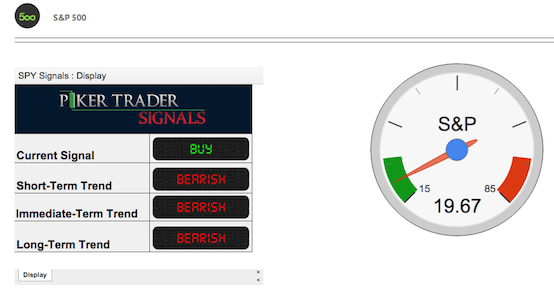

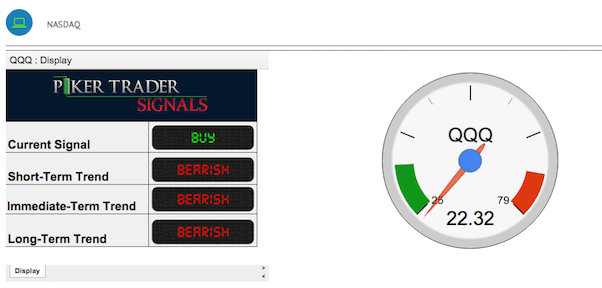

Friday, we expected the market to bounce which it did in the AM but sold off the rest of the day especially as the end. Our indicators are still oversold and a buy signal the S&P 500, NASDAQ and the Dow Jones. In fact breadth was slightly better then Thursday sell off, so there is a slight positive divergence going on underneath the market. But there are a lot of factors in the global economy that can put continued pressure on this market.

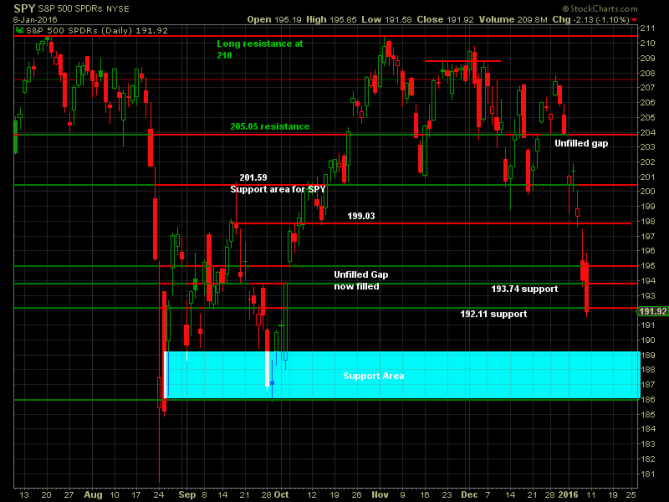

Looking at SPY we can see that SPDR S&P 500 (N:SPY) is nearing the lows of 2015 and a potential support area. The market bounced off these lows twice in 2015 and now provides a potential bouncing area or a stop-loss area. A move below this levels and our indicator moving off oversold buy would signal us to get the losses and wait for a new signal.

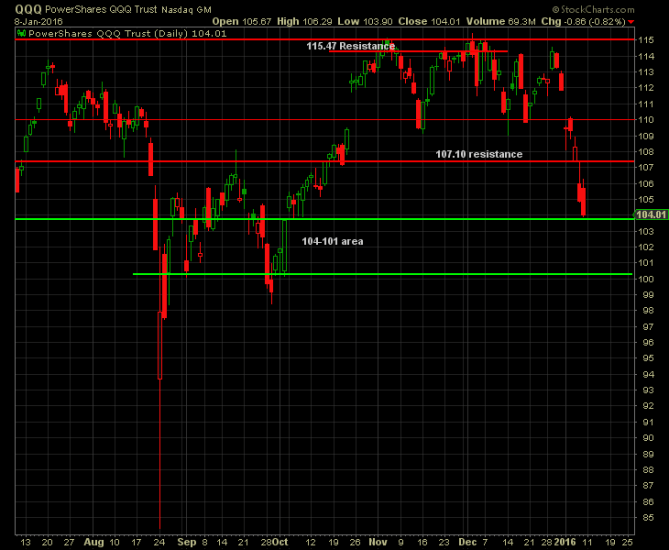

The Q's are at similar level touching a support levels. The Q's charts look a little strong then the SPDR S&P 500 (N:SPY) but in a very similar situation. The are of support for the Q's is 104-101, below this would be trouble for the bulls and a good stop area.