A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators noted heading into February Options Expiration, the equity markets had finally seen their first 3%, 5% and 10% pullbacks in a very long time, all in one week. Elsewhere looked for Gold (NYSE:GLD) to continue lower while Crude Oil (NYSE:USO) also continued to pullback. The US Dollar Index ($DXY) bounce looked to continue while US Treasuries (NASDAQ:TLT) were biased continue lower.

The Shanghai Composite (NYSE:ASHR) and Emerging Markets (NYSE:EEM) were both biased to the downside, but with Emerging Markets at long term support. Volatility (NYSE:VXX) looked to remain elevated keeping the bias lower for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts incurred major damage in the shorter time frame but all ended with potential reversal candles, awaiting confirmation Monday. The longer timeframes all saw major resets to momentum indications and stopped short of any trend change.

The week played out with Gold finding support and then rising rapidly while Crude Oil had a small bounce that failed before pushing higher at the end of the week. The US dollar bounce ended and it dropped to the recent lows while Treasuries held at their lows. The Shanghai Composite finally found a bottom and bounced into the Lunar New Year while Emerging Markets reversed higher.

Volatility moved lower all week taking pressure off of equity markets. And the Equity Index ETF’s responded with strong moves to the upside. The SPY, IWM and QQQ moved higher each day adding to the win streak with the SPY and IWM recovering more than 61.8% of the drop while the QQQ was stronger recovering over 78.6% of its move down. What does this mean for the coming week? Lets look at some charts.

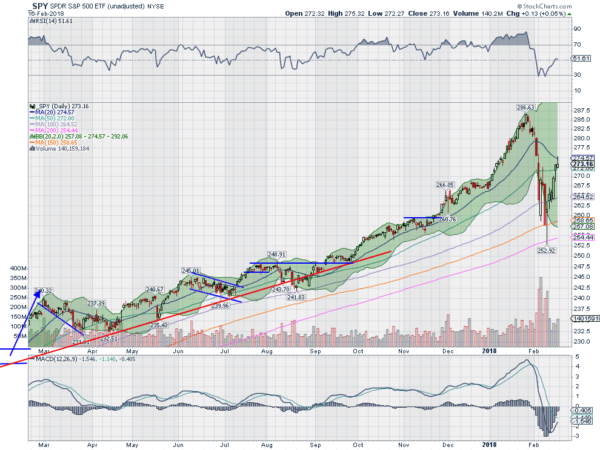

SPY Daily

The SPY came into the week down almost 9% on the year after a small bounce and hammer candle to end the prior week. Monday confirmed the hammer as a reversal with a move higher, and over the 100 day SMA. Tuesday held there with a small move higher but Wednesday changed moods with a big move to the upside. Thursday continued the reversal with another strong move up and over the 50 day SMA and Friday rounded out the week with 5 days of positive closes and a 61.8% retracement of the drop.

The long upper shadow on the Friday candlestick after touching both the 61.8% retracement and the 20 day SMA will give some pause and prevent the all clear signal from sounding. The daily chart also shows the RSI stalling at the mid line, not a strong showing, with the MACD about to cross up.

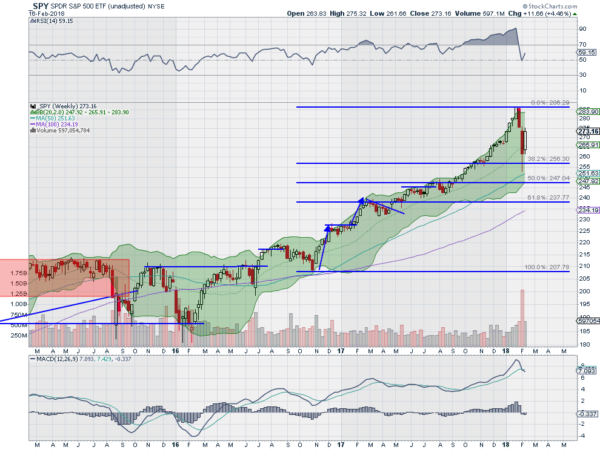

The longer timeframe shows an inside candle with strong movement to the upside, a positive. It also shows the RSI turning back up at the mid line with the MACD avoiding a cross down. A much stronger story on this timeframe. There is resistance at 275 and 279 then 280 and 282. Support lower comes at 272.50 and 269 then 267 and 265.50.

Cautious Reversal Higher.

SPY Weekly

With February Options Expiration behind, the equity markets have recovered substantially from their first correction in 2 years. Elsewhere look for Gold to continue higher in its new uptrend while Crude Oil also resumes the path higher. The US Dollar Index looks better to the downside and US Treasuries are biased lower. Both are entering major trend change territory. The Shanghai Composite and Emerging Markets have reversed their moves lower with the Chinese market still a bit weak.

Volatility continues to drift lower easing the pressure on the equity markets. The equity index ETF’s SPY, IWM and QQQ, all had strong moves higher on the week, retracing at least 61.8% of the moves lower. All three ended the weak with possible reversal candles on the shorter timeframe though, but with strong charts on the longer timeframe. Perhaps some short term weakness remains. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.