Last week’s review of the macro market indicators noted heading into the historically light Christmas week equity markets looked strong. Elsewhere looked for Gold (GLD (NYSE:GLD)) to continue higher in its uptrend while Crude Oil (USO (NYSE:USO)) also forged higher. The US Dollar Index (DXY) looked to continue to mark time sideways while US Treasuries (TLT) were biased lower.

The Shanghai Composite (ASHR) and Emerging Markets (EEM) were looking to stay in consolidation mode. Volatility (VXX) looked to remain very low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts agreed, especially in the longer timeframe, but might have a quiet week in the short run.

The week played out with Gold continuing higher on its longest win streak in over 20 years while Crude Oil also continued to move up, closing at 2½ year highs. The US Dollar continued sideways early and then dropped to end the week lower while Treasuries flexed their muscles and ran higher. The Shanghai Composite stuck close to the tightening range between the 20 and 200 day SMA’s while Emerging Markets moved higher up through recent resistance.

Volatility held in a narrow range near 10 and under all of its SMA’s, keeping the wind at the backs of the equity markets. The Equity Index ETF’s had a mostly uneventful week holding in tight ranges, all building bull flags near their all-time highs. What does this mean for the coming week? Lets look at some charts.

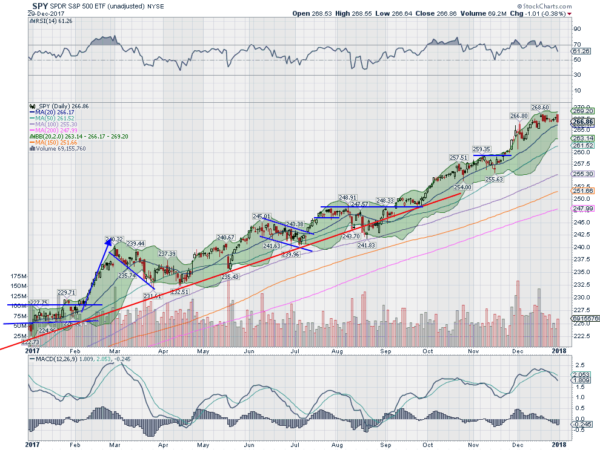

SPY (NYSE:SPY) Daily, $SPY

The SPY came into the week just off of its all-time high and settling into a tight range. Not much changed during the week as it had 3 more very narrow range days before a gap up open Friday. That sold off though, closing the gap and putting price back into the same narrow range. The daily chart shows the RSI strong in the bullish zone and moving sideways with the MACD resetting slightly lower.

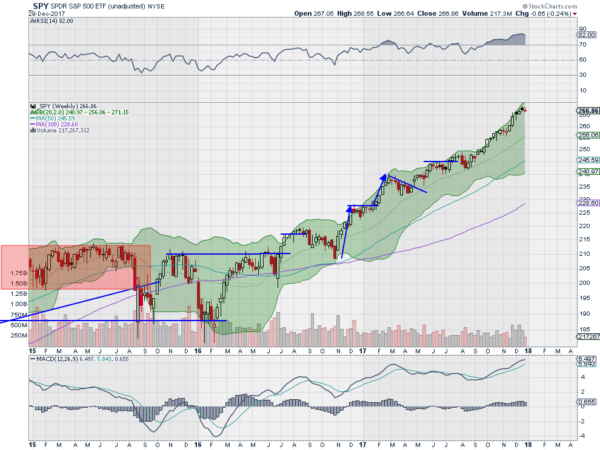

The weekly frame continues to show strong momentum with the RSI deep into overbought territory but moving sideways while the MACD rises. The Bollinger Bands® continue to rise allowing the price to move up as well. There is resistance at 268.60 and then free air above. Support lower comes at 267 and 265.50 then 262.50 and 260. Short Term Consolidation in Uptrend.

SPY Weekly, $SPY

As 2017 comes to a close the equity markets limped into the last day, but holding near their all-time highs. Elsewhere look for Gold to continue its uptrend while Crude Oil breaks higher as well. The US Dollar Index continues broad consolidation but with risk to the downside while US Treasuries are biased higher in their broad consolidation. The Shanghai Composite and Emerging Markets both continue to consolidate, the Chinese market after a pullback while Emerging Markets do so in their uptrend.

Volatility looks to remain very low keeping the wind at the backs of the equity index ETF’s SPY, IWM and QQQ. Their charts show short term consolidation of the long uptrends with digestion while the longer frames remain strong. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.