Last week’s review of the macro market indicators noted heading into the FOMC meeting and December options expiration the equity markets were showing some life. Perhaps the Santa Claus Rally had begun. Elsewhere looked for Gold ($GLD) to continue lower while Crude Oil ($USO) stalled in its uptrend. The US Dollar Index ($DXY) was biased higher in consolidation while US Treasuries ($TLT) marked time sideways.

The Shanghai Composite ($ASHR) continued to retrench after a long run higher and Emerging Markets ($EEM) were seeking support as they retested breakout levels. Volatility ($VXX) looked to remain very low keeping the wind at the backs of the equity index ETF’s $SPY, $IWM and $QQQ. The SPY (NYSE:SPY) and QQQ remained strong on the weekly timeframe with the IWM showing some potential weakness. The SPY was also strong on the daily timeframe while the IWM and QQQ were turning up but still looking for new highs.

he week played out with Gold starting lower but finding support and bouncing while Crude Oil tried to move higher only to give the gain back. The US Dollar worked higher then stumbled and recovered while Treasuries moved up testing December highs. The Shanghai Composite put in a Dead Cat Bounce ending lower while Emerging Markets held in a tight range over support.

Volatility held tight to the 10 level, ending the week moving lower and keeping the bias higher for equities. The Equity Index ETF’s were mixed on the week, with the QQQ rising all week, the IWM consolidating over support and the SPY rising, retracing and then bouncing. All finished the week strong. What does this mean for the coming week? Lets look at some charts.

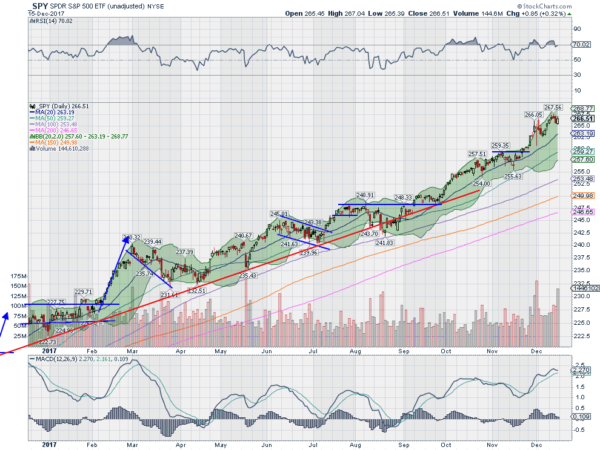

SPY Daily, $SPY

The SPY had started to recover from a small dip and at an all-time high coming into the week. It continued that move up Monday and Tuesday, making 2 more all-time high closes. Wednesday it started higher again but could not hold up and closed marginally lower. It continued down Thursday but then recovered Friday, ending just shy of another all-time high.

The daily chart shows the RSI is strong in the bullish zone with the MACD high and running flat. All the SMA’s continue to rise in parallel, the sign of a strong trend. And the Bollinger Bands® give the price room to move higher. The rebound from the pullback gives a target to 270.50.

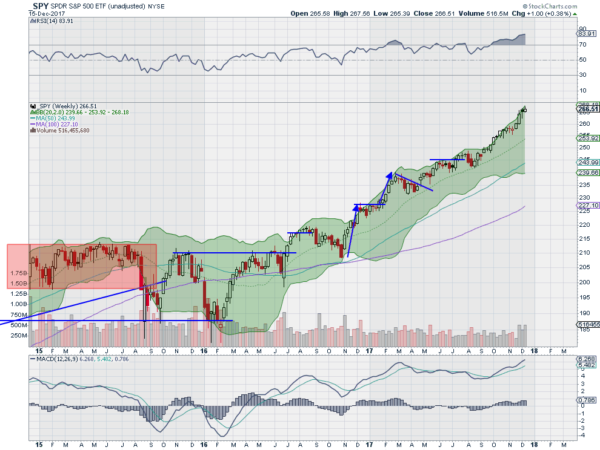

On the weekly chart the uptrend continues with price riding the upper Bollinger Band®. The RSI on this timeframe is strong and overbought. The MACD is rising and high. There is no resistance higher. Support lower comes at 262.50 and 260 followed by 259.25 and 257. Continued Uptrend.

SPY Weekly, $SPY

As Options Expiration and the FOMC meeting pass, equity markets look strong heading into the last full week of trading for the year. Elsewhere look for Gold to continue to bounce higher while Crude Oil pauses in the uptrend. The US Dollar Index looks to continue to mark time with a downward bias while US Treasuries continue their short term uptrend. The Shanghai Composite remains in a downtrend approaching the long term support and resistance zone while Emerging Markets consolidate in their uptrend.

Volatility looks to remain very low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ) into the end of the year. Their charts all look strong on the longer timeframe. On the daily timeframe the SPY and QQQ are also strong with the IWM close to a break out if it moves higher. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.