Last week’s review of the macro market indicators noted with Thanksgiving behind and the holiday season in full swing, it usually means light trading for equity markets. But light or not, equities came into the season ready to party and looking strong. Elsewhere looked for Gold ($GLD) to consolidate, marking time while Crude Oil ($USO) continued its move higher. The US Dollar Index ($DXY) was renewing its downtrend while US Treasuries ($TLT) were drifting higher, trying to make a new high.

The Shanghai Composite ($ASHR) was pausing while Emerging Markets ($EEM) were renewing their trend higher. Volatility ($VXX) was back to very low levels keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts all looked strong on the weekly timeframe. On the daily frame though the SPY (NYSE:SPY) appeared to be strongest with the QQQ at some resistance and the IWM consolidating.

The week played out with Gold holding at resistance early and then falling back late in the week while Crude Oil met resistance and pulled back slightly before a late week reversal. The US Dollar held in a tight range at the recent lows while Treasuries got tripped up mid week only to recover Friday. The Shanghai Composite drifted lower in consolidation while Emerging Markets pilled back from fresh highs to support.

Volatility drifted higher and then spiked Friday, giving equities a kick in the teeth. The Equity Index ETF’s all started the week moving higher and making new all-time highs. The QQQ’s surrendered that perch Wednesday though as the SPY and IWM continued up. They both peaked Thursday and fell back Friday, joining the QQQ’s. All 3 started to mount a reversal Friday afternoon. What does this mean for the coming week? Lets look at some charts.

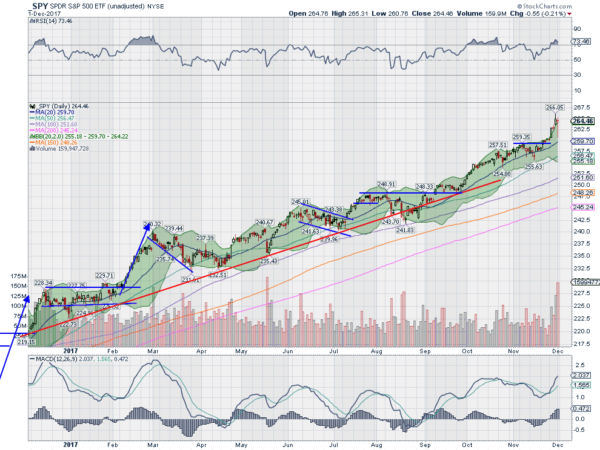

SPY Daily, $SPY

The SPY came into the week fresh off of a new all-time high. It held there on Monday, moving back inside its Bollinger Bands® with a small body candle. Tuesday saw a renewed push higher with a Marubozu and after a minor pause Wednesday it continued to another new all-time high Thursday. Friday opened slightly lower and then fell precipitously late in the morning on news. It recovered the rest of the day, ending the day slightly lower but printing a long shadowed Hanging Man candle.

A lower close Monday would confirm this as a reversal pattern, but Japanese candlesticks do not give targets for moves. The daily chart shows the price finishing outside of the Bollinger Bands® again. It also has a RSI in technically overbought territory while the MACD is rising on the daily chart. The total picture reads as a pullback intraday to near the 20 day SMA in the uptrend.

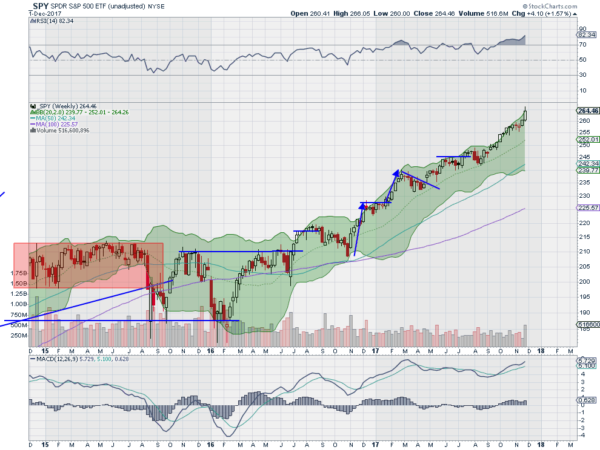

On the weekly chart the SPY put in a strong week, up over 1.5%. The RSI is overbought and rising, a sign of strength. The MACD continues higher as well. There is no resistance over the all-time high close at 265.01. Support lower sits at 262.40 and 260 then 259.25 and 257 before 256 and 254. Uptrend Continues.

SPY Weekly, $SPY

Heading into the first week of December the equity markets look strong on the longer timeframe after weathering a short term shock Friday. Elsewhere look for Gold to consolidate under 1300 while Crude Oil consolidated in its uptrend. The US Dollar Index is marking time with a bias to the downside while US Treasuries consolidate in the range in place since September.

The Shanghai Composite is also moving sideways with a bias for a pullback while Emerging Markets retrench in their uptrend. Volatility looks to remain low but may creep up removing some support for equities. The equity index ETF’s SPY, IWM and QQQ show unfettered uptrends on the weekly charts. On the daily charts they may need a breather after the intraday shock Friday. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.