Last week’s review of the macro market indicators noted heading into the FOMC June meeting and monthly Options Expiration that equity markets looked strong. Elsewhere looked for Gold (GLD (NYSE:GLD)) to continue to consolidation around 1300 while Crude Oil (USO (NYSE:USO)) consolidated after pulling back. The US Dollar Index ($DXY) looked to continue lower while US Treasuries(TLT) were biased lower in broad consolidation.

The Shanghai Composite (ASHR) was consolidating at 52 week lows and Emerging Markets ($EEM) remained in a pullback in the uptrend. Volatility (VXX) looked to remain very low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts showed the IWM the strongest and leading on the longer timeframe with the SPY (NYSE:SPY) and QQQ building strength as well.

The week played out with Gold continuing to consolidate while Crude Oil drifted higher until both nosedived Friday. The US Dollar found support and bounced late in the week while Treasuries also found a bid and moved higher. The Shanghai Composite lost support Friday and closed at a new 18 month low while Emerging Markets made new lows on the year.

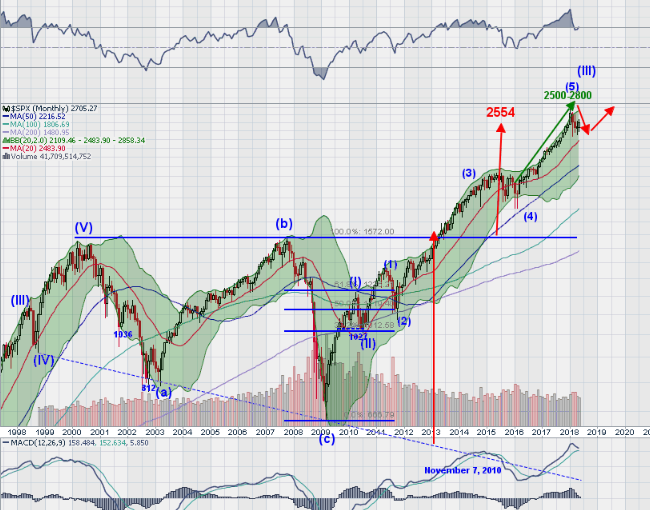

Volatility held in a tight range under its moving averages, keeping the bias higher for equities. The Equity Index ETF’s drifted higher on the week, with the QQQ and the IWM making new all-time highs before pulling back Friday. The SPY has yet to break the March high bounce. What does this mean for the coming week? Lets look at some charts.

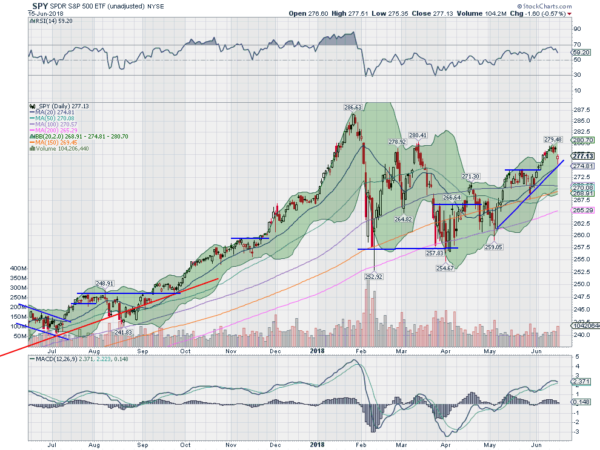

The SPY came into the week rising and just shy of the March top. Monday it tried but failed to break through and fell back. Tuesday was another small range day but it did manage to close over the March high by a few pennies. It gave some back to Friday levels after the FOMC meeting Wednesday and then reversed slightly to the top again Thursday. Friday it gapped down though and could not recover to fill it by the end of the day. In all it finished the week lower.

The daily chart shows the pullback Friday near the 20 day SMA and rising tend support before a late day surge. It leaves a gap open above. The RSI is in the bullish zone but pulling back while the MACD is trending higher but looks ready for a cross down.

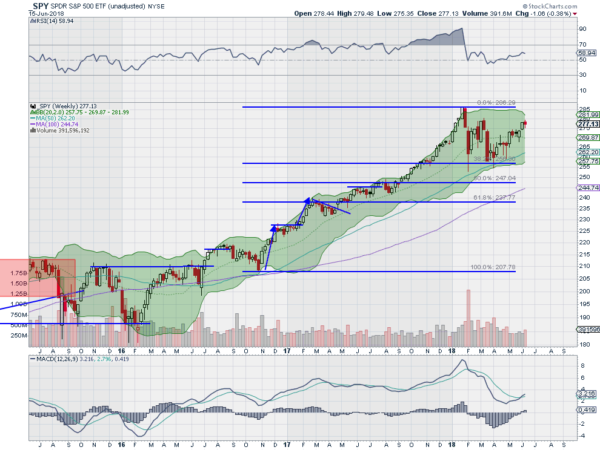

On the longer timeframe it looks like a pause in the move higher. The Bollinger Bands® are squeezing in, often a precursor to a move, and the RSI is moving higher in the bullish zone. The MACD is crossing up and positive, a bullish sign. There is resistance at 277.50 and 279 then 280 and 283 followed by 286.50. Support lower sits at 274.50 and 272.50 and 271.40 then 269 and 267.50. Uptrend Continues with Possible Short Term Pause.

With June options expiration and the June FOMC meeting behind the market can look forward to slow summer trading and the next quarter’s earnings season. As it does, equity markets continue to look strong. Elsewhere look for Gold to resume its move lower while Crude Oil turns lower as well. The US Dollar Index continues to strengthen while US Treasuries consolidate in the channel that has held then all year. The Shanghai Composite is making multi year lows and looking weak with Emerging Markets on the verge of turning a digestive bull flag into a bearish reversal.

Volatility looks to remain at very low levels keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts are a bit mixed with the IWM and then the QQQ leading in the shorter timeframe as the SPY continues to struggle at the March highs. But on the longer timeframe all look strong, still the IWM leading with the QQQ close behind and the SPY dragging up the rear. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.