Last week’s review of the macro market indicators noted as the calendar turned to March equity markets again looked weak only to finish with a strong Friday, just like Friday February 9th. Elsewhere looked for Gold (NYSE:GLD) to continue to consolidate in a broad range while Crude Oil (NYSE:USO) might pause in its short term downtrend. The US Dollar Index ($DXY) continued to consolidate sideways while US Treasuries (NASDAQ:TLT) were consolidating after their move lower.

The Shanghai Composite (NYSE:ASHR) was biased to the downside short term and Emerging Markets (NYSE:EEM) looked to tighten their broad consolidation at the recent top. Volatility (NYSE:VXX) looked to remain elevated keeping the bias lower for the equity index ETF’s $SPY, NYSE:IWM and NASDAQ:QQQ. Their charts showed big moves lower for the week and then strength on Friday suggesting a possible reversal. The weekly charts were not as optimistic with red candles at lower highs.

The week played out with Gold rising early in the week only to give it back later while Crude Oil went through its own roller coaster, rising then falling and end the week moving higher. The US Dollar gapped down and then closed the gap and held slightly lower while Treasuries moved in a very tight range at support all week. The Shanghai Composite moved higher out of consolidation and over the moving averages while Emerging Markets moved slightly higher.

Volatility continued to drift lower but holding over the long suppressed levels, relieving pressure on equities. The Equity Index ETF’s took advantage of this moving higher on the week. The SPY (NYSE:SPY), IWM and QQQ all started higher Monday with the IWM continuing the rest of the week, but the SPY and QQQ pausing mid week before resuming the path higher. What does this mean for the coming week? Lets look at some charts.

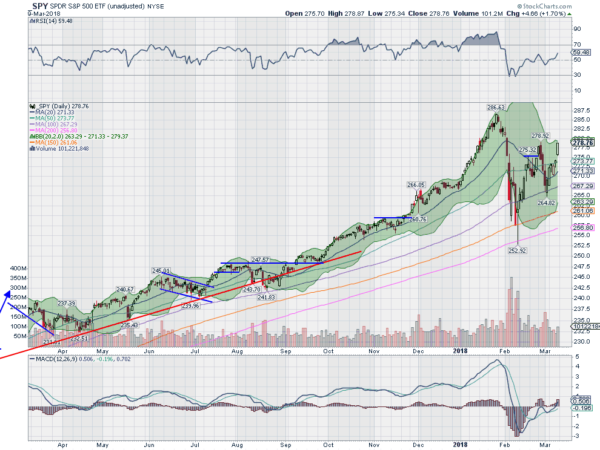

The SPY came into the week a bit muddled. It had just printed a 3 Black Crows, a bearish candlestick pattern, but then reversed it with a strong Friday. Monday showed follow through ending at the 50 day SMA. It held there through Thursday and then gapped higher and ran Friday. It ended the week having retraced that 3 Black Crows.

The daily chart shows that it is approaching the Bollinger Bands®. The RSI is rising but has yet to cross 60 into a firm bullish zone, and the MACD is rising and positive. Overall a positive chart at resistance. A little push Monday could send it on the path to new highs.

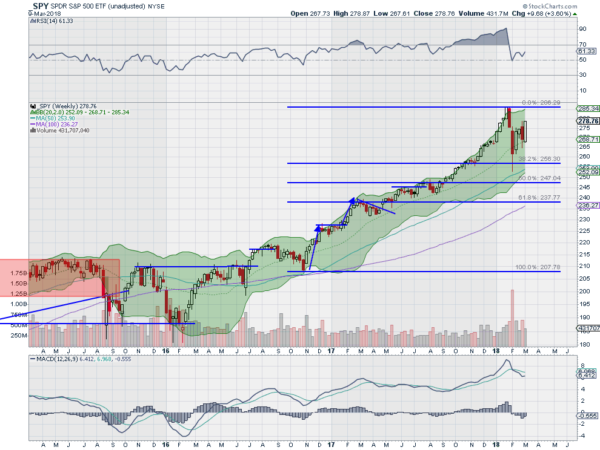

The weekly frame shows a bullish Marubozu candle, strength all week long and into the close. It was also a bullish engulfing candle, boding for more upside. The RSI on this timeframe is rising in the bullish zone with the MACD kinking towards a cross up, but positive. Much stronger on this timeframe but not out of the danger zone until a new all-time high is made. There is resistance at 279 and 280 then 283.30 and 286.60. Support lower comes at 275 and 272.50 followed by 268 and 267. Continued Uptrend.

SPY Weekly, $SPY

Heading into March options expiration week the equity markets are looking strong, with the QQQ at all-time highs and the IWM and SPY near their highs and almost out of danger. Elsewhere look for Gold to consolidate in a broad range while Crude Oil consolidates with a longer term bias lower. The US Dollar Index is treading water in a downtrend while US Treasuries consolidate in their downtrend. The Shanghai Composite and Emerging Markets are both consolidating, the former from a bounce and the latter at the highs.

Volatility continues to drift lower easing the path for equities. The equity index ETF’s SPY, IWM and QQQ all posted stellar performance for the week, printing bullish Marubozu candles, with the QQQ ending at all-time highs. The SPY and IWM are close to new highs and should they print them the all clear signal will sound for equities. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.