Last week’s review of the macro market indicators noted as Options Expiration and the FOMC meeting passed, equity markets looked strong heading into the last full week of trading for the year. Elsewhere looked for Gold (GLD (NYSE:GLD)) to continue to bounce higher while Crude Oil ($USO) paused in the uptrend. The US Dollar Index ($DXY) looked to continue to mark time with a downward bias while US Treasuries ($TLT) continued their short term uptrend.

The Shanghai Composite (ASHR) remained in a downtrend approaching the long term support and resistance zone while Emerging Markets (EEM) consolidated in their uptrend. Volatility (VXX) looked to remain very low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) into the end of the year. Their charts all looked strong on the longer timeframe. On the daily timeframe the SPY (NYSE:SPY) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) were also strong with the IWM close to a break out if it moved higher.

The week played out with Gold pushing higher while Crude Oil started lower but quickly reversed and moved up the rest of the week. The US Dollar continued to move sideways while Treasuries reversed lower early in the week and then found support. The Shanghai Composite found support at the 200 day moving average again while Emerging Markets held over support a second week.

Volatility remained in a narrow range, peeking over 10 for only half of Tuesday, keeping the bias higher for equities. The Equity Index ETF’s all started the week higher, with the SPY, IWM and QQQ all gapping up and setting new all-time high closes Monday, but then all three closed the small gaps and ran sideways the rest of the week just under the highs. What does this mean for the coming week? Lets look at some charts.

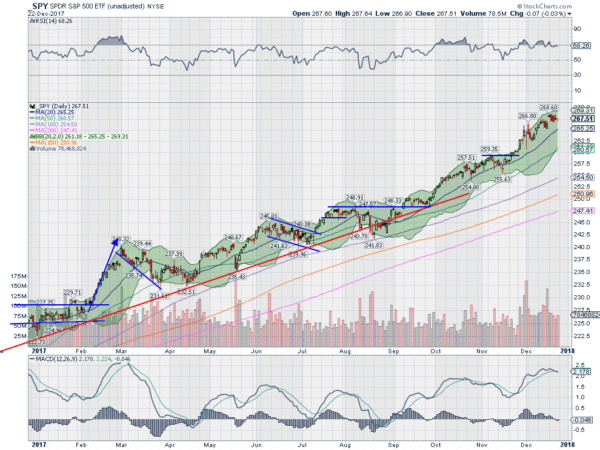

SPY Daily, $SPY

The SPY had started a very small pullback but caught itself to end the prior week. Monday was a show of strength though as it gapped higher, held and closed there, at a new all-time high. The rest of the week drifted slightly lower, closing the gap Wednesday and then ending the week with two inside days. The price action brought it closer to its 20 day SMA, slightly easing one overbought indicator.

The daily chart shows the RSI is holding very strong in the bullish zone, but not overbought and moving sideways. The MACD is crossed down but at a very shallow angle with the Bollinger Bands® rising on the bottom but flat at the top. Might be time for some consolidation into year end.

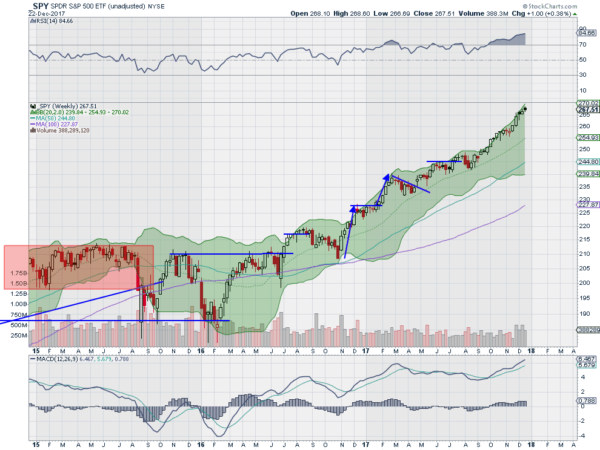

On the weekly chart there is no sign of letting up. Just a steady march higher. The RSI on this timeframe is strong and overbought, but slowing its ascent, that is a good sign. The MACD is rising and price is following the Bollinger Bands higher. There is no resistance over 268.60. Support lower comes at 266.50 and 265.50 then 262.50 and 260. Continued Uptrend.

SPY Weekly, $SPY

Heading into the historically light Christmas week equity markets look strong. Elsewhere look for Gold to continue higher in its uptrend while Crude Oil also forges higher. The US Dollar Index looks to continue to mark time sideways while US Treasuries are biased lower. The Shanghai Composite and Emerging Markets are looking to stay in consolidation mode.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPY, IWM and QQQ. Their charts agree, especially in the longer timeframe, but may have a quiet week in the short run. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.