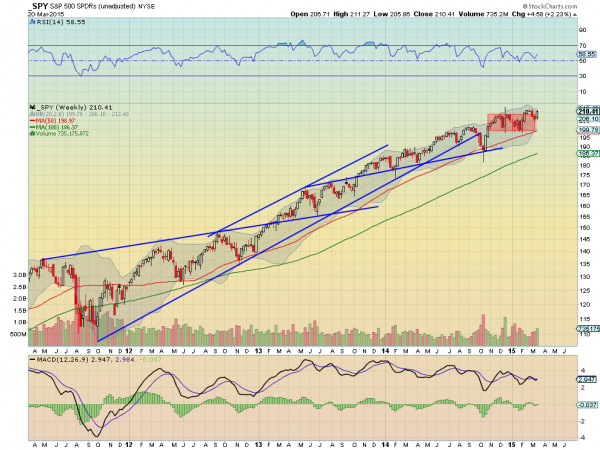

On the weekly chart the Bollinger Bands® have squeezed and are opening to the upside to allow a move. The RSI on this timeframe remains bullish and is rising with a MACD building a symmetrical triangle. The Measured Move of the box break higher would give a target of 224. There is no resistance over 212.25, and support lower comes at 210.25 and 209 followed by 206.40 and 204.40. A Rise or Consolidation in the Uptrend with a Short Term Upside Bias.

SPY Weekly, SPY

Heading into Spring, College Basketball’s March Madness, the April options cycle and the last full week of March, the equity markets are looking strong. Elsewhere look for Gold to bounce higher in its downtrend while Crude Oil consolidates in its downtrend. The US Dollar Index is consolidating the move up and US Treasuries are looking strong. The Shanghai Composite is also strong and looks to move higher while Emerging Markets are biased to the upside in the short run but not looking really strong.

Volatility looks to remain subdued and drifting lower keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts also look good for more upside with the IWM the strongest even at all-time highs, and the SPY and QQQ showing signs of a possible short term pause before another move up. Use this information as you prepare for the coming week and trad’em well.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.