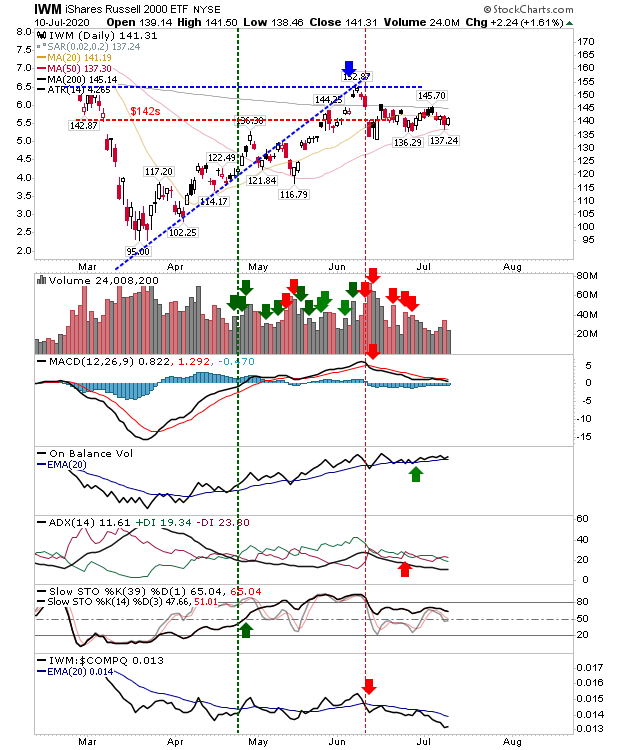

With the week behind us the S&P stood poised to break to new highs for the recovery rally, following the lead of the NASDAQ which is already posting new multi-year highs. The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) is looking a little more tentative as it remains below its 200-day MA on bearish MACD, ADX and relative performance.

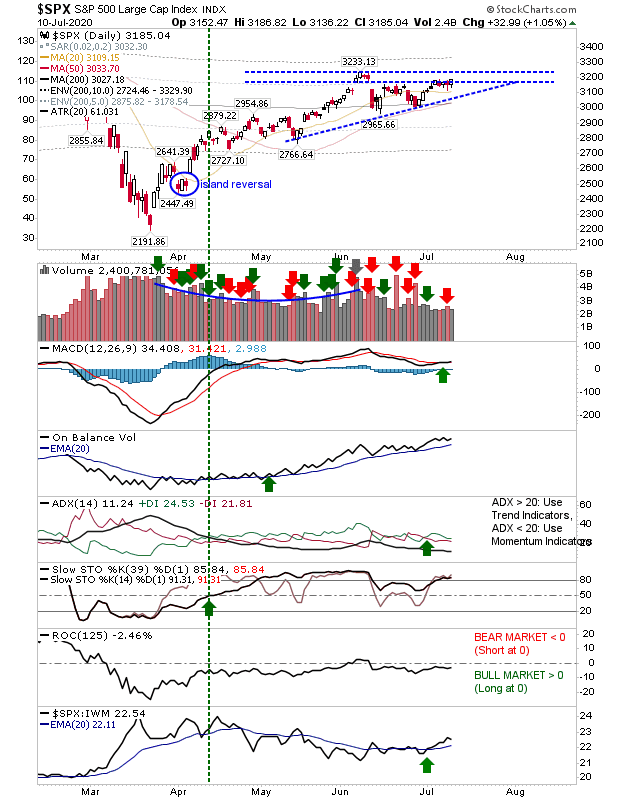

The S&P is shaping a bullish ascending triangle—effectively a mini-base inside the larger consolidation defined by the Covid-19 selloff. Technicals are all bullish, plus it has the added benefit of outperforming the Russell 2000—so money coming to the market is moving into safety-first stocks than more speculative Small caps stocks.

The NASDAQ is still the lead index, but the rally has yet to consolidate its gain in any meaningful manner. The index is rallying inside a narrow defined channel—when the index breaks channel support it should mark the start of the consolidation I'm seeking.

Ideally, we want to see growth stocks (the Russell 2000) participate in the rally enjoyed by Tech stocks, helped in part by a breakout in the S&P. As things stand, Tech stocks (well, FAANG stocks) are doing all the legwork but a rally making new all-time highs during a pandemic needs greater market participation.