Last week’s review of the macro market indicators noted heading into the first week of December that equity markets looked strong on the longer timeframe after weathering a short term shock Friday. Elsewhere looked for Gold ($GLD) to consolidate under 1300 while Crude Oil ($USO) consolidated in its uptrend. The US Dollar Index ($DXY) was marking time with a bias to the downside while US Treasuries ($TLT) consolidated in the range in place since September.

The Shanghai Composite was also moving sideways with a bias for a pullback while Emerging Markets ($EEM) retrenched in their uptrend. Volatility ($VXX) looked to remain low but might creep up removing some support for equities. The equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) showed unfettered uptrends on the weekly charts. On the daily charts they might need a breather after the intraday shock Friday.

The week played out with Gold continuing sideways Monday and then turning lower while Crude Oil pulled back but bounced Friday to end the week slightly lower. The US Dollar drifted higher while Treasuries moved higher but could not hang on and gave most of the move back by Friday. The Shanghai Composite did retrace, finding its 200 day moving average while Emerging Markets retested their support area.

Volatility held in a tight range falling back below 10 to end the week, building the bias higher for equities. The Equity Index ETF’s all started the week to the downside with the QQQ finding support first, then the SPY (NYSE:SPY) and finally the IWM reversing Thursday. This left the QQQ close to all-time highs and the SPY and IWM not far behind. What does this mean for the coming week? Lets look at some charts.

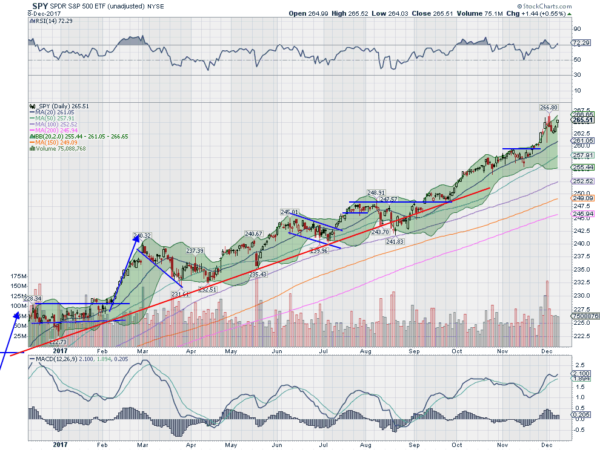

SPY Daily, $SPY

The SPY came into the week after printing a Hanging Man candle to end the prior week. This is a possible reversal candle following an uptrend and is confirmed with a lower close the next day. Monday did see that confirmation and then continuation lower Tuesday. But the reversal ended there and gives a good lesson. Japanese candlestick patterns give continuation and reversal signals but not magnitudes. The price rebounded and continued higher Thursday with follow through Friday to close at another all-time high.

The pullback and reversal gives a target on a Measured Move to 272.80. The daily chart shows the RSI turning back up into slightly overbought territory, with the MACD rising. The Bollinger Bands® are also opening to the upside. A very bullish short term picture.

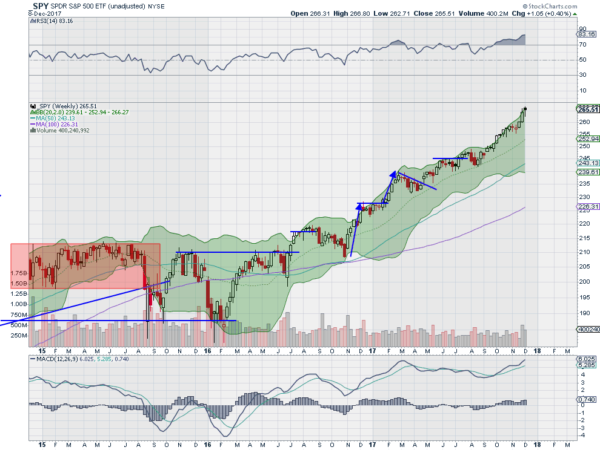

The weekly timeframe shows a new weekly closing high as well. The RSI on this timeframe is overbought and showing strength in the low 80’s while the MACD rises. There is no resistance higher and support lower comes at 262.40 and 260 then 259.25 and 257 before 256. Continued Uptrend.

SPY Weekly, $SPY

Heading into the FOMC meeting and December options expiration the equity markets are showing some life. Perhaps the Santa Claus Rally has begun. Elsewhere look for Gold to continue lower while Crude Oil stalls in its uptrend. The US Dollar Index is biased higher in consolidation while US Treasuries mark time sideways. The Shanghai Composite continues to retrench after a long run higher and Emerging Markets are seeking support as they retest breakout levels.

Volatility looks to remain very low keeping the wind at the backs of the equity index ETF’s SPY, IWM and QQQ. The SPY and QQQ remain strong on the weekly timeframe with the IWM showing some potential weakness. The SPY is also strong on the daily timeframe while eh IWM and QQQ are turning up but still looking for new highs. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.