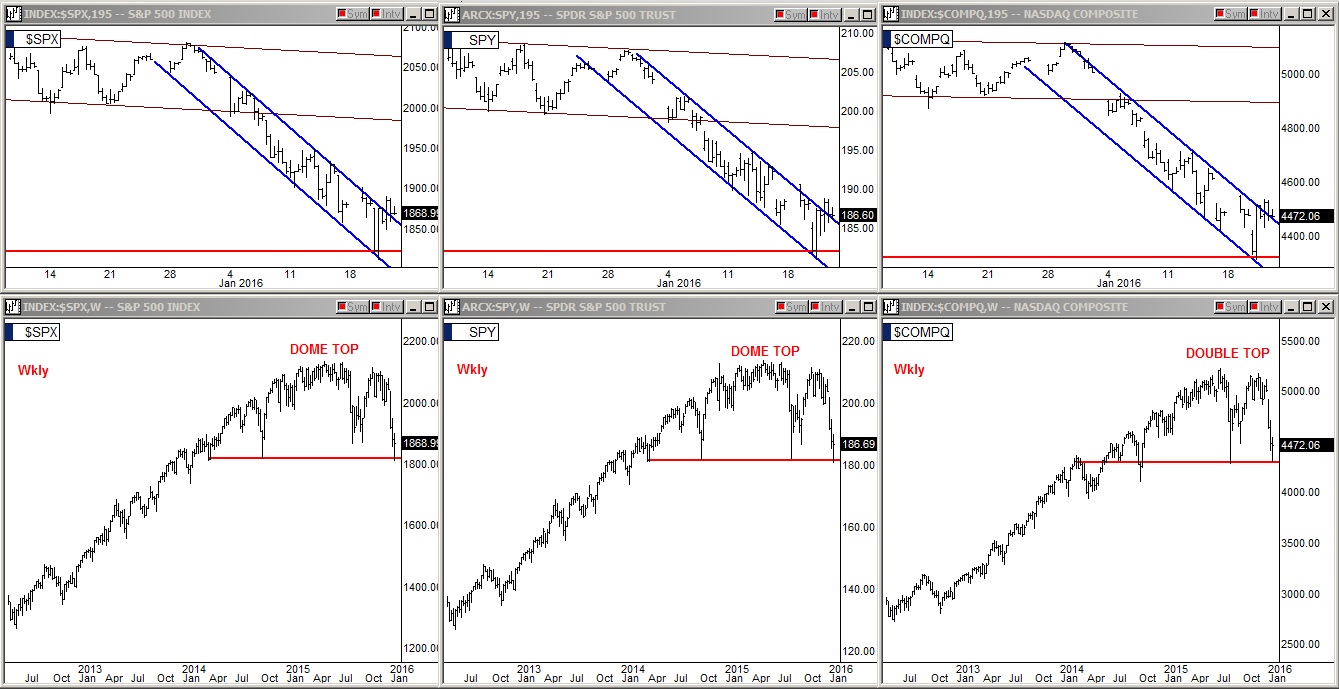

In the market Thursday, they rallied the wagons to keep from losing the two year necklines on the indices and they popped the SPX, N:SPY, and NASDAQ higher midday but gave most of it back by the bell. Are we supposed to consider this a breakout? Looking closely at the SPY and NASDAQ, Thursday's closing prices are within one point of Wednesday's close (shown in my previous article). The indices essentially moved themselves out of a downhill channel by going sideways which had to happen because the charts moved sideways with the opening of a new bar where they went ahead and forced a pop but the market just didn't buy it. Overall, this was a lame attempt to trigger a breakout to save the neckline.

The Advance Decline and Tick turned quite bearish in the last two hours, however, they will probably run the overnight futures higher Thursday night and come in during premarket with the same routine but I really can't see any signs that traders/investors are buying into any of it. Granted tomorrow is Friday and that used to mean float up Friday on thin volume with a ramp up into the close but whether or not they can make it happen this time we will have to see. Considering the obvious lack of buyers here and index propping going on to a level we rarely see, this might be a historical battle in the charts when looking back on it later.