It's been a while since I provided an update on the S&P 500 and NASDAQ, but the time has come to provide some more detailed insights. First, lets go back to the last day of Trading last year (December 29), which was all but Bullish and many charts had turned sour and negative, which was evident from analyzing them.

But, already on the first Trading day of this year (January 2), did the market something that surprised many, me included: the market decided to extend. If you follow my Daily Markets Updates section you’ll see I instantly turned my views of the market 180 degrees as well, and since then tracking the market has become relatively easy except for these extensions of already extended waves. Namely, for analysts and Elliot Wavers, extensions cannot be forecasted. All we can do is go first by the standard Fibonacci-extensions and retraces for 2nd, 3rd, 4th and 5th waves. For example, 3rd waves typically travel to the 1.382x to 1.618x Fib-extension of the 1st wave, measure from the low of the 2nd wave. The subsequent 4th wave will then fall back to the 0.764x to 1.000x Fib-extensions, etc. But, it doesn’t have to be that way, and in this case it surely is not on many wave degrees. Let me explain.

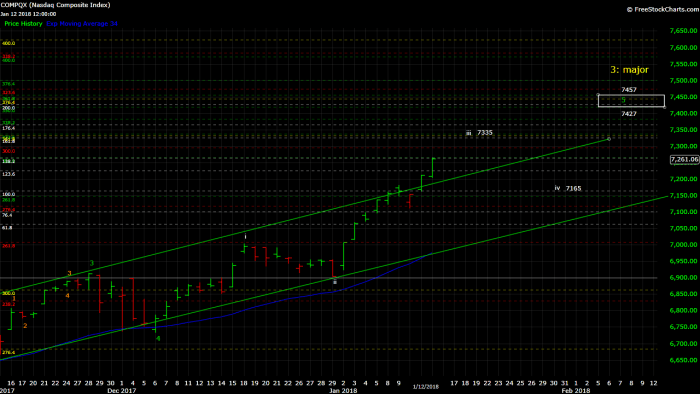

Instead of the entire minor-5 wave, that came close to the ideal 5=1 target of $7030 on the NAS the market decided to extend. It was only minute-i of minor-5. Now minute-iii is solidly underway and it’s ideal target is $7335: the 1.618x Fib-extension for a typical 3rd wave. Then minute-iv down to $7165: the 1.000x Fib-extension for a typical 4th wave. And then minute-v to around $7427-7457 for all of minor-5 and major-3. These are targets based on ideal-standard Fib-extensions and retraces for 3rd and 4th and 5th waves, but there’s no guarantee the market will adhere to these. But, it’s all we can forecast for now and note the Fib-cluster at this target zone: the minute, minor, intermediate, major waves’ Fib-extensions all coincide here. This would mean major-3 did a around 3.764x Fib-extension of major-1: massive, but very uncommon extension.

For the S&P there are many more 4th and 5th waves to wrap up: pico-4, 5; nano-4, 5; and micro-4,5 are left before major-3 wraps up. See Figure below. These extended extensions also mean that we constantly must move goal posts further and further north for Major-3. I am now looking for SPX2824-2894; the 2.764x to 3.000x extensions of major-1. Very uncommon, but since the S&P already surpassed the 2.618x extension at SPX2779 by a wide margin on Friday and because none of the charts analyzed suggests anything else but higher prices going forward, those two Fib-extensions are simple next. As you can see, that fits with the (black) major-3 projections made on my hourly chart (SPX2830-2875) based on STANDARD fib-extensions and retraces for the upcoming 4th and 5th waves.