Last week’s review of the macro market indicators saw that with the first Quarter in the books, equity markets were trying to brush off the recent pullback and start higher. Elsewhere looked for Gold (NYSE:GLD) to consolidate in the short run while Crude Oil (NYSE:USO) continued higher. The US Dollar Index (DXY) looked better to the upside for the coming week while US Treasuries (NASDAQ:TLT) remained in their consolidation range.

The Shanghai Composite (NYSE:ASHR) looked to continue to drift higher, trying to separate with long term levels and Emerging Markets (NYSE:EEM) continued to move higher. Volatility (NYSE:VXX) looked to remain at abnormally low levels keeping the wind at the backs of the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts looked constructive on the short term, and bullish for the QQQ, while longer term in consolidation. Perhaps the short term would spill over into the longer term.

The week played out with Gold pushing sideways with a slight drift up until a stronger move up Friday faded to end the week near flat while Crude Oil continued its trend higher. The US Dollar consolidated the prior week’s move before advancing Friday while Treasuries continued to consolidate in a range. The Shanghai Composite pushed up to a new 2017 high while Emerging Markets consolidated over support.

Volatility had another small range week at abnormally low levels. The Equity Index ETF’s were similar but split, with the SPY and QQQ drifting early and spiking Wednesday only to give that up and then drift the rest of the week. The IWM had a similar pattern but started the early part of the week lower and climbed tat the end. What does this mean for the coming week? Lets look at some charts.

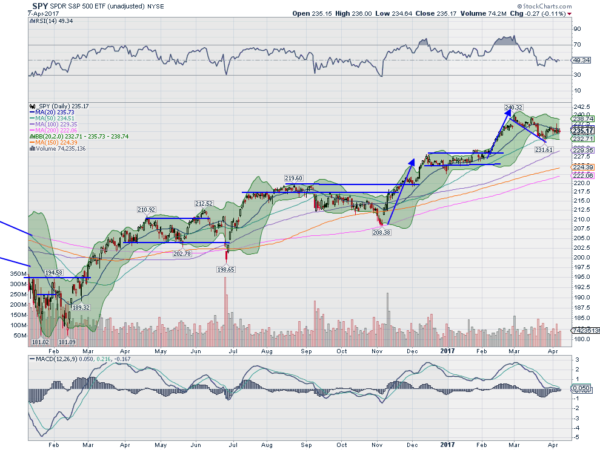

SPY Daily

The SPY started the week after a stall at the 20 day SMA to end the prior week. And that 20 day SMA held it down all week. A tight range week moving between the 20 day SMA and the 50 day SMA. Wednesday’s break out attempt is nothing but a memory now. That wedge between the 20 and 50 day SMA’s is tightening though, leaving little room for this to continue.

The daily chart shows the RSI is holding along the mid line, bullish, while the MACD has leveled in the pullback at the zero line. It still looks like a series of lower highs and lower lows in the short run. Perhaps a bull flag, not enough to get bearish at this point. On the weekly chart the promising Piercing Candle from the prior week did not deliver any further upside, at least yet.

The RSI has pulled back from being technically overbought while the MACD is about to cross down, bearish. No strength and a case building for some pullback. The 20 week SMA sits below at 230 though, showing the SPY has some strength. There is support at 233.70 and 232.10 followed by 229.40. Resistance above comes at 236 and 237.10 followed by 239.80. Consolidation with Possible Pullback in the Uptrend.

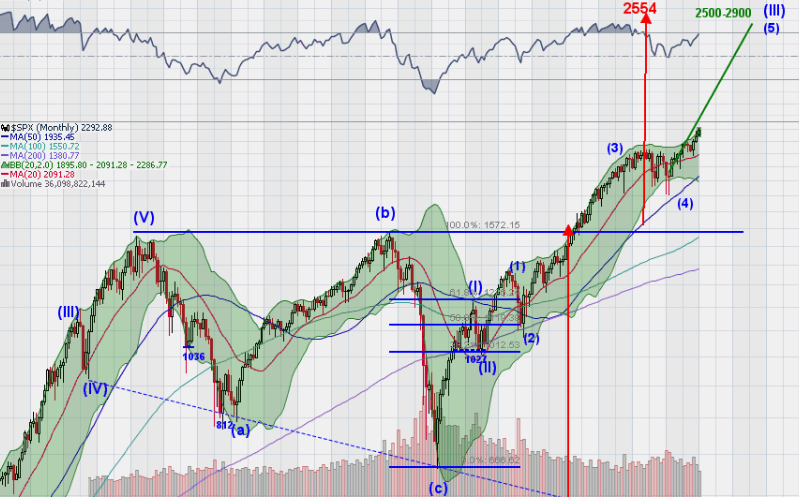

SPY Weekly

Heading into the holiday shortened week for Easter, the equity markets still look a bit vulnerable in the short run and stronger in the intermediate. Elsewhere look for Gold to consolidate in its uptrend while Crude Oil continues higher. The US Dollar Index looks better to the upside while US Treasuries remain in their consolidation range. The Shanghai Composite looks to continue to plod slowly higher and Emerging Markets also continue to look strong.

Volatility looks to remain at abnormally low levels keeping the wind at the back of the equity Index ETF’s as they all consolidate. The SPY and IWM look more vulnerable than the QQQ on their daily charts. All look stronger on weekly charts with the IWM showing the strongest potential for an early move. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.