Since the U.S. President Donald Trump indicated that he is ready to impose tariffs on $500 billion worth of Chinese goods to the U.S. if China does not back down on its trade policies and shrugged off the impact on the stock market, sending waves through U.S. equities, I’ve found that this aggressive tone is evident enough to grow tit for tat geopolitical moves from different parts of the world. His will looks only to result in escalation of tariff trade war concerns, instead of any positive effort to cool down worries of global economy. Although, the U.S. President Donald Trump dismisses negative impact on stock markets from escalating trade tensions, but the U.S. stock futures took a dive in reaction to this news.

Moreover, this hype will prevail over the other global indices too, because it is impossible to predict the upcoming reactionary move not only from the China but also from other countries too. I find that the reactionary upcoming moves may be mapped from the fact that the European stocks also slumped after Trump’s comments. Germany’s DAX fell 70 points or 0.55% while in France the CAC 40 decreased 42 points or 0.79% and in London, the FTSE 100 was down 23 points or 0.31%. Meanwhile the pan-European Euro Stoxx 50 slipped 15 points or 0.44% while Spain’s IBEX 35 lost 40 points or 0.42%.

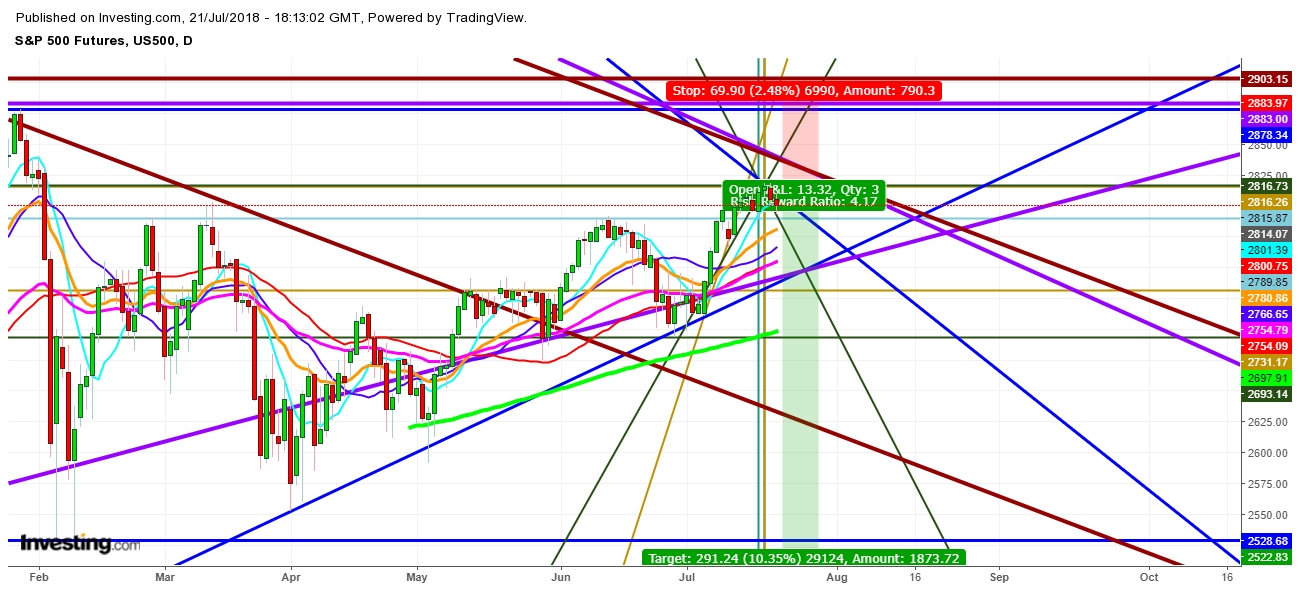

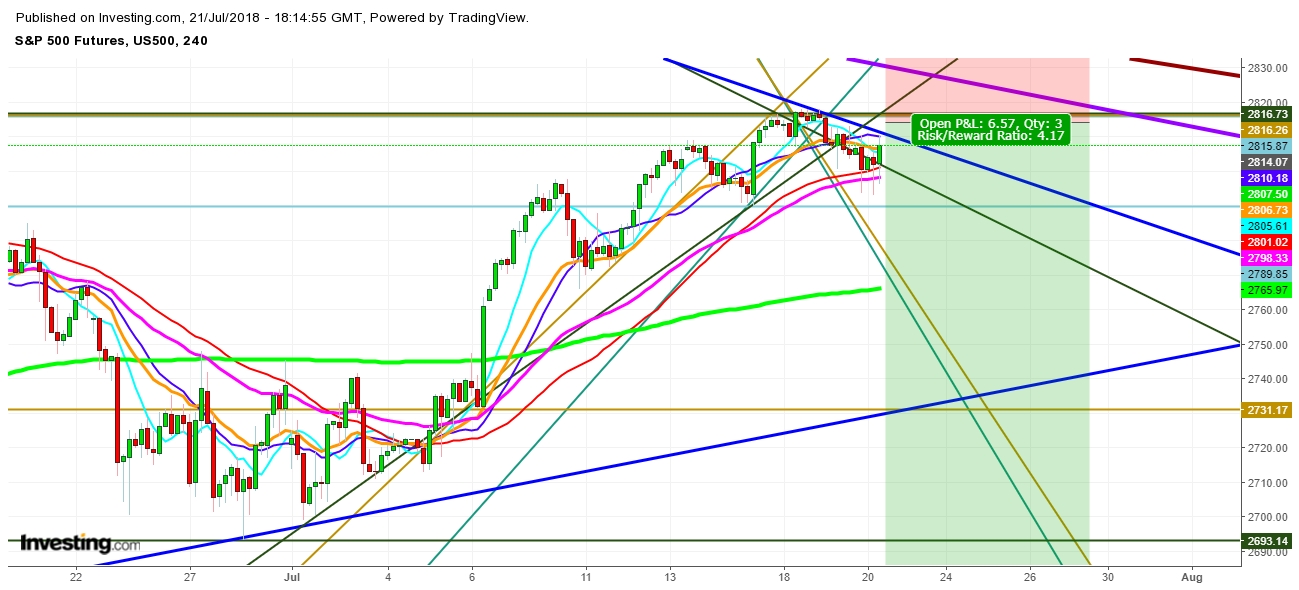

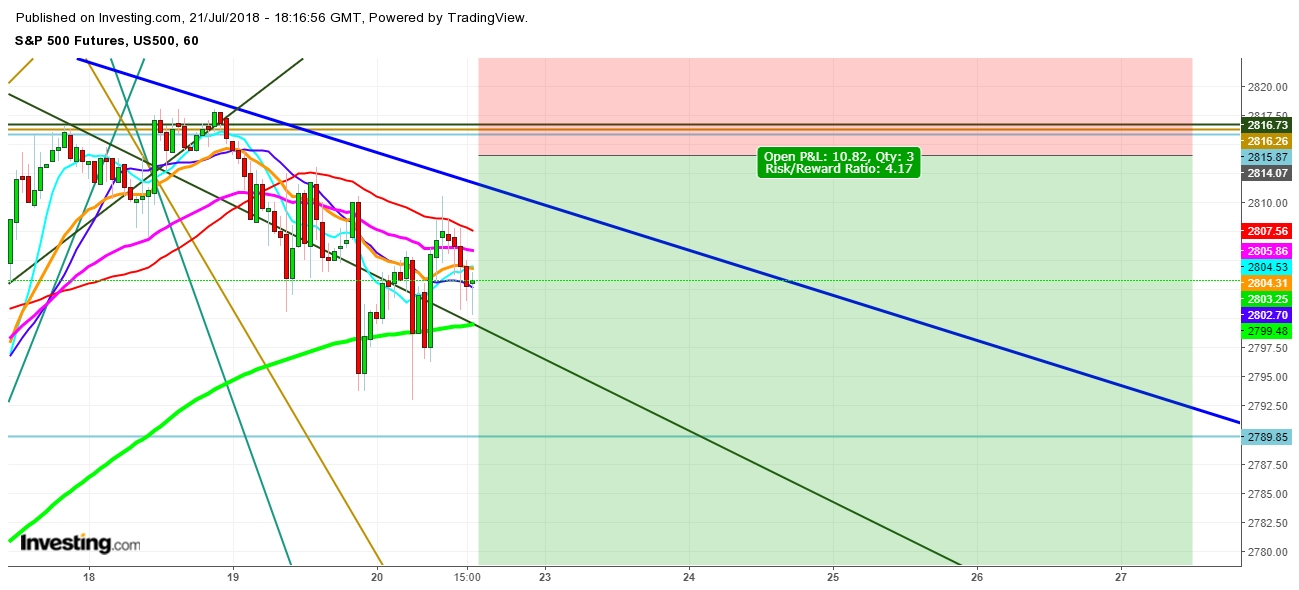

This chain reaction of Trump’s bold statement looks as an alarming sound, especially at the time while most of the global indices are at their highs. No doubt that the growing indecisiveness in global equity markets will be at its highest pitch during the upcoming week. On analysis of the movement of S&P 500 futures in different time frames, I find the following trading zones for S&P 500 futures for the Week of July 22nd, 2018. To understand the following charts in detail see my video.

Disclosure

1. This content is for information and educational purposes only and should not be considered as an investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital be involved which you are prepared to lose.

2. Remember, YOU push the buy button and the sell button. Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from an investment and/or tax professional before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.