A monthly excerpt from the Premium subscriber version covering all 13 markets.

Last month in this space my Monthly Macro Review/Preview had monthly outlook heading into April suggesting the equity markets were a bit mixed with the SPY the strongest. Gold ($GLD) looked to continue in the consolidation zone while Copper moved back into its consolidation zone as well after a peek below. Crude Oil continued to consolidate with an upward bias and Natural Gas was pulling back in the uptrend. The US Dollar continued to be uninspiring moving sideways while (US Treasuries) were at a critical juncture with April’s movement possibly setting a longer trend. In foreign markets the Shanghai Composite looked to continue its long path lower with the German DAX consolidating before showing its next move. (Emerging Markets)) continued in the lower half of their broad consolidation range (Volatility) looked to remain low giving equities a favorable environment. The equity charts themselves showed the SPY pushing higher out of consolidation, while the iShares Russell 2000 Index (ARCA:IWM) and PowerShares QQQ (NASDAQ:QQQ) consolidated with a stronger possibility of reversal. How does an additional month impact the longer term picture? Let’s look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

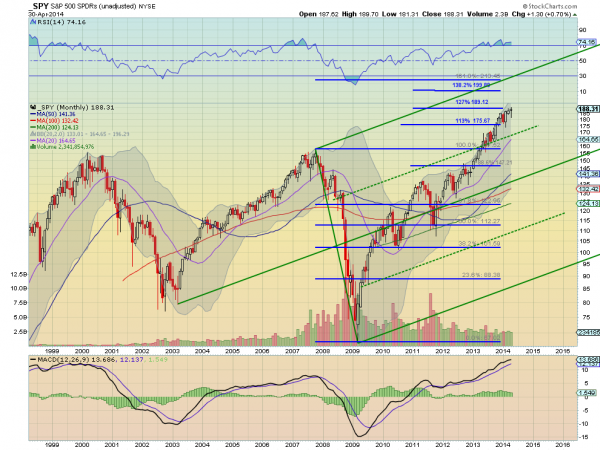

SPY

The SPY continued higher, touching the 127% extension of the move lower during the financial crisis. The candle for April was a Hanging Man, a possible reversal if confirmed lower in May. But the RSI continues to hold in bullish territory with a MACD that is rising. These support more upside. The price remains in the middle of the Upper Median Line and the Median Line of the bullish Andrews Pitchfork, and could be drawn either way. There is no resistance higher but he 138.2% extension is next near 200. Support lower comes at 175 and 162. Continued Upward Bias with Chance of Consolidation.

The monthly outlook suggests that Gold and Copper will continue in their consolidation zones with a bias lower for Gold and drift lower for Copper. Crude Oil looks to continue to consolidate as well with a bias higher while Natural Gas looks good for more upside. The US Dollar Index look weak and leaking lower while US Treasuries look strong. The foreign markets are mixed again with the Shanghai Composite continuing lower while Emerging Markets and the DAX consolidate with an upward bias. Volatility looks to remain in the lower range experienced in the last six months keeping the wind at the back of the equity markets. The Equity Index ETF’s SPY, IWM and QQQ themselves are bouncing around and look to continue that. The SPY looks the strongest and biased higher while the IWM and QQQ are consolidating with the QQQ’s looking a bit weak. Use this information to understand the long term trends in Equities and their influencers as you prepare for the coming months.